1. Introduction

The year 2023 continues to be one of uncertainty, which has led to muted returns from many hedge fund strategies during the first half. The weakness of the US banking system and the headwinds from the higher rate regime are at odds with the strong performance of risk assets during the first six months of the year. Forward paths from here remain difficult to discern, but within markets we believe there are more attractive risk/reward trade offs now than earlier in the year.

2. Our Outlook

Forward paths from here remain difficult to discern, but within markets we believe there are more attractive risk/reward trade-offs now than earlier in the year.

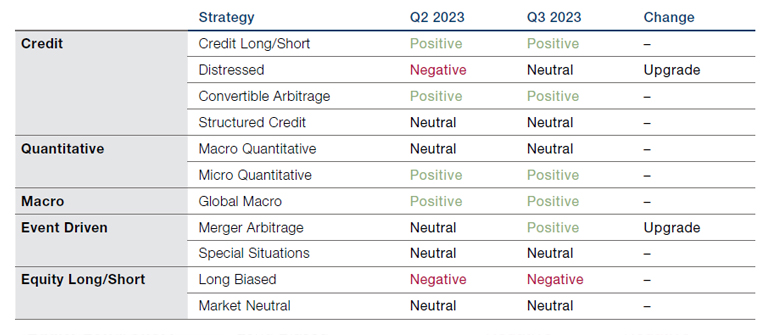

We believe that two areas in particular warrant an upgrade in our outlook given the current market conditions. Merger Arbitrage has had multiple challenges during the first half of the year, leading to disappointing performance from many hedge funds in this space, but we now believe that spread widening has priced in much of the risk, and therefore the carry from this strategy looks particularly attractive. The other upgrade is in Distressed credit investing, where an increase in default rates is leading to a more fertile set of trades for specialists in this area. We are wary of the risk of further economic deterioration, and therefore have set our outlook only to neutral for this strategy. We remain positive on strategies that generally benefit from increased volatility and dispersion, such as Credit Long-Short, Convertible Arbitrage, Micro Quant and Global Macro.

Figure 1 summarises our stance on different hedge-fund strategies for Q3 2023.

Figure 1. Q3 2023 Outlook Versus Q2 2023 Outlook

3. The Details

3.1 Credit

We continue to maintain a positive view on Credit Long/Short, having upgraded the strategy last quarter, but we have also upgraded our view on Distressed from Negative to Neutral.

While broad US high yield and CCC rated spreads are at or below historical median levels, the demand for higher-quality names has led to somewhat elevated levels of spread between lower- and higher-quality credits, which should be good for the forward-looking opportunity set. It is something of a simplification, but hedge funds typically buy lower-rated names at wider spreads while shorting higher-quality names trading at tight spreads. Single-name and sector-level dispersion remains elevated despite an overall benign spread environment, as this is driven by the varying impact of higher rates/inflation on different issuers, in terms of cost of funding, impact on margins, etc.

Our upgrade in Distressed is driven by a meaningful pick-up in the pace of defaults/distressed exchanges in the year to date.

In addition, primary market access remains challenging, particularly for lower-quality issues, because of higher rates and tighter lending standards. This is leading to ongoing dislocations within capital structures, which leads to opportunities for capital structure arbitrage specialists to trade debt versus equity.

Our upgrade in Distressed is driven by a meaningful pick-up in the pace of defaults/ distressed exchanges in the year to date ($43billion as of May 2023 versus $48billion in 2022). The par-weighted US high yield default rate (including distressed exchanges) is now at 2.41% (a 2-year high) compared with a record low of 0.32% at the end of February 2022. The expectations of a further increase in corporate defaults, especially if rates stay at elevated levels over the coming one to two years, should put further pressure on servicing debt. We remain wary, however, of the impact of a more severe economic downturn on the price of distressed debt and therefore remain neutral for now on the opportunity.

We retain a positive view of Convertible Arbitrage, with good idiosyncratic opportunities across credit, event-driven, and issuance-related opportunities. Despite the rally in broad equity markets, around 55% of the US convertible bond universe is still represented by low-delta (0-40%), yield-oriented names, which presents opportunities for outright credit as well as cap structure arb-oriented positions for managers with deep credit skills. There are also increased opportunities from active primary markets as issuers proactively seek to address the short-dated term structure of maturities. Managers with adequate resources are also taking advantage of elevated exchange/buyback activity, with the potential for ongoing alpha generation from engaging with issuers around corporate liability management transactions.

In Structured Credit, we remain neutral and continue to recommend diversified exposures across residential/consumer sectors. Spreads remain wide across securitised products sectors and loss-adjusted yields remain elevated, while the aggregate consumer credit fundamentals remain sound (i.e., total debt, leverage, and debt service near multi-year lows). The opportunity set across CRE/CMBS and CLOs is expected to play out over the medium to longer term and is more nuanced and idiosyncratic, requiring detailed deal-level research to identify alpha.

Of course, if we see lower volatility in rates markets and generally lower market stress, this should be supportive of Structured Credit; particularly if a more positive outlook for the economy plays out. However, we note that the full impact of tighter monetary policy has yet to be felt on consumer and residential credit markets, and that modelling the expected increase in delinquencies/defaults is a very inexact science.

3.2 Quantitative Strategies

We remain positive in our outlook for Micro-Quant strategies, the performance of some of which is being fuelled by higher rates and stock volatility, which continues to create dispersion and trading opportunities (as these strategies seek to transform small price inefficiencies in corporate assets into alpha). However, the rise and dominance of platforms and multi-strategy firms (“Multi-PM groups”) presents opportunities and challenges for quant investing, this is especially true in the field of new launches.

Mature spin-offs from Multi-PM groups are one type of new launch that we usually associate with less risk. Meanwhile, the availability of capital for less established Quant PMs has been eased by Multi-PM groups; this has arguably made early-stage investing more toxic to all but the most sophisticated and experienced investors. Less-experienced players should be mindful of the adverse selection associated with new launches. As good Quant PM teams can readily secure great economics and significant capital, choosing the independent route involves greater upfront risk and cost. Their decision trade-off ought to be reflected in the confidence, capacity claims and/or the quality and uniqueness of the intellectual property developed by each new launch; but it could just as easily reflect a lack of interest from Multi-PM groups, delusions of success from the new PM and/or the appeal of the trader’s option. This remains a difficult assessment.

We believe broader macro strategies that can leverage distinct investment themes across asset classes, styles and regions will benefit from emerging macro trends and the volatility surrounding them.

Last time we mentioned the additional utility Macro Quantitative strategies offered investors with few alternatives to short futures. This was especially relevant for investors desiring to short fixed income. We note, from investor conversations and broker reports, that the appetite for this is waning; understandably, given the rise in global interest rates. Therefore, we have maintained our stance of being neutral Macro Quantitative strategies, both across Diversified strategies and Trend. The one area of Macro Quantitative investing that is most fertile continues to be commodities. This is driven by institutional investor interest in the diversification and inflation-protection benefits of this asset class.

We have also noticed that investors are favouring Discretionary Macro over Diversified Macro Quantitative strategies, arguing that a Discretionary approach can be more proactive and/or reactive to regime changes and difficult markets. We certainly saw this logic play out in March 2023 when human PMs were much quicker at reducing short fixed income exposure, or had already moderated it.

3.3 Macro

We maintain a positive outlook for Global Macro investing as markets adjust to a more fragmented global economy, characterised by tighter monetary policy and reduced global trade. We believe broader macro strategies that can leverage distinct investment themes across asset classes, styles and regions will benefit from emerging macro trends and the volatility surrounding them.

Differences between economies in terms of the trajectory of disinflation and varying sensitivities to tighter policy should provide further opportunity for managers to position around their expectations for monetary policy. Even after one of the sharpest episodes of monetary tightening in history, there remains significant uncertainty over when and where the current cycle ends. Core inflation remains above target in many economies, while imminent recession risks appear to have eased and labour markets globally continue to show tightness. However, given where rates currently are and where they are expected to stay over the near term, the risk of further financial accidents looms, complicating the outlook.

We believe that regional dispersion should persist over the medium term as shifting secular trends challenge investors’ assumptions from the pre-Covid era. Pricing the extent and timing of policy easing against a backdrop of rising geopolitical tensions, quantitative tightening and economic fragmentation won’t be straightforward, and mispricings may feature across asset classes as a result. Governments and corporates have recently announced initiatives to shorten and diversify highly concentrated supply chains, as the Covid-19 pandemic and the economic sanctions imposed on Russia have highlighted the risk of dependence on other economies for key resources. Winners and losers are expected to emerge from an increase of inward-looking policies and policies designed to restrict trade, particularly in the emerging markets.

However, in the shorter term, we note that Macro risk appetite has been relatively muted this year against a backdrop of choppy yet rather directionless markets. The speed at which the market has cycled through narratives has made it difficult for managers to trade many durable themes, and there’s a risk this dynamic persists over the short term while central bank rhetoric remains highly responsive to recent economic data releases.

3.4 Event Driven

We have moved to a positive stance on Merger Arbitrage, as there is a more favourable risk-reward environment due to wider spreads and risks being well-priced into deals. This situation has emerged after a difficult H1 has resulted in wider or (individually and temporarily) even dislocated spreads. Antitrust risk probably priced at “peak fear”, i.e., taking on that risk is currently well compensated. Technicals are supportive, e.g., deal activity has been improving, especially in small to mid-caps and notably in Europe. Private Equity funds remain under pressure to put capital to work, and the financing environment is supportive of dealmaking. Following challenges in the first half of the year, there has also been a lot of derisking from Merger Arbitrage, e.g., in multi-strategy platforms and UCITS funds.

3.5 Equity Long/Short

We have moved to a positive stance on Merger Arbitrage, as there is a more favourable risk-reward environment due to wider spreads and risks being well-priced into deals.

The main risk to Merger Arbitrage is that US antitrust moves are expected to remain interventionist and even losing cases in court will probably not slow down attempts to block deals. Volatility of the closure paths of such deals is likely to remain elevated, but this also offers trading opportunities.

In Special Situations we remain neutral. Catalysts and fundamentals are often being dominated by structural effects, like the rotation into AI and tech. Global Event Driven portfolios can be vulnerable to derisking contagion following losses. But the corporate actions pipelines are robust, as pressures to restructure corporations and build shareholder value continue to mount, also due to the engagement of activist investors. That said, soft catalyst strategies are being helped by the current market stability, but are vulnerable to flows overwhelming fundamentals, and mid-caps can be challenging to hedge.

We continue to monitor the opportunities around event-driven investing in Japan, where the ongoing theme of corporate governance tailwinds has been further strengthened by recent Tokyo Stock Exchange reforms. The overall buoyant macro environment should generate M&A, as well as other corporate restructurings with opportunities to find both long and short ideas, e.g., as inflation benefits companies with pricing power.

We continue to hold a preference for low net ELS managers and have maintained our neutral rating for Market Neutral Equity Long/Short and a negative rating on Long-Biased Equity Long/Short. While equity beta has seemingly been good for portfolios this year, we have several concerns over possible equity market risks, namely:

- Market breadth is weak – the top five S&P500 stocks are responsible for most of the YTD gains, and an outsized amount relative to prior years.

- Extremes in positioning have been built up; such as growth (tech) vs value (banks, energy, materials), Japan vs China, or large cap vs small caps.

- The above, combined with heavy positioning in equities from macro and multi-strategy shops, make us wary of mean-reversion events. Given the heightened levels of each, such reversions would be sharp and likely to impact ELS managers, who tend to take a longer-term viewpoint, more disproportionately.

- The question of recession still looms, though positioning implies managers feel this is less likely than when we published our last Outlook.

- Takeover risk appears heightened in Europe, with large PE cash balances combined with some stabilisation in interest rates leading to an uptick in M&A activity in Q2. This threatens short books, especially for those managers with positioning in smaller or mid-cap names.

While market breadth remains challenged, we believe there are some areas that are starting to become more attractive due to increased dispersion, as well as emerging long-term themes. While some may argue that taking directionality is the best way to play themes or trends, we point to the fact that for all beneficiaries or winners, there are losers that make strong alpha short candidates.

Firstly, Japan is quite interesting for many reasons. In short and within a longshort framework, the recent move by TSE to accelerate improvement in corporate governance should lead to increased dispersion. Secondly, AI has been solidified as a long-term growth theme. While there was significant hype in May 2023, there are legs to the theme, and we believe it touches more than just traditional ‘TMT’ stocks. Lastly, the Inflation Reduction Act and the CHIPS and Science Act have accelerated the reshoring/deglobalisation trend. Energy transition remains a long-term theme, but this legislation has also created separate tailwinds in the industrials and consumer complexes.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.