Introduction: The Challenges of Forecasting Macro Regime Changes

The facts indicate that the might of the US and NATO military intelligence networks failed to predict how quickly the Taliban would overthrow the Afghan government once the US had announced its intention to withdraw. Indeed, President Biden himself conceded in a public address to the nation on 31 August, “that assumption that the Afghan government would be able to hold on for a period of time beyond military drawdown turned out not to be accurate”1. There is consensus that this appears to have been a serious failing on the part of the military intelligence community. But it’s also an example of the challenges of forecasting: even when armed with reliable information, events can occur that were difficult to predict.

The forecasting challenge becomes even more complex when it comes to financial markets. There are multiple known and unknown factors, and then there is the added uncertainty of how markets will respond to these factors.

Will the vaccines succeed in containing the coronavirus pandemic, allowing us to view the health crisis of 2020 as an event in the past, or will variants emerge that threaten yet more significant disruption? How long will central banks be able to keep propping up asset prices? Have they reached the limit of what they can do? When will public debt levels become unsustainable?

These are significant questions which feel almost impossible to answer. And life doesn’t get any easier when it comes to forecasting macro regime changes.

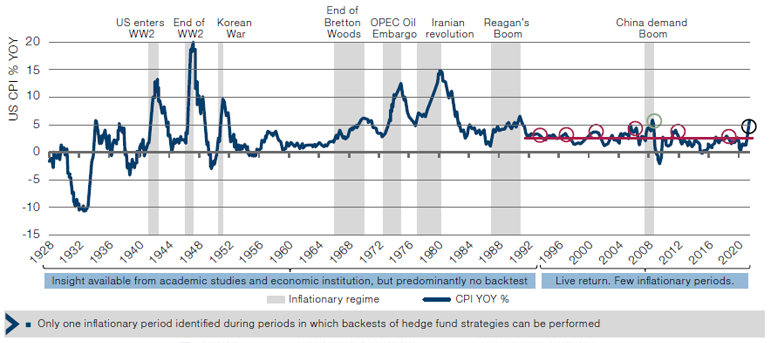

Many indicators are currently pointing to a rise in inflation – and whether that is transitory or becomes more entrenched remains to be seen. It is possible that we’re on the cusp of a structural change, heading towards an environment of higher and more volatile inflation. But there are also deflationary forces at play which, if they were to get the upper hand, would force markets in an entirely different direction. Timing such macro regime changes is nigh-on impossible. The last significant increase of US inflation above 10% year-on-year was in the late 1970s – and we have many false alarms since then (Figure 1).

Figure 1. US Inflation and Inflationary Periods

Source: Man Group, National Bureau of Economic Research; 1926-March 2021.

But even if you had perfect foresight and were able to correctly time a rise in inflation, it can be difficult to predict which asset classes perform well in a high-inflation regime. To further complicate things, conditions for some asset classes have materially changed since we last experienced inflation. While oil and coal have traditionally been drivers of cost-push inflation, the current shift to decarbonisation creates real uncertainty as to how these asset classes perform in inflationary conditions. Furthermore, equity sectors like information technology did not even exist the last time inflation was above 10%!

Navigating Choppy Waters

How do we navigate these market changes?

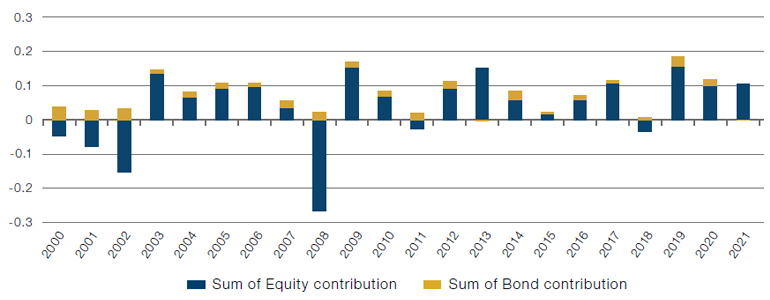

Finance 101 tells us that diversification can help improve the risk-return potential of a portfolio. The risk in a notional 60/40 stock/bond portfolio is substantially skewed to stocks because of their higher volatility, and hence there is plenty of scope for diversification. Indeed, implicit in the thinking behind a 60/40 notional mix of equities and bonds is the concept of diversification: not only have equities and bonds each had positive returns in the long term, but their returns have also historically displayed a low correlation to each other. However, the reality is that 60/40 returns have been dominated by equity returns and diversification does not always mitigate the large drawdowns, such as in 2008 (Figure 2).

Figure 2. Returns to a 60/40 Portfolio

Source: Man Group, Bloomberg; between January 2000 and August 2021. 60/40 portfolio is based on 60% MSCI World Net Total Return Index (hedged to USD) and 40% Barclays Capital Global Aggregate Bond Index (hedged to USD). The composite is an appropriate benchmark for the programme for performance illustration purposes.

True Risk-Based Diversification and Dynamic Risk Management

AHL TargetRisk philosophy is that portfolios should be constructed on the basis that risk-adjusted returns have historically been positive across asset classes, while providing good long-term diversification properties across different market regimes. As such, our risk balanced approach aims to tilt the total client portfolio exposures closer to equal amounts of risk across asset classes, rather than being dominated by equity risk. Not only does optimised diversification deliver better risk characteristics, but it also allows us to deliver greater benefit from the upside of markets by using cash efficient instruments (e.g. futures) to extract enhanced returns for similar levels of overall portfolio risk.

However, it is not sufficient to rely on optimised diversification alone. Markets have repeatedly taught that diversification tends to abandon investors when they wish to rely on it most: during periods of significant selloffs. In this scenario, even a manager with highly regarded skill in tactical allocations can face material portfolio losses.

Therefore, in addition to Man AHL’s standard risk management framework, AHL TargetRisk makes use of three further risk overlay components. These cover momentum, intraday correlation and volatility, with the strategy taking multiple samples per hour. The momentum and correlation overlays, if triggered, can reduce market exposure by up to 50%, while the volatility overlay can reduce even further. The combined goal of these additional risk and drawdown controls is to seek material reductions in exposure at times of market stress and subsequent rapid re-gearing of the portfolio once market conditions have stabilised.

- Volatility overlay: Our proprietary models aim to counter persistent fluctuations in volatility by dynamically scaling up the portfolio at times of low volatility, and scaling down at times of high volatility. Our ‘Volatility Switch’ model is designed to significantly increase/decrease the sensitivity (and subsequent speed) of our portfolio adjustments depending on the velocity of changes in market volatility – this allows us to avoid unnecessary trading costs in more normalised environments whilst also allowing the portfolio to be highly reactive in the case of larger market moves. A recent upgrade to the volatility signals makes use of high frequency data, with multiple samples per hour, enabling higher confidence in our estimates of the true level of market volatility;

- Momentum overlay: This model reduces the exposure to assets that are in a downward trend, a key lesson from more than 30 years’ experience of managing CTAs;

- Correlation overlay: Based on academic research developed by the Oxford-Man Institute, this model aims to reduce portfolio exposure when the risk of a bonddriven sell-off increases, as indicated by bond price declines plus increasing (intraday) bond-equity correlations (the ’HEAVY’ model).

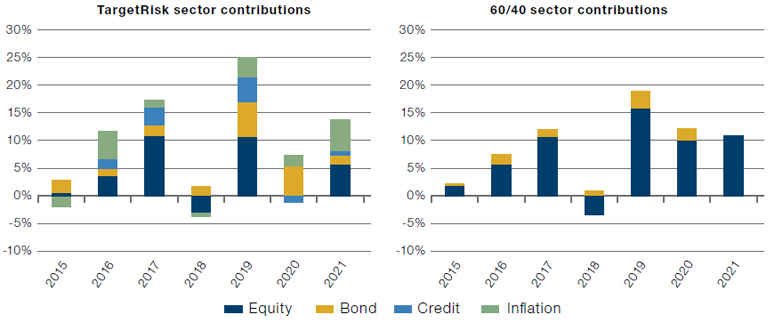

As a result, when we compare TargetRisk returns to a traditional 60/40 portfolio, not only does the strategy outperform the 60/40 portfolio, but it does so while achieving balanced returns between all sectors. This highlights TargetRisk’s ability to generate balanced returns in different market environment and not relying on valuation-stretched equities (Figure 3).

Figure 3. Return Contributions by Asset Class

Source: Man Group, Bloomberg; between January 2015 and August 2021. The 60/40 portfolio is based on 60% MSCI World Net Total Return Index (hedged to USD) and 40% Barclays Capital Global Aggregate Bond Index (hedged to USD). The composite is an appropriate benchmark for the programme for performance illustration purposes.

Conclusion

As the title of this piece suggests, we should remain humble in the face of uncertainty and admit that we don’t know what’s going to happen next. Investors need a map to navigate this uncertainty. In our view, by targeting risk to gain true diversification across asset classes, and applying dynamic risk management, investors may be able to find a better way through difficult markets.

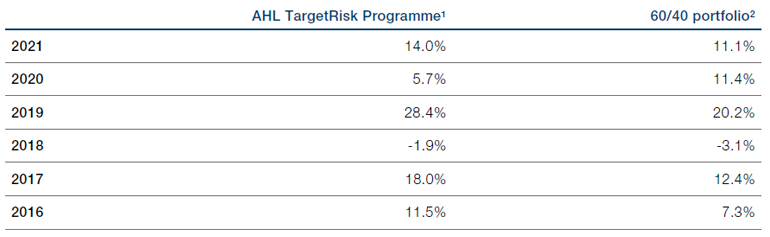

AHL TargetRisk Programme1 calendar year returns

1 January 2016 to 31 August 2021

Past performance is not indicative of future results. Returns may increase or decrease as a result of currency fluctuations.

1. Please note that the performance data is not intended to represent actual past or simulated past performance of an investment product. The data is based on a representative investment product or products that fully invest in the programme. AHL TargetRisk Programme is net of estimated fees and service cost of 0.95%.

2. 60/40 portfolio is based on 60% MSCI World Net Total Return Index (hedged to USD) and 40% Barclays Capital Global Aggregate Bond Index (hedged to USD). The composite is an appropriate benchmark for the programme for performance illustration purposes.

Important considerations

One should carefully consider the risks associated with investing, whether the strategy suits your investment requirements and whether you have sufficient resources to bear any losses which may result from an investment:

Market Risk - The Strategy is subject to normal market fluctuations and the risks associated with investing in international securities markets and therefore the value of your investment and the income from it may rise as well as fall and you may not get back the amount originally invested.

Counterparty Risk - The Strategy will be exposed to credit risk on counterparties with which it trades in relation to on-exchange traded instruments such as futures and options and where applicable, ‘over-the- counter’(“OTC”,”non-exchange”) transactions. OTC instruments may also be less liquid and are not afforded the same protections that may apply to participants trading instruments on an organised exchange.

Currency Risk - The value of investments designated in another currency may rise and fall due to exchange rate fluctuations. Adverse movements in currency exchange rates may result in a decrease in return and a loss of capital. It may not be possible or practicable to successfully hedge against the currency risk exposure in all circumstances.

Liquidity Risk - The Strategy may make investments or hold trading positions in markets that are volatile and which may become illiquid. Timely and cost efficient sale of trading positions can be impaired by decreased trading volume and/or increased price volatility.

Financial Derivatives - The Strategy will invest financial derivative instruments (“FDI”) (instruments whose prices are dependent on one or more underlying asset) to achieve its investment objective. The use of FDI involves additional risks such as high sensitivity to price movements of the asset on which it is based. The extensive use of FDI may significantly multiply the gains or losses.

Leverage - The Strategy’s use of FDI may result in increased leverage which may lead to significant losses.

Model and Data Risk - The Investment Manager relies on quantitative trading models and data supplied by third parties. If models or data prove to be incorrect or incomplete, the Strategy may be exposed to potential losses. Models can be affected by unforeseen market disruptions and/or government or regulatory intervention, leading to potential losses.

1. Source: The White House Briefing Room; 31 August 2021.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.