Introduction

It has been a long-held belief that the US healthcare sector fares better than other sectors during economic downturns as it benefits from inelastic demand, contractual rates with health plans and governments, and is generally favoured by risk-averse market participants. Private credit, as an asset class that performs best when invested in steady industries, has therefore historically maintained a heavy focus in healthcare. But the past two years have proven more challenging than anticipated for many private credit managers with significant allocations to healthcare: problems have arisen from asset-specific challenges, reimbursement “surprises” and general industry dynamics. The long-term revenue stability that has been the hallmark of the healthcare sector has created short-term headaches as cash flows from stable revenue have been squeezed by wage inflation and rising interest rates.

As investors watch private credit managers’ performance, they can now see differentiation between the asset managers invested in healthcare private credit. This paper explores the long-term and short-term healthcare industry trends. Further, it will articulate what we believe to be the key attributes of successful healthcare investors in private credit. Lastly, as the industry’s short-term challenges subside, healthcare should resume offering a potentially unique opportunity for private credit investors: a historically long-term stable sector that has inelastic demand, favourable credit terms and yields, and an ability for investors to differentiate between managers.

Supportive long-term factors

The healthcare sector is a key pillar of the US economy, representing approximately 17% of US GDP1. The healthcare sector consists of a wide range of subsectors, including healthcare providers, pharma-related businesses, manufacturers and suppliers of medical devices and lab tests, healthcare technology providers and administrative service providers to insurance payors and health systems. The healthcare sector benefits from several favourable industry drivers:

An aging population. Healthcare consumption increases as the US population ages. According to the Centers for Medicare & Medicaid Services (CMS), “per-capita costs for those 85 years old or older are twice as high as for those 65 to 84 years of age. As a large portion of the American population lives well beyond [previous] retirement age, the total cost of providing healthcare will grow as well.” As Figure 1 highlights, the 65+ cohort is expected to grow the fastest; within the 65+ cohort, the 85+ cohort, which has the highest per-capita costs, is forecast to grow even faster.

Figure 1. Over-65 cohort set to grow the fastest

Problems loading this infographic? - Please click here

Source: US Census Bureau (2004a, 200b, 2004c).

Inelastic/non-cyclical demand. According to The American Institute of Healthcare Management, the demand for healthcare products is typically inelastic. Stakeholders are typically not price sensitive when they have a medical condition, particularly when the cost is substantially paid by a government or insurance payor. As the chart below highlights, per-capita health spending has grown at around 4% CAGR over the past 10 years and is forecast to grow at an even faster rate of approximately 5% CAGR from 2022 to 2031 according to National Healthcare Expenditures forecast.

Figure 2. Annual change in per-capita health spending, %

Problems loading this infographic? - Please click here

Source: KFF analysis of National Health Expenditure data, available at https://www.healthsystemtracker.org/

Contractual revenue streams from health plans and governments. In an effort to reduce cost and better coordinate care for participants, employers, health plans and governments have coerced patients and providers to participate in tighter “in-network” health options. These health networks typically include contracts between plans and providers. These contracts have led to both stable rates for providers and cleaner revenue cycle management as contracts minimised rate disagreements and disputes. Furthermore, in the wake of the Affordable Care Act expansion of Medicaid coverage, healthcare providers have benefited from a reduction in the uninsured rate, which has resulted in lower bad debt.

Figure 3. Non-elderly uninsured rate

Problems loading this infographic? - Please click here

Source: KFF analysis of 2010-2022 American Community Survey, 1-year estimates. Note that due to disruptions in data collection during the Covid pandemic, the Census Bureau did not release ACS 1-year estimates in 2020. Includes non-elderly individuals aged 0 to 64 years.

Regulations and risk-averse stakeholders. With several layers of healthcare regulators and regulations, healthcare is a unique industry, with stringent barriers to entry. Relationships and revenue streams in healthcare enjoy stability provided by higher regulation-driven switching costs.

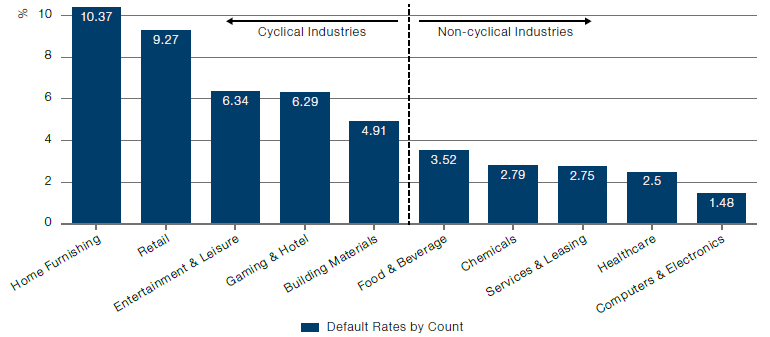

These favourable dynamics have historically presented healthcare private credit managers with an investment that offers lower default rates. As illustrated in the below chart, which details the cumulative default rate by industry from 1995 to 4Q 2022 for different sectors, historical defaults by borrower count for cyclical industries have immensely outnumbered the default rates of potentially recession-resistant industries, including healthcare.

Figure 4. Historically low default rates for healthcare

Source: LCD, a part of PitchBook Data, Inc., long-term sector default rates from loans closed between 1995 and 4Q22. Data has not been reviewed by PitchBook analysts.

Furthermore, within the past year, the default trends for the overall healthcare sector have fared relatively well compared with other sectors, particularly when excluding pharmaceuticals, which is a subsector that we believe private credit managers without advanced scientific knowledge should avoid.

Figure 5. Default rates by industry

Problems loading this infographic? - Please click here

Source: Proskauer Private Credit Group 4Q23 Survey.

However, because healthcare is the largest sector of the US economy, even if the default rate of healthcare sector loans is in line with other sectors, healthcare loan defaults will proportionately make up a larger portion of total defaults. This is what we saw in 2023: healthcare represented about 17% of defaults in the LSTA Leveraged Loan Index, mirroring healthcare’s approximate contribution to US GDP. This represents a material deviation from healthcare’s historical ratio of defaults in the LSTA Leveraged Loan Index to contribution to US GDP. While healthcare has outperformed in a recessionary environment, the sector should rather be expected to perform in line with other industries given the challenges it faces in an inflationary environment.

Figure 6. Sector mix of defaulted loans

Problems loading this infographic? - Please click here

Source: LSTA Leveraged Loan Index, bankruptcy and payment defaults as at 31 December 2023.

Recent pain

The healthcare sector was materially impacted by Covid which first resulted in declining patient volumes due to lockdowns but recovered quickly with physician visits rebounding back to pre-Covid levels. While this demonstrated the resilience of the healthcare sector, new challenges (both healthcare-specific and broader macroeconomic headwinds) such as wage inflation, staffing turnover, an increase in underlying floating interest rates and the No Surprises Act2 have impacted the sector.

Figure 7. Volumes rebounded after lockdowns

Problems loading this infographic? - Please click here

Source: Berkeley Research Group.

While the increases in inflation and interest rates have impacted all sectors to varying degrees, the healthcare sector’s greatest strength may have been a key contributor to some of the recent problems for healthcare private credit managers. Stability of revenue makes for a non-cyclical end market, but that stability is not necessarily a strength in an environment of inflation. As predominantly service companies, healthcare providers are usually heavily dependent on staffing.

Wage inflation post Covid has not been unique to healthcare, but healthcare providers had cashflow impacts magnified by an inability to raise fixed contractual reimbursement rates. Providers with large staff of low-wage employees (skilled nursing facilities, home care aids, autism therapy) have been impacted the most. Physician practices (where typically, physician compensation is the largest expense and is calculated as a percentage of production/collections) have been less affected. Wage inflation and staffing challenges have not caused loan defaults in a vacuum, but even modest wage pressure has greatly narrowed the margin of error for companies in the space. Healthcare providers that were already underperforming had their challenges compounded in some situations by turnover, wage pressure and rising debt service payments.

Almost all borrowers, including healthcare sector borrowers, have been meaningfully impacted by rising interest rates, which in many cases have resulted in an almost doubling of interest expenses over the past two years.

In particular, rising interest rates have had a compounding cashflow impact for certain highly levered healthcare providers where the private equity owners pursued an aggressive, debt-financed M&A roll-up strategy. The interest rate increase has left many highly levered borrowers unable to pursue their acquisition-driven growth thesis. This has been driven by either underperformance or due to the cost of debt capital becoming too expensive, which could result in providers avoiding acquisitions in order to focus on servicing interest expense burdens.

Surprised by “No Surprises”

The No Surprises Act aimed to limit the amount that healthcare providers can bill patients, health plans or governments when the provider does not have an “in-network” contract. Providers now have a harder time charging egregious rates for care when not bound by a network contract with a health plan or government payor. Margins on “out-of-network” revenue have fallen significantly for certain providers, and many healthcare stakeholders that rely on significant out-of-network billings have fallen into financial distress.

- While most healthcare providers have little or no out-of-network billing, certain subsectors more heavily rely on it. The legislation has had a particular impact on certain healthcare modalities including anesthesia, ambulances and emergency care.

- Even for certain healthcare providers that did not have meaningful out-of-network billing, the legislation weakened their negotiating leverage with commercial insurance payors, as the threat to go out-of-network rather than accept reduced in-network rates now has less credibility.

- Private credit managers have experienced performance declines and losses on certain impacted healthcare investments, particularly on investments supporting aggressive private equity backed healthcare providers. Notably, this impact has not been felt by all private credit managers, as some managers with significant healthcare expertise have long avoided financing providers that had concentrations in out-of-network billing because of concerns about their sustainability.

Pain subsiding? Not entirely straightforward

The legislation impact from the No Surprises Act has had a varied impact on private credit managers – those managers with deep healthcare insights were able to steer clear of healthcare providers with aggressive out-of-network billing processes. In contrast to the legislative impacts, inflation and interest rates have had a broader impact on the healthcare sector, but one can see early signs of recovery.

US monthly inflation hit a peak at over 9% in 2022. But the monthly rates have settled between 3 and 4% for each month during the second half of 2023 and into 2024. The aggregate inflation data does not give the full story as inflation varies by industry. Even within healthcare, there is further disparity in inflation as healthcare’s inflation burden varies depending on the sub-sector. Going forward, we do expect providers to get some relief as wages stabilise.

Figure 8. US wages vs inflation, %

Problems loading this infographic? - Please click here

Source: Statista https://www.statista.com/statistics/1351276/wage-growth-vs-inflation-us/

Further, the underlying insurance payor contracts or scheduled government payor rates that support the stable healthcare revenue streams have been renegotiated at higher rates in certain circumstances, but the lagging effect of such rate increases will take time to fully offset the wage inflation impact.

An inflation recovery might still be in the early innings as seen by the Federal Reserve’s hesitance to lower interest rates. But consensus inflation forecasts and forward interest rate curves paint a relatively clear picture of recovery, with inflation projected to decline from the current 4% level to 2% by the end of 2024.3

Execution within healthcare private credit

The recent healthcare dynamics have provided another indirect benefit – private credit investors can now see differentiation amongst managers. Data depicting specific healthcare performance within a private credit manager’s portfolio is not easy to attain, but one can look at the varied healthcare performance of the public business development companies (BDCs). In reviewing the various private credit manager performance, one can see trends that reflect the managers that have been successful in healthcare. We have found that successful firms usually operate with dedicated healthcare teams that conduct their own independent healthcare diligence, proactively pursuing and avoiding certain healthcare sub-sectors. We believe that managers of healthcare within private credit must maintain a consistent and disciplined approach through every cycle.

Dedicated healthcare teams

Most private credit managers do not maintain a dedicated healthcare team. Given the specific industry aspects of healthcare, dedicated healthcare professionals with significant experience are crucial for fully understanding risks and opportunities in healthcare private credit. For example, the layers of regulations, significant reimbursement risk, complex corporate structures and unusual revenue cycles all require dedicated/ experienced healthcare professionals for fully assimilating information and correctly understanding risks.

Independent due diligence

Private credit market transactions are typically originated in conjunction with a leveraged buy-out by a private equity sponsor. As part of the private equity sponsor’s diligence work, they engage consultants and attorneys to conduct certain aspects of industry/company diligence. The consultants/attorneys typically put together detailed reports for their private equity clients, which are then shared with private credit managers. The private credit managers are not clients of the diligence providers, yet most private credit managers rely on and defer to the diligence work. A key element that is lost in this outsourced diligence dynamic is the fact that there are different levels of risk tolerance for private equity and private credit investors. Equity and credit underwritings should not be checking the same boxes. Successful private credit managers have lower risk tolerance – they need to assess risks independently and cannot simply rely on a third party.

- A successful healthcare private credit manager will possess broad and deep healthcare expertise to perform their own diligence and use their own consultants and attorneys to analyse a situation as well as the work performed for the private equity firm.

- This is particularly crucial in healthcare because large portions of reimbursement and regulatory diligence is outsourced. Private credit managers need their own consultants to verify what the private equity firm is sharing. Further, when compared to private equity, credit managers need due diligence with a much lower risk tolerance, they cannot simply defer to the private equity firm and their consultants and lawyers.

Healthcare sub-sector focus, proactively pursuing/avoiding certain sub-sectors

In our view, another key attribute of a successful private credit manager is the ability to proactively assess the various sub-sectors within healthcare. A private credit manager needs to maintain credit discipline while managing private equity customer expectations. A successful private credit manager will know the opportunities and pitfalls of the various healthcare sub-sectors. This allows them to execute swiftly and screen opportunities immediately, and not wait for further industry diligence work. This ability to “see around corners” enables the solid private credit manager to avoid passing on transactions late in the transaction process, which could strain relationships with private equity firms. Quicker credit decisions are key to maintaining relationships with private equity firms as a “quick no beats a slow yes” when deciding to pass on, or pursue a transaction. Slow processing of healthcare transactions leads to sloppy execution, poor private equity relationships, and potentially higher defaults.

Consistent disciplined credit approach through cycles

In order to execute swiftly while making sound credit decisions, it is critical for the credit manager to have a deep understanding of the credit attributes and risks specific to each subsector.

In order to execute swiftly while making sound credit decisions, it is critical for the credit manager to have a deep understanding of the credit attributes and risks specific to each subsector. A healthy private credit manager will often maintain a “healthcare playbook” for proactively assessing healthcare industry sub-sectors. The playbook is typically relatively comprehensive since healthcare is such a large portion of the economy. To that end, a credit manager’s playbook needs to include healthcare providers, pharma-related business, medical device and lab test manufacturers, payor and health system service providers and healthcare information technology. Below are certain healthcare sub-sectors and their related opportunities and pitfalls.

Healthcare providers consist of physician, dental and other (e.g. physical therapy) providers of healthcare services. These can represent attractive credit profiles based on the strong demand tailwinds from an aging population and the non-discretionary nature of the procedures. However, there are significant risks to focus on, including the heavy emphasis on M&A and the execution risk of successfully integrating ongoing acquisitions, especially resulting in disruptions to complex billing and collections processes. These are also human capital businesses, so any elevated turnover will quickly translate into meaningful underperformance. Finally, a negative reimbursement outlook or poor regulatory compliance can impair a healthcare provider. An attractive healthcare provider credit profile will mitigate these risks through a combination of strong market position, a diverse provider base with low turnover, robust corporate infrastructure with demonstrated success with integrations, a strong compliance function and a stable reimbursement history and outlook. In addition to these business attributes, it is critical to partner with private equity groups with deep healthcare expertise and significant equity in the capital structure.

Pharma-related businesses provide services to support large pharmaceutical manufacturers, including clinical trial support and outsourced non-core functions (e.g. marketing, packaging, data analysis) or specialty pharmacy services for niche drugs or patient populations. This subsector is attractive due to strong demand tailwinds from an aging population, ongoing new drug development spending and an increasing focus by large pharma companies on outsourcing non-core services. Prominent risks to be cognisant of with this subsector include large revenue concentrations with a small number of top pharma manufacturers, potential non-recurring revenue from project work related clinical drug trials or commercial drugs nearing the end of their patent expiration and failure to consistently comply with stringent FDA regulations. An attractive pharma-services credit profile will be a market leader providing specialised services to a diverse customer base with consistent year-to-year revenue from the same customers, ideally tied to drugs with long-dated patents and a strong regulatory compliance track record. The most attractive pharma-related credit profiles provide services to drug manufacturers that are “spec’d in” to the drug’s FDA approval, which creates extremely high switching costs as any attempt to switch service providers requires FDA re-approval.

Medical device and lab test manufacturers and suppliers either manufacture or distribute implantable medical devices or diagnostic lab tests. This subsector is attractive due to the strong tailwinds from an aging population with a non-discretionary need for device implants and lab tests. Notable risks to manage with this subsector include a disproportionate concentration of revenue with a small number of devices or lab tests, potential for supply-chain disruption (e.g. heavy reliance on international suppliers), excessive capital expenditure requirements to maintain manufacturing facilities and any history of FDA regulatory issues. An attractive credit profile in this subsector will have a diverse customer base of blue-chip multinational device and lab companies, limited reliance on international suppliers, the ability to pass inflationary cost increases through to end customers, consistent recurring revenue from customers year-to-year for products with stable non-cyclical demand and a strong regulatory compliance track record. Similar to pharma-related businesses, attractive credit profiles in this subsector will also benefit from high switching costs because once a subcomponent has been included in an FDA-approved product, it is highly disruptive to obtain reapproval for replacement with a different part.

Payor or health system service providers deliver outsourced support services (e.g. processing claims for complex patient cases) to insurance payors or health systems. This subsector has historically had strong tailwinds from the consistent growth and profitability of large insurance payors and health systems and their ongoing trend to drive efficiencies by outsourcing non-core services. Prominent risks for this subsector include the potential for a concentrated customer base due to the small number of US insurance payors, the potential for insourcing or poor historical customer retention, the obsolescence of any technology the outsourced provider relies on for delivering services, and, in some cases, relying on large workforces outside Tier 1 countries, which implies low complexity or differentiation of the services. An attractive credit profile will have strong market position with specialised services and sustainable differentiation as well as a diverse customer base with “sticky” relationships driven by their technology being embedded within the customer’s systems. This will drive consistent recurring revenue from ongoing services.

Healthcare information technology (HCIT) businesses provide software and other technology that healthcare businesses use as their underlying IT platform. This subsector has enjoyed robust growth as healthcare providers have increasingly updated antiquated IT systems and benefits from a SaaS-based revenue model that provides attractive recurring payments. The top risk focus is ensuring that there is no meaningful risk of obsolescence for the HCIT borrower’s technology. Profiles with anything more than minimal customer churn or large capitalised software development costs required to maintain the business should be avoided. Also, because this subsector has been viewed highly favourably by private equity buyers, there have been some instances of the market providing excessive amounts of leverage. An attractive HCIT profile will have a SaaS revenue model with highly consistent recurring payments, low customer churn due to the mission-critical nature of the technology and a reasonable free cashflow profile relative to software development and debt-service costs.

Warren Buffett has famously discussed the dangers of times when market participants demonstrate herd mentality by emotionally entering and exiting markets at the wrong times. The same can be true for private credit. Managers need to consistently approach each market development with the same credit discipline. Given some of the healthcare market trends, consistent credit discipline is particularly required for private credit managers in the healthcare sector. One of the key tenets of a sound healthcare private credit manager is maintaining discipline during favourable markets while demonstrating confidence during industry turbulence. Too many private credit managers entered or increased healthcare exposure during the favourable pre-Covid market, and many have since exited. This leads to a cycle of investing at the worst credit terms, and then sitting on the sidelines when the terms and opportunities are most attractive. A pure contrarian approach is also not the optimal strategy: the best managers maintain a consistent approach throughout the cycles. A key element to the required discipline is to not overweight certain credit metrics. A sound credit opportunity will satisfy each of the fundamental credit metrics during any market dynamic.

As an example of this dynamic, private credit managers will underwrite and calculate both enterprise value cushions and cashflow coverage cushions when evaluating a loan opportunity. Sound managers should actually struggle at times during favourable market conditions. It’s easy to gravitate toward low loan-to-value (LTV) transactions when valuations are at inflated levels during favourable markets. One cannot look at LTV in a vacuum. Private credit opportunities must also maintain healthy cashflows and their cashflow coverage metrics need cushions to stomach potential adverse performance. A credit opportunity with very low LTV can also be over-levered; while counter-intuitive, this is not a contradiction as inflated valuations may be depressing LTVs while the underlying company cashflows cannot cover debt services with adequate cushions. When underwriting and structuring a transaction, a successful private credit manager will not overweight or overlook any of their underwriting hurdles or standards even when tempted during hot markets. We believe a consistent, disciplined approach leads to solid performance though cycles.

In summary

By comparison to the pre-Covid deal environment, current healthcare private credit transactions enjoy lower leverage / debt loads, more favourable credit terms and higher yields. A sophisticated private credit manager can take advantage of the favourable market while mitigating recent concerns by maintaining a dedicated healthcare team, understanding the specific healthcare sub-sectors, performing independent diligence and maintaining a consistent approach.

Despite certain private credit managers experiencing some instances of recent credit problems with healthcare borrowers, healthcare private credit currently provides a highly compelling investment opportunity that can capitalise on favourable long-term healthcare industry dynamics while taking advantage of current credit terms and higher yields. Recent turbulence has highlighted the differentiation between private credit managers. The right private credit managers maintain dedicated healthcare teams that favour certain healthcare sub-sectors, while conducting their own diligence – including diligence that is typically outsourced – and demonstrating discipline during all cycles. By partnering with proven credit managers with dedicated healthcare teams, asset managers will be able to participate in debt investments in the largest sector of the US economy while maintaining an appropriately balanced level of risk to deliver stable returns through the economic cycle.

1. Source: Statista, https://www.statista.com/statistics/184968/us-health-expenditure-as-percent-of-gdp-since-1960/

2. The No Surprises Act protects people covered under group and individual health plans from receiving surprise medical bills when they receive most emergency services, non-emergency services from out-of-network providers at in-network facilities, and services from out-of-network air ambulance service providers, according to the Centers for Medicare & Medicaid Services https://www.cms.gov/newsroom/fact-sheets/no-surprises-understand-your-rights-against-surprise-medical-bills

3. Source:https://www.morningstar.com/economy/why-we-expect-inflation-fall-2024

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.