1. Introduction

The process of incorporating considerations other than financial returns in investment decisions has a long history. Since the early 2000s, responsible investing considerations have been steadily gaining acceptance as important factors for the investment process. This is arguably part of an ongoing process of reconsidering what role corporations should have in society.

Indeed, asset managers face the ESG question both as corporates and for the products they offer as an asset manager. The emerging importance of ESG factors is an opportunity to increase the impact asset managers have, not only on client outcomes, but also on the environment and society more broadly.

As such, there was no doubt this year when we, at Man Group, decided that the topic of our annual academic board advisory meeting would be on responsible investment. In this first of a 2-part series, we take a look at what the research – both from academics and practitioners – says on ESG investing, including: what is ESG investing; ESG and corporations; how ESG is incorporated in practice; whether ESG investing influences corporate behaviour; and the impact of ESG on asset returns.

In the second article, we will bring together the thoughts of Man Group practitioners and academic advisors on these areas.

2. What Is ESG Investing?

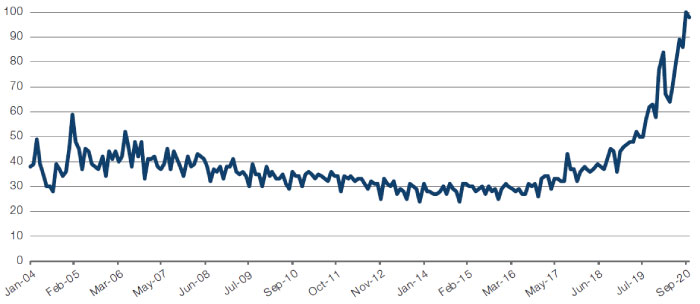

Responsible investing has taken several forms over time. In recent years, a framework that received increasing attention (Figure 1) is that of so-called Environmental, Social, and Governance (‘ESG’) investing. In this document, we aim to provide some background around the main themes in this area, from the justifications and practical methods for its application, to research around its impact.

Figure 1. Interest Over Time for Search Term ‘ESG’

Source: Google Trends; as of November 2020.

Measure represents relative to the highest point on the chart (e.g. a value of 100 represents peak popularity).

2.1. Historical Overview

We provide a brief overview of the use and development of socially responsible investment practices throughout history. For a more in-depth review, see Townsend (2020), Schueth (2003), and Sherwood, Pollard (2018).

2.1.1. Historical Examples of Ethics-Based Systems of Rules

The idea of including considerations other than financial returns into investment decisions has a long history. In ancient times, this happened mainly through religious law.

- For example, in the Jewish Torah, the Book of Leviticus (generally dated to the 6th-4th century BC) already provides several principles to regulate the ownership of land, the lending of money and taxation. The focus of these principles was that of maintaining a fair and stable society, rather than facilitating the maximisation of personal gain;

- Similar principles were developed in the Islamic world, with particular focus on the prohibition of riba, a term often associated with usury, but which can be more broadly associated with exploitative gains made in business or trade. These principles are applied to this day in Sharia-compliant finance;

- Another example of principles-based investing is provided by the system developed by the Religious Society of Friends (Quakers). In its Quaker Philadelphia Yearly meeting of 1758, the society agreed that from that moment it would be prohibited for members to invest in the slave trade. Similarly, the Methodist movement adopted in the 19th century a system of socially responsible investment practices based on John Wesley’s 1872 sermon, ‘The use of money’. The guiding principle of their system was that no harm should be inflicted on other men from one’s business and investing practices.

2.1.2. Modern Examples

During the 20th century, the impetus for the inclusion of social responsibility principles into investing came more decisively from the social and cultural changes of the 1950-1990 era.

- During the 1950-60s, several trade unions started investing pension monies in socially relevant projects, such as medical facilities and housing projects. They also started using their stock holdings for the purposes of shareholder activism;

- In the 1960s, the Civil Rights movement employed boycotts and financed economic development projects as part of their fight1;

- In the 1970s, company boycotts were organised against companies providing weapons for the Vietnam War2;

- During the 1970-80s, a campaign of divestment started from companies operating in South Africa, which at the time was still under the apartheid system3;

- By the 1980s a set of practices had developed for Socially Responsible Investing (‘SRI’) in North America. These revolved around exclusion screens, i.e. investing in a similar universe to the benchmark, but avoiding investments in alcohol, tobacco, gambling, weapons manufacturers, adult industry and nuclear energy. In addition to this, another practice developed of investing in the ‘best-in-class’: companies that were leaders, in each sectors, in terms of environmental, social, and governance issues.

- By the 1990s, the interest in socially responsible investment started becoming more mainstream, leading to the first advisory services targeting specifically investors conscious of environmental and social issues.4

2.2. How Do We Define ESG Today?

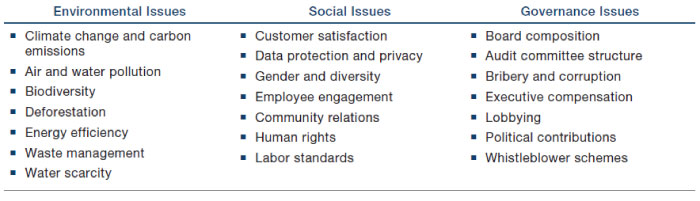

A decisive change in the practices of socially responsible investing occurred in the 2000s, where several intergovernmental initiatives, especially in Europe, started promoting increased levels of corporate disclosure and shareholder rights protections. It is in a 2004 report from the UN Environmental Programme (‘UNEP’) Finance Initiative that, when talking about disclosures from brokerage houses, we find one of the first uses of the phrase ‘environmental, social and governance issues’, later shortened into ESG. Figure 2 lists some examples of the issues commonly covered under each category.

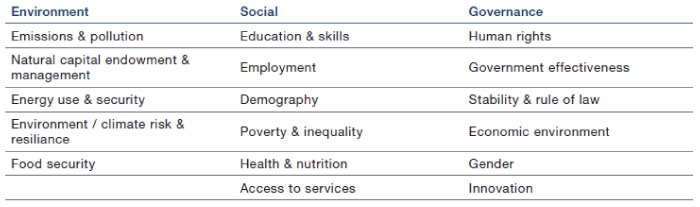

Figure 2. Examples of Environmental, Social and Governance issues

Source: CFA (2015).

2.2.1. Environmental Factors

Factors in this category relate to the impact that companies have on the environment. This category is arguably the one that has received most attention in recent years. Below, we provide a brief summary of the main environmental risk factors.

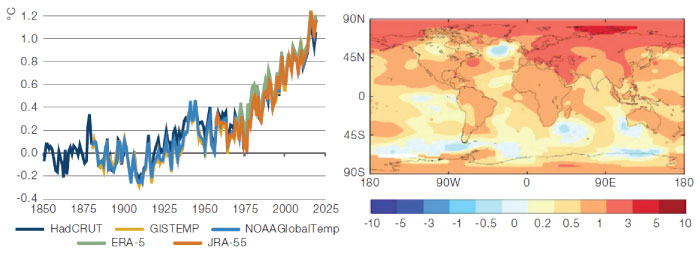

Figure 3. Increase in Global Temperatures

Source: Met Office, WMO (2020Left: Difference between yearly global average temperature and average temperature for the preindustrial period of 1850-1900; Right: 2016-2020 average temperature less 1981-2010 average temperature.

- The first risk factor we cover is global warming. Since the beginning of the 20th century, average global temperatures have increased by approximately 1° above pre-industrial levels (see left panel of Figure 3). This increase has been uneven across geographical areas, with some regions experiencing larger changes than others (see right panel of Figure 3). Over time, there has been increasing evidence that human activities can contribute to this phenomenon via the production of greenhouse gases5;

- Current predictions are that temperatures are likely to reach 1.5° above pre-industrial levels between 2030 and 2052 at the current rate (see IPCC (2018)). Importantly, changes in temperature are affected by the cumulative build-up of greenhouse gases in the atmosphere (Allen et al. (2009)). This means that even if we reached zero net emissions today, the warming from current cumulated emissions would continue to increase (although IPCC (2018) estimates show that this effect alone would likely keep the increase below 1.5°);

- Another important environmental risk is deforestation, the practice of removing trees to make space for human activities. Usually, deforestation is carried out in the context of farming, mining or drilling activities. Deforestation has direct effects on people who depend on forests for subsistence. It also impacts directly animals living in those areas, leading to a reduction in biodiversity. Deforestation also has an indirect impact through global warming, as the reduction in the number of trees leads to a reduced ability to absorb carbon dioxide in the atmosphere;

- Overfishing i.e. catching fish at a rate that is too fast for stocks to replenish, is another detrimental practice. It often involves large amounts of bycatch, fish that is captured but unwanted, and thus discarded. Such practices create risks for marine ecosystems and have the potential, if left unchecked, to generate a food crisis for populations that are dependent on fish for subsistence;

- General pollution of the air, land or water is another source of environmental risk. This can have adverse effects on human health; in the worst cases, increasing the incidence of cancers. It can also make certain areas inhospitable, such as areas exposed to nuclear accidents or with polluted water supplies. It has a direct effect on biodiversity, making areas inhospitable for plants and animals. Finally, it has an indirect effect through global warming: the burning of fossil fuels adds greenhouse gases to the atmosphere, thus contributing to global warming.

The environmental factors we discussed pose physical risks to human life. Examples of these include6:

- Some areas might become inhabitable, potentially leading to humanitarian crises;

- The incidence of extreme weather events might increase;

- Food supply chains might be impacted via reduced agricultural yields and destruction of marine life.

They also pose transition risks for businesses. For example, if the economy underwent a process of decarbonisation (i.e. a reduction of the reliance of productive processes on fossil fuels), all industries would be impacted in a way or the other. However, this process would pose larger risks for some industries. For example, the energy industry could be disproportionately affected via an accelerated shift away from the capital-intensive activities of oil, gas, and coal production, in favour of renewable energy.

2.2.2. Social Factors

Factors in this category measure the impact of a company on its employees, customers, other stakeholders and society as a whole. The focus is on monitoring whether the company acts with fairness in its relationships with stakeholders, and whether it promotes desirable values through its activities. Factors that are important in this context include:

- The quality of the company as an employer: does the company protect and promote the health and well-being of employees? Does it provide training and development opportunities?;

- The relationship of the company with customers: does the company produce high-quality goods? Does it take care of the customer through a good customer-care programme? Does it ensure that the goods sold do not present a health and safety hazard for customers?;

- The relationship of the company with suppliers: does the company monitor the impact it has through its supply chain activities? For example, does it make sure that its suppliers do not engage in unfair labour practices or expose their employees to health and safety risks? Does it monitor their environmental impact?;

- The relationship of the company with society at large: does the company respect and promote values that are desirable from society’s point of view? For example, does the company have concrete policies to prevent discrimination in the workplace, and is it a promoter of diversity? Does it make sure to have a net positive impact on the communities in which it operates? Does it engage in charitable activities?

2.2.3. Governance Factors

Factors in this category are related to systems the company puts in place to ensure that shareholder value is protected. Factors that are taken into consideration include:

- Protection of shareholder rights;

- Safeguarding the independence of the board of directors and promoting diversity within it;

- Ensuring that management compensation policies are transparent and aligned with shareholders and stakeholders more in general;

- Safeguards in place against bribery and corruption.

2.2.4. ESG Today

The last decade witnessed several developments in the field of ESG investing. Starting in 2005, asset owners under the auspices of the United Nations (‘UN’) developed the Principles for Responsible Investing (‘PRI’), with the goal of making the financial system sustainable. The signatories pledged to invest following ESG principles. The initiative was very successful. As of 2019, it counted 2,300 signatories with assets under management (‘AUM’) of USD80 trillion. In 2015, Morningstar partnered with Sustainalytics to provide ESG ratings of mutual funds, a first important step in making ESG investing more accessible to retail investors. Indeed, as of the start of 2018, global sustainable investing assets in major global markets reached USD30.7 trillion, from USD22.9 trillion in 2016.7 The last few years have witnessed the developments of the first ESG benchmarks by index providers, and futures are starting to be traded on these.

2.3. Focus on Environmental Factors

As mentioned, institutional investors are taking the issue of climate risk seriously and the issue has received a large amount of attention in recent years. This is partly due to the fact that some of the environmental risks can be more easily quantified. For example, Daniel et al (2018) build an asset pricing model to derive optimal pricing rules for carbon emissions given the uncertainty about the damage they cause. In their model, the optimal price will be high today, when uncertainty about the damage is high, and should decrease in the future as uncertainty is resolved. A model of this type is quite precise in its recommendations and could provide hints as to how regulators are likely to address the issue of carbon emissions. Another example is the Report of the High-Level Commission on Carbon Prices, (Stern and Stiglitz (2017)), which finds that the price of CO2 emissions consistent with meeting the Paris Agreement temperature targets is of at least USD40-80/tCO2 by 2020 and USD50-100/tCO2 by 2030, assuming that other supportive policies are enacted. This gives a quantitative assessment that can be used by corporate decision makers and investors.

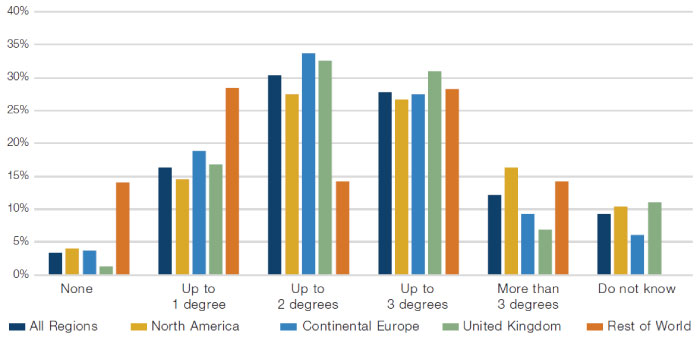

To better understand how investors think about environmental issues, it is useful to look at recent data from surveys. We look at one in particular, Krueger et al. (2020). The survey contains several important observations, of which we report a few key ones:

- Most respondents expect a rise in temperatures in the future. A significant portion expects such rise to exceed the 2° target of the Paris Agreements (Figure 4);

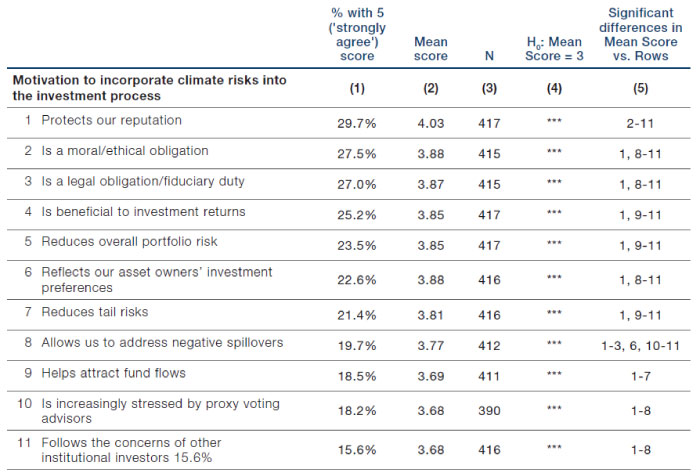

- There is no single catalyst for the inclusion of climate risks into the investment process. Institutional investors worry about a wide array of issues, such as the impact on their reputation, the fact that it is a moral and/or legal obligation and the fact that it might have an impact on portfolio return and risk (Figure 5);

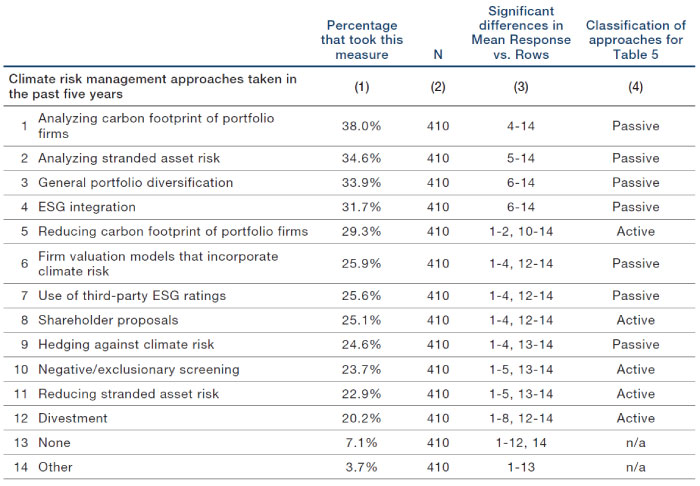

- There is a wide array of actions that institutional investors take to protect themselves from climate risks. This reflects the complexity of the issue, and clearly shows that no unified approach has emerged. Some of the most used approaches include the analysis of carbon footprints and stranded asset risk8, general diversification, the reduction of the carbon footprint of portfolio firms, and the use of ESG data, either via ESG integration in the investment process or by using third-party ESG ratings (Figure 6).

Figure 4. Distribution of Expectations for Global Temperature Rise by the End of This Century by Region

Source: Krueger et al. (2020).

Figure 5. Motivations to Incorporate Climate Risks Into the Investment Process

Scale goes from one (‘strongly disagree’) to five (‘strongly agree’). Column 1: percentage of respondents indicating strong agreement. Column 2: the mean score, with higher values corresponding to stronger agreement. Column 3: number of respondents. Column 4: results of a t-test of the null hypothesis that each mean score is equal to 3 (neither agree nor disagree). *** indicates statistical significance at the 1% level. Column 5: results of a t-test of the null hypothesis that the mean score for a given reason is equal to the mean score for each of the other reasons (only differences significant at the 10% level are reported). Source: Krueger et al. (2020).

Figure 6. Percentage of Respondents That in the Previous Five Years Took a Given Approach to Incorporate Climate Risks Into the Investment Process

Responses were not mutually exclusive. Column 1: percentage of respondents that took a certain measure. Column 2: number of respondents. Column 3: results of a t-test of the null hypothesis that the percentage for a given approach is equal to the percentage for each of the other approaches (only differences significant at the 10% level are reported). Column 4: classifies the motives into more active and more passive approaches. Source: Krueger et al. (2020).

In summary, the respondents in the survey from Krueger et al. (2020) generally believe that climate factors represent a risk for their portfolios, both from a purely financial standpoint, but also from a legal and fiduciary standpoint. Encouragingly, most respondents seemed to address the issue continuing the engagement with markets and managing the risk rather than divesting.

3. ESG and Corporations

In this section, we analyse how ESG considerations can impact the behaviour and performance of corporations. We start by looking at different views of the role of firms in society and their implications in terms of ESG considerations. We then look at studies of the impact that paying attention to ESG considerations has on corporate performance.

3.1. Should We Step Away From the Shareholder-Centric View?

3.1.1. The Classic View of the Role of the Firm

- The classic view of the role of the firm traces its roots to the discussion of self-interest in the Wealth of Nations of Adam Smith (1776). This book developed the idea that the pursuit of self-interest by individuals (and, by extension, by corporations acting on their behalf) in a system that allows free exchange of goods (i.e. in the absence of unfair practices or monopolies) ultimately leads to the highest possible prosperity. On this basis, classical economics has embraced the view that companies should focus on maximising shareholder value, while stakeholders should be protected by contracts and regulations;

- As formulated in Pigou (1920), the state should intervene only in selected cases where solutions of this kind are not viable, as when the transaction costs are too high and when there is an informational asymmetry;

- A famous proponent of the classical view was the economist Milton Friedman. In his 1970 New York Times article, he defended vigorously the principle that the sole objective of a company executive should be that of maximising shareholder value as measured by market value. The pursuit of goals other than the maximisation of shareholder value was viewed by Friedman as a symptom of a principal-agent problem, where the entrepreneur is effectively using the shareholders’ capital for his own purposes. For this reason, Friedman argued that ethical issues should be left to individuals and governments to deal with;

- Cheng et al. (2020) provide empirical evidence that Corporate Social Responsibility (‘CSR’) expenditure by firms is at least partially caused by agency problems, where the managers effectively use the investor’s money for socially valuable projects. When governance and managerial incentives are improved, the authors observe that CSR expenditures are reduced and firm value increases. While the now richer shareholders might make up for the reduced CSR expenditure via private donations, the authors find that this does not happen in practice. They therefore suggest that a trade-off might exist between corporate governance and investment in social responsibility projects;

- There is also some evidence that classic methods of nudging firms towards behaving ethically might actually be counterproductive. For example, Davies and Van Wesep (2018) model the effect of divestment campaigns on executives’ behaviour. They find that, because most divestment campaigns only have a short-term price impact on stock prices, they are unlikely to change the behaviour of executives, whose pay is linked to long-run prices, profitability and stock returns. Under certain conditions, they might even create perverse incentives; for example, for executives whose pay is linked to long-term stock returns, which would benefit from lower prices in the short term. In an empirical study of executives’ pay, they find that for most of them their wealth would not change, and sometimes would even increase, following a divestment campaign.

3.1.2. Challenges to the Classic View

The classic view has not gone unchallenged and has been the subject of fierce debate over time.9 A broader view of the role of the firm is generally becoming accepted. As an example, we report few quotes from the recently adopted 2020 Manifesto of the World Economic Forum10:

The purpose of a company is to engage all its stakeholders in shared and sustained value creation.

[A company] responsibly manages near-term, medium-term and long-term value creation in pursuit of sustainable shareholder returns that do not sacrifice the future for the present.

A company is more than an economic unit generating wealth. It fulfils human and societal aspirations as part of the broader social system.

Another example is provided by the 2019 Statement on the Purpose of a Corporation11 by the Business Roundtable, an association of the chief executive officers of leading US companies. Selected quotes follow below:

While each of our individual companies serves its own corporate purpose, we share a fundamental commitment to all of our stakeholders. We commit to:

- Delivering value to our customers.

- Investing in our employees. [...]

- Dealing fairly and ethically with our suppliers. [...]

- Supporting the communities in which we work. [...]

- Generating long-term value for shareholders, who provide the capital that allows companies to invest, grow and innovate. [...]

These examples show that the emerging view of the company includes much broader obligations than the simple maximisation of shareholder value. We point the reader to Draaisma et al. (2019) for a self-contained discussion of the main issues, and Canfield et al. (2020) for an example of a discussion of these themes in a practical context (the mining sector in this case). In what follows, we present studies and articles that contributed to this discussion.

- An example is the development of stakeholder theory. Freeman (1984) describes it as a system which emphasises the value created not only for shareholders, but also for the network of stakeholders connected to the enterprise, such as customers, employees, suppliers and communities at large;

- Bénabou and Tirole (2010) study cases where CSR and profit maximisation are not inconsistent with one another. They describe three motivations that can lead a company to pursue CSR projects: doing well by doing good; delegated philanthropy; and insider-initiated corporate philanthropy.

‘Doing well by doing good’ is the idea that some actions taken in a CSR context can actually improve company performance. An example of this is that of CSR helping by curbing management’s short-termism. This can be a serious problem: Graham et al. (2005) show, in a survey of more than 400 executives, that a large portion of them (78%) is ready to take actions that may sacrifice long-term value in order to smooth earnings and make them more predictable. Bénabou and Tirole (2010) argue that CSR could be consistent with profit maximisation if, by taking a long-term view, investors are able to contrast the managers’ tendency for short-termism. CSR can also help by facilitating the achievement of a dominant position in the market, by attracting loyal customers, placating regulators or encouraging regulatory standards that will put competitors at a disadvantage.

‘Delegated philanthropy’ refers to cases where shareholders might be willing to forego part of their profits to further a social cause. The company might be better positioned to manage donations in the presence of informational asymmetries or high transaction costs (e.g. when supplementing the income of workers from developing countries) or because of technical expertise (e.g. when supermarkets use their expertise in logistics to coordinate relief convoys for areas hit by natural disasters). In some cases, achieving the social objective requires the cooperation of the firm (e.g. when working to improve working conditions for employees). Forcing companies not to be involved in these activities might actually result in a net loss to society.

In cases of ‘insider-initiated corporate philanthropy’ the manager is initiating philanthropic activities not at the request of corporate stakeholders, but because of an interest in engaging with some causes or, in the worst cases, because of political affiliations or business relationships. This is not compatible with profit maximisation and is closest to the aspects of CSR criticised in Friedman (1970); - Magill et al. (2015) discuss the fact that usually large firms face risks that can have an impact on stakeholders other than their shareholders. When the firm focuses only on shareholder value these risks are not internalised, so that there is a suboptimal investment in their prevention. Under their framework, giving at least some weight to the welfare of stakeholders other than shareholders can improve economic efficiency;

- Ferrell (2016) does not find evidence that CSR is associated with indicators of agency problems, such as excessive cash holdings or a disconnect between corporate performance and executive pay. To the contrary, they find an association between CSR and tighter cash constraints and higher sensitivity to the link between pay and performance. Companies ranking higher in terms of CSR tend to have better protections for minority shareholders and, in the absence of large agency problems, tend to rank better in terms of Tobin’s q, which is a proxy for firm value;

- Hart and Zingales (2017) argue that Friedman (1970) would only be right when business activities are separable from the damage-generating activities or when governments internalise perfectly externalities through their systems of laws. Because this is not true in the real world, the authors argue that shareholder value and market value are not the same thing. Companies should therefore focus on maximising the former, for example by letting shareholders vote on the direction of corporate policy.

3.2. Can Companies ‘Do Well by Doing Good’?

In this section, we look the impact that following CSR principles can have on operating performance. The relationship with asset returns will be discussed in Section 6.

- An influential paper in this strand of academic research is Gompers et al. (2003). The authors find that companies with strong investor rights tend to have better operating performance;

- More recently, Eccles et al. (2014) look at a sample of companies that voluntarily adopted by 1993 environmental and social policies. They find that these high sustainability companies tend to outperform in the long run, both in terms of stock appreciation and accounting performance. This is true particularly for sectors where the customers are individuals, competition is based on brands and reputation, or where products depend on the extraction of natural resources;

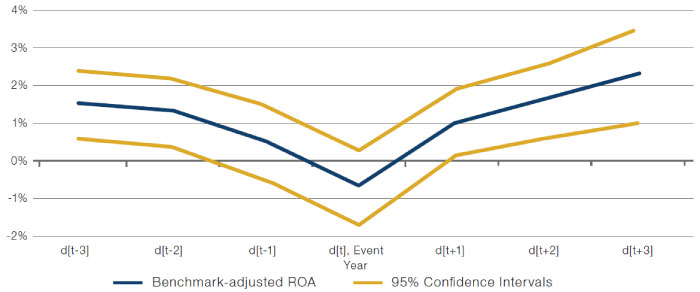

- In the context of governance improvements generated by interventions by activist investors, Brav et al. (2015) find that activism tends to produce long-term improvements in productivity. This can be observed in Figure 7. Moreover, the plants that are sold after intervention from activist investors tend to then experience improved productivity, suggesting that activist investors also increase value by facilitating the efficient reallocation of firm assets. Importantly, the authors find that firm workers do not tend to benefit from activism, as their productivity increase without a corresponding increase in wage;

Figure 7. Return on Assets Tend to Increase After Interventions by Activist Hedge Funds

Source: Brav et al. (2015).

- Dimson et al. (2015) carry out a study of social responsibility engagements. They find that positive engagements are followed by positive abnormal returns, improved accounting performance, improved governance and increased institutional ownership;

- Flammer (2015) focuses on CSR proposals from shareholders that pass or fail by a small margin. This provides a quasi-experiment on the effect of CSR proposals on performance, as the passing of the ‘close-call’ proposals is similar to a random assignment of CSR policies to companies. The study finds that the adoption of the proposals leads to positive returns on announcements and superior operating performance in terms of labour productivity and sales growth. However, this does not imply that CSR proposals are beneficial in general, as ‘close-call’ proposals tend to be different from other proposals along key dimensions.

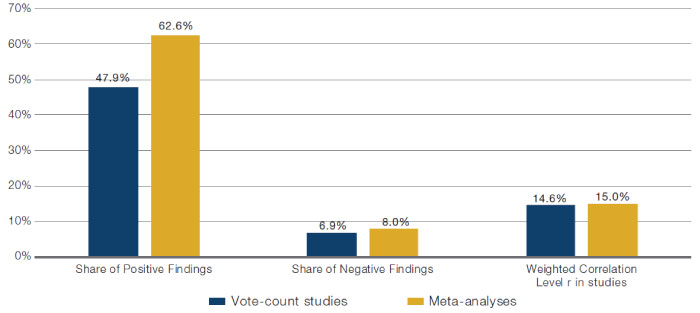

- Friede et al. (2015) is a meta-study of approximately 2,000 previous studies on the effect of ESG on performance. Approximately 90% of the studies find that applying ESG criteria does not impact performance negatively. Moreover, majority of the studies find that the impact is actually positive. Figure 8 shows a summary of these results from the paper;

Figure 8. Meta-Analysis of ESG Factors and Corporate Financial Performance

Source: Friede et al. (2015).

-

Appel et al. (2016) find that passive mutual funds influence governance, leading to an increase in the number of independent directors, a decrease in barriers to takeover, and more equal voting rights. They then find this to be associated with improvements in the long-term performance of the firm in terms of ROA;

-

Brav et al. (2018) find that, while hedge fund activism tends to reduce R&D expenditures by 20% on average, patents produced tend to increase by 15%, pointing to improvements in the efficiency of R&D processes12;

-

Hedge fund activism could generate benefits that go beyond those experienced by the target company: Aslan and Kumar (2016) find that the improvements in productivity at the target firm push competitors to take actions to boost their competitiveness;

-

Gantchev et al. (2019) show similar results, and also find that the measures taken by competitors lower their probability of being targeted by activist hedge funds.

4. How Is ESG Incorporated in Practice?

There are multiple ways in which investors incorporate ESG considerations into their investment process. We describe some of these (non-mutually exclusive) methods and we provide data on their prevalence.

4.1. ESG Considerations in the Investment Process

In this section, we describe different methods to incorporate ESG considerations in the investment process. While the methods might be different, they all lead to tilt portfolios away from companies exposed to high ESG risks, and towards companies with low exposure to ESG risks. This could impact portfolios and companies in different ways:

- It could increase the cost of capital of companies with high ESG risk. This could, in turn, push them to align their practices with ESG principles;

- It can have an impact on the risk and return characteristics of the portfolio. The academic evidence is ambiguous on the direction of this effect. We refer the reader to Section 6 for a more in-depth discussion;

- It could increase investment towards certain sectors with the expectation of higher returns, for example because of incentives from governments to innovate in a specific area (e.g. renewable energies).

In our description, we use a categorisation into six methods as put forth in CFA (2015). Note that, as mentioned above and as we will see in later sections, different authors might use somewhat different categorisations. See Furdak et al. (2019b) for a more in-depth discussion of the pros and cons of different approaches.

4.1.1. Exclusions Approach

This approach focuses on the creation of exclusion lists, used for negative screening purposes, i.e. deciding which types of asset or companies must be excluded from the investment universe. Exclusions can be applied to entire sectors, individual companies or even specific products, usually based on specific ESG criteria (classic exclusionary screening). Another way to create negative screens is to do so based on norms issued by supranational bodies such as the OECD, ILO, UN and UNICEF (norms-based screening). The exclusions approach is the method with the longest history, having been used for a long time by faith-based organisations. According to the Global Sustainable Investment Alliance13, this was the approach with the largest AUM in 2016, with an investment of approximately USD19.8 trillion.

4.1.2. Integration Approach

This approach aims at including considerations related to ESG factors in traditional financial analysis. As an example, ESG considerations can be integrated into a stock valuation model both via the cost and revenue projections.

- Expected costs are influenced by the availability of natural resources, which could be impacted by climate change. The expected rise in temperature in the next decade might impact the wear and tear of infrastructures and equipment. Regulations to discourage the use of fossil fuels might also have an impact on the cost of production. Labour laws might impact employment expenses;

- Expected revenues can also be impacted by ESG factors. A clear example is that of energy companies, which will be affected in the future by efforts from regulators to limit the use of fossil fuels. Another example is that of reputation and brand name, which can improve revenues by attracting new customers and helping to retain current ones.

Incorporating these factors in projections of cash flows is a way to fully integrate ESG in company valuation and may help in the security selection process. A similar process can also be applied to asset allocation tasks such as the decision of how much to allocate to a certain country or sector. This process is very different from just excluding certain securities/sectors/countries from the investable universe based on ESG ratings. This approach was the second most popular in 2016, according to the Global Sustainable Investment Alliance. AUM invested under this approach totalled to USD17.5 trilion.

4.1.3. Best-in-Class Approach

This approach focuses on investing only in the ‘leaders’, in terms of best practices, in a certain peer group. A peer-group can be the industry where a certain company operates or even the simple investment universe of the investor. Investors in this category can reward a combination of both the quality in a company’s practices and the amount by which they improved in a certain period.

4.1.4. Active Ownership/Corporate Engagement

This involves interacting with companies with a view of promoting social responsibility and good governance. The most direct form of interaction is voting at shareholder’s meetings in a way that is aligned with ESG criteria. Often voting is delegated to proxy advisors, whose research can help to form an opinion on the issue. There are other forms of engagement, where a true dialogue is commenced with the company in order to identify key areas of concern and potential ways forward. These include, for example, writing to the company, meeting with its representatives, raising questions at a general shareholders’ meetings, filing shareholder resolutions, attempting to gain a seat at the board, etc.

4.1.5. Thematic Investing

This involves identifying sectors that will be affected by secular trends such as climate change, pollution, ageing population, urbanisation, etc. Companies providing solutions to these challenges could be well-positioned to experience superior long-term growth. This approach aims to identify such firms, under the assumption that they will represent attractive investment opportunities.

4.1.6. Impact Investing

This refers to investing in companies or projects that have a specific social or environmental goal. Some key factors that distinguish this type of investment from others are that the invested companies/projects have as their main purpose the achievement of the environmental or social goal, and that the invested companies are committed to their progress towards these goals to be measured. To this purpose, the Global Impact Investing Network (‘GIIN’) issues a series of performance metrics, the Impact Reporting and Investment Standards (‘IRIS’) metrics catalogue, that can be used to evaluate the progress being made. Another key factor distinguishing impact investing is that investors in this category try to deploy capital to projects with a social or environmental benefit that would not have happened without their investment.

The GIIN defines four key elements of impact investing:14

- Intentionality: Investors have the intention to contribute with their investment to a specific social and/or environmental issue. This differentiates impact investing from strategies such as ESG;

- Financial returns: Impact investing is different from philanthropy. It seeks a return on invested capital;

- Range of asset classes: Impact investing can be carried out across asset classes;

- Impact measurement: Investors commit to measure what the impact of their investment in in terms of social and environmental performance.

4.2. What Is the Prevalence of Different Methods of ESG Incorporation?

ESG considerations have significantly grown in influence over time. Several surveys find that investors prefer funds that incorporate these considerations, and are even willing to give up financial returns in order to have an environmental and social impact.15 Investment managers responded to this interest by developing products that incorporate ESG considerations, using the methods described in the previous section. In this section, we provide a summary of survey studies that provide information on the prevalence of different methods.

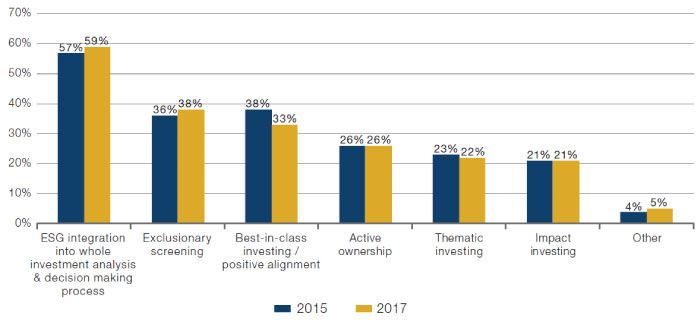

The first study we take under consideration is a 2017 ESG survey from the CFA institute. This provides data on the main methods its members use to incorporate ESG considerations into their investment process. Figure 9 shows the results of this survey and compares them to those from 2015. In both years, ESG integration was the most commonly used approach, followed by exclusionary screening and best-in-class investing.

Figure 9. Percentage of Respondents Using a Specific Method to Incorporate ESG Considerations in the Investment Process

Source: CFA (2017).

When looking at the actual AUM for different categories, the story changes slightly. Figure 10, from the 2018 Global Sustainable Investment Review, shows AUM data for some slightly more granular categories and compares the data in 2016 with the data in 2018. All categories experienced a significant increase in AUM for the period under consideration. Negative screening was the most prominent method used to incorporate ESG considerations, followed by ESG integration and corporate engagement.

Figure 10. AUM by Strategy Type

Source: 2018 Global Sustainable Investment Review.

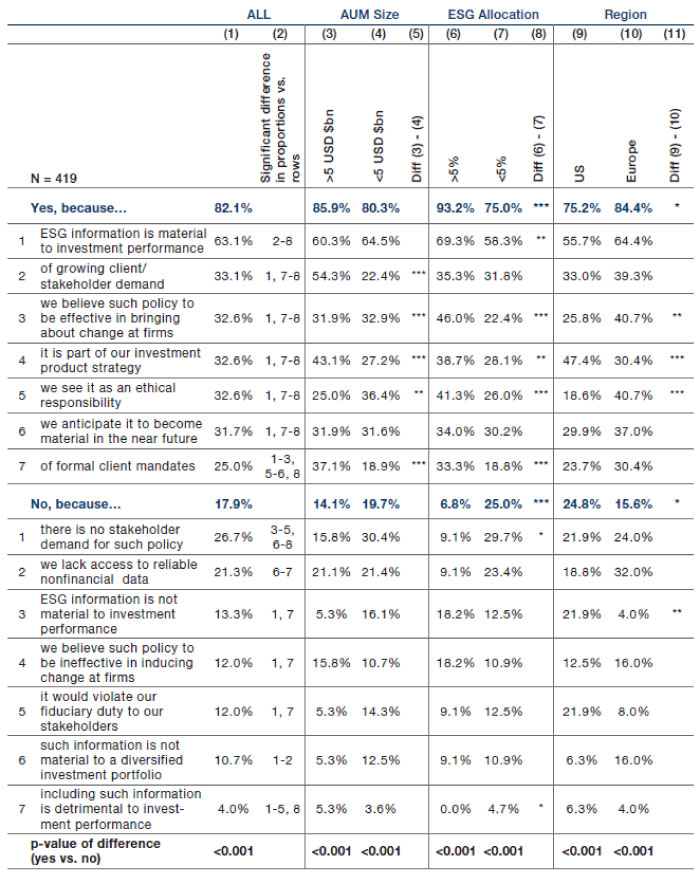

Another relatively recent work based on survey data is Amel-Zadeh and Serafeim (2018), who give an in depth look at the ways ESG is implemented in practice. Looking at Figure 11, we can see that most of their respondents incorporate ESG information in their investment process. The most common reason for this is that the respondents consider such information material to performance. This is true in the overall sample and in the several subgroups presented in the table. Other reasons include factors related to the impact that the adoption of ESG considerations can bring about and factors more related to business strategy (increasing demand from clients, formal mandates, etc).

Figure 11. Survey Responses to the Question: Do You Consider ESG Information When Making Investment Decisions?

Column 1: percent of respondents choosing the response in a given row. Column 2: results of a t-test of the null hypothesis that the percentage for a given alternative is equal to the percentage for each of the other alternative responses, where only significant differences at the 5 percent level are reported. Columns 3 and 4 report the percentages for investors with AUM >$5bn and AUM <$5bn. Column 5 reports the results of a test of the null hypothesis that the percentages in Columns 3 and 4 are equal to each other. Columns 5 and 6 report the percentages for investors with ESG allocation > 5% of AUM and < 5% of AUM. Column 7 reports the results of a test of the null hypothesis that the percentages in Columns 5 and 6 are equal to each other. Columns 9 to 11 report the percentages by geographical regions and the respective tests of the null hypothesis that the percentages in the specified columns are equal to each other. ***, **, * denotes significance at the 1%, 5%, and 10%-level, respectively. Source: Amel-Zadeh and Serafeim (2018).

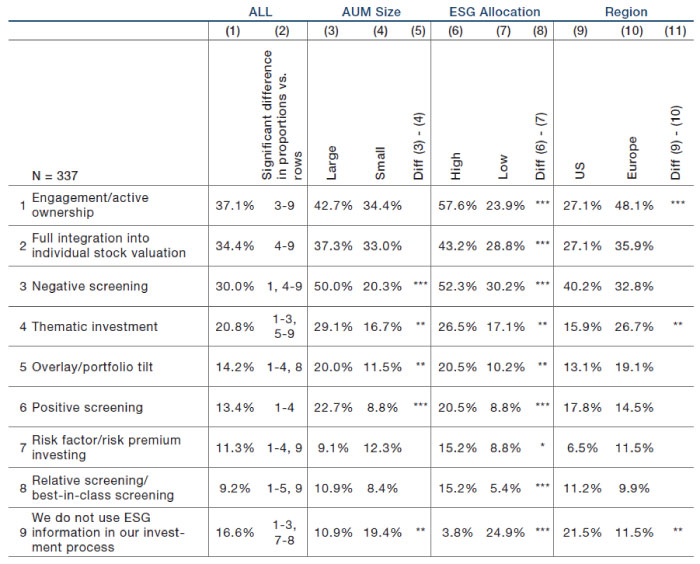

Figure 12 looks at the top methods used to incorporate ESG considerations in the investment process. While the ordering is slightly different from the previous surveys, we still find that the top methods are corporate engagement, full integration, and negative screening. Importantly, only 16% of the respondents do not use any ESG information in their investment process.

Figure 12. Survey Responses to Question: How Do You Integrate Material ESG Information in Your Investment Process/How Do You Use ESG Information to Define Your Investment Universe?

Column 1: percentage of respondents choosing the response in a given row. Column 2: results of a t-test of the null hypothesis that the percentage for a given alternative is equal to the percentage for each of the other alternative responses, where only significant differences at the 5 percent level are reported. Columns 3 and 4 report the percentages for investors with AUM >$5bn and AUM <$5bn. Column 5: results of a test of the null hypothesis that the percentages in Columns 3 and 4 are equal to each other. Columns 5 and 6: percentages for investors with ESG allocation >5% of AUM < 5% of AUM. Column 7: results of a test of the null hypothesis that the percentages in Columns 5 and 6 are equal to each other. Columns 9 to 11: percentages by geographical regions and respective tests of the null hypothesis that the percentages in the specified columns are equal to each other. ***, **, * denotes significance at the 1%, 5%, and 10%-level. Source: Amel-Zadeh and Serafeim (2018).

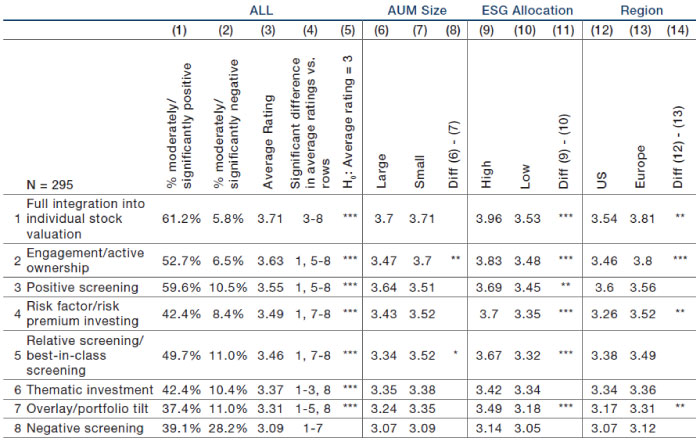

Another question in the paper asks respondents to what extent they believe that different ESG strategies will impact investment returns. Results are displayed in Figure 13. For none of the methods respondents seem to think they will have to suffer a moderately/significantly negative impact. In addition, in the cases of full integration, corporate engagement and positive screening, more than half of the respondents believe that the method will have a moderately/significantly positive impact on returns. Of all the strategies, the one that seems to create more questions is negative screening, for which almost 30% of respondents expect moderately/significantly negative returns.

Figure 13. Survey Responses to Question: Which of The Following ESG Strategies Do You Believe Improve or Reduce Investment Returns Compared to a Market Benchmark?

(Scale: 5 = significantly positive, 4 = moderately positive, 3 = neutral, 2 = moderately negative, 1 = significantly negative). Column 1 (2) reports the percentage of respondents indicating the impact levels of 4 or 5 (1 or 2) on a scale of 1 to 5. Column 3 presents the average rating. Column 4 shows the results of a t-test of the null hypothesis that the average rating for a given row is equal to the percentage for each of the other rows, where only significant differences at the 5 percent level are reported. Column 5 reports the results of a t-test of the null hypothesis that the average rating for a given row is equal to 3. Columns 6 and 7 report the average rating for investors with AUM >$5bn and AUM <$5bn, respectively. Column 8: results of a t-test of the null hypothesis that the average ratings in Columns (6 and 7 are equal to each other. Column 9 and 10: average rating for investors with ESG allocation >5% of AUM <5% of AUM. Column 11: reports the results of a t-test of the null hypothesis that the average ratings in Columns 9 and 10 are equal to each other. Columns 12 to 14 report the percentages by geographical regions and the respective tests of the null hypothesis that the percentages in the specified columns are equal to each other. ***, **, * denotes significance at the 1%, 5%, and 10% level. Source: Amel-Zadeh and Serafeim (2018).

4.3. ESG in Different Asset Classes

The methods for incorporating ESG we described in the previous section have been routinely applied in equity investments. More recently, interest has started to emerge around fixed income ESG solutions, both in the corporate and sovereign space. In this section, we comment on some key issues around the application of ESG in these asset classes. For a discussion of how ESG frameworks can be applied by discretionary hedge funds, see Ward (2019). As of today, the application of an ESG framework is harder for futures-based alternative strategies such as macro strategies. We refer the reader to Forterre (2019) for a discussion of issues and potential solutions.

4.3.1. ESG in Equity

The methods for the incorporation of ESG considerations that we described in the previous section have been routinely applied in the context of equity investment. The routes for practical implementation are several: investing in SRI/ESG funds, passive replication of ESG benchmarks, active selection of ESG managers, in-house active ESG investing, and full integration across in-house investing and risk monitoring functions.

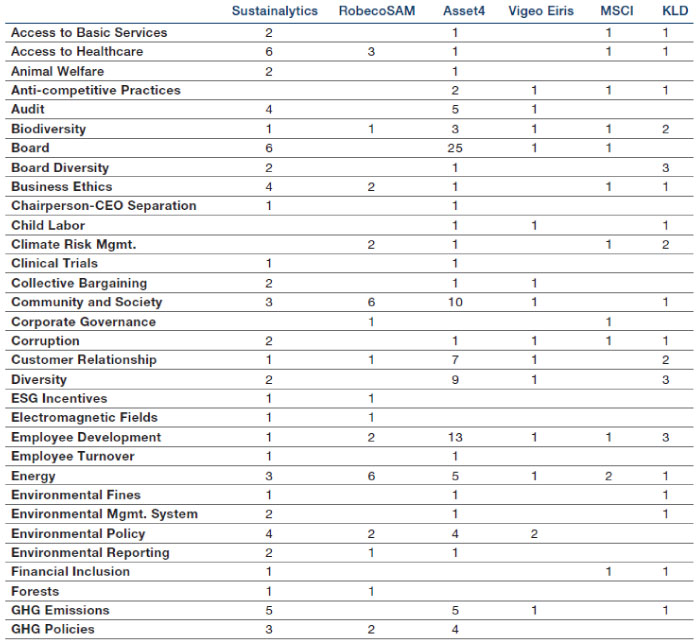

All of these methods require the use of extensive ESG datasets. Historically, most of the datasets focused on private corporations. ESG analytics started being provided in the 1980s by firms such as Vigeo-Eiris (now owned by Moody’s) and Kinder, Lydenberg, Domini (KLD, now owned by MSCI). This data provided a way to rate companies based not only on their financial performance but also on their impact on the environment and society more at large. This information was initially consumed mainly by faith-based investment managers, for which religious values guide investment practices. Nowadays however, the range of institutions using it has expanded considerably. ESG rating companies provide data on a wide range of indicators, measuring the characteristics of a firm along different dimensions, such as diversity, corporate governance, emissions, labour practices, etc. Figure 14 from Berg et al. (2020) provides a list of categories (rows) for which different providers (columns) publish indicators. Each cell reports the number of indicators that a certain rating company provides for a certain category.

Figure 14. Number of Indicators per ESG Ratings Provider and Category

Source: Berg et al. (2020).

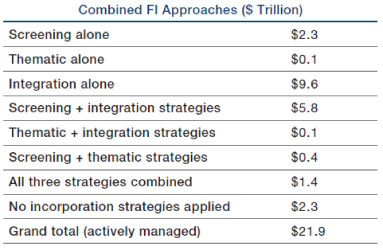

This large variety unfortunately has not come with standardisation. Chatterji et al. (2016) document a substantial lack of agreement between ESG ratings from different providers. Such disagreement persists even after adjusting for differences in methodology. Berg et al. (2020) look at ratings from six different providers and document a strong divergence. The authors also study the drivers of ratings disagreement, focusing on three types of divergence:

- Scope divergence: refers to the extent to which ratings diverge because they are based on different sets of attributes;

- Measurement divergence: refers to the divergence caused by the fact that different firms may measure the same attribute with different variables (e.g. measuring labour practices with workforce turnover versus number of labour-related lawsuits);

- Weights divergence: refers to the divergence caused by the fact that companies might weight attributes differently when calculating an ESG score.

The study finds that the main source of divergence is measurement divergence, followed by scope divergence. Hence, not only do different raters measure the same concepts differently, but they also do not use the same variables to measure attributes. Because the difference is not driven by weight differences (weights divergence), it is not possible to adjust for divergences by modifying the weights given to different attributes. Finally, there seems to exist a rater effect, whereby raters that score a company high in a certain category will tend to give it a high score also in other categories.

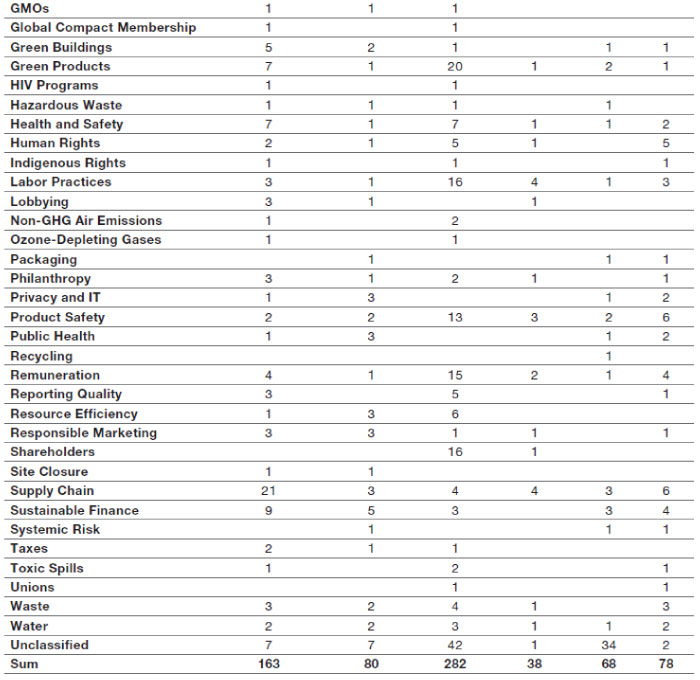

Another paper which finds strong divergence between ratings is Gibson et al. (2019). While Berg et al. (2020) focus on the drivers of divergence, Gibson et al. (2019) focus on the relationship between divergence in ESG ratings and stock returns. Their universe is that of companies in the S&P 500 Index in the period 2013 to 2017. Figure 15 is an excerpt from their paper which shows cross-sectional correlations between ESG ratings from different providers. The correlation between ratings from different providers is 0.46, with environmental factors showing the highest correlation (0.43) and social factors presenting the lowest one (0.19). The authors find evidence that ratings disagreement impacts stock returns differently for different ESG factors. In particular:

- Ratings disagreement on environmental factors is related positively to future expected returns. The authors link this to models from the heterogeneous beliefs literature, which find that higher belief dispersion about an asset leads risk-averse investors to require a higher future return;

- Disagreement on social (governance) factors is positively related to future expected returns if the disagreeing rating agency is located in a civil (common) law country. In particular, civil (common) law countries tend to have a shareholder(stakeholder)-centric view of the role of the firm. Hence, they might be better at evaluating social(governance) factors. Disagreement by rating agencies in those jurisdictions might lead to overvaluation and lower future returns.

Figure 15. Summary Statistics and Pearson Correlations Between Ratings of Six Data Providers

Results are provided for the Total rating and the individual E, S, and G ratings. Descriptive statistics are provided in the first four columns, while correlations are displayed in the remaining ones. The last row of each panel contains the average correlation between all providers. Source: Gibson et al., 2019.

Importantly, rating disagreements might have asset pricing implications, as shown in Avramov et al. (2020). The authors develop an asset pricing model which takes into account ESG ratings disagreement. Higher rating disagreement generally leads to higher market premium, lower investor demand and lower welfare. High disagreement will limit the ability of ‘green’ firms to benefit from a lower cost of capital, thus limiting their capacity to have a positive social impact.

4.3.2. ESG in Fixed Income

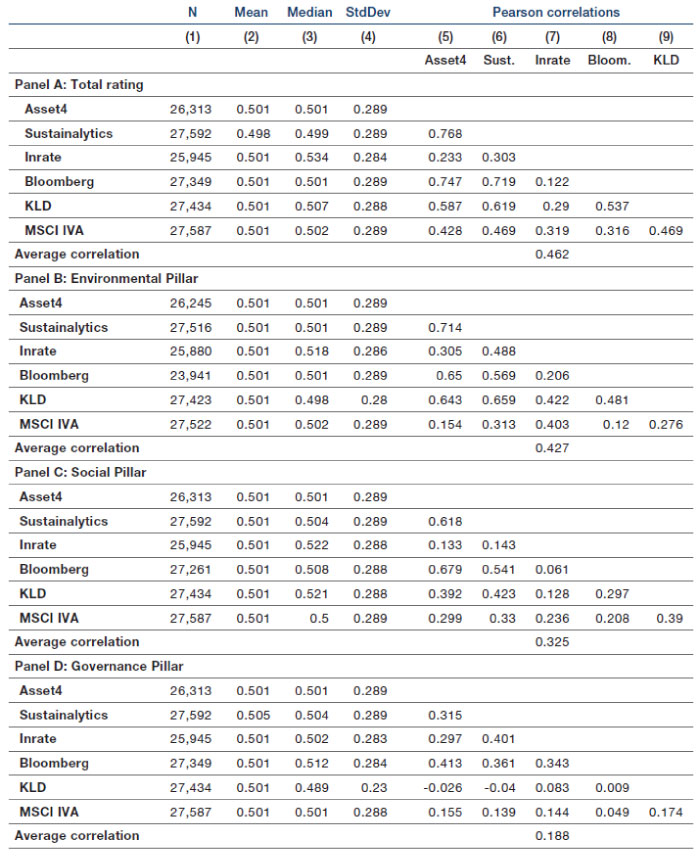

The methods for incorporating ESG factors in fixed income investing are similar in spirit to those used in the equity space. Figure 16 from World Bank 2018 shows that as of 2017, most fixed income assets were managed using an integration approach, either on its own or in combination with screening.

Figure 16. AUM by Method of ESG Incorporation in Fixed Income (as of 2017)

Source: World Bank (2018).

The practical methods for implementation are similar to the ones used for equity investments: investing in SRI/ESG funds, passive benchmarking, active manager selection, active in-house strategies, and integration across in-house investing and risk-monitoring functions. In addition, investors in fixed income can also rely on investment in ‘thematic bonds’. These are bonds issued to finance projects with a specific ESG focus. World Bank (2018) provides several examples:

- Green bonds: used to finance projects linked to climate or environmental themes. These can be issued by supranational organisations, governments and corporates;

- Social bonds: used to finance projects linked to social themes, such as the construction and maintenance of schools and hospitals;

- Social impact bonds: these are bonds which finance specific projects with high social impact (e.g. refugee employment support, reskilling of prisoners, support for elderly people) and for which repayment is contingent on the success of the project;

- Sustainable and Sustainable Development Goals (‘SDG’) bonds: these constitute a broader category of bonds issued to finance projects aligned with one or more of the Sustainable Development Goals of the United Nations.

The data monitored in the fixed income space is similar to the one used in the equity space. In particular, ESG company ratings used for equity investments can also be used for credit investments.16 For sovereign issuers, ESG rating agencies have developed country-level indices focusing on the long-term sustainability of the respective country’s economy. A set of ESG scores for sovereigns is also produced by the World Bank. These provide information on 17 sustainability themes reflecting the 17 Sustainable Development Goals from the United Nations. We reproduce the monitored themes in Figure 17.

Figure 17. Sustainability Themes for World Bank Sovereign ESG Ratings

Source: World Bank.

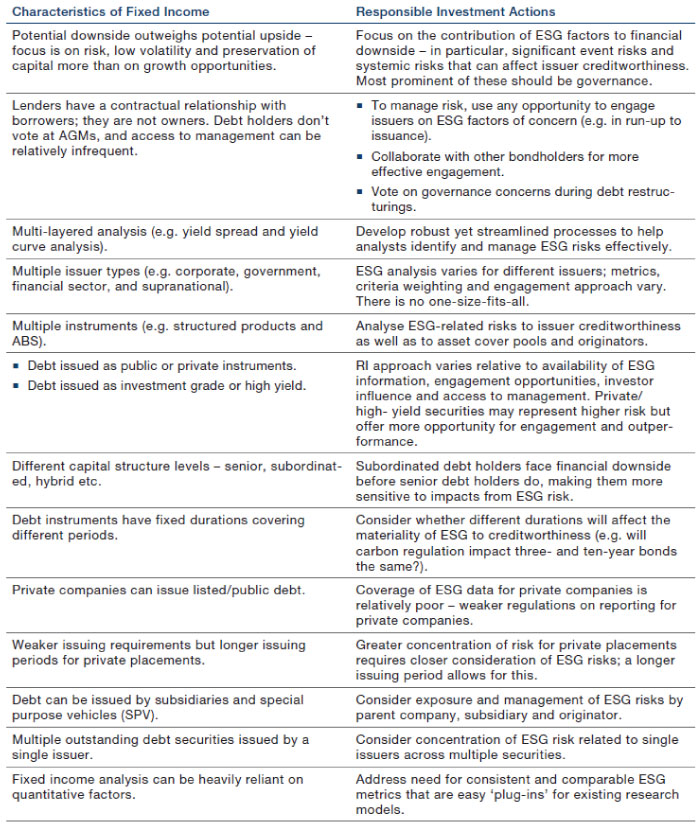

Finally, although the methods for ESG incorporation are usually similar across equity and fixed income instruments, fixed income instruments have their own peculiarities (e.g. fixed durations, different seniority levels, multiple issues, etc.). These can require ad-hoc adjustment to be made to properly incorporate ESG considerations.17 Figure 18 from World Bank (2018) provides a good summary of the implications of such differences.

Figure 18. Characteristics of Fixed Income and Implications for Incorporation of ESG Factors

Source: World Bank (2018).

5. Does ESG Investing Influence Corporate Behaviour?

In this section, we examine how the increased investors’ focus on ESG factors can affect corporations. We look at the different roles of activist and passive investors and provide examples of academic research that documented an impact on cost of capital.

5.1. How Does the Focus on ESG From Asset Managers Affect Companies?

Activism by shareholders, especially when of the hedge fund type, is often portrayed in a negative light: activist investors are seen as pursuing short-term profits at the expense of other stakeholders. Academic research has provided evidence that this need not be the case, and that activist investors can improve firm performance via the corporate governance reforms they promote.

5.1.1. The Role of Activist Investors

Activist investors generally engage in what Edmans (2020) calls specialised engagement, where the actions to be taken are specific to the target firm. Edmans (2020) analyses some factors that might give hedge fund activists an edge in driving change at companies:

- Portfolio concentration: As opposed to large passive funds or funds with benchmark constraints, activist hedge funds have a large stake in each company in their portfolio. This gives them an incentive to find ways to solve their problems;

- Performance fees: These make sure that the activist investor receives a good part of the value it creates. The incentive for value creation will be higher than for a fund just receiving a fixed management fee;

- Resources dedicated to engagement: Engagement is a key part of the investment process for activist hedge funds. This is not the case for many mutual funds, whose value proposition is that of having a low cost.

Academic research has documented extensively the impact of activist investors on corporate governance and as a result on performance:

- A first example is the already-quoted paper by Gompers et al. (2003). While the paper focuses on the relationship between governance and equity prices, it also found that companies with strong investor rights tend to have better operating performance;

- Brav et al. (2008) show that the changes proposed by activist investors achieve success in approximately two-thirds of the cases. The subject firms tend to experience increases in payouts, improved operating performance, and higher CEO turnover. The stock price tends to increase around the announcement of investment from an activist fund, with abnormal returns of approximately 7%;

- Brav et al. (2015) find that activism tends to produce long-term improvements in productivity. Moreover, the plants that are sold after intervention from activist investors tend to then experience improved productivity, suggesting that activist investors also increase value by facilitating the efficient reallocation of firm assets. Importantly, the authors find that firm workers do not tend to benefit from activism, as their productivity increases without a corresponding increase in wages;

- The already quoted study by Brav et al. (2018) finds that, while hedge fund activism tends to reduce R&D expenditures by 20% on average, patents produced tend to increase by 15%, pointing to improvements in the efficiency of R&D processes18;

- As mentioned earlier, the benefits are also not restricted to the target firm: Aslan and Kumar (2016) find that improving productivity at the target firm pushes competitors to boost their own;

- The already mentioned study by Gantchev et al. (2019) also finds that the measures taken by competitors lowers their probability of being targeted by activist hedge funds;

- For other types of institutional investor, such as pension funds and mutual funds, evidence is not clear cut. For example, Yermack (2010) is a study documenting that not all interventions by institutional investors have positive effects on firm operating performance.

5.1.2. The Role of Large Institutional Investors

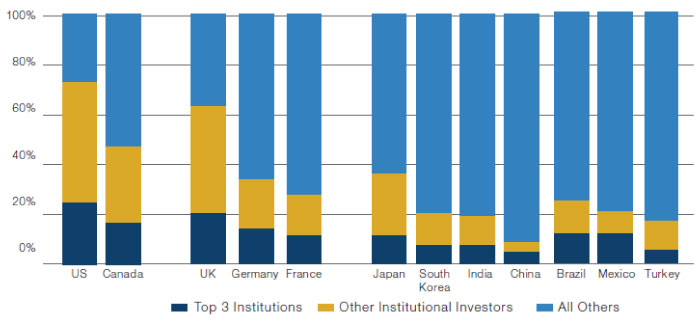

While activist investors engage in specialised engagement, non-activist investors such as passive mutual funds usually engage in what is called generalised engagement. This involves voting so as to implement changes with a broad scope, without the need for in-depth strategic analysis of the company. Examples of this include voting to increase the pay horizon for executives, to ensure the independence of board directors, to improve transparency in reporting, etc. As explained in Edmans (2020), large passive funds have a comparative advantage in this type of engagement: owning most stocks in an index leaves them with little resources for in-depth strategic analysis of a company. However, these investors have size on their side. To give an idea of the magnitude, Figure 19 shows the percentage of market capitalisation in several countries which is owned by institutional investors in general, and in particular by the top three largest global investors. With such large sizes come strong voting powers, making this category of investors particularly suited for engaging in generalised engagement.

Figure 19. Percentage of Total Market Capitalisation Owned by Top Three Institutional Investors

Source: Matos (2020); as of December 2017.

- Appel et al. (2016) find that the stocks at the bottom of the Russell 1000 Index, which tend to have smaller ownership from passive mutual funds, tend to have worse governance and long-term performance than similar stocks at the top of the Russell 2000 Index;

- The influence of institutional investors is not limited to governance. Dyck et al. (2019) find that institutional ownership is a key driver of E&S performance, potentially because of financial and social returns;

- Chen et al. (2020) examine the impact of institutional investors on companies’ CSR ratings. They find that institutional shareholders can have a significant impact on companies, improving their CSR profile.

5.2. The Effect on Cost of Capital

We look at some academic evidence of the impact of ESG factors on cost of capital. The general consensus seems to be that ESG considerations can have an effect on cost of capital, with different factors being material for different types of assets.

- Gompers et al. (2009) study dual-class firms. Usually, firms’ insiders – like managers and directors – are granted ‘superior’ shares with higher amounts of votes per share.19 For these firms, the authors find that, on average, insiders have 60% of voting rights and 40% of cash flow rights. This disconnect between voting rights and cash flow rights is exploited by the authors to disentangle the incentive effects (from cash flows rights) and entrenchment effects (from voting rights) that managers face. They find that firm value is increasing in insider’s cash flow rights and decreasing in insiders’ voting rights;

- El Ghoul et al. (2011) find that, after controlling for Fama-French factor exposures and industry and year fixed effects, firms with lower CSR scores tend to have higher costs of capital;

- Aslan and Kumar (2012) study the relationship between corporate ownership structure and cost of debt. They find a significant positive relationship between control concentration by dominant shareholders and cost of debt. Moreover, they find that dominant shareholders keep in mind the effect of the ownership structure on cost of debt when choosing their control and cash flow stakes. Factors such as the quality of investment opportunities, tangible asset intensity and strength of investor rights all influence the impact of control concentration on cost of debt, and the authors find that as such they are taken into consideration by the dominant shareholders when making their decisions on the amount of control concentration;

- Chava (2014) finds that companies excluded by environmental screens tend to have higher cost of capital on their stocks and tend to pay higher interest on bank loans;

- Baker et al. (2018) look at the pricing of green bonds, which are issued to finance environmentally friendly initiatives. They find that green bonds are generally priced at a premium;

- Zerbib (2019) finds instead that the yield of green bonds is marginally lower than that on comparable non-green bonds. He concludes that, for the time being, pro-environmental preferences have a low impact on bond prices. This is true both on the positive side (where respecting that preference might bring to a decrease in yield) and on the negative side (where adherence to environmental standards might reduce profitability and therefore increase yields);

- Flammer (2020) examines the issuance of green corporate bonds by corporates. These bonds are used to finance environmentally friendly projects, such as interventions to cut emissions, projects to promote resource conservation, etc. The author hypothesises three reasons why a company might want to issue these types of bonds: signalling their commitment towards the environment, greenwashing (i.e. marketing themselves as committed towards the environment while not actually taking concrete steps in its favour) and managing the cost of capital. The study finds that the stocks of issuers of green corporate bonds experience abnormal returns around the announcement of the issuance. Following the issuance, the issuers tend to change their behaviour by becoming more environmentally friendly. This points against greenwashing being the reason for issuing corporate green bonds. Their investor base also changes, with ownership by long-term investors and green investors increasing. Finally, the study documents that green corporate bonds tend to have similar yields to comparable non-green bonds. This points against cost of capital management being the reason for issuing corporate green bonds. In summary, the evidence presented seems to point to signalling being the prevalent reason for issuing green corporate bonds;

- Ilhan et al. (2020) find evidence corroborating the thesis that carbon risk is priced. In particular, they observe that insurance against tail and variance risk is more expensive for stocks with higher exposure to carbon risk. They link this to the high policy uncertainty around emission regulations: there are several possible ways to implement restrictions and it’s not certain which one will be chosen, the price for carbon emissions is highly variable depending on what model is used to estimate it, and finally the reduction in emissions necessary to achieve climate goals is itself quite uncertain.

- Giglio et al. (2018) find that climate risk is priced in real estate markets. In particular, they observe that real estate assets display a downward sloping term structure of discount rates. They develop an asset pricing model that reproduces this stylised fact as a consequence of the lower climate risk exposures of long-run cash flows versus short-run cash flows. In particular, when a climate risk strikes cash flows are hit in the short run, but they then revert to their mean in the long run, as the economy adjusts and recovers from the shock;

- Other papers finding evidence that climate risk is priced in real estate markets are Bernstein et al. (2019) and Baldauf et al. (2020). All of these papers focus on the impact of sea level change on house prices. Murfin and Spiegel (2020), however, find the price impact to be limited instead.

6. What Is the Impact of ESG on Asset Returns?

In this section, we examine academic evidence on the relationship between ESG factors and asset returns. We start by looking at some theoretical models, to provide guidance as to what relationship we might expect to observe. We then look at the evidence, which turns out to be mixed: some studies find that non-ESG assets outperform in the long run, while others find that ESG assets are the ones outperforming. We quote here a study whose results do not fit in either category: Dai and Meyer-Brauns (2020) find that data on greenhouses emissions is not meaningfully associated with future company profitability or expected future stock or corporate bond returns.

6.1. ESG and Returns: The Theory

- An early model is that of Heinkel et al. (2001). The authors develop an equilibrium model of exclusionary ethical investing, where a proportion of investors refuses to invest in firms that do not meet their ethical criteria. If this happens, neutral investors will be happy to buy the shares, but they will only do so for a lower price, to compensate for the loss of diversification in their portfolios now that they hold a higher proportion of the polluting companies. The amount by which prices fall will depend by the share of capital held by responsible investors. The fall in price increases the cost of capital for the polluting companies. In the model, companies are allowed to change their technology in order to meet ethical investment criteria. The firms using polluting technologies will reform only when the increase in cost of capital coming from the boycott from ethical investors is larger than the cost of reforming the production technology to make it clean. The authors calibrate their model with real world data and show that, in a realistic setting, more than 20% of total capital should belong to ethical investors to generate an increase in cost of capital sufficient to generate a change in behaviour from polluting companies. The authors note that, at the moment the paper was written, the proportion was closer to 10%;

- Albuquerque et al. (2019) model CSR investments as an activity that increases product differentiation (e.g. because consumers might prefer the product from the firm engaging in CSR activities). Firms have heterogeneous costs of CSR adoption. Firms with lower adoption costs are more likely to undertake CSR investments. The demand curve for CSR firms will have a lower price elasticity, leading to higher profit margins. On one end, the higher profit margins will make total profits less susceptible to aggregate shocks, thus increasing firm value and decreasing cost of capital. On the other hand, the higher profit margins will push also the firms with higher adoption costs to invest in the technology. These higher adoption costs will make aggregate profits more susceptible to aggregate shocks, thus decreasing the value of the marginal firm. The trade-off between the two effects depends on the proportion of consumer spending on CSR goods. A smaller (higher) proportion will result in fewer (more) firms adopting the CSR technology, hence increasing (decreasing) the value of the marginal firm;

- Baker et al. (2020) show that simple portfolio choice models are unable to explain why environmentally sensitive investors would have lower allocations to stocks of polluting firms. In those models, pollution is a negative externality, and therefore it is an undiversifiable source of risk. If polluting firms produce more, they will have higher profits but will also lead to higher pollution, lowering the utility of pollution-sensitive investors. The optimal response for this group is therefore to hold more, not less, of their capital in such firms, in order to hedge the risk of pollution. In the words of the authors, pollution-sensitive investors substitute lost environmental consumption for material consumption. The authors however show that there are modifications of this simple model that can account for the preference of pollution-sensitive investors for non-polluting firms. A first example is a case where pollution-sensitive investors internalise their aggregate contribution to pollution and coordinate to reduce their investment in high-pollution firms, in this way overcoming their individual hedging incentives. A second and simpler case is the one where pollution-sensitive investors receive disutility from holding investments in polluting firms, and their aversion to these investments is large enough to overcome the hedging motives;

- Classic economic models like Pástor et al. (2020) suggest that the preference of some investors for ‘green’ firms will push up the stock price of the latter, leading to lower expected returns in equilibrium. In this model, in equilibrium investors hold the risk-free asset, the market portfolio, and an ESG portfolio. The allocation to each depends on risk aversion and on the relative preferences for ESG assets;

- Pedersen et al. (2020) provide an equilibrium asset pricing model with ESG preferences. They derive an ESG efficient frontier over which investors trade off risk-adjusted performance and ESG considerations. All optimal portfolios can be obtained as a combination of the risk-free asset, a minimum variance portfolio, the maximum Sharpe Ratio portfolio, and a so-called ESG-tangency portfolio. In this model, ESG has a benefit because it can be used to update returns and risk expectations, thus raising the efficient frontier. It has a cost to the extent that investors, in the pursuit of their ESG preferences, deviate from the maximum Sharpe Ratio portfolio.

6.2. Evidence That Higher ESG Risks Has Led to Higher Returns

- Hong and Kacperczyk (2009) is a widely quoted paper that provides evidence that ‘sin’ stocks generate higher average returns as they are shun away by norm-constrained investors. The authors find that sin stocks are less held by norm-constrained investors and more by mutual and hedge funds. Moreover, they tend to be less covered than other stocks. The authors suggest that the higher average returns come mainly from the fact that they are shun by norm-constrained investors and because they face higher litigation risk;

- Riedl and Smeets (2017) find evidence that investors are willing to accept lower financial returns from socially responsible investments. This reflects their investment motives, which are not centred around financial performance, but also revolve around social preferences and social signalling;

- Barber et al. (2020) find that venture capital (‘VC’) funds with a dual mandate to generate financial returns and to have a social impact generate returns that are 4.7% lower than funds with comparable characteristics in terms of vintage and geographical area. They also provide evidence suggesting that investors might be willing to forego the higher returns to obtain nonpecuniary rewards in the form of social impact;

- Bolton and Kacperczyk (2020) find that companies with high CO2 emissions tend to display higher returns on average, which are not explained by usual risk factors. This could suggest that investors are pricing in a carbon risk premium, compensating them for bearing risks related to future regulations on carbon pricing.

6.3. Evidence That Lower ESG Risks Has Led to Higher Returns

- The already quoted study by Gompers et al. (2003) finds that, during the 1990s, a portfolio going long companies with high governance scores (strong shareholder rights) and going short companies with a low governance score produced a 4-factor alpha of about 8.5% per year;

- Core et al. (2006) investigate the findings from Gompers et al. (2003) that firms with weaker governance tend to have lower abnormal returns. Firstly, the authors show that firms with weak governance tend to have worse operating performance. To prove that the differences in operating performance cause the differences in future returns, it is necessary to show that the former were unexpected. In an analysis of analyst forecast errors, however, the authors do not find evidence that analysts are surprised when forecasting differences in operating performance for firms with different levels of governance. The authors also study earnings announcements and find that the outperformance of good governance stocks is not concentrated around these events. This implies that investors do not learn about the differences in operating performance during earnings announcements, corroborating the hypothesis that this information does not come as a surprise. Finally, the authors also show that weak and strong governance firms are taken over at similar rates. Hence any differences in takeover probability are also unlikely to explain the differences in stock performance. The authors conclude that it is unlikely that it is the stronger governance that is causing the abnormal returns. They point to sample-specific effects or differences in expected returns as more likely causes;

- Bebchuk et al. (2013) document that, while the link between investor rights and operating performance still existed throughout the 2000s, the link with stock performance disappeared, as market participants started paying attention to this factor;

- An alternative explanation for the disappearance of the positive relation between governance and returns is provided by Li and Li (2018). The authors look at the value of a firm as the sum of its assets in place, its investment options and its divestiture options. Firms with stronger governance practices suffer from fewer investment distortions which should give them access to both better investment options and better divestiture options. Investment options are ample during booms and are riskier than the assets in place. Therefore, in periods of economic boom, when their investment options are plentiful, we should expect firms with good governance to have a higher beta, and thus higher expected returns. Divestiture options are less risky than assets in place. During economic busts we should expect firms with good governance to have a lower beta and thus lower expected returns. The authors carry out several empirical tests of this idea, finding, among other things, that firms with better governance do tend to have higher (lower) expected returns when growth is strong (weak) than firms with weaker governance;

- The already quoted study by Brav et al. (2008) shows that stock prices tend to increase around the announcement of investment from an activist fund, with abnormal returns of approximately 7%;

- An older study is Derwall et al. (2005), looking at the performance of SRI stocks in the period from 1995 to 2003. They find that SRI stocks outperform, even after accounting for market, style, and industry exposures. The outperformance is also robust to transaction costs;

- Edmans (2011) shows that stocks with high employee satisfaction earned a significant positive four-factor alpha of 3.5% in the period 1984-2009. The author provides potential theoretical explanations for this effect. Satisfaction can bring additional motivation to employees, making them more productive. It can also bring them to identify with the firm, internalise its objectives, and therefore increase effort. Additionally, high employee satisfaction can improve retention, a key source of value in knowledge-based industries. Whatever the exact channel, it is not unreasonable to think that, because employee satisfaction is an intangible, investors might not be able to fully incorporate its effect on stock prices, as they do, for example, with R&D;

- Hartzmark and Sussman (2019) do not find evidence that high sustainability funds outperform low sustainability funds. However, they find causal evidence that being categorised as a high sustainability fund increases inflows;

- Hong et al. (2019) show that, in countries with positive drought trends, the stocks of food producers tend to exhibit lower future expected returns. This indicates that the investors are not pricing correctly the risk of drought;

- Alok et al. (2020) find that money managers within regions that have been affected by a climate disaster underweight within that region more than other managers. They attribute this behaviour to salience bias, i.e. a tendency to overestimate the probability of events based on their emotional significance, vividness, or proximity. This is reminiscent of Dessaint and Matray (2017), who find that, after a hurricane strikes, managers of companies in the affected area temporarily increase corporate cash holdings as a reaction to a perceived increase in liquidity risk, even if actual liquidity risk has not increased;