Introduction

Discere mutari est – to learn is to change.

It seems apt to apply the phrase to much of the higher education establishment across the western world, where it is widely believed that education is one of the most effective ways to reduce poverty and inequality and improve social mobility, while also supporting future economic growth by developing human capital.

But as we all know, this current coronavirus recession is, well, dare we say it, unprecedented. Normally, recessions generally tend to boost demand for higher education: if getting a job is harder, expanding your knowledge should allow you to get ahead of the pack (and even get a better job) than the one you originally would have wanted.

But we are now in a quaking new world: quarantine rules mean that foreign students aren’t allowed to enter countries, while government rules on social distancing combined with student nerves may result in low student numbers.

Still, every cloud has a silver lining. We believe that the pandemic has the ability to shake complacency out of higher-education institutions. Issues that have long haunted higher education – such as student debt and representation of ethnic minorities – could be a thing of the past.

The Ugly

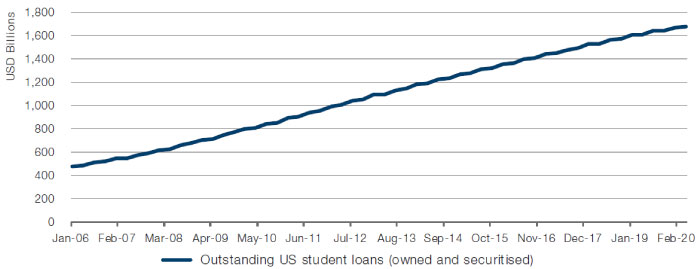

In April 2017, the New York Fed warned about ‘seriously delinquent’ student debt rates in the US and how “those with significant student debt are much less likely to own a home at any given age than those who completed their education with little or no student debt.” Indeed, about 44 million Americans have about USD1.6 trillion in student debt1 (Figure 1), with more than 30% of them in default, late or have stopped making payments six years after graduation.2 Basically, in the decade since 2008, we have swapped a housing debt bubble for a student loan bubble.

And, unfortunately, that’s not really a surprise to us. The College Board estimated that during the 2019-20 school year, the average cost of tuition, fees, room and board ranging from about USD21,950 for in-state students at public universities (USD38,330 for out-of-state students), rising to USD49,870 at private non-profit universities and that the college graduates leave with about USD29,000 of debt, on average. Another study by think-tank Demos found that the average student debt burden for a married couple with two 4-year degrees was USD53,000, and in fact, resulted in an overall wealth loss of USD208,000 over their lifetimes.

Quite an irony, given that college education is supposed to increase wealth.

This debt has also resulted borrowers delaying traditional markers of adulthood – getting married, having kids, buying a home, even purchases of white goods! Even more worrying is the link between high student debt loads and issues like depression and marital failures.

And the issue is even starker when comparing the amount of student debt owed by an average white student versus an average black student: white borrowers pay down their education debt at 10% a year, compared with 4% for black borrowers, in part because of a racial pay gap.3

Figure 1. Outstanding US Student Loans

Source: Federal Reserve Bank of St. Louis; as of April 2020.

The UK is no less different. While average student debt in the UK may not be as high as in the US, the Institute for Fiscal Studies has calculated that a fifth of British graduates would be better off if they had never gone to university.

The Good

But maybe, just maybe, the pandemic has offered a lifeline here, a chance to change the current state of higher education for the better.

First off are the fees charged. Universities are proud of their centuries-old traditions, and for some of them, rightly so. However, instead of being a public good, we have now come to think of university education as a luxury good, which allows these universities to charge high fees. Just like physical luxury goods though, the price tag is dependent on low supply and high demand. But quarantine rules mean that lucrative foreign students aren’t allowed to enter countries, while government rules on social distancing combined with student nerves may result in low student numbers. Without face-to-face interaction and the actual experience of physically attending college or university, the value of higher education has dropped dramatically, in our view. A USD50,000 price tag for a private non-profit university in the US just seems hard to accept in this instance. So, lower fees, lower debt.

Secondly, a virtual classroom will mean that universities will be no more constrained by the size of lecture rooms or the number of beds in dormitories. This will naturally solve the problem that universities are facing in terms of extending offers to students from ethnic-minority or low-income backgrounds. In the UK, for example, students from black and ethnic minority backgrounds made up less than a quarter of all university students in the 2018/19 academic year.4 However, only 5% of students at the Russell Group – a collection of 24 prestigious ‘research-intensive’ universities, often considered to be the most elite in the country – are from black and ethnic minority backgrounds. Across the Pond, the story is roughly the same: in the US, children from the top 1% income-earning households are 77 times more likely to get into Ivy or Ivy-plus institution than the bottom quintile.5

In all seriousness, does education provide a social benefit if the private-sector company is mostly educating wealthier children?

The Investment Opportunities

So, in a few years’ time, it is feasible that universities will be welcoming not thousands of students, but tens of thousands of students. We believe technology companies which help universities achieve that goal in terms of enrolments, virtual classes, examinations, etc, will be winners. As NYU Stern’s Scott Galloway says, “big-tech companies are about to enter education … in a big way, not because they want to, but because they have to.”

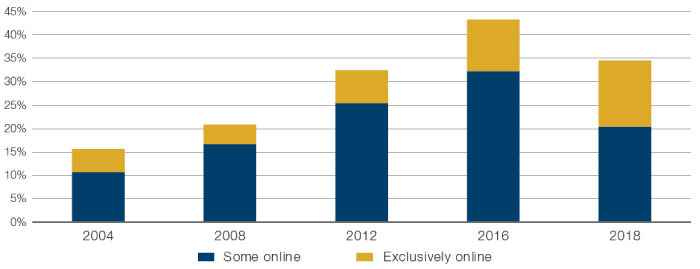

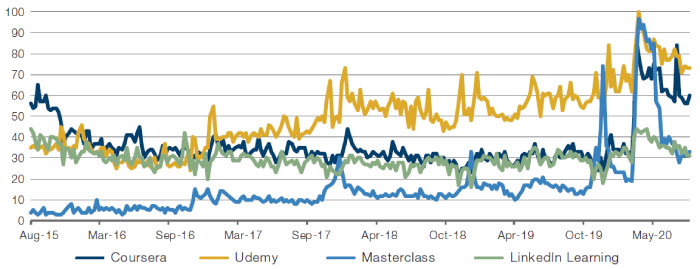

As the market evolves, digitalisation and personalisation will become becoming increasingly relevant. As mentioned above, the Covid-19 pandemic is likely to act as an accelerant for online education, which grew – albeit slowly – between 2004 and 2018 (Figures 2-3). Publishing companies that emphasise this digitalisation – such as tutoring apps, online books, web-based scoring systems – will reach a wider audience for its learning products, in our view. This isn’t just related to higher education, but also companies that help with professional qualifications, such as online access to academic and peer-reviewed publications.

Figure 2. Percentage of US Students Taking Online Courses

Source: Prof G analysis of NCES data.

Figure 3. Surge in Google Search Volume of Online Education Providers, US

Source: Google Trends; as of 16 August 2020.

Beyond looking at companies addressing education services directly, we believe that it is also important to pay attention to the level of investment companies make in their own employees’ development through on-the-job training. There is significant benefit to companies investing in training, be it underpinning future growth potential, improving productivity and decreasing employee turnover. Research from the American Society for Training and Development has suggested that companies offering wide-ranging training programmes deliver 218% higher income per employee compared to companies not offering formalised training, as well as better profitability and higher price to book value multiples for their listed stocks.6

Given the sheer scale of the addressable market opportunity, it has also been speculated that ‘big tech’ names such as Alphabet and Apple could look to launch their own education platforms, potentially in the fields of professional skills certification or by offering digitised courses, lectures or tools for student engagement. With a global installed base of over 1.5 billion devices as of the end of 20197, it isn’t hard to imagine how Apple could successfully monetise its own ‘Education iTunes’ or subscription service like Apple TV+ to capitalise on the dramatic growth and enormous potential of the global education market.

Much like the continued threats to commercial property from the (now very rapid) shift to ecommerce, there are clearly risks to property markets heavily linked to student housing. Towns with substantial student populations have in the past been able to rely on a consistent, relatively dependable influx of renters annually as universities restart, but as education content consumption shifts to a potentially more distanced, digitised model, the risks to residential property markets in these areas are clear.

Conclusion

One of the United Nations’ Sustainable Development Goals is quality education – “ensure inclusive and equitable quality education and promote lifelong learning opportunities for all.”

Over time, university education has somehow transitioned from a public good to a luxury good that demands a hefty price tag and could have actually worsened income inequality. We believe the pandemic has given us a once-in-a-lifetime opportunity to shake complacency out of higher-education institutions. Issues that have long haunted higher education – such as student debt and representation of ethnic minorities – could be a thing of the past.

1. Source: Federal Reserve Bank of St. Louis; as of 7 August, 2020.

2. Source: New York Times; The Student Debt Problem Is Worse Than We Imagined.

3. Source: Jason N. Houle and Fenaba R. Addo; Racial Disparities in Student Debt and the Reproduction of the Fragile Black Middle Class; 2 August, 2018.

4. Source: Higher Education Statistics Agency.

5. Source: The Prof G Show with Scott Galloway; Town Hall on Higher Education.

6. Source: New York Times; Study ties educational gains to more productivity growth; 1995.

7. Source: Apple; Apple Reports Record First Quarter Results; as of 28 January, 2020.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.