Introduction

After years of meagre yields under zero and negative interest-rate policies, investors could be forgiven for gorging on investment-grade (‘IG’) bonds that in aggregate can pay over 5%.1 Even better, breakeven rates currently offer a margin of protection against potentially higher rates from here (Figure 1).

Figure 1. Breakeven Rates

Problems loading this infographic? - Please click here

Source: Bloomberg, ICE BofA, Man GLG; as of 24 March 2023. Breakeven rates represent the amount by which yields would have to increase before the given index would incur a negative total return over the next 12 months.

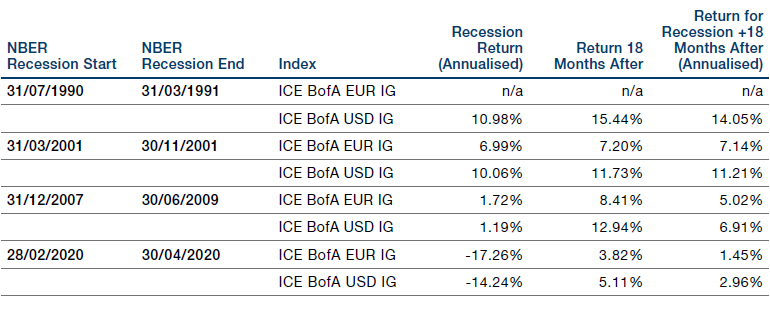

Investors may also take some comfort from IG’s record of resilient performance during periods of slowing growth.

Investors may also take some comfort from IG’s record of resilient performance during periods of slowing growth (Figure 2). At such times, IG typically benefits both from a demand tailwind as investors move up the credit spectrum and also the market’s duration component if interest rates must be cut.

Figure 2. IG During Downturns

Source: Bloomberg and Man GLG; as of 24 March 2023. The periods highlighted are exceptional and the results do not reflect typical performance. The start and end dates of such events are subjective and different sources may suggest different date ranges, leading to different performance figures.

Yet despite these attractions, we would be wary of allocating indiscriminately to IG in current conditions. After the recent turmoil, spreads on the global BBB index have now moved above median levels (Figure 3). This makes valuations on aggregate more attractive, in our view, than the levels reached in late February – but we think dispersion will continue to increase over the coming quarter.

Figure 3. Global BBB Index Spread

Problems loading this infographic? - Please click here

Source: Man GLG; as of 24 March 2023.

European Exceptionalism

Only one part of the market looks particularly expensive – the US.

When searching for opportunities with better risk/reward characteristics than the index average, regional and sectoral options become apparent. Starting with geography, the index masks the fact that only one part of the market looks particularly expensive – the US (Figure 4). North American IG spreads have remained stubbornly lower than those available in Europe, with Sterling IG notably cheaper, which can in large part be attributed to political uncertainty rather than substantial differences in fundamentals of the underlying indices’ issuers.

Figure 4. Euro, Sterling and US Dollar IG Spreads

Problems loading this infographic? - Please click here

Source: Man GLG; as of 24 March 2023.

Index holders are highly geared towards the area of the market where we see the least value.

These divergent valuations matter not just to active managers, but should also concern passive investors too, given that US assets comprise around two-thirds of the main global IG benchmarks (Figure 5). This leaves index holders highly geared towards the area of the market where we see the least value . Importantly, this balance can change – only a few years ago US IG bonds offered higher spreads than European equivalents – so we believe it pays to be nimble and opportunistic.

Figure 5. Composition of Global Corporate IG Index by Currency

Problems loading this infographic? - Please click here

Source: Man GLG based on ICE BofA Global Corporate Index; as of 23 March 2023.

Moving Beyond the Benchmark

Dispersion tends to accelerate as we go through slowing growth and into recessions, where downgrades are likely to accelerate and cyclicals underperform.

Looking beyond the largest constituents within the benchmark can also lead to what we believe are attractive return opportunities. Within the Global IG Corporate Index there are over 1,000 bonds that offer a spread over 300 bps (Figure 6), which we believe highlights the attractive return potential within the broader market. Dispersion tends to accelerate as we go through slowing growth and into recessions, where downgrades are likely to accelerate and cyclicals underperform.

Figure 6. Number of Bonds in ICE BofA Global Corporate Index with OAS >300 bps

Problems loading this infographic? - Please click here

Source: Man GLG based on ICE BofA Global Corporate Index; as of 15 March 2023.

Get Real

From a sector perspective, we think European real estate at prevailing spreads – having historically traded in line with the broader universe – presents an opportunity that only occurs once in multiple cycles (Figure 7).

Again, though, selection is key: some issuers, notably those with high debt levels and low yielding asset portfolio, will come under substantial pressure and do not offer value even at higher spreads. Instead, we prefer to scour strained sectors for the companies with the strong fundamentals and lend money only there rather than to all. We expect the strongest in European real estate today to reward investors as much as the leisure sector did post-lockdowns in 2020, UK companies following the Brexit vote in 2016-17, or energy companies when the oil price crashed in 2015.

Figure 7. European Real Estate IG Spread

Problems loading this infographic? - Please click here

Source: Man GLG; as of 24 March 2023.

We think European real estate at prevailing spreads presents an opportunity that only occurs once in multiple cycles.

Beyond real estate, we also saw value in financials even before the crises in California and Switzerland spilled over – but again selectively and not just in the obvious names. We prefer companies in this sector that can benefit from higher interest rates without large banks’ exposure to a deteriorating macro backdrop; this includes investment platforms managing clients’ cash or clearing and trading execution businesses, which hold customer deposits but have little credit risk on their own balance sheet. We are not negative on all banks, though, and we expect the best run to remain profitable even as the economic cycle darkens.

Conversely, cyclicals strike us as unappealing at this juncture, as despite the challenging conditions these sectors do not offer a compelling discount to non-cyclical companies. Where we do take some cyclical risk, we look instead to those select financials that can enjoy the tailwind of higher interest rates.

1. Source: Bloomberg; as of 28 February 2023. Based on yield to worst of S&P Global Developed Corporate Bond Index.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.