Introduction

The first half of 2022 was the second-worst half of a year for 60/40 in the past 222 years.

Diversification was Harry Markowitz’s ‘free lunch’.1 In this paper, we explain why and how investors can order from a fuller menu for their portfolios.

The longstanding starting point in the pursuit of diversification has been a traditional balanced portfolio of equities and bonds. But as Figure 1 shows, a standard 60/40 portfolio (with a 60% allocation to US equities and 40% to US Treasuries) has had its worst start to a year this millennium as both asset classes lost money. Indeed, at the start of May, both the S&P 500 index and 10-year US Treasury index completed five consecutive weeks of declines – the first time such losing streaks had ever coincided. According to analysis by Man’s Dynamic Allocation (DNA) team, the first half of 2022 was in fact the second-worst half of a year for 60/40 in the past 222 years (1932 provided the worst).

Figure 1. Performance of Standard 60/40 US Portfolio, 1999-2022

Problems loading this infographic? - Please click here

Source: Man Group; as of June 2022. Based on a theoretical portfolio 60% allocated to the MSCI World Total Return Index and 40% to the Bloomberg Barclays US Treasury Total Return Index. Past performance is not indicative of future results. Please see the important information linked at the end of this document for additional information on hypothetical results.

The driver of such a poor start to the year has been losses across both equities and bonds. This will have had a substantial impact on defined-benefit (DB) pension schemes, as equities and bonds comprise around 95% of the risk of a typical DB portfolio (Figure 2).

Figure 2. Illustrative Contribution to Risk in a DB Scheme

Problems loading this infographic? - Please click here

For illustrative purposes only. Based on analysis by Man Group as of 1 May 2022.

In this paper, we will argue that investors cannot rely on the diversification offered by bonds. Instead, we believe genuinely diversifying strategies (i.e. to both equity and bonds) now merit greater consideration than in any recent period. In particular, liquid alternatives – which, as well as equities and bonds, can trade everything from soyabeans to power contracts – may help investors meet their objectives in the current environment.

Is Now The Time For Further Diversification?

60/40 portfolios have been popular because they have worked. It’s therefore hard to conclude that the consensus reflected in Figure 2 has been wrong in recent years; investors who spurned additional diversification from a traditional portfolio and focused simply on equity and bond beta have been rewarded. But, as we know, the past is not a guide to the future. We believe the prevailing valuation, risk and correlation dynamics all urge a reappraisal of the outlook for equity/bond portfolios.

The liquidity provided by central banks over the past decade has contributed to high valuations across the main asset classes, in effect pulling future returns into the current period. But that tap is now being closed.

2018 was the most recent attempt by central banks to shrink balance sheets and hike rates (in both cases less aggressively than today). It wasn’t a period that traditional asset owners remember fondly: at its lows, the S&P 500 was down by 12% while US 10-year yields were up by more than 80 basis points.

The driver of this tighter policy is the current inflation environment, something that most current finance professionals have never before experienced. There have been lots of papers showing the returns of risk assets in periods of inflation have historically been negative. Coming at the same time as the end of ‘easy money’, we believe this represents a serious risk to traditional assets. But perhaps more concerning is the impact that inflation can have on the correlation between equities and bonds.

Analysis by Man Group suggests that, historically, periods of elevated and persistent inflation have been accompanied by a positive correlation between stocks and bonds. Figure 3 reveals that when US Consumer Price Index (CPI) inflation has persistently been above 2.7%, bonds and equities have been positively correlated. We are obviously well above that level today (US CPI was 9.1% in June, according to the Bureau of Labor Statistics), which is likely to impair the risk mitigation many expect from fixed income.

Figure 3. US Stock/Bond Correlation and Inflation – Higher Inflation Has Historically Been Associated With Higher Correlations Between Equities and Bonds

Source: Henry Neville, Man Group; as of 31 March 2022. The size of the bubbles indicates equity valuations; a larger bubble signifies that equities are more expensive. Stock/bond correlation is between the S&P 500 Total Return and the Bloomberg Barclays US Treasury Aggregate Total Return indices. Valuation calculated as the percentile monthly price-to-earnings ratio from January 1960 to March 2022. Core CPI from the US Bureau of Labor Statistics.

We haven’t yet seen in granular data the correlations between equities and bonds shift, though of course that has been little comfort to holders of a traditional portfolio, as Figure 4 illustrates.

Figure 4. Quarterly Returns of Equities and Bonds, Q4 1998 to Q1 2022

Problems loading this infographic? - Please click here

Source: Bloomberg and Man Group; as of 10 June 2022.

There are plenty of risks to the traditional 60/40 portfolio as we look forward.

Taking all this together – elevated valuations, the risks posted by tightening monetary policy, and high inflation being associated with a positive stock/bond correlation – there are plenty of risks to the traditional 60/40 portfolio as we look forward.

It may seem like we are arguing that now is the time for further diversification. This is partly true, but we also think this should be a long-term move rather than a short-term tactical change. Market timing is notoriously difficult, but in our view a more diversified portfolio offers ongoing benefits.

Alternative Options

Fortunately, investors are not limited to a simple choice between equities and bonds. Diversification remains possible beyond these asset classes and, as we have set out, in our view now is the time to embrace Markowitz’s wisdom in full.

This is where we believe alternative assets can play an important role. We see three main categories in this space:

- Private markets – including private equity/credit, property and infrastructure

- Liquid alternative assets – including commodities

- Liquid alternative strategies – including hedge funds and risk premia

The first two certainly have roles, but investors must also be aware of their potential downsides. Private markets, for example, are far less liquid than their public counterparts. While investors may benefit from an illiquidity premium2, our concern in this paper is diversification. Of course, if we measure diversification using day-to-day correlation to risky assets, private assets fare well; their lack of mark-to-market pricing can give the impression of diversification. However, we strongly believe that the diversification investors seek is downside diversification – and more precisely diversification in periods of large losses for traditional portfolios. These are typically the periods when private assets are least likely to offer the diversification required, given their underlying revenue drivers aren’t completely independent from public equivalents. If anything, the large flows into these assets in recent years are likely to have made them more susceptible to sentiment, and a simultaneous loss.

Liquid diversifying assets are an essential allocation, in our view. Broad exposure to commodities is an important part of a well diversified portfolio – particularly given their historic performance in inflationary environments3 – but investors should be aware of the huge shifts in prices here over the past 12 months.

Some have suggested the more experimental path into the cryptocurrencies as a diversifier. Our view was that their apparently diversifying characteristics were an illusion in the tail distribution. Recent events have supported this thesis, with most cryptocurrencies selling off alongside other risk assets in 2022.4

How ARPs Can Hit the Right Notes

We therefore believe that now is the time to reconsider liquid alternative strategies, which span everything from hedge funds through to alternative risk premia (ARP) strategies. This broad spectrum inevitably creates a wide range of outcomes for investors, but there are areas that are in our view focused on exactly the characteristics that investors require. Looking primarily at ARP, their emergence was driven by investor demands for liquid, transparent, and (most importantly) diversifying strategies in cost-effective form - exactly what we think investors need now. However, it is essential to structure them to avoid the potential pitfalls. When done well, we believe they can offer:

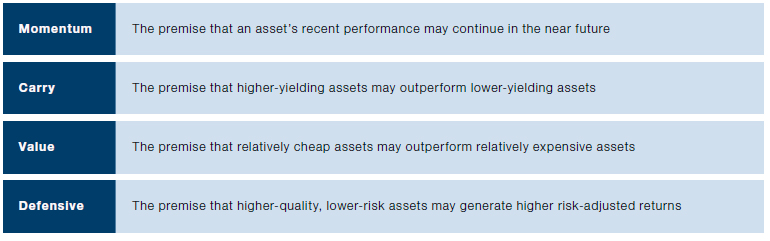

- Returns – academic research on extensive datasets, and supported by theoretical rationales for their persistence, has documented the risk premia connected to the sources of return listed in Figure 5.5

- Diversification from traditional assets – ARP strategies have historically exhibited low correlations to other asset classes, but more importantly can be structured specifically to avoid tail correlation with traditional assets.

- Liquidity – ARP strategies trade in highly liquid global assets, including equities, bonds, currencies, and commodity futures. They should be available for investors to rebalance their holdings as the wider portfolio requires, as well as providing liquidity as schemes seek to de-risk. An additional benefit is that these daily priced portfolios reveal the true extent of the diversification being offered.

- Transparency – well structured and managed ARP strategies should give investors full visibility over both the underlying securities in the portfolio and the process by which that portfolio is constructed.

- Cost effectiveness – this liquidity, combined with operationally efficient trading and transparent fees, can help to minimise costs for the end investors.

- ESG integration – reflecting ESG considerations within ARP strategies is still an emerging field, but in our view there are pragmatic, incremental approaches to doing so, as we will explore in more detail in a forthcoming paper.

Figure 5. Four Persistent Market Inefficiencies, or ‘Risk Premia’

For illustrative purposes only.

While we have highlighted four of the best-known risk premia here, that doesn’t mean ARP strategies are static – far from it. ARP approaches require constant research and development just to maintain their core characteristics.

We believe the combination of these attributes is what drove the emergence of ARP approaches – a collection of liquid, transparent and (most importantly) diversifying strategies.

Yet after a period of inflows early in their life, ARP strategies have often been overlooked by investors recently, perhaps a victim of the strength of the long bull run for traditional assets or the wide dispersion in the performance of ARP products.

It is notable, however, that several ARP funds have performed as should have been expected. They focus on exactly the set of criteria we think have been highlighted as necessary by the market this year. They are also largely offerings from similar types of firms – large, well resourced, with a pedigree in systematic strategies, and able to offer a set of strategies structured for the end investor’s benefit. These providers, offering truly diversifying return streams, have been able to generate returns in 2022’s challenging environment. In part, this is due to their unconstrained, multi-asset, multi-signal approach.

Summary

The value of true diversification through liquid, affordable structures is in our view is as high as ever.

The value of true diversification through liquid, affordable structures is in our view is as high as ever. Those who have tolerated greater risk concentration in recent years have been supported by an extraordinary period of easy monetary policy. But that is ending.

Finding the right strategies to diversify portfolios is challenging, but we are confident that there are effective and efficient active approaches with strong track records of providing genuine and repeatable diversification.

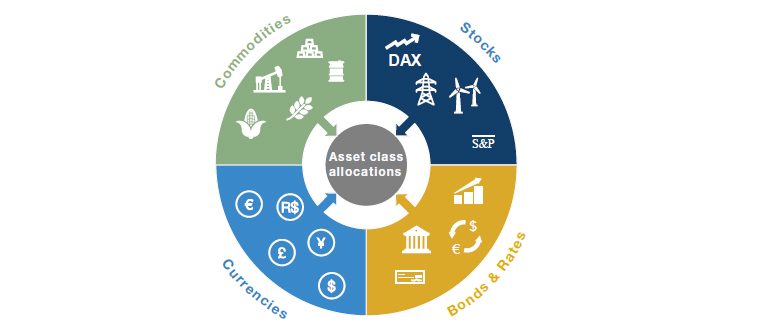

These active strategies can draw upon a huge range of assets and signals to seek to generate returns to diversify from more passive traditional allocations (Figure 6). They can be structured in liquid, capital-efficient forms, targeting maximum impact, as well as giving investors the ability to rebalance portfolios as needed (as many have done this year).

Figure 6. Illustrative Universe of Assets for ARP Strategies

For illustrative purposes only.

The flexibility of the strategies means they can be accessed in multiple vehicles, aligned to the specific requirements of individual investors, such as:

- Combined with risk-managed long-only mandates

- In market-neutral form for even greater diversification

- ESG integration

As a new market paradigm seems to be taking form, we expect the types of well structured liquid alternatives we have described above to demand the attention of investors seeking genuine diversification.

1. Markowitz, H. (1959). Portfolio Selection. New Haven, Connecticut: Yale University Press.

2. Unlisted assets clearly add illiquidity to a portfolio. This is not necessarily a problem, but investors should be rewarded for that illiquidity risk. Whether there is sufficient reward for this (or indeed any reward over understandable factors) is a fair question, and a particularly relevant one given both the recent flows into the space and the higher fees typically attached to private assets.

3. The Best Strategies for Inflationary Times

4. Man Group’s June 2022 research paper, “An Investor’s Guide to Crypto”, explores digital assets more fully.

5. For example, Israel, R. and Maloney, T. “Understanding Style Premia”, The Journal of Investing Winter 2014, 23 (4) 15-22.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.