Within a few decades, we expect to move from a world where retirees will lose their current reliance on a combination of existing defined benefit (DB) arrangements, state pension and owner-occupied property. ‘Generation DC’ (defined contribution) will primarily have to rely on their pension investments to fund their retirement. The implication is that they’ll need to take a lot more risk to generate the returns they need.

What’s the best way to make your money work harder? For many schemes and their members, the default answer has been adding more risk through equity beta earlier in the lifecycle.

Embedded assumptions

At Man Group, we’re in full agreement that to optimise retirement outcomes you should aim to maximise your investments, not just your contributions. An equity beta boost, however, has a few embedded assumptions which may not hold up versus history:

- It lets past performance guide the future: while we’ve seen historically strong equity returns over the past thirty years, can we be as confident over the next 10, or even 20 years? Many argue that the equity risk premium (the excess return you’d expect to receive over risk-free investments or cash) is shrinking

- It ignores the quality of returns: especially if point one comes into play, rather than maximising your equity allocation, it might make sense to take the equivalent ‘risk budget’ and allocate it to multiple return streams

So how might investors think about getting the most value out of their ‘risk budget’? One way could be by using portable alpha strategies, which typically combine beta (or market exposure) with other liquid, uncorrelated assets or return streams. How does this approach work?

Choose a risk level, and then make the most of it

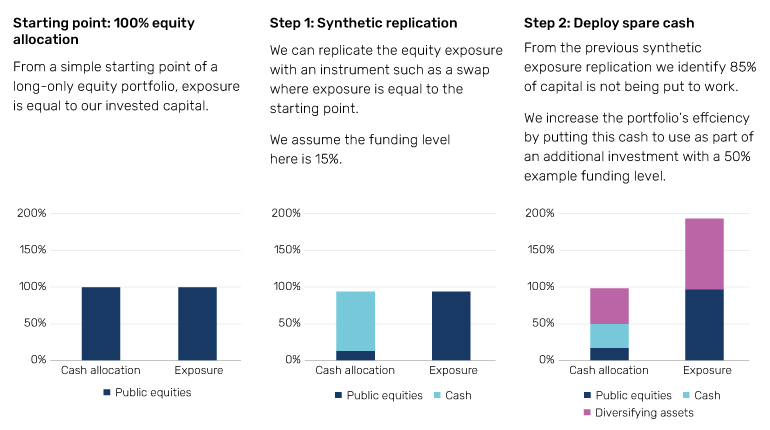

Firstly, through portable alpha, a typical allocation of 100% equities can be recreated using a variety of derivatives (for example swaps or futures) to create a more ‘cash-efficient’ exposure, i.e. not requiring 100% of cash to achieve the desired exposure. In fact, depending on the equity exposure you’re seeking, cash requirements can be as low as 10-20%, held as margin against the positions.

A portion of the remainder will be kept as cash, earning interest, with scope to invest up to 50% in other investments, as in the example below:

Combining beta and diversifying return streams to enhance returns and build a more diversified balanced portfolio

Source: Man Group, 2024. For illustrative purposes only.

How can this help a saver over the long term? In the example above, you’ll receive the full return of the 100% equity allocation in your original portfolio, plus the return of the 100% allocation to diversifying assets.

Of course, there are risks associated with using derivatives to create cash-efficient portfolios. At the forefront of investors’ minds will be the concern that the cash required to maintain the exposure may increase materially (typically due to a market drawdown or increased market volatility). The key here is to aggressively stress-test margin requirements over time, and ensure the portfolio has a healthy buffer.

Time to get creative

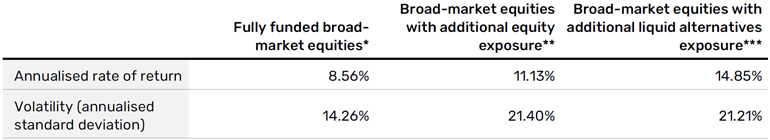

In the example below, we illustrate using the spare cash in a few different ways. An investor could fully fund a 100% allocation to broad-market equities, with no cash remaining (the navy line) or take additional notional exposure to equities (the turquoise line), leaving a substantial cash buffer to cover the potential for elevated volatility and drawdown risk.1 Finally, they may choose to gain additional exposure to liquid diversifying return streams (the pink line) to complement their equity exposure. Both of the latter approaches have historically resulted in significantly higher returns versus the fully funded equity portfolio.

Of course, this is not without its risks. But, as we see from the example below, the inherent diversification achieved through accessing different return streams can help to reduce total portfolio volatility as well as the maximum drawdown potential.

Cumulative return of different portfolios

Problems loading this infographic? - Please click here

* MSCI World (USD, net of dividends total return) hedged, **150% MSCI World (USD, net of dividends total return) hedged portfolio, ***100% MSCI World (USD, net of dividends total return) hedged & 100% liquid alternatives. The liquid alternatives allocation is based on a representative strategy. The representative strategy is provided for illustrative purposes and should not be relied upon. Other liquid alternatives may provide varied results.

Source for both the chart and table: Bloomberg, Man Group from using monthly returns from 31 January 2006 until 31 December 2024. For illustrative purposes only. Past performance is not a guide to future performance. Index performance returns do not reflect any fees or expenses. These are hypothetical portfolios, indices are unmanaged and one cannot invest directly into an index.

Enhanced outcomes through enhanced exposures

In our view, derivatives are far from a dirty word. Carefully implemented through a portable alpha approach, they can enhance the long-term return of your portfolio, and when combined with truly diversifying, liquid return streams can lower total portfolio volatility, as well as drawdowns through time.

1. Additional exposure is assumed to be financed at the LIBOR rate.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.