It’s not just familial dynamics. To adapt one of the most famous first lines in literature: successful quant run-ups have all been alike; every quant crisis has been a crisis in its own way.1

Historically, periods of strong quant performance have often been characterised by good performance from traditional factors such as Value, Momentum, and Quality.

On the other hand, approximately once per decade, traditional quantitative factors undergo a drawdown, with each market crash imparting its own unique lesson. What can today’s investors glean from the events of the past quarter of a century and how can they apply these lessons in 2025? It looks to be another ‘interesting’ year with Donald Trump taking up the reins, rising geopolitical tensions and uncertainty around inflation and monetary policy.

A brief history of quant

When the ‘Dot Com’ bubble burst in 2000, not unlike the collapse of the more recent growth bubble, it demonstrated the longer-term benefits of investors remaining disciplined about their core beliefs and fundamental analysis, in the face of dizzying levels of market euphoria. In both cases, careful risk management became critical to navigating and limiting the downside risk.

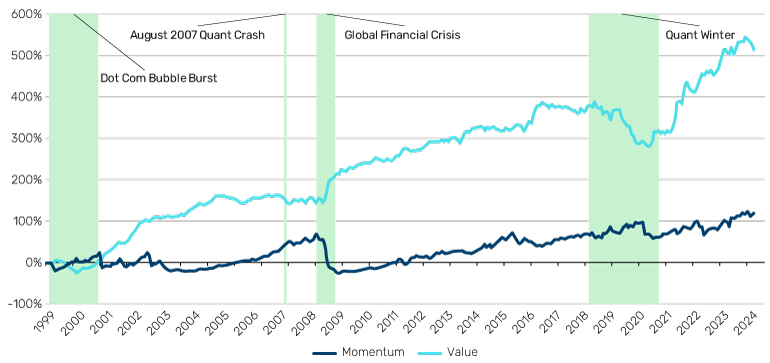

The Technology, Media & Telecoms bubble-induced vertigo generated a golden era for Value investing. Then, the quant-specific 2007 crisis and the very-much-not-quant-specific Global Financial Crisis (GFC) sparked significant soul-searching on the topic of crowding and the need for intra-quant differentiation. What followed was again a period of strong performance stemming from Momentum as well as Value.

In the middle of 2018, everything changed again. A Federal Reserve shift in monetary policy caused a breakdown in traditional factor performance, and particularly in the diversifying properties of Value and Momentum. Set against this backdrop, what seemed like an insatiable market appetite for growth threw Value into a drawdown.

Figure 1. Value investors were hit hard during the ‘Quant Winter’ of 2018 - 2020

Cumulative average Barra factor performance across regions

Source: MSCI Barra, Man Numeric as at 30 November 2024

Finally, in 2020, the Covid-19 pandemic was a black swan event that was driven to further extremes by fiscal stimulus packages and easy monetary policy. It exacerbated Value investors’ plight, further concentrating market winners and leading to a Momentum crash on the day the Pfizer vaccine was announced.

Lessons from history

These past four years, the ‘Quant Winter’ of 2018 to 2020 has thawed into a rather sunny ‘Quant Spring’. However, the lessons of the crisis remain pertinent, with growing differentiation between managers who remain almost exclusively dependent on harvesting traditional factors and those who have begun to incorporate more idiosyncratic approaches. In fact, since the GFC, cross-sectional standard deviation amongst quant managers has never been higher than it is today.

The explosion of the alternative data sector is partially responsible. Novel datasets tracking metrics such as geolocation/foot traffic, patent filing counts, and credit card transaction spend have allowed for the development of models based on sources entirely outside the realm of traditional financial data.

Meanwhile, machine learning (ML) techniques, although developed in the past couple of decades, have found their way into quantitative investing as the applications to low signal/noise ratio market data are ironed out. Although these techniques can be implemented on traditional financial data sources, the more idiosyncratic signals they create are generally focused on non-linear relationships orthogonal to classic financial econometrics.

The need for differentiation and specialisation

Both alternative data signals and machine learning algorithms tend to produce alphas that are fairly uncorrelated with traditional factors. Within Man Numeric, the correlations between the alphas sources we employ today with the traditional alphas we had heading into the Quant Winter presently average around 40-50% across all regions.

With the flames of macroeconomic uncertainty fuelled by potential tariffs, monetary policy, and geopolitical whiplash, portfolio diversification is the safest harbour in the storm. Because, if Tolstoy (and history) has taught us anything, it’s that the next crisis will be different.

All data Bloomberg unless otherwise stated.

With contributions from Nina Gnedin, Portfolio Manager and Ori Ben-Akiva, Director of Portfolio Management, Man Numeric.

1. Leo Tolstoy, Anna Karenina: "All happy families are alike; each unhappy family is unhappy in its own way."

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.