The Bank of England (BoE) will meet on Thursday against the backdrop of a difficult start to 2025 for central banks around the world. What was supposed to be a period of further easing as inflation continued to retreat from the highs of 2022 has been upended by US President Donald Trump’s weekend announcement to impose tariffs on Canada, China and Mexico. The move has injected fresh volatility into markets and heightened uncertainty for policymakers.

While tariffs on Mexico and Canada have been temporarily paused, those on China have taken full effect, prompting retaliation from the world’s second-largest economy with counter-levies and intensifying concerns over potential escalation.

For much of the world, current monetary policy was shaped by the relief of disinflation. The European Central Bank (ECB), the Bank of Canada, and Sweden’s Riksbank have already cut rates this month and the BoE is expected to follow suit this week with a 25-basis point (bps) cut to 4.5%. This is expected to also lessen the fiscal burden of financing the UK’s deficit, which has been a persistent headache for Chancellor Rachel Reeves. Beyond Thursday, though, the picture is anything but clear.

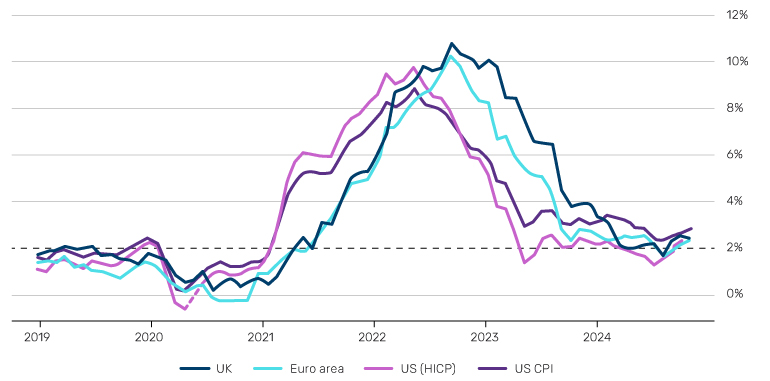

In January, softer-than-expected inflation data in the US and UK had bolstered the case for maintaining a more accommodative policy stance. The US 10-year Treasury yield fell 25bps in just four trading days after the 15 January consumer price index (CPI) print, fuelling a rally in longer-dated government bonds. For a moment, the narrative seemed clearer: price growth was easing after all (after an uptick at the end of 2024), giving central banks room to cut rates and allowing policymakers to focus on supporting economic growth.

Figure 1. Inflation has ticked up again beyond central banks' 2% target

Source: Bloomberg as at 31 December 2024

Tariff shock

Trump’s tariffs have thrown a spanner in the works. The dollar surged after the announcement as markets priced in the inflationary impact of trade levies on three of the US’s largest trading partners. The new president has also threatened to impose import duties on goods from the European Union, leaving markets and central bank officials scrambling to work out their impact on the global economy.

In our view, concerns about US inflation were warranted even before the tariff announcements. To us, the broader market narrative around the US Federal Reserve (Fed) lowering rates appeared overly optimistic and risked underestimating the stickiness of inflation. Even if individual CPI prints come in marginally lower, inflation expectations stubbornly above the Fed’s 2% target don’t fit well with central banks cutting rates.

Even after the tariff news, market pricing for rates remains largely unchanged from the start of the year, with two cuts still anticipated this year. The Fed will update its own projections on the economy and rates at their next meeting in March.

Policy error?

Trump’s return to the Oval Office has introduced a new layer of uncertainty to an already complex economic picture. Potential tariff-driven inflation risks may keep rates higher for longer, while the president’s promised deregulation push could further fuel economic growth – and inflation along with it. In such a scenario, the Fed would have little justification for cutting rates.

This also raises the prospect of a standoff between Trump and the Fed. Trump has never been shy about calling for lower rates, and his renewed pressure could lead to policy missteps or decisions made for the wrong reasons.

For now, central bankers find themselves at the mercy of Trump’s trade and economic policies, torn between the need to manage inflation, maintain credibility and navigate an increasingly unpredictable global landscape

What's Next For Climate Investors?

From a climate investor's perspective, the world seems – according to the old idiom – to be at sixes and sevens.

The Copernicus Earth Agency recently confirmed that the planet breached 1.5°C of warming for the first time in 2024. This milestone comes against the backdrop of the Los Angeles wildfires and last year’s devastating Milton and Helene hurricanes.

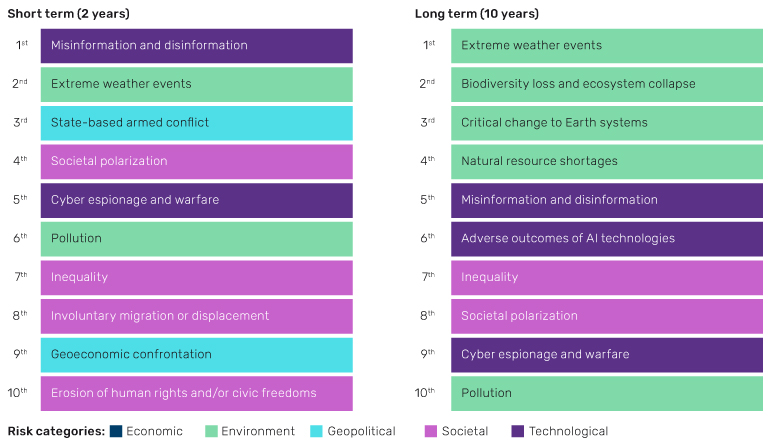

Extreme weather events continue to dominate both the short- and long-term risk outlooks in the World Economic Forum’s 2025 report, underscoring the urgency of climate action.

Figure 2: Over the long term the key global risks are climate related

Source: World Economic Forum Global Risks Report 2025, 15 January 2025

Yet, in the US, the political winds are blowing in the opposite direction. Following the country’s withdrawal from the Paris Accord, several of Trump’s latest executive orders have significant implications for the renewable energy industry. These include a pause on key Inflation Reduction Act (IRA) funding items, a moratorium on offshore wind development and rollbacks on oil and gas restrictions. At the same time, a national energy emergency has been declared, alongside fast-track permitting for new infrastructure and ambitions to grow the US’s LNG export capacity.

Waning support

Support for collective climate action is also waning. In 2024, the Net Zero Insurance Alliance dissolved. By December, every large US-based bank had exited the Net Zero Banking Alliance, with Canadian banks following suit. Meanwhile, the Net Zero Asset Managers initiative is suspended and under review after a US House Judiciary probe into the participation of over 60 US-based asset managers.

This does not spell the end of net zero investing, but it does raise questions about what these commitments will look like going forward. As we explored in our latest podcast with Professor Tom Gosling, London School of Economics, the key question is this: will climate investors reset, recalibrate, or retreat from net zero?

For now, the answer is unclear. Many signatories of net zero alliances have stepped back from collaborative efforts due to legal and antitrust concerns in the US. However, most remain committed to their individual net zero targets. Organisations like the International Investors Group on Climate Change, are also adapting to this highly politicised environment, providing frameworks like the Net Zero Investment Framework 2.0, which focuses on “objectives” rather than fixed targets.

Silver lining

That doesn’t mean a reckoning won’t come. Copernicus’s indication that the earth is already breaching 1.5°C suggests that achieving a 1.5°C pathway may no longer be viable. Investors may need to double down, shifting to a negative emissions approach instead of net zero, reflecting the longer-term and increasingly difficult nature of emissions reductions. Alternatively, they may have to recalibrate their ambitions to the less aggressive 2°C goal – the original Paris Agreement commitment. For now, 1.5°C remains relevant as a benchmark but increasingly unrealistic as a portfolio target.

There is, however, a silver lining for climate investors. This shakeout could help distinguish serious investors from those who have used net zero as a greenwashing tool. Moreover, areas like climate adaptation and resilience represent not only a pragmatic refuge during politically uncertain times but also a critical investment theme given the rising frequency and damage of extreme weather events.

All data Bloomberg unless otherwise stated.

With contributions from Adam Singleton, CIO, External Alpha and Jason Mitchell, Head of RI Research , Man Group.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.