So, as the election countdown intensifies, how will markets react to a Kamala Harris or Donald Trump victory?

Precise forecasting is of course impossible, particularly in the context of the current geopolitical turmoil. But with abundant data at our disposal, it’s worth examining how industries and sectors may fare after 5 November.

We have taken a systematic approach and explored whether election odds (which represent political expectations) can be linked to equity-factor returns (characteristics like size, value, industry or even country that drive stock performance).

We find that they can, and that industries like financials, energy, and technology responded the strongest to shifts in election odds, highlighting their sensitivity to policy changes. By understanding these dynamics, investors can more effectively navigate the complex interplay between political outcomes and market responses.

Maybe not surprisingly, historical data also shows that financials often benefit from Republican wins, given how the party favours policies like deregulation and tax cuts which tend to spur corporate lending, while sectors like automobile components and consumer durables tend to do well under the Democrats.

Understanding election odds

Election odds, often derived from betting markets and prediction platforms such as PredictIt and tracked by Bloomberg, serve as a proxy for political expectations.

Throughout the current election cycle, market expectations have been shaped by events like primary debates, major announcements or events like the assassination attempt on Donald Trump. These are reflected in shifting betting odds for a Republican or Democratic win.

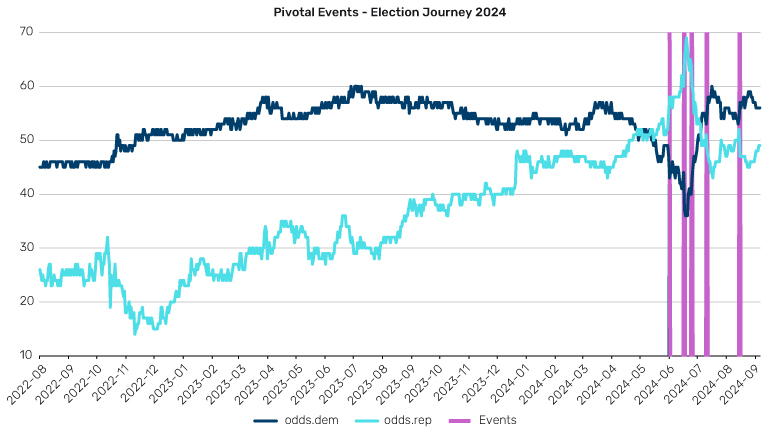

Figure 1: Key moments in electoral odds shifting

Source: Bloomberg

In Figure 1 we’ve highlighted a few key moments in the recent runup to the election, showing how market sentiment adjusted in real time to new information.

- Event one: first Presidential debate (Trump vs. Biden 27 June 2024)

- Event two: Trump assassination attempt (13 July 2024)

- Event three: Biden pulls out (21 July 2024)

- Event four: Walz announced as running mate (6 August 2024)

- Event five: second Presidential debate (Trump vs. Harris 10 September 2024)

Last week’s debate between Vice President contenders Tim Walz and JD Vance has not moved the dial and neither (at the time of writing) has the escalation of the war in the Middle East.

Market reactions to political shifts

Election outcomes exert a powerful influence on economic sectors and markets tend to price in distinct scenarios depending on whether a pro-business or pro-regulation party is expected to win.

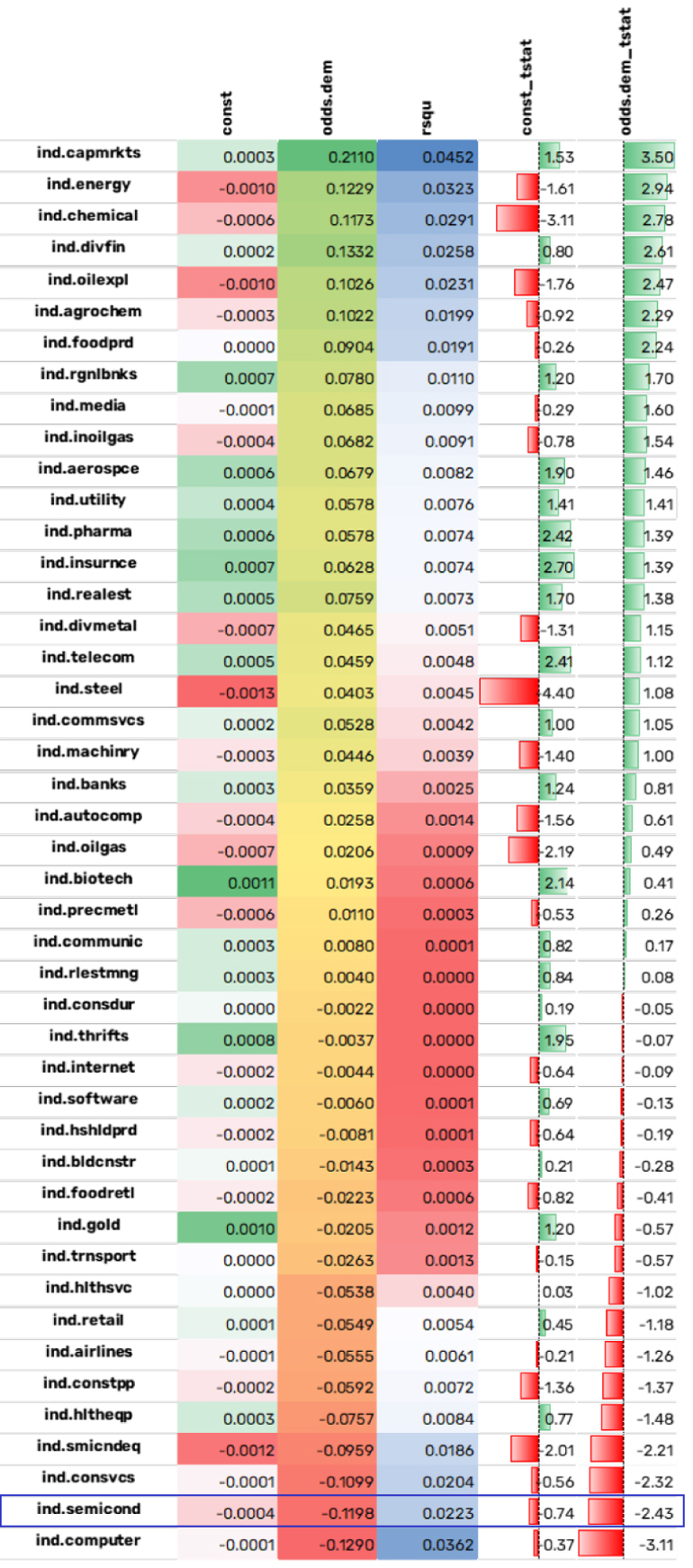

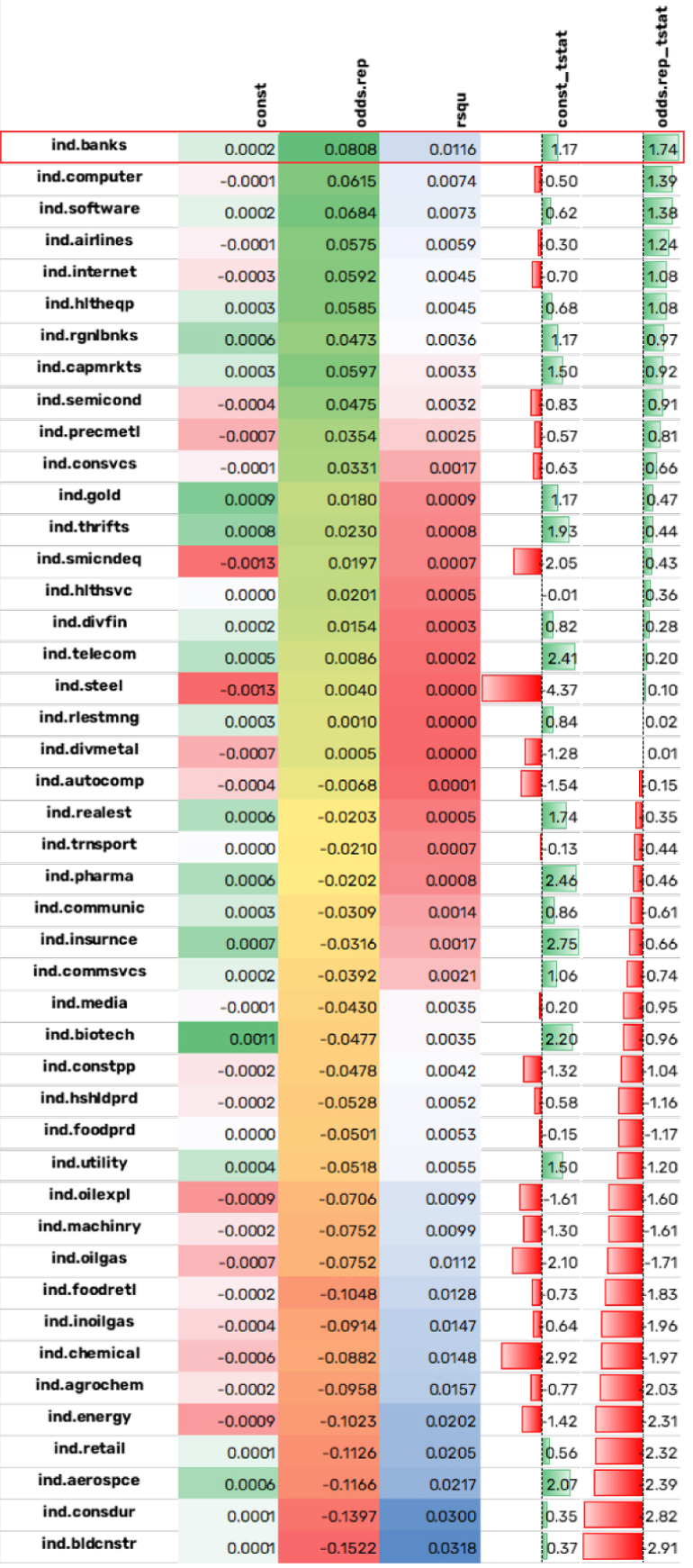

Trying to quantify the potential market impact of changes in betting odds for this election we ran a regression analysis examining the relationship between industry returns and the daily fluctuations in victory odds for each party, helping to identify which sectors are most sensitive to political shifts.

Returns for banks were the most responsive and moved in line with any changes in the Republican party’s odds to win the election, boding well for the sector. On the other hand, semiconductor manufacturers, particularly those outside the US, are seen as not faring well under a Democrat administration amid expectations of potential trade restrictions, export controls and geopolitical shifts impacting supply chains.

Figure 2: Semiconductors won't do well under Democrats; banks thrive under Republicans

Democrats

Republicans

Source: Man Numeric calculations, MSCI Barra

Applying a similar regression framework to equity style factors—specific investment strategies like growth or value—reveals that ESG (environmental, social, and governance) factors often align with Democratic policies. Companies attuned to Democrat-led ESG goals generally move in step with Democratic victory odds.

However, it's important to note that regression analysis highlights co-movement rather than causation.

Measuring market sentiment

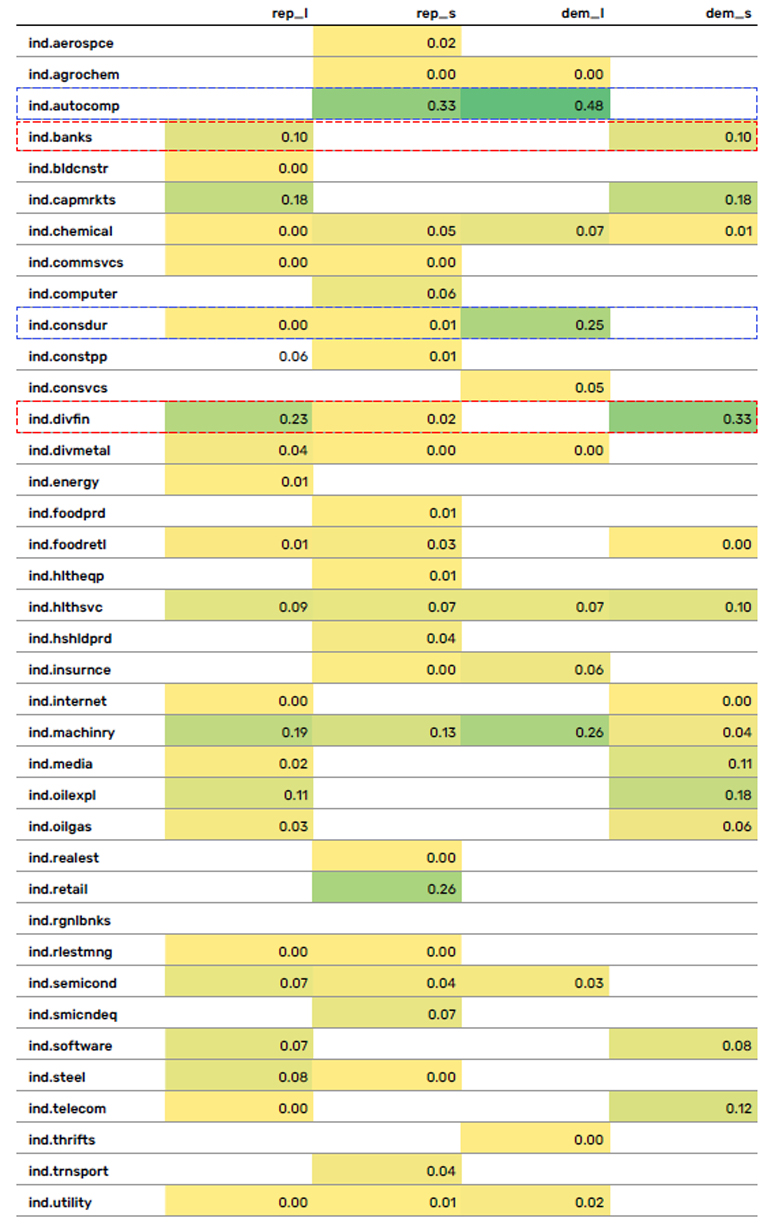

Another way to better understand market sentiment around potential election winners is to examine election baskets — groups of stocks expected to perform under specific political scenarios — and their underlying exposures.

Figure 3: Elections basket confirms that the Republicans are beneficial for banks and Democrats for the car sector

Source: Man Numeric calculations based on Morgan Stanley election basket data, MSCI Barra

Figure 3 summarises the exposures of baskets positioned to be long (l) or short (s) given either party’s victory. Again, the table shows that financial institutions, like banks, will benefit from Republican wins, while sectors such as automobile components and consumer durables may thrive under Democratic leadership. Historical data supports these patterns, with banks rallying post-Trump’s election in 2016 and automotive sectors after Joe Biden’s win in 2020.

Factoring in election outcomes

As we enter the final stretch of the election cycle, our research finds that financials, energy, and technology are most influenced by election outcomes, as they experienced the most pronounced shifts with changes in political sentiment. That said, while these patterns provide valuable insights, they do not guarantee future performance. The interplay between politics and market dynamics is complex and shaped by factors beyond electoral probabilities. These are uncertain times, and a nuanced understanding of these implications is crucial for any investor’s decision-making.

Decoding 2024: Market Lessons from Past Elections

The stakes are high for this election, so to gain further insights into what impact the outcome will have on markets and the economy, we have scrutinised past election cycles, using our proprietary MacroScope model.

It analyses historical market regimes to help us understand future behaviour by comparing risk factors and sectors. This allows us to identify recurring trends and anticipate how current macroeconomic conditions might interact with political developments.

Today is just like July 2019

It’s probably not a surprise after last month’s Federal Reserve interest rate cut that the MacroScope model's current positioning most strongly echoes July 2019, followed by mid-2020, and late 2010.

These periods were marked by the Fed’s monetary policy shifts, including lowering key rates and expectations of quantitative easing. These actions historically bolster market confidence, favouring Momentum and Beta strategies that thrive on volatility and directional market moves.

In this context, interest rate-sensitive sectors, such as biotech and internet software, have emerged as attractive bets. These industries often thrive in low-rate environments, benefiting from cheaper capital and growth prospects.

Conversely, financial sectors like savings banks and mortgage finance appear less appealing.

Shifting similarities

The similarities have shifted quite a bit this year. Initially, the environment bore a striking resemblance to early 2020. This was fuelled by the anticipation of a Donald Trump-Joe Biden rematch, echoing the uncertainties of the pandemic era, which were marked by economic volatility and market unpredictability.

However, as Trump's campaign gained traction and he became the presumptive Republican nominee, the model saw 2016 and his unexpected victory as the most similar period. At that time corporate profits were near all-time highs, and so were stocks. Bets on Trump trades peaked in July after the first campaign debate and an assassination attempt.

This shift reversed a few days later after Biden withdrew his candidacy, and Kamala Harris announced she was running for President. The resulting market uncertainty saw similarities with previous election years converge, reflecting a period of recalibration as investors digested new information.

The macroeconomic environment shifted again in August, drawing parallels with 2012 and reflecting a weakening US dollar and steepening yield curves. This period of financial flux underscores the market's heightened sensitivity to political developments and the constant ebb and flow of economic indicators.

As the election approaches, financial markets remain acutely aware of the intricate dance between politics and economics. The evolving macro backdrop of Fed policy moves geopolitical uncertainty demand vigilant attention from investors.

With contributions from Michael Dowd, head of investment risk at Man Numeric, Nannu Lakshminarasimhan, a quantitative risk analyst at Man Numeric and Valerie Xiang, associate portfolio manager at Man Numeric.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.