As the dust begins to settle following a historic Labour victory in the UK general election, all eyes are on Prime Minister Keir Starmer and his plans to rebuild Britain ‘brick by brick’ and to deliver economic growth.

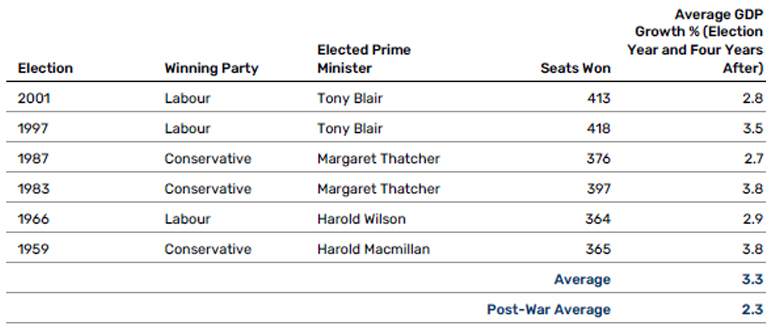

With 411 seats in parliament (at least 326 are required to secure a majority), the Labour Party has secured one of the largest majorities in post-war history. With this in mind, we looked at every notable majority in the UK since 1945 to see how previous majorities had fared in terms of economic growth (Figure 1).

We found that the six governments with large majorities since World War II delivered an average of 3.3% GDP growth during the election year and four subsequent years. This compares to the post-war average of 2.3%. Although we can debate causation and correlation, clearly there is some historical precedent to state that majorities bring above average growth.

Figure 1. Significant majorities have historically delivered above average growth

Source: Bloomberg.

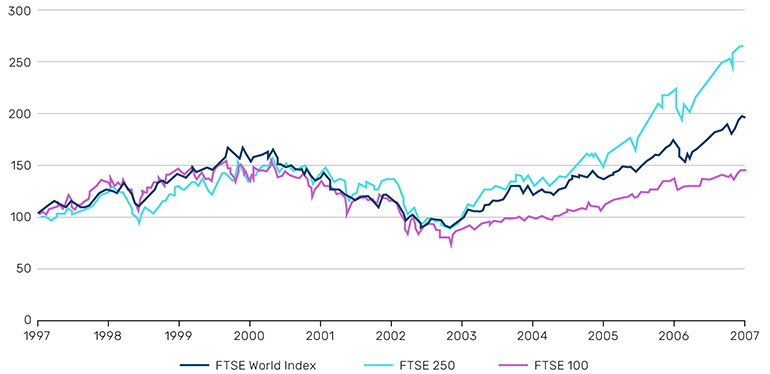

In terms of the new government’s domestic agenda, there is some correlation with that of New Labour, led by Tony Blair. Figure 2 shows that during the Blair years from 1997 to 2007, the performance of the FTSE 250 Index (which is approximately 80-85% domestic facing companies) outstripped large cap companies in the UK, represented by the FTSE 100 Index, as well as the FTSE World Index.

Figure 2. FTSE 250 outstripped large caps and the FTSE World during the Blair years

Source: Bloomberg. Performance rebased to 100.

Of course, the proof will be in the pudding, but how could economic growth potentially be achieved this time around?

Construction, construction, construction

Although the UK slipped only briefly into technical recession at the end of 2023, some sectors of the market have been notably depressed and have experienced recession like conditions, a topic we wrote about in detail earlier this year.

One such sector is construction, which has been blighted by planning malaise in recent years. Brick delivery volumes are down 30% from their 2018 peak and lower than they were during the Global Financial Crisis.1

Labour identified construction via reforms to the planning system as the clearest economic multiplier – or opportunity to generate growth – in its manifesto, This echoes a 2020 study from the Confederation of British Industry and Oxford Economics which calculated that every £1 spent on construction creates £2.92 of value to the UK economy.2

The pick and shovel business

We have already seen a rally among housebuilder stocks on the back of Labour’s expected planning reforms, but as active managers, we look for those companies which we believe have the most recovery potential.

Mark Twain famously wrote, “When everyone is looking for gold, it's a good time to be in the pick and shovel business.” In a similar vein, we see the potential benefits weighted to the second line construction plays in the UK. We have already mentioned brick manufacturers but in short, it’s everything that feeds into building a house – except potentially the housebuilders themselves!

With contributions from Henry Dixon, Portfolio Manager, UK equities at Man Group.

1. Source: ONS, available here: https://www.gov.uk/government/collections/building-materials-and-components-monthly-statistics-2012

2. Source: https://www.cbi.org.uk/media/4121/fine-margins-february-2020-cbi.pdf

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.