The 22 February 2024 marked a long-awaited day for the Japanese investment history books. After 34 years, the Nikkei 225 extended its rally and finally surpassed the December 1989 record.

The initial rush of excitement was quickly followed by questions over whether that means the market is again in bubble territory. And we all know how that went the last time.

The answer is no, the contrast between the general situation and valuations between the late 80s bubble era and today couldn’t be any more stark.

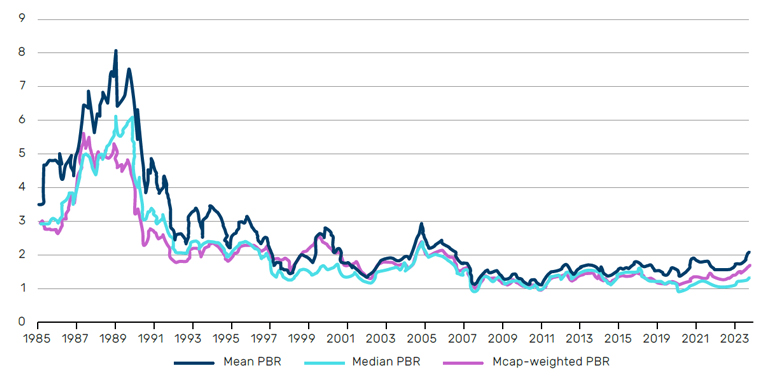

In 1989, the market boom led to Japan accounting for 37% of global stocks by market cap.1 The Nikkei 225, was trading at 60 times its earnings over the trailing 12 months, and it had an above 8 times Price to Book ratio.

Figure 1. Valuation levels between 1989 and now could not be more different

Source: Factset and Goldman Sachs.

Despite the new high and a, at the time of writing, more than 17% increase from the start of the year, the Nikkei 225 trades at around 16 times its Price to Earnings ratio, twice its Price to Book ratio, and 37% of the companies included in the Nikkei 225 index have a market price that is lower than their book value.

A multitude of factors have aided in the Nikkei’s climb beyond bubble era highs, many of which we have flagged in recent months.2 An economy that is emerging from three decades of deflation, authorities focused on the creation of a virtuous cycle of rising wages and prices, supported further by Prime Minister Fumio Kishida’s “new form of capitalism” and a once-in-a-generation request by the Tokyo Stock Exchange to improve corporate value and capital efficiency. A unique collection of tailwinds that have simultaneously propelled the Japanese equity market and the foreign investor’s interest in the region. With this symbolic high for the Nikkei, there are also encouraging signs that domestic investors are gradually shifting their attention back to their own market too.

But what about the economy?

A momentous day for investors, particularly for the patient individuals who have kept the faith since the Japanese bubble era.

But is this optimism also reflected in the nation’s economy? Earlier this month Japan fell into recession, with real GDP contracting at an annualised rate of 0.4% in Q4 2023 following a 3.3% drop in Q3. To us it’s a technical recession, largely driven by weakened domestic consumption (fuelled by a mini cost-of living crisis), delayed increases in wages and deferred CapEx by corporations due to labour shortages and higher costs.

Wage growth will remain the key driver over the medium-term to ensure Japan has truly exited structural deflation which has stifled the economy for three decades and can move forward into an era of steady and sustainable growth. It’s still early days but the signs are positive.

Major Japanese companies, including Honda Motor and Aeon Group, agreed this month to fully meet their labour unions’ demands in this year’s wage negotiations, starting in the spring. Honda, which reached an agreement in the first round of talks for a second straight year, agreed to a 5.6% increase. Aeon, a leading retailer and Japan’s largest employer of part-time workers, fully met union demands and reached an accord about a week earlier than in 2023. Wages for full-time workers will rise 6.4%, above last year’s 5%, while part-time workers will receive a 7% raise in hourly pay.

Fuelled partly by a need to keep their highly skilled workers, these moves align with government pressure to put more money into workers’ pockets. As welcome as the return of inflation may be on a macro-economic level, it has led to a cost-of-living crisis for ordinary Japanese citizens and fuelled dissatisfaction with the government.

The BoJ - will it, won’t it ?

This trend is then supportive of a Bank of Japan move to exit of its policy of negative interest rates and yield curve control (YCC) in the near term, given their forward-looking approach. This might also help to explain why the market remains unfazed by the news of the recession.

Macro factors aside, the key reason behind Japan’s recent, and potential future, strength is the corporate governance revolution driven by the Tokyo Stock Exchange. Momentum continues to build here.

In the non-life insurance sector, the Financial Services Authority (FSA) is pressuring companies to unwind their cross-shareholdings following recent collusion scandals. The three largest non-life insurers under review do have existing plans in place to gradually reduce their almost Yen 8 trillion of cross shareholdings, but the FSA has only given them until the end of February to come up with accelerated divestment plans. This regulatory push has been positively received by the market, with the affected companies seeing a 13-25% rise in their stocks the same week the order was issued in early February. This development could also benefit other financials, like banks, life insurers, and brokers, that still hold significant cross-holdings.

The Tokyo Stock Exchange continues to monitor and publish their list of companies that have adequately disclosed plans to improve corporate value. With the AGM season in June, more companies are also expected to disclose their plans, further bolstering investor confidence and retaining the spotlight on corporate Japan.

Foreign investors have clearly taken note of the radical improvements that corporates are endeavouring to achieve. But with restricted liquidity (only 220 stocks have an average daily traded value over $20mn in Japan3), buying has focused on larger capitalisation companies and market breadth has remained narrow over the last 15 months. Semiconductor-related names have been a key market driver in recent weeks, mirroring the global trend.

This helped to push the Nikkei 225 past the 1989 high, ahead of the broader Topix Index which is more reflective of wider corporate Japan and also not too far from an all-time high. A Topix record would signal that a robust broad-based recovery is well and truly underway. And that may finally confine Japan’s lost eras to the history books.

With contributions from Emily Badger, a Portfolio Manager in the Japan CoreAlpha team.

1. Sources: All sources Bloomberg unless otherwise stated.

2. https://www.man.com/maninstitute/japan-value-2024-reasons-to-remain

3. Source: Goldman Sachs.

Index Definitions:

Nikkei 225: The Nikkei 225 is a price-weighted equity index, which consists of 225 stocks in the Prime Market of the Tokyo Stock Exchange.

Topix Index: TOPIX is a market benchmark with functionality as an investable index, covering an extensive proportion of the Japanese stock market. TOPIX is a free-float adjusted market capitalization-weighted index, covering an extensive proportion of the Japanese stock market.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.