Risk Appetite: Capitulation?

Inflation. Energy prices. Geopolitical risk. It’s fair to say that 2022 has hardly been a picnic for investors.

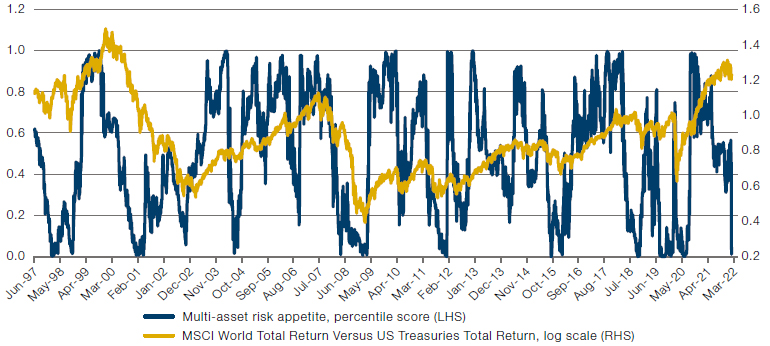

But despite a volatile few months, risk appetite was far away from panic levels, at least until the recent invasion of Ukraine. Figure 1 shows multi-asset risk appetite as of 22 February, compiled from 46 asset classes by measuring the trailing risk/reward profile across the risk spectrum. While risk appetite had fallen from the heady days of the 2020 reflation trade, it was above the 40th percentile (on a sample from 1997), and was still a long way from capitulation territory, when investor sentiment tends to fall into the bottom decile.

Since the invasion of Ukraine, however, we have observed a sharp downturn in sentiment, with risk appetite now in the first percentile. This is similar to the true capitulatory selloffs seen during the Global Financial Crisis of 2008 or the pandemic crash of 2020. History says that markets tend to stay highly volatile in the near-term against this backdrop of capitulation. But in the medium term, returns in riskier assets tend to be skewed very positively.

Figure 1. Multi Asset Risk Appetite Versus MSCI ACWI Index

Source: Bloomberg; as of 28 February 2022.

Pestilence, War… Famine?

O tempora, o mores! To the coronavirus pestilence we have now added war in the Ukraine. And with war, comes a different threat: food prices.

Since the invasion, European natural gas has surged (Figure 2) Natural gas is of course used in heating and electricity production. It is also a key component of nitrogen-based fertilisers.

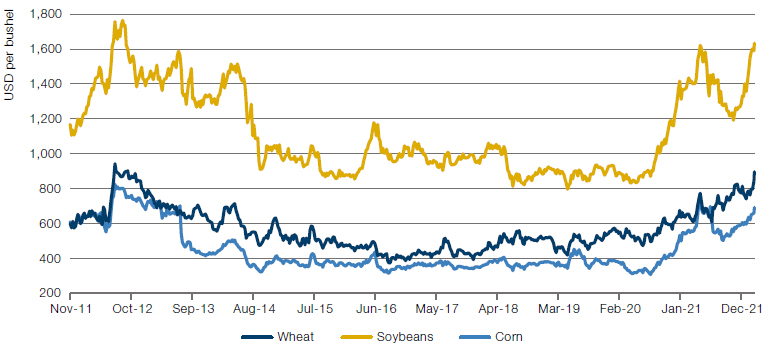

Without fertiliser, crop yields will certainly fall. This has already been reflected in the price of agricultural commodities: wheat has risen by 16.4%, corn by 6.6% and soybeans by 2.7% since 22 February1 (Figure 3). Furthermore, Russia and Ukraine are jointly responsible for a third of the world’s wheat exports and a fifth of its corn. Ukraine also supplies a third of China’s corn imports – crucial feed for the world’s largest pig herd.2

This creates two factors to be aware of. The first is the humanitarian implications: high food prices cause hunger. The second relates to inflation. Food is one of the largest items in the US CPI basket, comprising some 14%. If the war in Ukraine continues to restrict natural gas supplies, the inflationary momentum is only likely to grow.

Figure 2. European Natural Gas Prices Have Surged…

Source: Bloomberg; as of 28 February 2022.

Figure 3. …As Have Those of Various Food Commodities

Source: Bloomberg; as of 28 February 2022.

With contributions from: Ed Cole (Man GLG, Managing Director – Discretionary Investments) and Giuliana Bordigoni (Man AHL – Director of Specialist Strategies)

1. The date of the first economic sactions on Russia. The full invasion occurred on 24 February 2022.

2. Financial Times.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.