Get Well Soon? Molnupiravir and the Health-Risk Basket

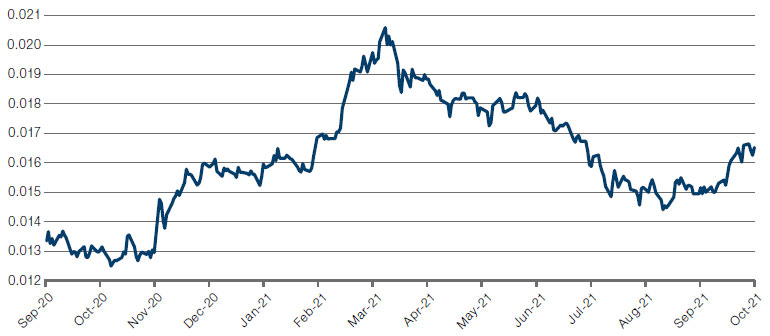

Since March, the re-opening trade which powered so much of 2020’s recovery has been stalling, as illustrated by the performance of the health risk basket – stocks such as airlines, tour operators or hospitality, which are reliant on the re-opening of the economy after the pandemic (Figure 1).

However, all may not be lost for health risk stocks. The development by Merck of molnupiravir, an oral anti-viral treatment, offers another method for reducing the impact of the Covid-19 pandemic. Taken after patients develop an infection, the drug is designed to reduce coronavirus symptoms for those with Covid-risk factors such as age, obesity, diabetes or cardiovascular conditions. Of the 775 patients in the study, eight deaths were recorded in the placebo group. None of the patients taking the drug died. Hospitalisations halved, from 14.1% in placebo patients to 7.3% in the nonplacebo group.

Licensing agreements are in place with Indian generic drug manufacturers, which should reduce the potential for supply bottlenecks to emerge. In addition, Pfizer, Shionogi and Gilead also have oral treatments in development, and Atea/Roche are due to report Phase III results on their own drug before the end of 2021.

In our view, this development has great potential to fully re-open the global economy. At USD700 per course, it is not cheap, but is far cheaper than the cost of hospital treatment. Likewise, because it specifically targets those patients who are most at risk, the drug is likely to lessen the political cost of re-opening, leaving the level of infections unchanged but massively reducing hospitalisations and deaths.

All in all, we are not surprised that the health risk basket has jumped on the news: molnupirarvir might just provide a final return to normal life.

Figure 1. Health Risk Basket Versus S&P 500 Index

Source: Bloomberg; as of 6 October 2021.

Health Risk Basket represented by Goldman Sachs US Global Health Risk.

An Eye on Supply-Chain Bottlenecks

Everyone is an expert on supply-chain bottlenecks now. But it’s often the case that when developments that have occupied financial markets for months – and we must remember that the first obvious shortage was semiconductor logic chips in the first quarter of this year – get to the mainstream, the trend is often close to exhaustion.

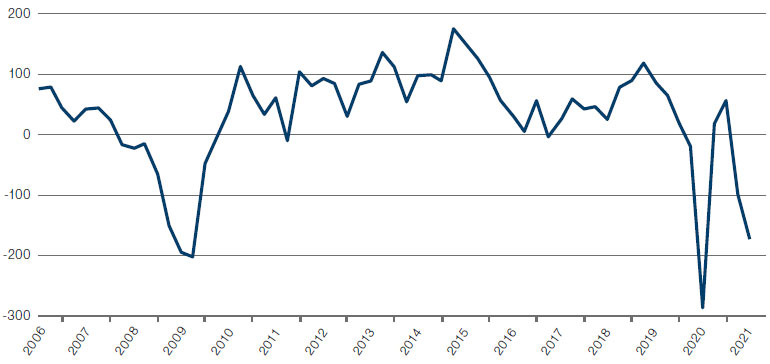

The subcomponents of the global manufacturing PMI survey for September is hinting that the worst of the supply bottlenecks might be receding. Delivery times are now turning higher from an extreme low, indicating that while things are not good, they are less bad. This is key to watch, and ultimately should be a positive for the global cycle if inventories can be replenished amid still-strong production and new orders (Figure 2).

Figure 2. US GDP Dollar Level Change in Private Inventories

Source: Bloomberg; as of 11 October 2021.

With contribution from: James Terrar (Man GLG, Analyst) and Ed Cole (Man GLG, Managing Director – Discretionary Investments)

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.