Key takeaways:

- Even if markets ended November in positive territory, high factor volatility suggests that considerable turbulence remains beneath a relatively benign surface

- 2026 will, one way or another, be the litmus test of whether reality can match the AI hype

- Outside of AI, the longer-term focus remains on inflation, potentially over-accommodation of monetary policy from the Fed under a new governor

There is a party trick you can use to entertain small children that involves attaching a hidden piece of clear tape to a balloon and then pushing a pin through the tape. Much to the children's surprise, the balloon does not burst as expected but simply deflates slowly. We haven't identified the sticky tape yet, but the AI/tech bubble appears to have performed a similar trick in November.

A quick audit of some assets at the more speculative end of investors' risk tolerance shows how much pressure has been released from the system (all moves are as of 1 December, measured from their peak in the last two months): Bitcoin -31%, Nvidia -15%, Oracle -36%, Coreweave -49%, the Goldman Sachs Non-Profitable Technology Index -17%. But the S&P 500 finished November in slightly positive territory, suggesting this revaluation of the hotter parts of the market has been achieved without much systemic contagion.

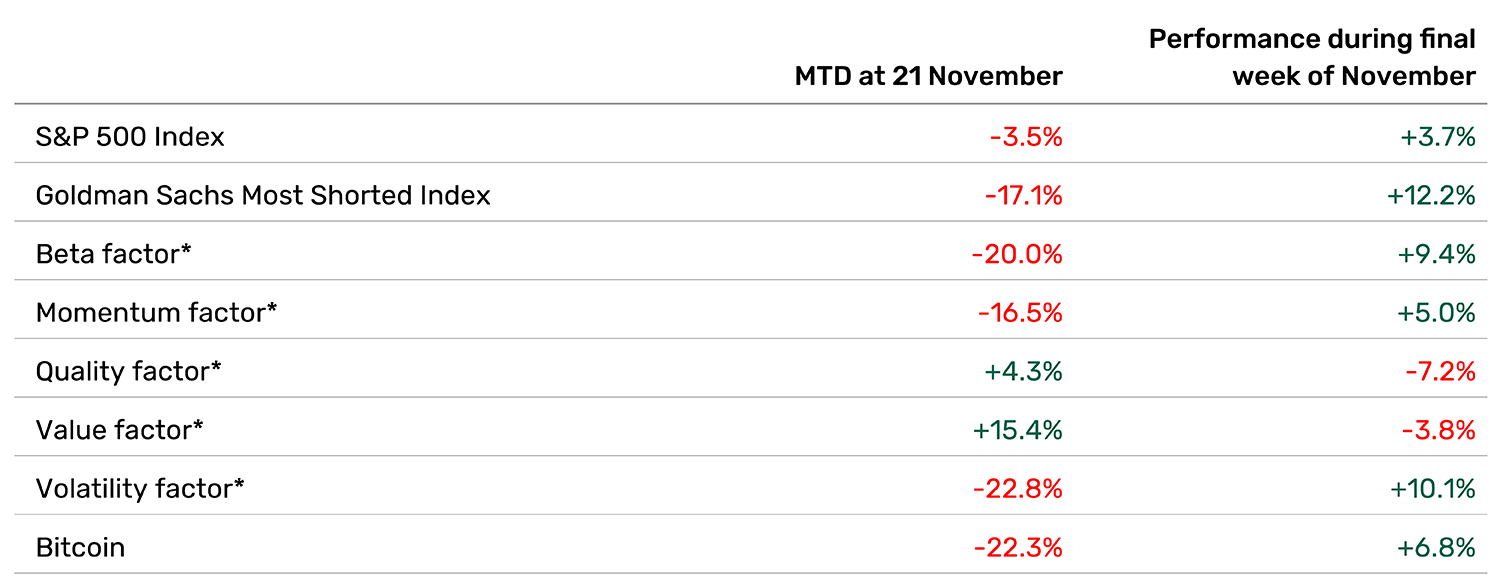

Look beneath the surface, however, and there are still sufficient reasons to remain vigilant. November was very much a month of two halves (albeit of different lengths). Figure 1 shows performance for various assets during the first three weeks in the first column, and during the final week in the second column.

Figure 1: Selected asset returns in November

*all factors are taken from Morgan Stanley market neutral indices.

The observations are easy to draw. Firstly, the market still feels very one-dimensional: if we were to tell you the direction of one of the above metrics for the next week, you would have a good chance of predicting the direction of the others. Secondly, factor volatility remains high, suggesting that beneath the relatively benign surface, there is considerable turbulence.

So, as is often the case in periods of temporarily high valuations in a small part of the market, we see increased correlation of factors on both the way up and down. The recovery during the final week of November for more risk-seeking assets raises the question of a possible "Santa rally" into the end of the year. Given the lack of new earnings news from the market leaders, speculation and sentiment can dominate.

The good news, if one can call it that, is that the projected timelines for these AI companies to make breakthroughs in computing power and to generate real profits are not that long – a few years at most. That means 2026 will, one way or another, be the litmus test of whether reality can match the hype.

Key drivers of hedge funds’ performance: an early November snapshot

Equity Long/Short:

- Equity markets experienced a volatile month, though most global equities staged a strong rally in the last week of November. The outliers here were Asian equities (Japan, China, Korea in particular), where concerns about AI valuations hit in a delayed manner. Like last month, the two themes continuing to drive investor sentiment are AI and interest rates

- Equity Long/Short manager performance generally followed the same path as above, with losses early in the month followed by gains late in the month. Given net exposures remain heightened across the space (excluding Equity Market-Neutral funds), beta unsurprisingly had a large impact on returns. Early indicators are that equity long-short funds outperformed the market in November and exhibited positive alpha

- One glimmer of hope for value-driven investors was a reversal in the performance of crowded longs versus shorts, with the most-shorted names coming under pressure early in the month. That said, this dynamic did reverse in the last week of November and if there is indeed a "Santa rally," this could lead to continued erosion of short alpha

Credit:

- Credit markets followed a similar path to equities in November, with spreads widening slightly during the first three weeks of the month, only to tighten in the last week back to close to the tightest levels seen all year

- Credit hedge funds had a mixed month in November, with managers generally following a similar path to the market – weak to begin, followed by a late month recovery

- Convertible Bond Arbitrage managers saw a more muted month in November following a strong period in the prior few months. Managers are still benefiting from higher levels of convertible bond issuance, although outright exposures to convertibles were weak, particularly in the early part of the month

Relative Value:

- US deal flow activity continues to be robust. Some notable deals include Kenvue/Kimberly Clark, consumer health goods, (US$33 billion market cap) and Exact Sciences/Abbott in the med tech space (US$19 billion market cap)

- Covestro AG and Abu Dhabi's XRG (formerly ADNOC) received final EU regulatory approval for the EUR 15 billion deal

- Japan continues to see a steady stream of takeouts. For example, KKR launched a tender offer for Forum Engineering. Also in Japan, minority shareholders continue to dispute the price and implementation of Toyota Group's plan to buy out Toyota Industries (TICO) as part of the ongoing unwind of its cross-holdings

Macro:

- Discretionary Macro strategies were mixed in the first part of November; however, we expect to see final numbers adjust higher due to a recovery in some widely held themes in the second half of the month

- US and UK rates performed positively, with some managers tactically adding to long positions as yields rose at the start of November. There were also gains in Japanese government bond shorts following the announcement of a new fiscal package in Japan

- FX trading was more mixed as managers lightened their US dollar shorts in October, turning net long in many instances. Japanese yen shorts continued to profit, as did select EM longs

- It was a similar story in gold, where longs were trimmed amid strong recent price action and a more uncertain Federal Reserve (Fed) outlook going into the December meeting

- Equity longs suffered at the start of the month, though a strong recovery later looks to have benefited directional exposure

Quantitative Strategies:

- Traditional trend-following strategies enjoyed a strong month, with long euro, short Japanese yen and long precious metals driving gains, though initial losses from equity longs could not quite be recovered. Alternative trend strategies also added with longs in EM fixed income and currencies, while shorts in EU energies were also profitable

- Elsewhere, short-term momentum strategies generally struggled with the shift in risk appetite during November, particularly in equity markets. Diversified quant macro strategies broadly struggled in fixed income; however fundamental signals worked well for some in energy markets

- Quantitative equity market-neutral strategies were generally driven by the high degree of volatility in intra-market factors, with Value and Quality outperforming for the first three weeks of the month, followed by a recovery in more risk-on factors such as Beta, Volatility and Momentum in the last week

On the radar:

- All eyes are now on the performance of high beta, market leaders in the AI and tech space, and whether these stocks can recover the ground lost in November

- While the frenzied pace of ‘deals’ between large AI groups appears to have slowed, the volume of warnings around the need to win the arms-race towards AGI has increased, with Sam Altman of OpenAI calling it a ‘code red’ situation

- Outside of AI, the longer-term focus remains on inflation, potentially over-accommodation of monetary policy from the Fed under a new governor next year, and the sustainability of government debt balance sheets

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.