Introduction

We can debate the trajectory of interest rates, economic growth and default rates from dawn to dusk, but that would not change the truism that the upside is capped at the yield level for the passive investor.

A good investment is a function of two variables: price and quality. In the corporate bond world, quality reflects the likelihood of default and is impacted by the corporate’s level of indebtedness and the robustness of its business model. Unlike equities, where valuations can be subjective1, expected returns for bonds are straightforward to assess as they closely follow the yield. The expected annual return of a basket of corporate bonds is the average effective yield net of any credit losses arising from defaults.2 So, in a best-case scenario of no defaults, the maximum upside of a bond portfolio is the yield.

An age-old debate amongst investors is whether price is more important than quality. If you put two equity investors in a room, they will have three different opinions on the matter. Luckily, in bonds, because expected returns follow yields so closely, the answer is that price is almost always more important than quality. We can debate the trajectory of interest rates, economic growth and default rates from dawn to dusk, but that would not change the truism that the upside is capped at the yield level for the passive investor.

The challenge currently is that more than 60% of the fixed income market yields less than 1% and only 2.5% of the market yields more than 4% (Figure 1). This is a far cry from the yields available 20 years ago, and even two years ago. It is not only government bond yields that are very low, but also corporate credit spreads (or the difference in yields between government and corporate bonds, Figure 2).

Problems loading this infographic? - Please click here

Source: Bloomberg; as of August 2021.

Note: The index includes government, securitised and corporate bonds, including both the Investment Grade and High Yield markets.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of June 2021.

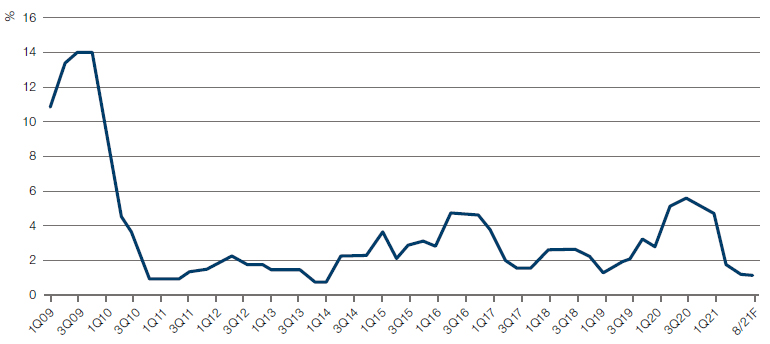

With many government bonds and even some corporate bonds being a liability (negative yielding), the challenge investors face today is the greatest in a decade and beyond. Extreme valuations come at a time when fundamentals appear to be rapidly improving as loose monetary and fiscal policies have led to low corporate default rates (Figure 3).

Figure 3. US High Yield Trailing 12-Month Annualised Default Rate

Source: Fitch Ratings; as of August 2021.

So how can an investor navigate the lowest yielding bond market in recent history? We outline four steps below.

Step 1: Skip the First Four Stages of Grief Straight Into Acceptance

It is said that a fool and his money are soon parted. Unfortunately, in times of financial euphoria it is often not just fools. From tulips in Amsterdam, to joint stock companies in London3, to SPACs in New York, history is littered with reasonable people getting carried away with the price insensitive crowds. Periods of booms are often characterised by a new generation of investors who suffer from financial history amnesia and eschew old investment dogmas.

Those who focus on quality might conclude that we are in a healthy investment environment where investors cannot possibly lose. However, if you are like us, and remember the price side of the equation, you will end up in with the opposite view that markets are dizzyingly expensive. The first step of navigating an expensive bond market is acceptance – the current investment environment is not paradise, but a paradise of fools.

Step 2: Stay Active

The effect of an ultra-low-yield world is profound and requires savers to re-think the way they invest in fixed income. The days of passively investing in bonds and doubling your money every 10 years are long gone. That is not a prediction, but a mathematical fact.

The days of passively investing in bonds and doubling your money every 10 years are long gone. That is not a prediction, but a mathematical fact.

In our view, however, expensive valuations do not mean that investors should throw in the towel on bonds altogether. First, virtually every asset class prices off bonds, and so valuations are lofty by historical standards across the board. Second, bonds remain an important diversifier due to their low correlation to with equities. This facet is particularly important during crises. As we were acutely reminded in 2020, there are always unexpected twists in the road; thus, diversification into bonds remains important. Third, the huge depth of the corporate bond universe4 allows an active investment approach to deliver attractive returns even in difficult valuation environments. In fact, fund selection over the medium term could prove more important than market timing.

Step 3: Be Radically Reasonable

“Anyone taken as an individual is tolerably sensible and reasonable – as a member of a crowd, he at once becomes a blockhead.”

− Friedrich von Schiller as quoted by John K. Galbraith

We believe that increasing risk appetite when valuations are unattractive is irrational, and therefore advocate keeping a constant underwriting standard across the cycle.

When asset prices are marching higher, it is all too easy to lower underwriting standards and chase yield alongside an army of optimistic buyers. However, we believe that increasing risk appetite when valuations are unattractive is irrational, and therefore advocate keeping a constant underwriting standard across the cycle. This approach leads to a counter-cyclical investing style, i.e., buying aggressively when valuations are attractive and taking a more cautious approach when opportunities are scarce. It is important to be radically reasonable when others forgo reason. Irrespective of whether valuations are expensive or cheap, any bond that enters a portfolio must pass a rigorous underwriting process. We believe an investor should only buy bonds with a yield that greatly overstates the credit risk, providing a wide margin of safety. If the market does not offer enough opportunities, investors could instead keep dry powder for an opportune time.

Step 4: Bend as a Willow, Not an Oak

The key advantage of an active strategy is that it is more flexible than a passive one. This allows investors to sift through hundreds of bonds and financial accounts, ensuring that only securities with attractive yields relative to the assessment of risk are invested in. Flexibility also allows investors to invest throughout the cycle without compromising on credit quality.

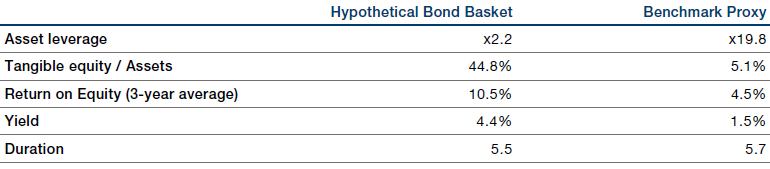

Figure 4 compares a hypothetical basket of select financial bonds5 relative to the three largest financial issuers of the Sterling Corporate and Collateralised bond index, which serve as a proxy for a passive investing strategy. As illustrated, the largest issuers in the benchmark, to which passive funds are most exposed to, have very high leverage of nearly 20 times (!) their tangible equity. Even with hugely leveraged balance sheets, these companies produced a very mediocre 4.5% return on equity over the last three years. On the other hand, the companies in the hypothetical basket run a prudent balance sheet (a tenth of the leverage at 2.2 times) and generate attractive return on equity of 10.5%. The hypothetical bond portfolio has robust fundamentals and a yield of 4.4%, nearly three times the benchmark proxy.

Figure 4. An Actively Managed Hypothetical Bond Basket Versus a Benchmark Proxy

Source: Man GLG. For illustrative purposes only.

Note: Asset leverage = Assets / Tangible Equity. Metrics for the benchmark proxy are an arithmetic average of bonds of the largest three financial issuers of the BofA Sterling Corporate and Collateralised Index. Figures are taken from the companies’ financial accounts.

Past performance is not indicative of future results.

Please see the end of this paper for additional important information on hypothetical results.

Conclusion

In our view, investors should avoid the temptation to increase risk appetite at a point of elevated valuations; and instead adopt a flexible and active approach to navigate the ultra-low-yield environment without taking on undue risk.

1. The value of a company’s equity is derived from the discounted cash flow it will generate in perpetuity. What these cash flows and the appropriate discount rate might be is unknown and therefore subjective.

2. Assuming re-investment of coupons at the same yield as the initial purchase.

3. Refers to the South Sea Company bubble.

4. ML BofA Global Corporate Bond index has c.17,000 constituents.

5. Financial companies include banks, insurers, holding companies and real estate investment trust.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.