To meet the goals of the Paris Agreement1, the world needs to decarbonize seven times faster than its current rate. This will require vastly more climate finance flows – almost USD 200 trillion in total between now and 2050. Financial Institutions (FIs), particularly asset owners and investors, play a critical role in bridging this investment gap; yet current conventional practices lack the incentive (to allocate transition finance to carbon-intensive sectors) and the framework (to set ambitious, science-based targets for transition-enabling capital allocation).

Although we are seeing investment in climate solutions increase, the data indicates a lack of allocation strategies tailored to climate solutions. Without science-based justification, capital allocation is heavily skewed towards directly held real estate and developed countries. More broadly, the finance industry has emphasized portfolio emissions as a key metric for decarbonization, which discourages investment in carbon-intensive sectors where climate solutions are most needed.

In a joint research initiative, Man Group and the Columbia Center on Sustainable Investment (CCSI) offer a framework setting out how investors can close the investment gap and decarbonize the real economy. Together (and in collaboration with climate and finance experts, asset owners, practitioners and policymakers), Man Group and CCSI have developed the Climate Allocation Compass – a Framework for Real-World Decarbonization (Compass-FRWD).

Compass-FRWD

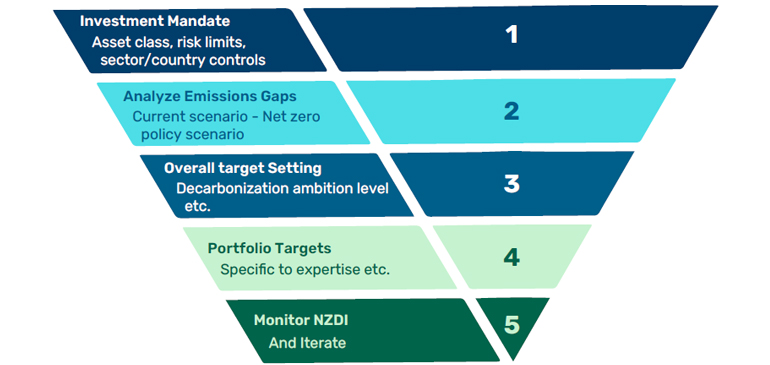

Compass-FRWD is a step-by-step guide to asset allocation across multiple portfolios, leveraging the strengths of different asset classes to meet decarbonization goals alongside traditional financial requirements (Figure 1). It is designed to help investors set targets and monitor the progress of their climate solutions investments as part of a coherent cross-asset strategy. For the first time, Compass-FRWD offers allocators a clear roadmap for deliberate, dynamic and net-zero aligned investment in climate solutions.

Figure 1: Visualizing Compass-FRWD, step by step

Source: Prepared by authors.

Across all portfolios using its framework, the guiding principle of Compass-FRWD is to identify where the required decarbonization effort is highest, and thereby to define optimal investment allocation targets that prioritize the regions and sectors where decarbonization is most needed.

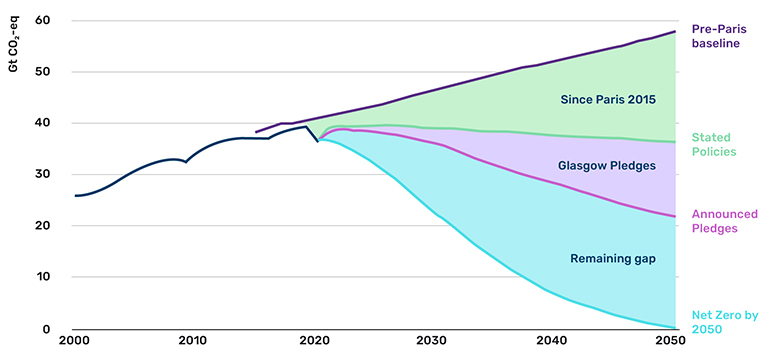

Assessing the decarbonization effort is based on emissions gaps per sector and region. Compass-FRWD calculates emissions gaps as the difference in projected emissions between a continuation of current policy conditions and the scenario which achieves net zero emissions by 2050 (Figure 2).

Figure 2: Global emissions pathways

Source: EU4Climate, as of 2021. Available here: https://eu4climate.eu/2021/12/01/developing-climate-change-mainstreaming-policies-in-the-eastern-partnership-region/

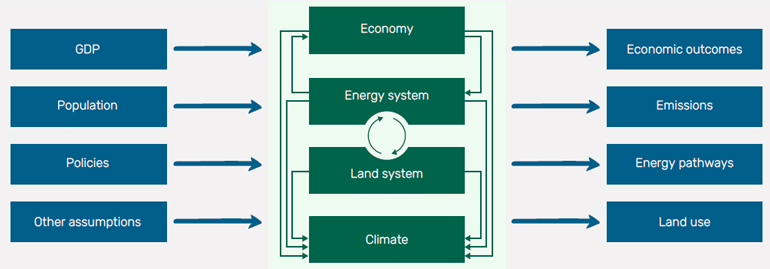

The scenario analysis is based on simulations within an Integrated Assessment Model (IAM), a core component of Compass-FRWD. IAMs are simplified numerical representations of complex physical and social systems, focusing on the interaction between the economy, society, and the environment (Figure 3). In Compass-FRWD, we can use an IAM to calculate the emissions gap for each country, or for a specific industry, like steel.

Figure 3: Schematic illustration of an IAM, with input parameters on the left, modules in the center, and outputs on the right

Source: Prepared by authors.

The capital allocation targets generated by Compass-FRWD are based on the relative emission gaps across regions, sectors and themes. Recognising that different portfolios have individual mandates, invest in different asset classes and have varying investment focuses, these overarching targets are then translated into portfolio-specific targets (Figure 4). For example, a portfolio might have a geographic emphasis, so the portfolio-level capital allocation targets across sectors would be calculated within that geography. Compass-FRWD emphasises the importance of working within existing portfolio constraints. While immediate shifts in capital allocation toward an ideal distribution across regions and sectors might not be achieved, concerted efforts are dedicated to gradually steering portfolios toward the most effective allocation strategies.

Figure 4: Transition from overarching targets to portfolio-specific objectives

Source: Prepared by authors, 2024.

At both the individual portfolio level and across all portfolios using the Compass-FRWD framework, capital flows can be tracked through a Net Zero Deviation Index (NZDI). The NZDI is the difference between the actual capital distribution and the optimal capital allocation targets. Recognizing the complexities in achieving optimal allocations, Compass-FRWD is intentionally designed to operate iteratively. Using the NZDI, investors can monitor the deviation of their capital distribution from those optimal targets at portfolio and strategy levels. The objective under Compass-FRWD is to progressively reduce the NZDI over multiple cycles to close the investment gaps.

The aim is to achieve an optimal distribution of capital allocation across regions and sectors. To achieve this, a holistic approach to portfolio construction is essential, treating the NZDI as a critical metric alongside traditional metrics like volatility in multi-asset portfolio construction.

Asset selection

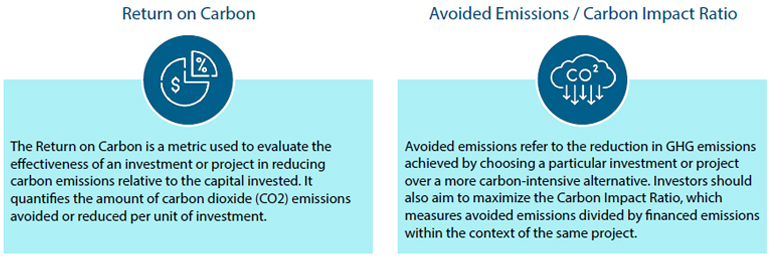

In the Compass-FRWD framework, assets targeted for investment must undergo a rigorous screening process to ensure alignment with an official national or regional taxonomy and with a net-zero transition plan at the issuer level. In selecting assets, the focus is on maximizing the return on carbon and avoided emissions relative to the specific mitigating measures (climate solutions) and sub-sectors, such as energy efficiency in steel (Figure 5).

Figure 5: Return on carbon versus avoided emissions/carbon impact ratio

Source: Prepared by authors.

This Compass-FRWD approach ensures that capital is directed where it is most needed, minimising the risk of over-allocating to regions and sectors that don’t suffer from an investment gap.

In Compass-FRWD, we advocate restricting investment to those asset classes that have demonstrated efficacy in supporting climate solutions. The impact of the five key asset classes — public equity, fixed income, private equity, real assets, and hedge funds — depends on transmission mechanisms, namely the avenues through which investors can affect real economy outcomes. Analysis reveals that fixed income, especially the nascent class of sustainability-linked products, has the highest potential for generating significant impact, whereas passive public equity has the least potential.

The effectiveness of asset class transmission mechanisms depends on various factors. The impact of public equity can be enhanced, for example, through security selection that allocates capital to issuers aligned to a net zero pathway, and to ‘enablers’ (companies that enable emissions reductions in the wider economy). The effectiveness of allocations to public equity can also be enhanced through active and collaborative engagement. Collaboration among FIs is essential to amplify the impact of these engagements, to enhance investable opportunities in specific regions or sectors, and target areas with limited capital allocation opportunities.

The development of new strategies will be critical to addressing the investment gap. To support cyclical progress there should be a focus on two primary actions: adopting a multi-asset class strategy and implementing an engagement strategy. The adoption of a multi-asset class strategy can be used to optimise allocations across asset class, sector and region. In multi-asset class portfolios, Technology Readiness Levels2 (TRLs) can serve as a first important metric in selecting the most suitable asset class, whether it be debt or equity, to effectively tackle sector-specific challenges. Low (riskier) TRLs are best addressed with asset classes with higher risk appetite such as grants, VCs, and private equity whereas the high (less risky) TRLs can be matched with less risky asset classes such as fixed income. Adopting a multi-asset class approach is not only necessary to accommodate the various TRLs that decarbonization encompasses, but also to assess which approach is best aligned with the risk/return profile of a specific portfolio, ensuring a coherent cross-asset strategy.

Challenges and opportunities

Climate finance must increase by at least five-fold annually, as quickly as possible, to avoid the worst impacts of climate change.3 While Compass-FRWD has been designed to contribute to this aim and provide a systematic approach for investors to shift capital towards the transition economy, challenges remain in effectively targeting emissions gaps to achieve real-world decarbonization.

The need for increased transition finance to emerging markets and developing economies (EMDEs) is most acute. Yet, within the landscape of green investments in EMDEs, specific and complex challenges heighten the risk of capital withdrawal from countries where ESG-labelled products and frameworks are not fully developed.

FIs also encounter challenges in allocating capital due to a lack of high-quality, reliable, and comparable data. This lack of clarity and data has stifled progress in the development of investable climate solutions. Without data, it is hard to support instruments that are less brown but not green due to the fear of greenwashing.

As mentioned above, shifting capital towards the decarbonization of the real economy requires a top-down but flexible approach, taking account of the risk profile of each portfolio and asset class. Helpfully, the expanding access to machine learning, natural linguistic processing and other technologies eases the burden of finding investable opportunities.

Collaboration will also be critical in addressing the investment gaps and reducing global emissions. A collaborative effort across the FI industry and with other stakeholders – policymakers, underwriters, multilateral development banks, asset owners and underlying issuers – is key to aligning investment beliefs with a decarbonization commitment. By fostering collaboration and leveraging insights from stakeholders, Compass-FRWD can be implemented most effectively to drive progress toward net-zero emissions.

Engagement leads to collaboration and eventually, alongside technology innovation and with a robust decarbonization framework such as Compass-FRWD, the industry can make strides in closing the investment gap.

Conclusion

Co-ordinated governmental and public sector leadership is vital to producing official decarbonization pathways and to redirecting global financial flows into the necessary geographies, sectors and technologies. The role of non-state actors is also critical in achieving climate goals. Most notably, as capital providers, underwriters, and fiduciaries of trillions of dollars of capital, FIs play a critical role in decarbonizing the economy and scaling access to climate solutions.

All these collaborators need a strategic framework serving as a multi-year compass, to help them ensure that capital is effectively allocated across regions and sectors. The approach to strategic investing in decarbonization outlined in Compass-FRWD, facilitates more efficient portfolio construction, allowing for adaptation to different portfolios with their own targets and mandates.

Increased global collaboration, technology developments to enhance investable climate solutions, and guidance from a practical decarbonization framework, can ensure that transition capital is allocated where it is most needed and is most impactful. This is what Compass-FRWD aims to achieve across asset classes and portfolios to achieve real-world decarbonization. Through these efforts, we can look forward to a sustainable future.

All data as of July 2024, unless noted otherwise.

1. The Paris Agreement is a legally binding international treaty on climate change. Its overarching goal is to hold “the increase in the global average temperature to well below 2°C above pre-industrial levels” and to pursue efforts “to limit the temperature increase to 1.5°C above pre-industrial levels.”

2. TRLs are a well-established framework used by organizations such as NASA, the European Space Agency (ESA), and the Department of Defense (DoD) to assess the maturity of technologies. The descriptions of each TRL level are widely available in technical literature and government publications and are also used by the IEA in the Energy Transition Perspective database.

3. Buchner, Naran, Padmanabhi, Stout, Strinati, Wignarajah, Miao, Connolly and Marini, Global Landscape of Climate Finance 2023.

Authors

Columbia Center on Sustainable Investment

Perrine Toledano, Ajay S. Jagdish, Maria Diez Andres, Ana M. Camelo Vega

Man Group

Rob Furdak, Christina Bastin, Matt Goldklang, Jane Smyth

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.