Key takeaways:

- Recent US Environmental Protection Agency (EPA) proposals may provide a structural boost to the US soybean market and indicate a first step towards broader domestic commodity-market support

- History shows that policy-driven commodity interventions have created sustained multi-year cycles

- That said, commodity markets are volatile and benefit from experienced active management

The humble soybean rarely makes financial headlines, but the EPA’s June biofuel proposals have thrust this Midwestern staple into the spotlight. We expect it will underpin strong US soybean oil demand while potentially signalling a broader policy shift toward energy security and domestic agricultural support.

The story:

The 13 June proposal is boosting domestic soybean oil demand through multiple policy levers.

It used the Renewable Fuel Standard, a programme that requires oil refiners to blend renewable fuels like biodiesel into regular petroleum fuels. To track compliance, refiners need special credits called Renewable Identification Numbers (RINs), which they earn by blending renewable fuels or purchase from others. The key proposals for the new renewable standards are:

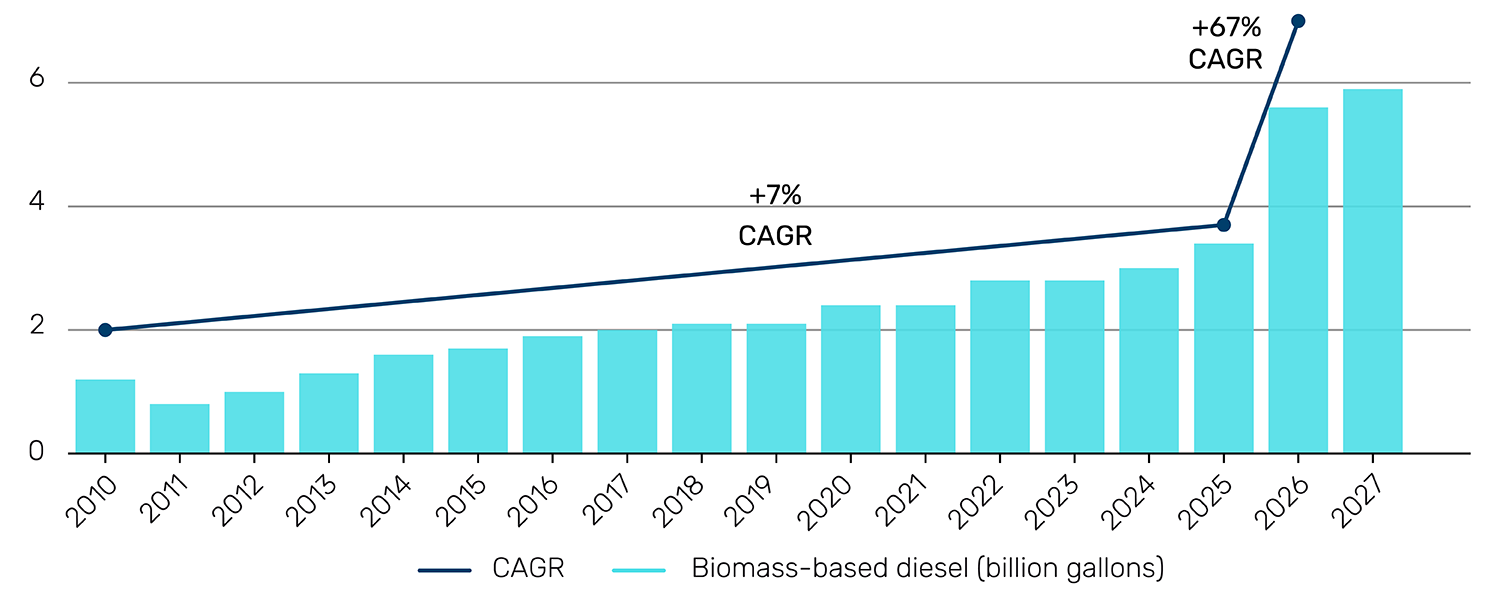

- An increase in biomass-based diesel production by 67%, requiring an additional 3.6 million tonnes of soybean oil. However, new crushing capacity coming online will provide only around 2.9 million tonnes, leaving a shortfall of approximately 700,000 tonnes

- Imported biofuels and those produced from foreign feedstocks will generate only half the RINs compared to domestic production, effectively favouring US-based soybean oil over foreign alternatives

- The new 45Z producer tax credit focuses on where raw materials originate. After December 2025, only materials from North America will qualify, further disadvantaging imports of used cooking oil or animal fats from overseas

Soybean futures rallied after the announcement.

Figure 1. Proposed biomass-based diesel volume requirements by the EPA

Source: US Environmental Protection Agency as of 13 June 2025.

Why consider commodities?

The combination of aggressive mandates and geographic sourcing preferences represents a fundamental shift by the US government toward energy security and domestic agricultural support, with material implications for commodity markets going forward.

Commodities traditionally serve as an inflation hedge, protecting portfolios when prices rise across the economy, and as a safe haven during market stress. But they can also be exploited with structural themes, like this particular EPA mandate.

The investment case extends beyond soybeans to the broader US agricultural sector (there are historic precedents, see the next section), including crush margins - the profit from processing soybeans into oil and meal. The structural shift toward domestic soybean oil production creates a significant supply-demand imbalance which may provide sustained support for:

- Soybean oil prices - structural demand increase with limited supply response

- US crush margins - domestic processing becomes increasingly advantaged

- US soybean complex - policy-driven demand boost for domestic feedstocks

Lessons from the past

There are a number of historical precedents where policy interventions have created significant commodity cycles. These two stand out to us.

Case study 1: Ethanol mandates of 2005

The 2005 Energy Policy Act addressed energy security concerns following Hurricane Katrina and rising gasoline prices. The legislation promoted domestic energy production and alternative energy sources like ethanol by establishing America’s first Renewable Fuel Standard, requiring minimum renewable fuel volumes annually.

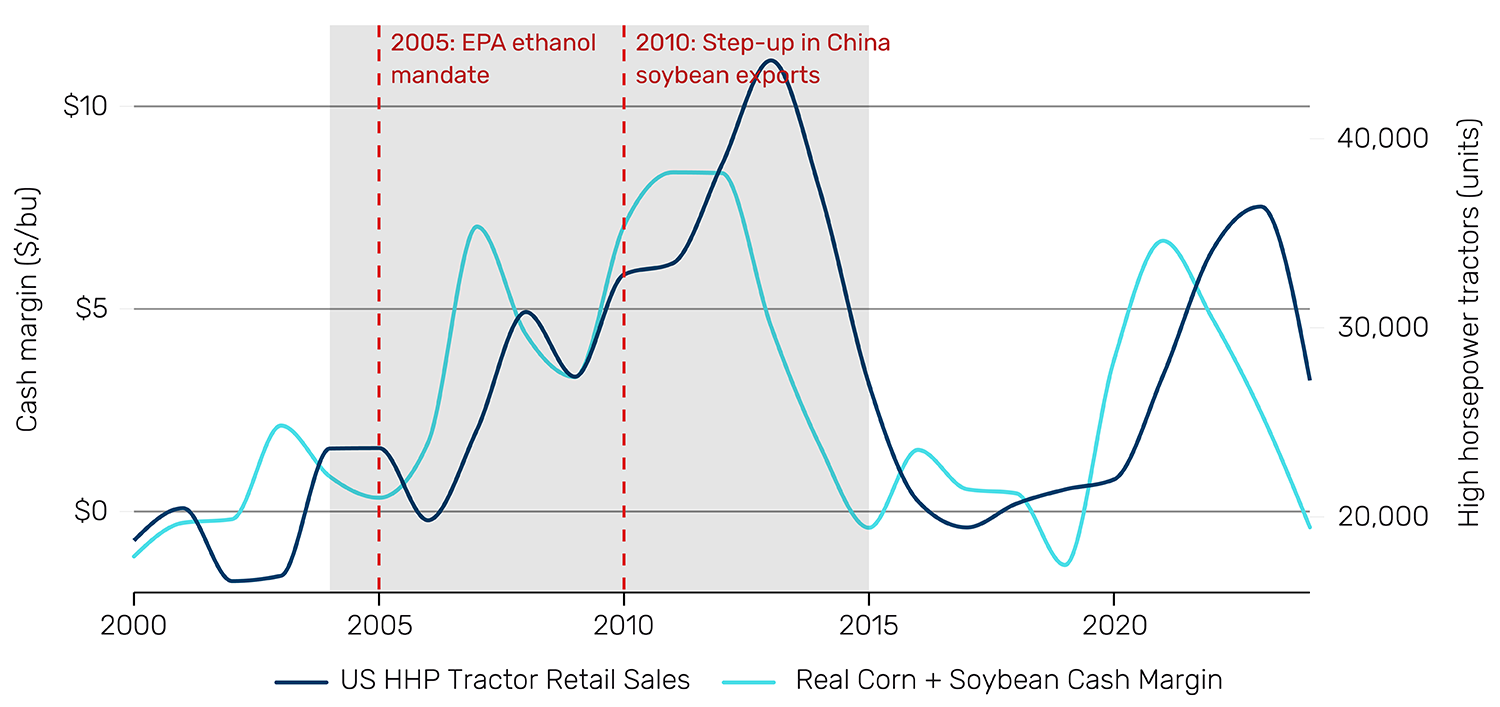

Corn markets captured most benefits as US Midwestern farmers moved away from balanced corn-soybean rotations to predominantly corn production. This policy-driven shift created a decade-long agricultural cycle (see Figure 2) that transformed pricing across the sector and drove up farmland values.

Figure 2. The 2005 ethanol cycle was the catalyst that helped drive a massive agricultural commodities cycle

Source: US Department of Agriculture and Association of Equipment Manufacturer as of 31 December 2024.

Case study 2: European carbon markets

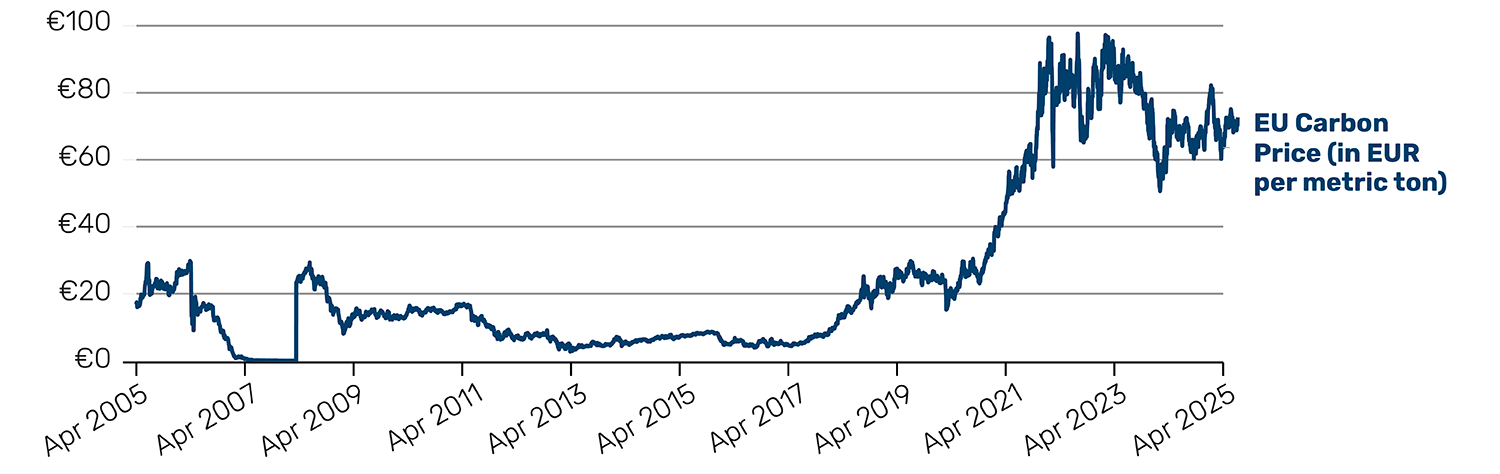

The The European emissions trading system launched in 2005 as the world’s first international carbon trading system. The system operates as cap-and-trade where emissions are capped annually, and allowances can be purchased and traded. Each year the cap shrinks to meet EU climate targets.

Initially, the system struggled with surplus allowances caused by free allocations and reduced industrial demand following the financial crisis. Prices remained below €10 for years. When the Market Stability Reserve was introduced in 2018, allowing the European Commission to adjust auction volumes based on market conditions, carbon prices surged from under €10 to over €90 by 2021.

Both cases demonstrate how regulatory frameworks create structural mechanisms that operate beyond normal supply and demand. Policy intervention generated multi-year cycles of support that rewarded positioned investors. The EPA mandates follow the same template of government-created structural demand.

Figure 3. Evolution of EU carbon allowances prices

Source: Bloomberg as of 29 July 2025.

Investment approaches

Natural resources remain volatile assets. Soybean oil prices fell 80% during the 2008 financial crisis, demonstrating that even policy-supported commodities face severe drawdowns. This volatility perhaps lends itself best to active management approaches. We highlight two below.

Fundamental equity strategies

Many managers target companies positioned to benefit from commodity movements rather than direct exposure. Agricultural processors benefit from both higher soybean oil prices and improved crush margins.

Alternative producers, from sources such as waste oil and animal by-products, are another potential beneficiary of industry dynamics.

These strategies offer greater liquidity than commodity futures and operational leverage that can amplify underlying price movements.

Systematic trend-following

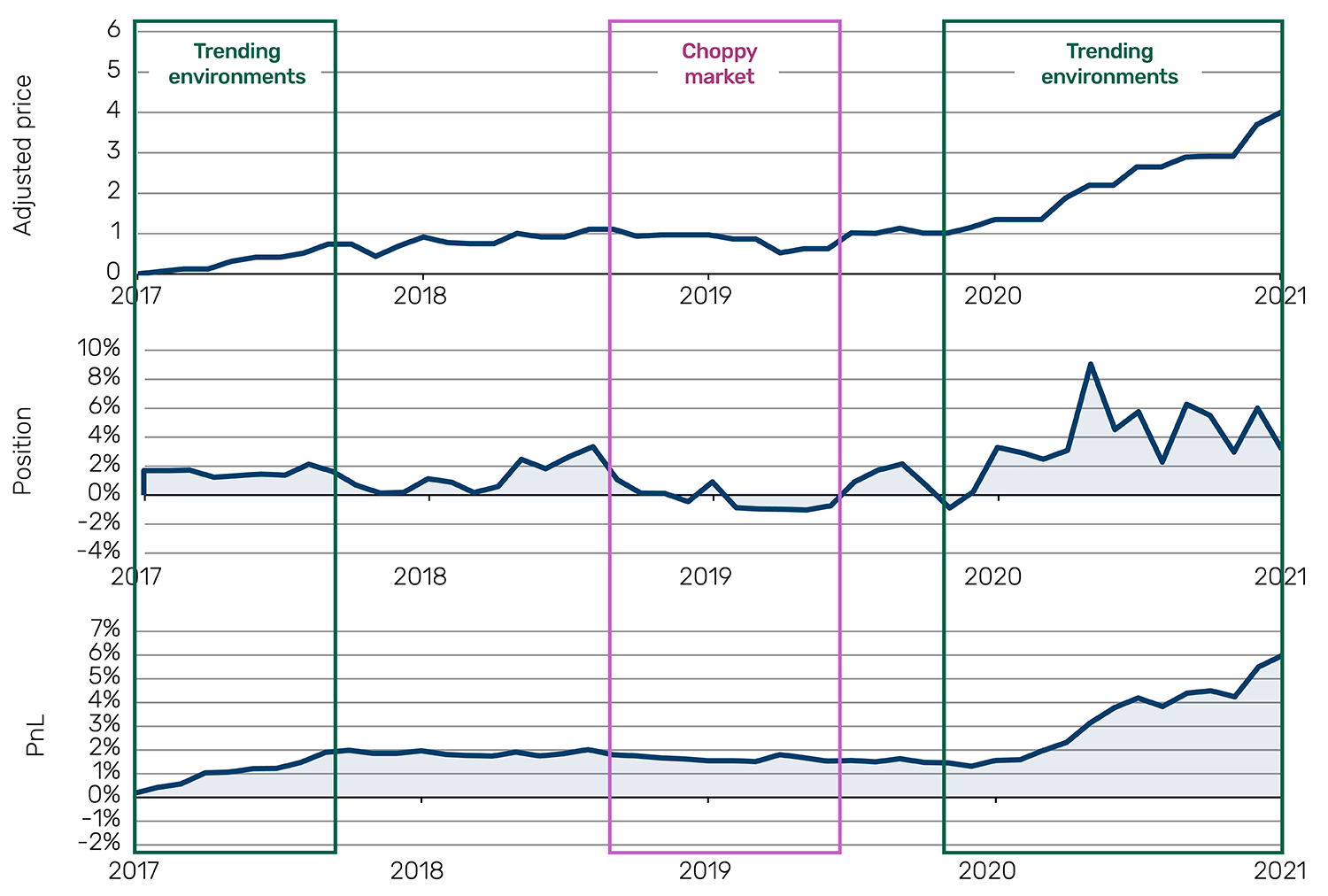

Trend-following strategies use a rules-based approach to identify trends across hundreds of markets, including commodities, aiming to capitalise on price persistence in either direction. Despite broad diversification, trend-following is “a buyer of stories” and gravitates toward compelling market narratives and scales exposure higher in markets showing strong trends while keeping positions minimal where trends remain weak.

Strong trends in select markets can potentially deliver meaningful gains, which they did during the rallies in Europe’s carbon emissions markets in 2018 when the Market Stability Reserve was announced and supply reductions were anticipated, and again in 2021 when large volumes of allowances were removed.

Figure 4 shows how trend models scaled exposure proportionate to trend strength during rising periods while maintaining low exposure during weak trending environments.

Figure 4. How trend models adapt to market conditions - carbon emissions example

Source: Man Group database as of 31 December 2021.1

Closing thoughts

What started with humble soybeans may signal something much larger — regulatory shifts that create structural multi-year investment opportunities across commodities and natural resources, as the extended corn cycle and European carbon’s dramatic surge demonstrate. However, natural resources remain volatile assets that require experienced active management to capture potential returns while navigating inherent risks.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.