Man TargetRisk Global Equities

- Experience – benefiting from over 30 years investment experience, combining the expertise from Man Group’s quantitative investment engines

- Track Record – builds on Man’s established TargetRisk programme. This tried and tested framework has a live track record since 2014 and AUM over $14bn1 in various global versions

- Diversification - portfolio combines two concepts: one focused on seeking low beta stocks and the other focused on identifying stocks that have low correlation

- Risk management – utilises a basket of highly liquid equity futures to mitigate against tail risk characteristics

1. As at 31 March 2023

Approach

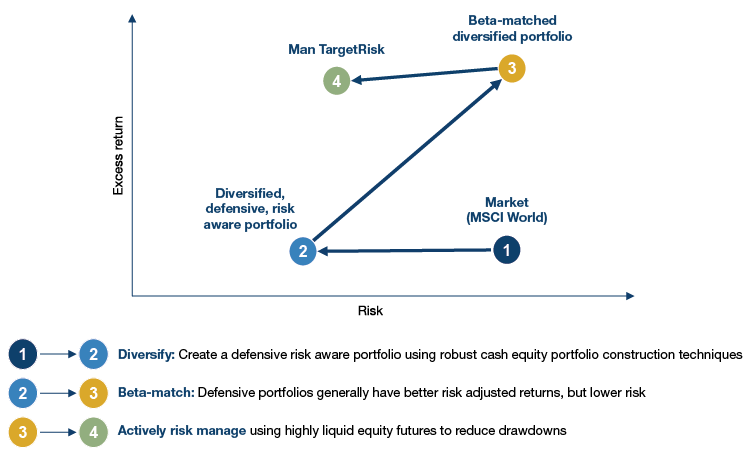

Man TargetRisk Global Equities programme is a systematic equity focused Strategy in which Man Group applies its advanced techniques in alternatives and long-only investment. The Strategy seeks to achieve medium-term capital growth by allocating capital to a portfolio of equities which aims to match the beta of global equities on average through time.

The Strategy's proprietary risk management process works to reduce portfolio exposure via a basket of futures contracts during times of heightened market stress.

The portfolio comprises of two main components:

- Long only equity – a diversified, risk-aware, global equity portfolio that is highly diversified and aims for a bias towards low-beta stocks, with the aim of delivering market returns with a lower volatility than the market. the portfolio combines two concepts: one focused on seeking low beta stocks and the other focused on identifying stocks that have low correlation to each other.

- Risk Overlay – dynamically manages the market exposure of the portfolio to control downside risk, managed via short liquid equity index futures. The overlays will not always be active and therefore there will be times when there is no short exposure. Additionally, when active, the risk overlay will not always match the regional split of the entire global equity portfolio, utilising regional specific futures to reduce risk only in those regions where the overlay triggers have been met.

How we risk-manage equity portfolios in an effort to generate superior returns2:

2. Schematic illustration.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.