After a turbulent start to last week, markets regained ground in the second half, soothed by jobless claims data in the US, reassurance on the direction of travel for Japanese rates and an above expectation manufacturing print in Germany.

With market levels finishing the week broadly where they started, what is the outlook for equities for the remainder of the year? In short, last week’s turmoil has created opportunities to add risk albeit against a backdrop of heightened volatility.

Soft landing and still-high valuations in the US

With corporate balance sheets still looking healthy, central banks less fearful of inflationary pressures and room for manoeuvre on interest rates if required, to us a soft-landing scenario still looks like the most likely outcome rather than a recession.

Expect a slow, steady grind with pockets of volatility in between as markets react to macro data and earnings.

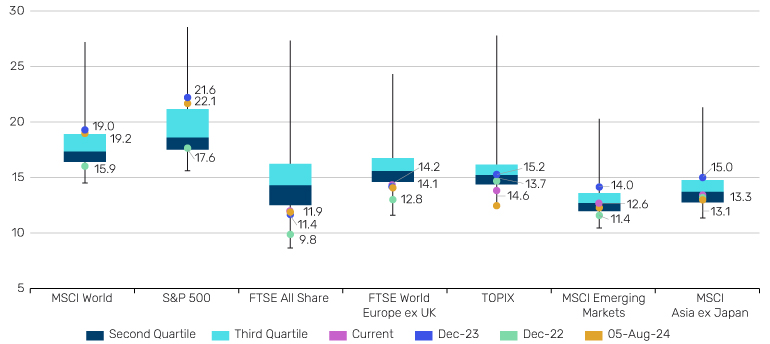

While many of the drivers behind last week’s record-breaking correction have been diluted, they have not disappeared. Given that most of this year’s market rally has been driven by stocks becoming more expensive with little change in their earnings potential it is unsurprising that valuations (although slightly moderated) remain elevated, particularly in the US.

Currently, the S&P 500 is still trading at 20 times forward 12-month earnings. Under a soft-landing scenario this number still feels lofty. After last week valuations now look more attractive in Japan and continue to remain low in the UK and Asia.

Figure 1: US equities continue to drive the valuation re-rating in developed markets

Source: Bloomberg

As the current earnings season draws to a close it has, for the most part, been positive with the breadth of upside surprises looking strong versus previous quarters (within the S&P 500 80% of companies have beaten expectations versus the long-term average of 76%).

However, markets are forward-looking, and there are some concerns surrounding the outlook in the strength of earnings. The magnitude of upside surprises across the majority of sectors has generally weakened. Across technology for example, the size of earnings-per-share (EPS) beats was the lowest in six quarters and, furthermore, estimates for upcoming quarters continue to be revised down.

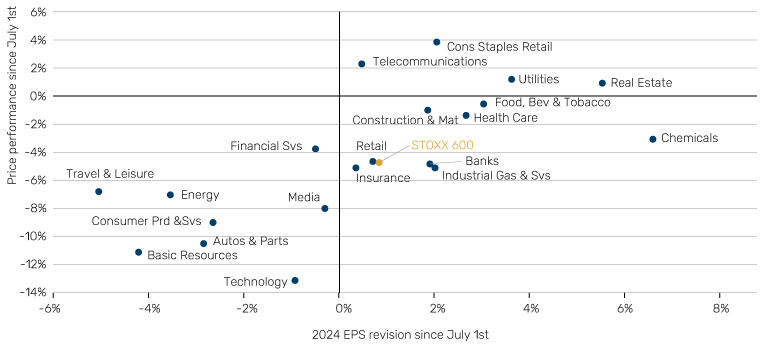

Yes, markets did behave rationally

One of the more surprising features of the most recent correction was that markets overall have behaved quite rationally – most sectors have performed in-line with their EPS revisions since the beginning of the quarter. Stocks that missed expectations were punished severely, as were those unable to deliver guidance improvement.

Figure 2: Estimates for upcoming quarters continue to be revised down

Source: FactSet,Datastream, Goldman Sachs Global Investment Research

With a potentially weaker growth environment and more muted market returns ahead, the importance of consistent stock selection increases. This year has already presented favourable opportunities for adding value, and this trend appears likely to continue. As you would expect given recent volatility, correlations, or the degree to which stock prices move together, have picked up in the past weeks, but importantly they remain below medium-term averages.

Problems loading this infographic? - Please click here

Dissecting this further, we see even lower correlations at an intra-sector level (Figure 4). In Europe for example, correlations between different sectors are somewhat elevated; however, within individual sectors, correlations remain low, providing an attractive backdrop for stock selection. Additionally, as the exuberance around AI-related names has subsided, markets are less focused on specific themes, offering another potential tailwind.

Problems loading this infographic? - Please click here

Following one of the best starts to the year for market returns and with no decline greater than 5% since the correction in the second half of 2023, there has been a distinct lack of attractive entry points for investors looking to add risk.

The current period of volatility provides such an opportunity. As previously discussed, even though markets reacted broadly rationally, the increased volatility has led to significant share price dislocations, creating potential entry points for investors.

Conclusion

Although markets appear to have recovered from last week’s rout, the volatility and dislocation present opportunities for entry into riskier assets. We expect a soft landing and valuations remain high in the US, but after last week look more attractive in Japan and continue to remain low in the UK and Asia. Markets will continue to react to macroeconomic data and earnings which provide a favourable backdrop allowing investors to capitalise on the current landscape while remaining mindful of underlying risks.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.