Trend-following's performance, as measured by the Barclay BTOP50 index of 20 mostly trend-following managers (BTOP50), is mildly positive year-to-date, registering a 1.9% gain through October. What is frustrating, however, is the lacklustre returns in the second quarter, third quarter and October, following the second-best first quarter in the index's approximately 40-year history.

As market practitioners we live and breathe trend-following daily, not just at month-end or quarter-end. What has been abundantly clear to us is that trend-following and, arguably, the broader market, has largely been driven by the constantly evolving perception of what central banks will do.

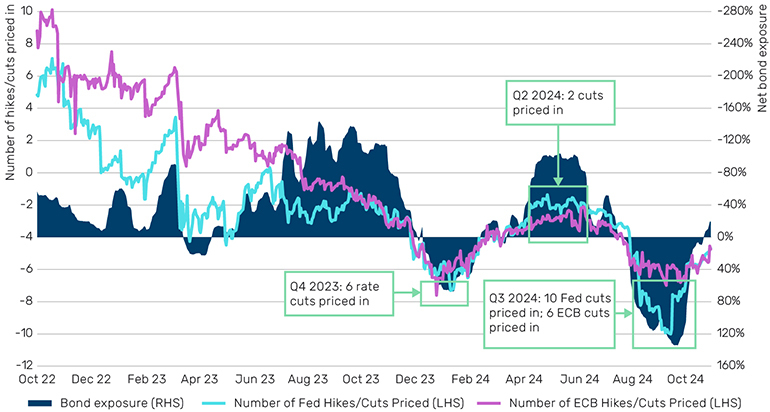

In Figure 1, we quantify the magnitude of this variability using the ‘number of cuts priced in’ statistic for the US Federal Reserve (‘Fed’) and European Central Bank (‘ECB’), frequently used by central bank watchers. We do this by extracting the number of 25-basis-point rate cuts predicted by futures markets over a one-year horizon. Alongside we plot the bonds exposure (duration greater than one year) of a trend-following strategy trading approximately 140 futures markets and targeting 15% return volatility. This covers the period following the peak of inflation, from October 2022 to October 2024.

Figure 1: Number of Fed and ECB cuts/hikes priced in over forward 12m period and trend-following bond exposure from October 2022 – October 2024

Source: Man Group and Bloomberg. Trend-following’s bond exposure is from a representative programme trading ~140 liquid futures and FX forwards markets. Fixed income exposure has been inverted. 1 October 2022 – 31 October 2024.

Visually, we observe nigh-on identical expectations of rate cuts in the US and Europe, particularly this year, alongside significant co-movement of trend-following’s bond exposure with these implied rate changes. Trend-following moved to short bonds at the start of 2024 as markets priced in six rate cuts on both sides of the Atlantic. Positions flipped to long as six cuts became two by the summer, only to move to short again in the fourth quarter.

Frequent transitions from short to long positions are rarely conducive to trend-following performance, and bonds have been one of the worst performing asset classes this year. To us, the turbulent nature of shifting rate cut expectations, and a lack of diversification across the pond help explain the lacklustre returns since the first quarter. But what is driving this?

The 2022 shift

The driver of this close coupling becomes clear when examining recent history. Trend-following delivered sizeable returns through October 2022 (an annualised 18% over two years), as markets responded to rising inflation and gradually abandoned the 'transitory' narrative. This created a fertile environment for trend-following: short equities, short bonds and long commodities.

A Federal Reserve Bank of Kansas City paper by Bauer, Pflueger, and Sunderam (2024), however, shows that markets' understanding of central bank behaviour evolved significantly through 2022. Each surprise rate hike taught investors that the Fed and ECB would respond more aggressively to inflation than previously believed. This shift meant predicting central bank moves ascended towards the top of investors' focus.

As a result, bond yields became more sensitive to economic data releases, given how directly they feed into Fed policy. This heightened reactivity, combined with recent employment and growth data lacking any clear direction, has created choppy patterns in rate cut expectations and, consequently, trend-following performance.

A key question is whether this is likely to continue. We would like to make two points:

First, we believe investors should take solace from the observation in the paper that the increased perception of central bank activity is a relatively recent phenomenon. Second, we should also highlight that while bond, and to a lesser extent, FX markets have had a heightened focus on the Fed’s activity this year, other markets have been more free-spirited. The (continued) rise of both the Magnificent 7 and cocoa in 2024, for example, have been trends from which the strategy has benefitted. It seems you can’t fight the Fed, but you can attempt to diversify from it.

Japan: Politics Matters Less Than Policies

Japan may have a new prime minister as soon as next week, following weeks of uncertainty after the ruling coalition, led by the Liberal Democratic Party (LDP), was defeated for the first time in 15 years in a snap election last month.

Media reports suggest a vote to confirm the new premier may be held in a special parliamentary session on 11 November. Uncertainty remains over whether Shigeru Ishiba, who was unexpectedly selected as LDP leader and became premier just a month ago, can survive the electoral setback.

While the opposition Constitutional Democratic Party gained seats, they remain well short of a majority, leaving smaller parties as potential kingmakers in coalition talks.

With markets awaiting the outcome of the US Presidential election, how much do Japanese domestic politics matter to investors? The political shifts matter for markets, though their impact tends to be limited. Japan has often been described as having a revolving door for prime ministers, with leadership changes historically having minimal market effect – the Abenomics years being a notable exception.

Opportunities for bargain hunters?

Ishiba is viewed as one of the least market-friendly candidates, favouring hawkish monetary policy and fiscal restraint over the expansionary approach of recent years. His proposals for tax increases have particularly concerned investors.

That said, despite sell-side predictions of significant losses, Japanese equities rallied on the first trading day after the 27 October election while the yen weakened, benefiting exporters. This reaction partly reflects expectations that Ishiba's weakened position may force a more accommodative stance, including a larger fiscal stimulus package than initially planned.

More bearish considerations are that political uncertainty is unlikely to encourage asset allocators to raise bets on Japan Inc. The equity market saw substantial volatility in early August, which dented market credibility, while the weak yen has reduced unhedged returns.

Uncertainty doesn't tend to help bank share prices, and if yields rise more slowly in Japan, the market will likely expect a less positive path for financials.

While political instability rarely helps asset allocation decisions, the key focus for investors will be on any shift in economic policy direction rather than the leadership contest itself. Another important consideration will be whether external events such as political uncertainty are providing opportunities for bargain hunting, especially in companies responding to the drive for better corporate governance – a theme likely to continue as a major driving force within the equity market.

All data Bloomberg unless otherwise stated.

With contributions from Yash Panjabi, client portfolio management analyst at Man AHL, Graham Robertson, partner, head of client portfolio management at Man AHL and Adrian Edwards, portfolio manager at Japan Core Alpha at Man Group.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.