We have seen a surfeit of commentary and analysis in recent years, including from ourselves, on the rise of passive investing and about the handful of mega-cap stocks that have thrived during a zero to low interest rate environment and driven a significant proportion of the gains in passive broad-market indices. After years of loose monetary policy, rates normalised in 2023 and resilience in recent economic data suggests companies should get used to an environment of higher rates for longer. In this context, we are interested to explore the relationship between the interest rate cycle and equity return drivers, and the potential future implications for equity investors.

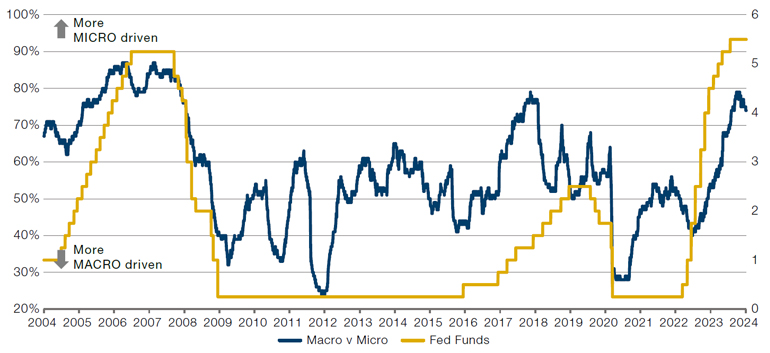

In Figure 1, we plot the relationship between interest rates and the proportion of stocks’ performance that can be ascribed to micro factors, describing firm-specific factors such as earnings revisions, product launches, management changes or M&A rumours or activity. The yellow line shows the Federal Funds Rate while the dark blue line represents the share of the return of the median S&P 500 Index stock which can be attributed to micro factors (higher means micro (stock-specific) considerations are driving performance; lower implies macro factors, including market (a price move that can be explained by a move in the broader market), sector, size, and valuation, are more dominant).

Figure 1. Share of median S&P 500 stock’s trailing 6-month return explained by micro factors

Macro factors include market, sector, size, and valuation, while micro factors are firm specific.

Source: Fed Funds, Goldman Sachs, as at January 2024.

Since 2004, the average proportion of stocks’ performance which can be explained by micro factors is 56%, though there is significant variation during this period. Figure 1 illustrates that periods when interest rates have been at or close to zero have been heavily macro driven, while the market has historically been more micro driven as rates have increased.

We have seen this play out recently as US interest rates moved from close to zero during the Covid-19 pandemic and its aftermath to more than 5% and this has coincided with a swing back to micro-driven performance. In January 2024, 74% of the median S&P 500 Index stock’s performance could be attributed to micro factors, well above the long-term average.

This may, in part, be attributable to the relationship between interest rates and the cost of capital. When interest rates start to normalise, or are indeed anything above zero, the cost of capital also normalises. Consequently, those companies which were already struggling or were established on the basis that rates would be close to zero for longer may be challenged sooner, leading to higher variation of returns between stocks in the same sectors. This differentiation is positive for fundamentals-focused managers who favour higher-quality companies that have strong returns on capital.

Further, when rates are low, investors have little choice but to look to buy any type of equities to secure a return stream – but when cash rates are high, as they are currently, investors have the option of getting a reasonable return from cash. Similarly, company managements have a higher bar on returns when deploying capital in a more normal interest rate regime. This has historically led to greater dispersion of stock returns with better capital allocators being rewarded in contrast to those making sub-optimal decisions. This backdrop is likely to strongly favour active management to unearth high-quality companies that can both weather the storm of higher interest rates and continue to provide attractive returns for investors.

Conclusion

While interest rates in the US have almost certainly peaked, a return to zero interest rates seems highly unlikely. This is important because, as outlined above, periods of zero or very low rates have historically coincided with heavily macro-driven markets. Conversely, in a more normalised interest rate environment such as today, micro factors have tended to outweigh macro drivers, which is more conducive to active management and stock-selection strategies.

With contributions from Mike Corcell, Portfolio Manager, and Alex Robarts, Portfolio Manager, Discretionary at Man Group.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.