Risk On, Warning Signs On

Investor risk appetite, in combination with market positioning, are currently giving us some cause for concern regarding the direction of the market.

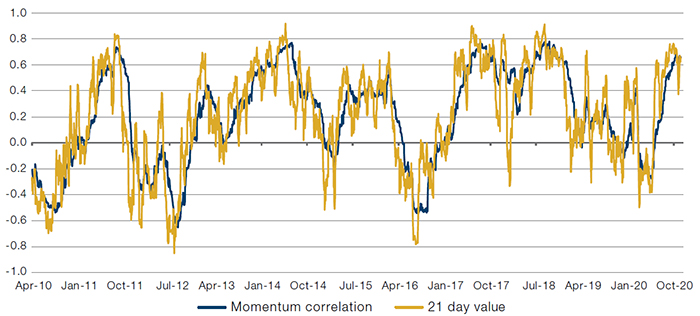

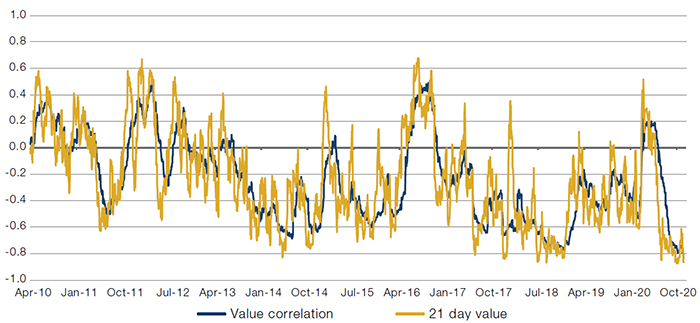

First, there is a lack of movement in positioning. Figures 1-2 show the correlation of popular hedge fund positions to the Momentum and Value factors, which show little sign of shifting after the dramatic factor reversal two weeks ago.

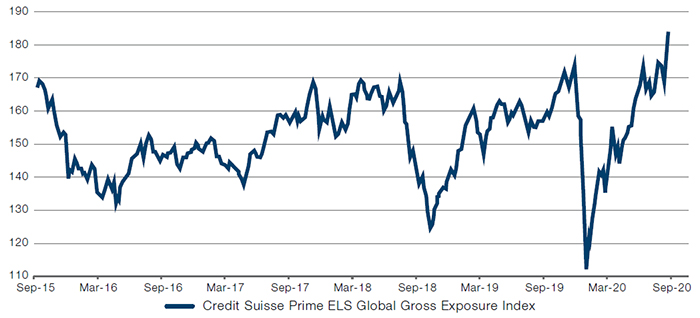

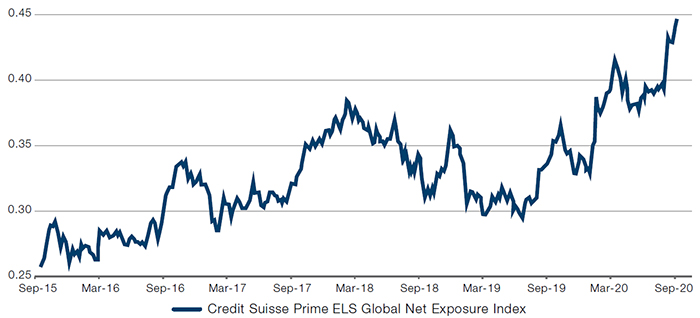

Second, Figures 3-4 show gross and net exposures, respectively, for equity long-short funds, comfortably at 5-year highs. The combination of factor positioning and extent of exposure suggests that, in aggregate, funds remain fully committed to prior winners continuing to win, and markets continuing their march higher.

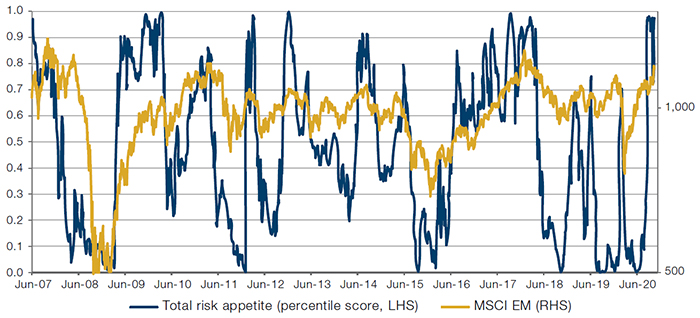

Perhaps that will be the way things play out. However, risk appetite is currently reflecting real levels of euphoria. Figure 5 shows our own measure of risk appetite on the y-axis, ranging from capitulation (bottom) to euphoria (top), overlaid versus the MSCI Emerging Markets Index, one of the riskier asset classes globally. That figure is currently in its 98% percentile over a range of almost 25 years. Historically, this data series has worked well as a buy signal, because panic typically reaches a synchronised crescendo. It works less precisely as a sell signal, because tops normally form quite slowly and over time. Still, it is clear that the majority of meaningful corrections have occurred against a backdrop of risk appetite above the 95th percentile. We’re unsure of the catalyst, but when conditions are ripe, the narrative for why a sell-off has occurred typically comes after the event.

Figure 1. Correlation of Popular Hedge Fund Positions to Momentum

Source: Man GLG; as of 29 October 2020. Popular positions as determined by Goldman Sachs ‘Hedge Fund VIP Long Short Positions’ data.

Figure 2. Correlation of Popular Hedge Fund Positions to Value

Source: Man GLG; as of 29 October 2020. Popular positions as determined by Goldman Sachs ‘Hedge Fund VIP Long Short Positions’ data.

Figure 3. Equity Long-Short Gross Exposures

Source: Credit Suisse; as of 16 November 2020.

Figure 4. Equity Long-Short Net Exposures

Source: Credit Suisse; as of 16 November 2020.

Figure 5. Risk Appetite Is Elevated

Source: Man Group; as of 12 November 2020.

Chinese SOE Defaults

Recent high-profile defaults by state-owned enterprises (‘SOEs’) in China have raised questions about whether the People’s Bank of China is withdrawing liquidity from the Chinese bond market.

Many investors believe SOE debt is safe because the Chinese government – either at a local or national level – will step in to prevent defaults. Indeed, during the coronacrisis and previous episodes of volatility (both in bonds and equities), the PBOC has resolutely supplied liquidity to maintain price stability.

That it is allowing a small number of defaults now could be a sign that the PBOC no longer wants to socialise all risk within the Chinese bond market, and is either letting local governments deal with the issues or allowing market forces to weed out the weaker companies.

Still, any liquidity issues are unlikely to be systemic, in our view. Indeed, officials from China’s State Council have asked government departments to conduct a risk assessment to prevent any spillover effects from the credit sphere that could cause financial systemic risks, according to Bloomberg.1

With contributions from: Ed Cole (Managing Director - Equities, Man GLG).

1. Source: Bloomberg; as of 16 November, 2020.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.