We Come to Bury Friedman, Not to Praise Him

In 1962, Milton Friedman famously wrote about the profit motive in his book Capitalism and Freedom: “there is one and only one social responsibility of business ... to increase its profits so long as it stays within the rules of the game ... without deception or fraud”.

This mindset of ‘maximising profits at all cost’ has held sway for about 50 years. It made its way into pop culture (remember Gordon Gekko’s declaration of “greed is good” in ‘Wall Street’?), but also became the official doctrine of The Business Roundtable (a lobbying organisation that represents many of America’s largest companies) in 1997.1

However, as companies start to face increased scrutiny, on issues ranging from working conditions to equal pay, corporations are changing their focus. Instead of myopically aiming to maximise shareholder value, companies are shifting to focus on all of their stakeholders – employees, customers, suppliers, local communities and society at large.

This has also been reflected in the Business Roundtable doctrine, which updated its language in April 2019 to say: “Each of our stakeholders is essential. We commit to deliver value to all of them, for the future success of our companies, our communities and our country.”

The Practical Men may still be slaves of some defunct economist, but on this issue, it’s not Friedman. And rightly so.

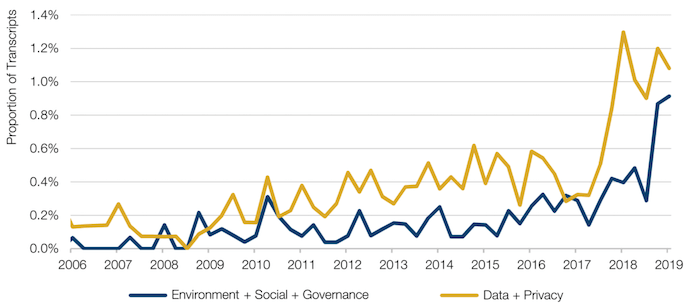

Figure 1. Word Prevalence in Earnings Call Transcripts

Source: Corporate data, Factset; as of 30 June 2019.

Sketching a Negotiating Position

The dust has settled somewhat since 31 January, the date that the UK formally exited the EU. And as it has settled, the shape of trade negotiations between the two powers has become much clearer.

Cushioned by a big majority, the UK government led by Boris Johnson has laid out its negotiating position. In a speech shot through with naval and trade allusions made in the Painted Hall of the Old Royal Naval College in Greenwich on 3 February, Johnson made his position plain: “There is no need for a free trade agreement to involve accepting EU rules on competition policy, subsidies, social protection, the environment, or anything similar any more than the EU should be obliged to accept UK rules…We have made our choice: we want a comprehensive free trade agreement, similar to Canada’s.2

This was further reinforced on 17 February by David Frost, the UK’s chief negotiator, speaking at ULS Brussels University: “It is central to our vision that we must have the ability to set laws that suit us – to claim the right that every other non-EU country in the world has. So to think that we might accept EU supervision on so-called level playing field issues simply fails to see the point of what we are doing. That isn’t a simple negotiating position which might move under pressure – it is the point of the whole project.”3

Michel Barnier, the EU’s chief negotiator, reacted by insisting that the UK’s geographical proximity to the EU meant that a Canada-style free trade agreement was impossible without regulatory alignment.4

Battle lines have therefore been drawn. With such divergent starting points, the possibility remains that talks will break down entirely.

The Music Keeps on Playing?

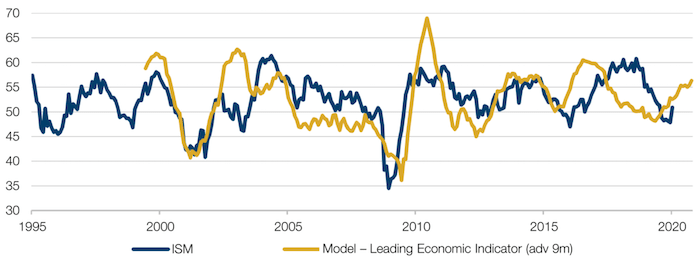

The US economic expansion grinds on. The Institute of Supply Management (‘ISM’) index jumped 3.1 points in January to 50.9 after five months of contraction, taking the indicator of US factory activity back into expansionary territory.

This is in line with the predictions of our US leading indicator model (Figure 2). Building on the work of Cornerstone Macro, it uses US capacity utilisation and import prices, the ISM price paid, the performance of Asian stock markets, the performance of US housebuilding stocks compared with US consumer discretionary stocks, global government bond yields and the US 2-year swap spread as inputs.

Figure 2. US Leading Indicator Model

Source: Man Solutions, ISM, Bloomberg; as of 13 February 2020.

Interestingly, the model has now signaled a continued economic expansion until the fourth quarter of 2020, culminating in a potential reading of 57 by the end of the year. This has been driven by falling global bond yields (with the global government 10-year yields falling from 1.2% to 0.6% over the past year) and the outperformance of housebuilders over consumer discretionary in the US (with the former up 20% against the latter over the past 12 months).

As a caveat, the indicator takes no account of the outbreak of coronavirus. It therefore doesn’t model its impact – which we expect could be large.

With contribution from: Rob Furdak (Man Group, CIO of Responsible Investment), Tim Bryant (Man Numeric, Research Analyst), Ben Funnell (Man Solutions, Portfolio Manager), Teun Draaisma (Man Solutions, Portfolio Manager) and Henry Neville (Man Solutions, Analyst).

1. “The Business Roundtable, 1997 September”.

2. “Prime Minister Boris Johnson’s Speech in Greenwich: Gov. UK 3 February 2020”.

3. “Top UK Brexit negotiator David Frost on his plans for EU trade deal, The Spectator 17 February 2020”.

4. “Michel Barnier: UK can’t have Canada trade deal with EU, BBC News 18 February 2020”.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.