Quote of the Week:

"This was a watershed moment. We’re not going back."

No End in Sight: ECB Cancels Bank Dividends

As we’ve previously written, there is a dwindling list of reasons to own the equity of European banks.

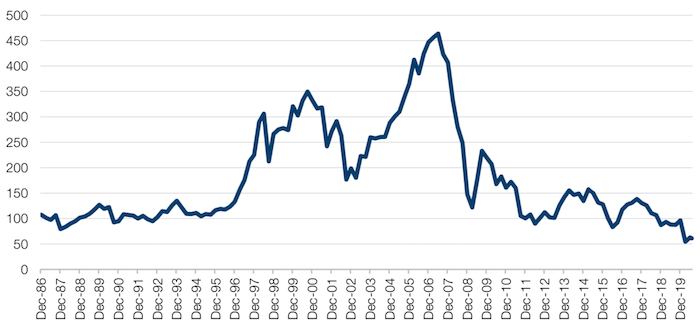

Already, the Euro Stoxx Banks Index trades at significant discount to book value. The current level of around 60 (Figure 1) implies a price-to-book ratio of just 0.4.1 With the sector trading at compressed multiples, dividends were almost the only way that bank shareholders saw any return on their investment.

And now, further misery has been heaped on the sector, as the European Central Bank has ordered banks to freeze dividend payments until at least 1 January, 2021. Ostensibly, this move aims to ensure the continued stability of European banking operations, with the directive further mandating that bonuses be “extremely moderate”. In our view, the ECB is taking an entirely blanket approach to a matter which requires some nuance: not all European banks are badly capitalised. And banks which were inadequately capitalised before the advent of the coronacrisis were amongst those least likely to be paying dividends anyway.

Whilst the ban on dividends does keep capital on banks’ balance sheets in the short term, it erodes the already-slim justification for owning bank equity. And without dividends to attract investors, it is difficult to see many buyers should there be a need to issue equity to improve capital adequacy – a not-unlikely scenario in the midst of a recession. Conversely, this is excellent news for the banks’ creditors, bolstering the cash available to pay liabilities.

Figure 1. Euro Stoxx Banks Index

Source: Bloomberg; as of 30 July 2020.

Surprise! The CESI and Momentum Correlations

The Citi Economic Surprise Index (‘CESI’) has risen to more than 200, its highest level on record. The index – which measures the pace at which indicators are above or below forecasters’ expectations – has previously tended to peak between 75 and 100.

So what does this tell us about the near term? Firstly, this index is mean-reverting by its nature – once a forecaster has been more positively surprised that they ever have before, they start raising their forecasts, and the barrier to future surprise gets higher.

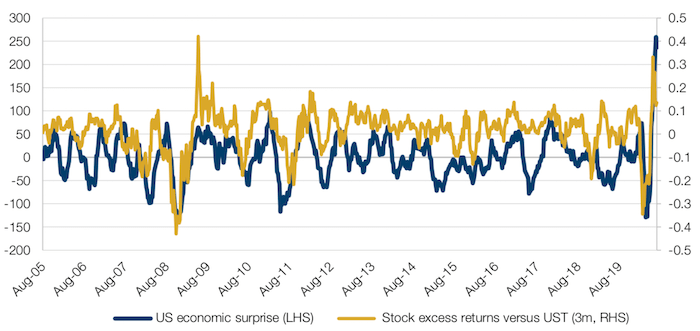

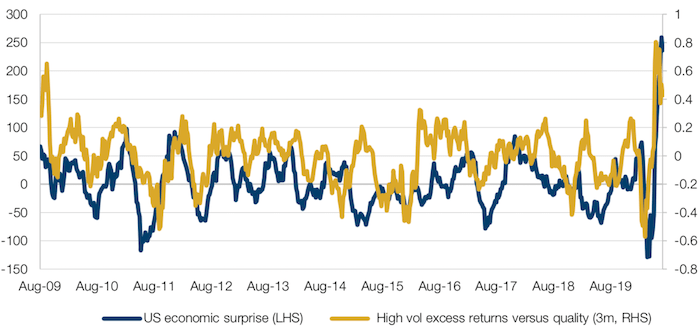

Secondly, this index correlates well with momentum in equities versus bonds, and with momentum in High Volatility over Quality: historically, when CESI reaches 75, the following two months’ returns for US equities versus Treasuries are negative 70% of the time (Figure 2), while the following six months saw High Volatility outperformance approximately 70% of the time (Figure 3).

Figure 2. CESI and Prior Momentum Stocks/Bonds

Source: Bloomberg, Man GLG; as of 27 July 2020.

Figure 3. CESI and Prior Momentum High Vol/Quality

Source: Bloomberg, Man GLG; as of 27 July 2020.

With contribution from: Giovanni Baulino (Man GLG, Portfolio Manager) and Ed Cole (Man GLG, Managing Director – Equities).

1. Source: Bloomberg.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.