Key takeaways:

- In recent years, direct lending in the United States and Europe has developed significantly. While the asset class is similar in structure and pricing across the two geographies, the US direct lending market is larger and better developed, with more experienced players

- The European direct lending market is smaller, less mature, and highly fragmented, with regional idiosyncrasies and regulatory complexities

- While Europe demonstrates promising growth potential, its long-term outlook is unclear.Investors seeking European exposure should be aware of the inherent risks and carefully evaluate the specific nuances and intricacies of each market to make informed investment decisions

A tale of two markets

The long-term trend of bank retrenchment has accelerated in the US middle market

Since the global financial crisis of 2008 (GFC), the long-term trend of bank retrenchment from the corporate lending space has accelerated in the US middle market. We believe this is likely to continue, in the wake of regional bank failures such as Silicon Valley Bank (SVB) and First Republic, which have prompted renewed regulatory scrutiny and concerns around continued regional bank failures and consolidation. This secular shift has allowed nonbank lenders to participate efficiently in credit markets and take greater market share from traditional lenders when compared to their European peers.

Conversely, regional, and local bank participation in Europe remains strong. European corporate borrowers place a large degree of emphasis on consistency of approach and prior transaction history. Particularities within the various local markets drive higher competition, highlighting the importance of local offices, teams, and depth of relationships to win deals. Furthermore, European private equity sponsors value the lower cost of capital, roughly a 1-2% discount compared to alternative lenders.1 This translates into a lower yield opportunity in European direct lending.

Notable distinctions exist between the US and European banking systems, which further explain the evolutionary differences and prominence of private direct lending across both geographies. According to the European Central Bank (ECB), domestic credit to the private sector granted by banks represents around 55% of gross domestic product (GDP) in the United States, significantly below the figure of more than 90% for the euro area. Total assets owned by banks as a percentage of GDP are approximately two-and-a-half times greater in the euro area relative to the US (244% vs 100%).2 The capital markets in the US have a notable depth and breadth, are comparatively advanced, and corporate borrowers have efficient access. Research from Oliver Wyman states that in Europe, 70% of corporate borrowing is intermediated by banks, as opposed to the US, where around 77% of corporate external funding is provided through capital markets.3

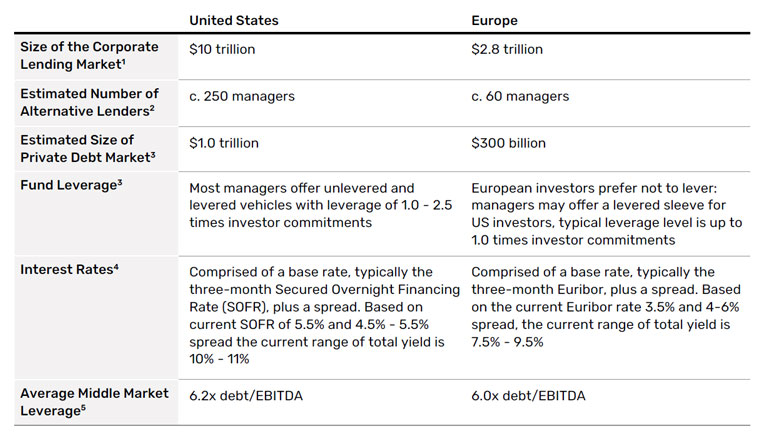

Figure 1. The US direct lending market is larger, with more managers and a higher yield on offer

Source: Nesbitt, Stephen L. Private Debt Yield, Safety and the Emergence of Alternative Lending. Wiley, 2023. 1. Securities Industry and Financial Markets Association. 2. Cliffwater Research. 3. Cliffwater Research. Leverage in private market investments tend to be measured as debt / equity capital, in contrast to the typical public market measurement of leverage as fair market value of assets / equity capital. 4. Please note, all figures are for illustrative purposes only. Based on Chatham Financial US and European Market Data. 5. S&P LCD and US LBO Review Q2 2022.

Unitranche structures are an increasingly popular one-stop debt-financing solution

Despite these structural differences, direct lending is broadly consistent between the US and Europe. Presently, a difference in base rates is driving yields higher in the US. Financing intermediaries are frequently used in Europe to place loan commitments and maintain lender relationships, whereas in the US transactions are managed directly by the lender, the sponsor, and their internal capital markets team. Across both regions, unitranche structures, which allow the borrower to receive funds from multiple parties, are an increasingly popular one-stop debt-financing solution. Historically, hybrid senior bank debt-mezzanine loan packages have been the bread and butter of the European leveraged lending landscape, which we believe lead to a higher risk profile for the typical loan in the European direct-loan universe. Currently, other deal structures, loan rates, and pricing are comparable between the US and Europe.

Portfolio risk management: key investor considerations

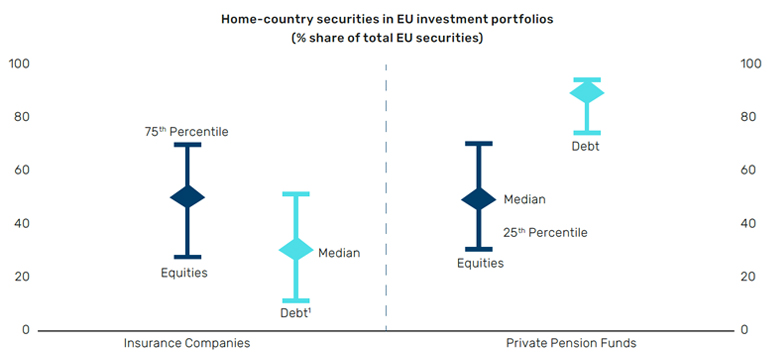

(1) Diversification: For European investors, adding a US direct lending allocation may diversify their portfolio and provide a yield pick-up, two powerful risk management tools to mitigate downside volatility in an environment of heightened risks and uncertainty. Many European investors already carry an overweight to the risks of their local economy as well as the broader European economy. Home country bias and a greater comfort level with the familiar typically translate into greater exposure to local stock and bond markets. An International Monetary Fund (IMF) study shows that even sophisticated long-term investors such as pension funds and insurance companies display a notable home bias in their asset allocation.4 The median insurance company or pension fund invests nearly half of their equity allocation in their own countries’ equities, with the debt portfolios showing an even greater degree of home bias, as shown in Figure [2].

Figure 2. European institutional portfolios are overweight local market risk

Source: IMF, European Insurance and Occupational Pensions. Data as of 2020.

Authority; Mercer European Asset Allocation Survey; and IMF staff calculations. 1. Excludes sovereign paper.

(2) Fragmented market and country risk: European managers are forced to contend with national lending dynamics, as they navigate a plethora of different cultural, legal, and regulatory considerations. Moreover, each nation has its own unique economic growth projections and political developments. The US and European economies have fundamentally different drivers. The World Economic Outlook (WEO) January 2024 update from the International Monetary Fund (IMF) shows a meaningful difference in growth between the US and euro area in 2023 (2.5% vs. 0.5%). This divergence is expected to persist in 2024 (2.1% vs. 0.9%) respectively and to narrow in 2025.5

Figure 3. US and European GDP growth figures, 2023–2025

Problems loading this infographic? - Please click here

Europe is not a monolithic market. Three countries represent more than two-thirds of all European transaction volume: (I) the United Kingdom, (II) France, and (III) Germany. This demonstrates a strong home bias, as lenders are concentrated in markets with the greatest efficiencies and strongest creditor-rights regimes. The regulatory framework is more straightforward and uniform in the US, which is inherently borrower-friendly, while Europe is more fragmented with regional nuances. A recent report from Fitch Ratings underscores the continued resilience of the US economy. In contrast, the United Kingdom and Germany entered a recession in the first quarter of 2024.6 Figure [4] shows differences in growth rates within the Eurozone – overall, the region showed flat growth while areas of growth such as Italy and Spain represent only a small subset of the opportunity set that’s accessible to investors in the European direct lending space.

Figure 4. When it comes to growth, the US is ahead of dispersed European countries

Problems loading this infographic? - Please click here

(3) Currency exposure: This is particularly relevant for European investors who wish to diversify by allocating to US direct lending. These investors often wish to insulate the portfolio from the potential adverse impact of the weakening of US dollar vs. euro / pound sterling. The most widely used instruments to hedge the risk are FX derivatives (futures, forwards, swaps). Man Varagon is developing a currency hedging program that could reduce the cash drag on currency hedges, improving the capital efficiency to the end investor.

(4) Underdeveloped non-bank sector & less experienced managers: The US direct lending market is a larger and more established ecosystem, with greater deal flow and a longer track record of financing successful investments. Following the global financial crisis (GFC) in the United States, there was a mass diaspora of cycle-tested investment professionals moving from sell-side leveraged finance groups to buy-side private credit firms. The same trend did not take place in Europe, as banks have retained market share, and therefore managers have shorter average tenures.

The long-term European direct lending growth trajectory remains opaque

Preqin’s 2024 Global Private Debt report revealed mixed dynamics on a regional basis. Europe increased its share of the number of funds closed, but lost share of capital raised. Current data shows global private debt investors favoring larger funds from experienced managers, and investors in Europe have shifted to smaller funds. While investors continue to allocate funds to Europe, it is not in the same volume as in other geographies.7

Figure 5. Europe lags other regions in its total capital raised

Problems loading this infographic? - Please click here

Figure 6. However, an increasingly large number of European funds are closing

Problems loading this infographic? - Please click here

Conclusion: Europe is growing, but the US continually compels

A significant amount of time will pass until the European private credit market offers a similar depth and breadth of opportunity relative to the US

In our view, the European direct lending market will likely continue to expand, gradually lending to larger corporations (historically greater than €100 million EBITDA) and financing a higher proportion of regional sponsor buyout transactions. However, we believe that a significant amount of time will pass until the European private credit market offers a similar depth and breadth of opportunity set relative to the US private credit market. According to our analysis, the European sponsor coverage market is likely seven to 10 years behind where the US market is today. Furthermore, Europe no longer provides a yield premium compared to the US, as it historically did during the infancy of the asset class. As the European market continues to evolve deal structures and pricing are converging, and largely similar across the two markets.

We remain steadfast in our core middle-market focus and conviction that the US direct lending opportunity set continues to be compelling compared to other geographies. The US has a more uniform structure and homogenous regulatory environment which facilitates greater opportunities across the space for private credit lenders. The market landscape is clear and allows managers to focus on a defined strategy. The sponsor-lender dynamic is fundamentally different in Europe versus the US. The US core middle market is direct relationship-based, with constructive structures and solutions. European-based sponsors are more aggressive with terms, and pricing. Lastly, given the use of intermediaries to place loan commitments, there appears to be less ability for direct lenders to engage directly with the sponsors and management teams of the borrowers. These unique structural features of the European direct lending market have resulted in lower credit spreads and potentially more contentious and prolonged restructuring processes. In our view, this trend will likely continue, as European banks make a protracted and concerted effort to retain market share across the corporate lending space.

1. Nesbitt, Stephen L. Private Debt Yield, Safety and the Emergence of Alternative Lending. Wiley, 2023.

2. European Central Bank, Occasional Paper Series, No 327, Understanding the Profitability Gap Between Euro Area and US Global Systemically Important Banks, 2023.

3. Oliver Wyman, Reference Study, The EU Banking Regulatory Framework and Its Impact on Banks and the Economy, 2023.

4. International Monetary Fund, IMF Background Note on Capital Market Union (CMU) for Eurogroup, 2023.

5. International Monetary Fund, World Economic Outlook Update, 2024.

6. Fitch Ratings, Non-Rating Action Commentary, US and European GDP Growth Paths Diverged Markedly in 2023, 2024.

7. Preqin, Global Report 2024: Private Debt, 2024.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.