As another eventful year draws to a close, market participants are turning their attention to what may be in store in 2025. Indeed, it’s the time of year when many investors pore over banks’ annual forecasts -- detailed reports, written by some of the most well-informed market participants -- which typically generate significant interest but rarely align with actual outcomes.

Prediction versus reality

Let’s look at the S&P 500 Index as an example. Figure 1 compares the largest banks’ annual forecasts for the index over the last seven years to its actual performance and clearly demonstrates a systematic divergence between prediction and reality.

Problems loading this infographic? - Please click here

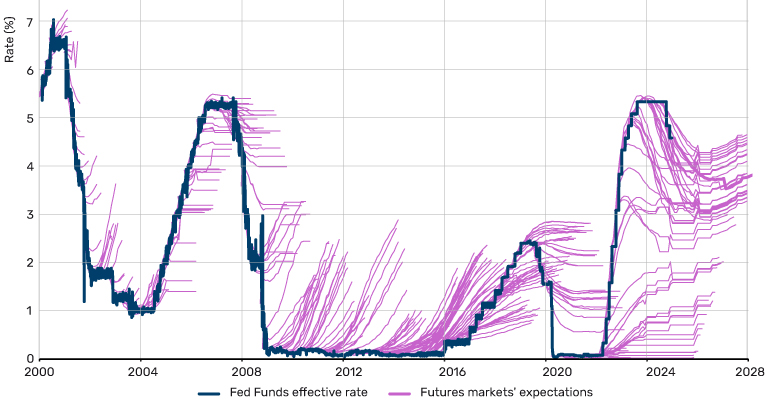

This same phenomenon can be observed in rates markets. Figure 2 shows the Fed Funds effective rate (solid line) alongside futures markets’ expectations for the direction of rates (hair lines). During the mid-2000s, markets consistently forecasted no change, yet rates kept going up. Following the Global Financial Crisis (GFC), we see a steepening curve, yet rates stayed flat for a long time.

Figure 2. Scant evidence that predictions are more accurate in rates market

Source: Bloomberg, Man Group, as at 1 December 2024.

Markets are currently pricing in a series of rate cuts for the remainder of this year and into the start of next year before rates stabilise at around 3%. Whilst it might be possible to predict the outcome of the next Federal Reserve meeting, little is certain after that.

Behavioural finance teaches us that human decision making is often influenced by several biases which can affect objectivity and accuracy, including confirmation bias, status quo bias and recency bias. More broadly, as we have witnessed, the world is an uncertain place and can change quickly and dramatically, impacting markets and volatility levels, which in turn limits the usefulness of macroeconomic forecasting.

Abandoning return forecasting for risk forecasting

Where does this leave investors? Few would dispute that the main goal of investing is to generate higher returns, but it is vital that consideration is also given to risk. In Figure 3, we compare returns and volatility over both a 10-year and a 100-year period. It reveals a clear trend: the equity volatility one month is a poor predictor of the equity return the following month. On the other hand, volatility last month is a good predictor of this month’s volatility. In short, while risk has been consistently forecastable throughout the last century, returns have remained stubbornly difficult to predict across both timeframes.

Problems loading this infographic? - Please click here

Problems loading this infographic? - Please click here

Closing thoughts

It may initially sound counterintuitive, but we don’t need to predict returns with greater accuracy to generate better returns from portfolios. While there is a large amount of randomness in markets, particularly in relation to the direction of returns, other features of the market are more predictable. The process of looking at the predictability of risk and then using this to adjust exposures (and to look to enhance returns) is one we have been adopting on behalf of our clients at Man AHL for the last 10 years.

So as 2024 draws to a close and we approach the beginning of a new year, it might be time to question conventional thinking, to embrace the uncertainty which lies ahead and to reconsider the basis upon which capital is allocated.

I will leave you with that food for thought and wish you an enjoyable and peaceful festive period.

To receive The Big Picture newsletter by email, please click below.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.