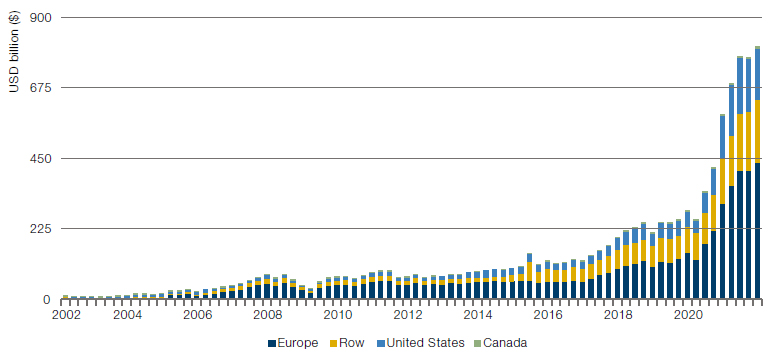

Thematic investing has seen a notable increase in popularity in the past few years. Thematic fund assets under management (AUM) reached $806 billion at the end of the 2021, increasing its share of total equity-fund AUM to 2.7% (Figure 1)1. This is a significant trend in the market, one to which we believe all investors should pay attention. In our view, thematic investing has a place in the future quantitative-investment landscape.

With advancements in data and analytic techniques, we believe that there are rich opportunities in thematic investing that we can harvest – but also challenges.

Themes can capture a unique perspective on companies that traditional sector or other groupings may not. With themes transcending sector and industry boundaries, thematic investing can allow us to capture salient trends in areas in which we have conviction. With advancements in data and analytic techniques, we believe that there are rich opportunities in thematic investing that we can harvest – but also challenges.

In this paper, we will give an overview of the evolution of thematic investing and its theory, before discussing how we address three primary issues relating to thematic investing from a quantitative perspective. These are: how to identify themes; how to select the optimal exposure to an identified theme; and how to gauge whether it is too late to allocate to a theme. In each, we think quantitative approaches can help along the thematic investment process.

Figure 1. Global Thematic Fund AUM

Source: Morningstar; as of 31 December 2021.

Evolution of Thematic Investing

The recent surge in thematic investing popularity does not mean it is a new phenomenon. The first modern thematic fund can actually be traced back to 1948, when Television Shares Management launched “The Television Fund”.2

Subsequently, popular themes or ways to group stocks together continued to evolve, including the Nifty Fifty in the 1960s-70s and style-box investing and sector classifications in the 1980s-90s. In the 2000s, we can recall the prominent example of the tech bubble, with the fall of companies such as Pets.com. Moving to the 2010s, we believe that innovation in data and techniques began to set the stage to invest systematically in a thematic way. New data allowed us to understand companies beyond their traditional sector and region classifications. For instance, supply-chain data show how companies are linked to their suppliers and customers. Geo-revenue data illustrate how companies operate across many regions. These advancements in data sources allow us to model companies in networks.

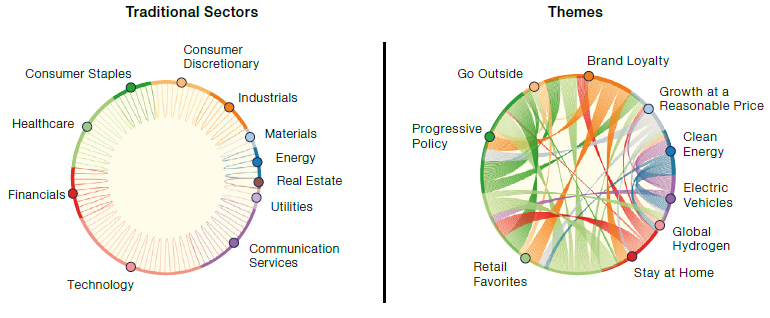

We believe themes today can be thought of as generalised networks at scale. In a traditional sector classification system, companies belong to one sector and there are no direct connections across sectors, as illustrated in the left plot of Figure 2. However, viewing companies through a thematic lens, we can see that themes are connected and can be viewed as networks, driven by how companies can belong to multiple themes. In Figure 2, we can visualise connections between sustainability-related themes such as clean energy, electric vehicles, and global hydrogen, but also see relationships between themes that at face value may be less related, such as ‘Growth at a Reasonable Price’ and ‘Progressive Policy’.

Figure 2. From Traditional Classifications to Connected Themes

Source: GICS, Man Group database (left plot); Bloomberg sell-side baskets data (right plot). Data as of 30 June 2022.

Thematic Investing in Theory

It is important to understand how to incorporate themes in an investment process.

While we’ve established that themes are not new and have been evolving over time, it is important to understand how to incorporate themes in an investment process. Thematic investment theory is also not new. Almost 10 years ago, consultants at McKinsey outlined the investment process and posited some of the key benefits of thematic investing:3

- Alpha generation through being able to take large bets in attractive investment opportunities

- Development of in-depth research skills to understand value and risk drivers of a theme

- Dynamic way to test convictions in a portfolio

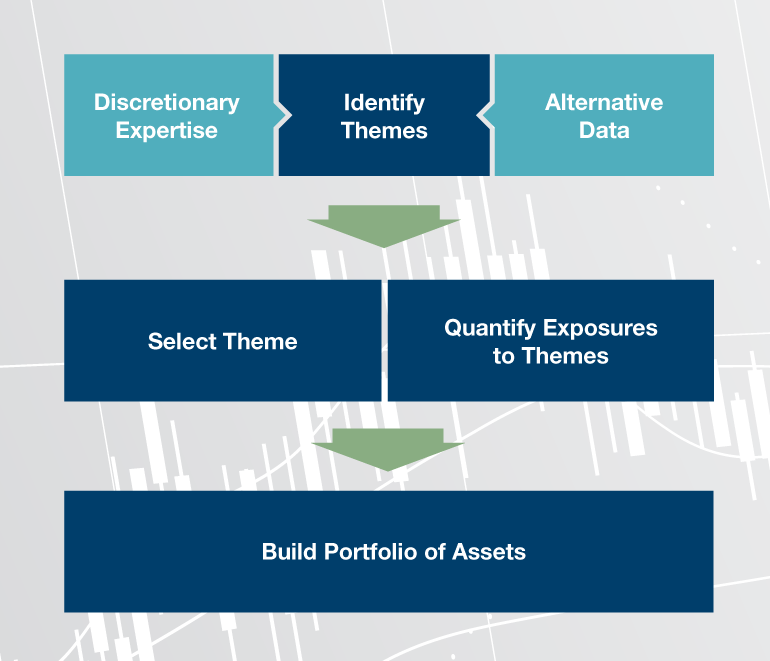

Adapting McKinsey’s framework, we summarise the thematic investment process in a few key steps (Figure 3). First, we must identify themes, a step in which we believe discretionary expertise and alternative data could assist. Then we need to figure out which companies belong to a theme and how to select the themes that are attractive investments. Finally, we build the portfolio.

Figure 3. Illustrative Thematic Investment Process

Source: Man Group. For illustrative purposes only.

However, there are many challenges in practice with implementing this process. For instance, how do we pick themes out of the many possibilities? How do we make sure that we have the right exposure to a theme? For instance, we need to ensure that the companies in a thematic basket are the names most exposed to that theme. We also need to be cognisant of unintended exposures when investing in a theme; for instance, if one had invested in the ‘Stay At Home During Covid’ theme, would that have unintentionally picked up growth exposure? It is important to be aware of these relationships between themes. And finally, when investing in a theme, how do we ensure that we are not too late? These are all questions that we aim to address from a quantitative perspective, starting with the question of identifying themes.

Identifying Themes

In our view, we can turn to multiple sources to identify themes, leveraging the expertise of discretionary investors as well as alternative data.

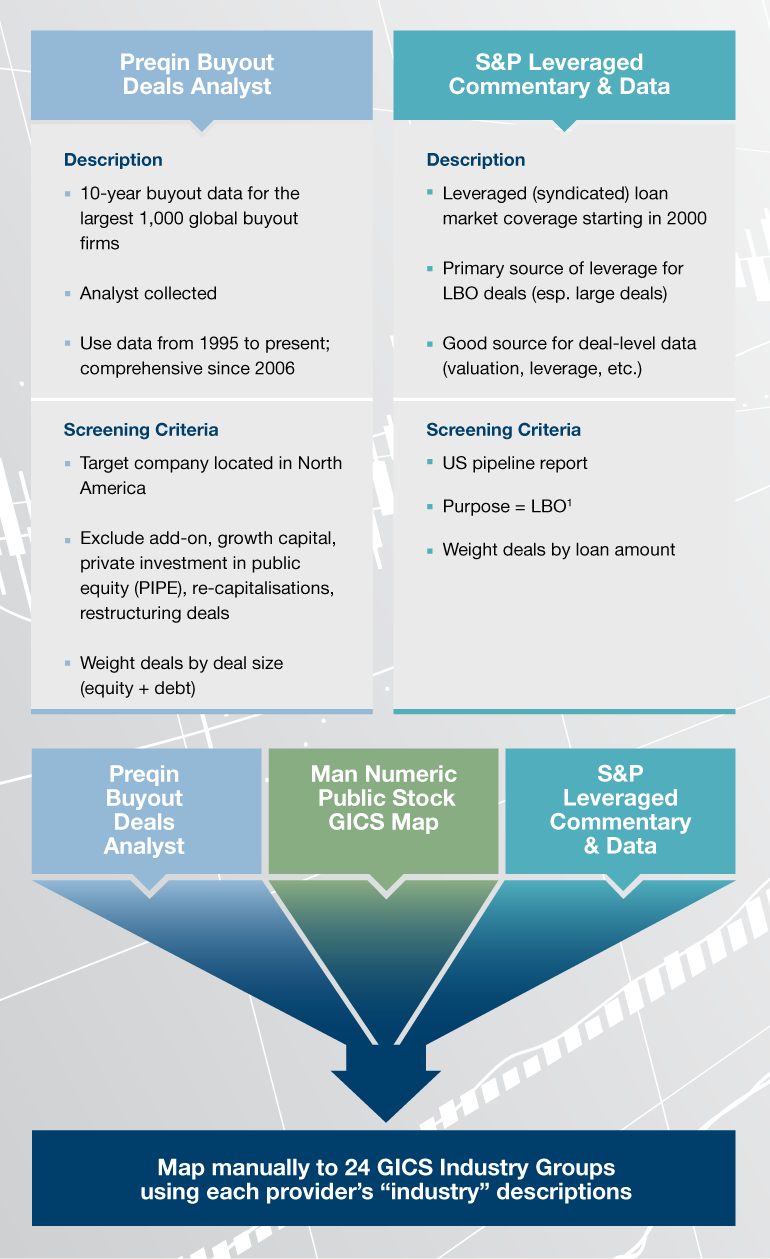

On the discretionary investor side, we can look at activity within the world of private equity (Figure 4). After mapping private-equity deals to stock GICS classifications, we can examine the sectors and industries to which private equity investors are allocating.

Figure 4. Drawing on Data from Private Equity

Source: Man Numeric; for illustrative purposes only. 1 S&P LCD defines LBOs as buyouts of a company by a PE sponsor. Excludes recapitalisations, refinancings, and follow-on acquisitions. The above example is intended as an illustration of typical investment considerations and strategy implementation. It should not be construed as indicative of potential performance of a fund or strategy or of any investment made by a fund or strategy.

One trend that we detect from this exercise is private equity’s earlier increasing allocation to the software and services industry, relative to the corresponding increase in the Russell 2500 (Figure 5).

Figure 5. Weight to Software and Services Industry Within Private Equity

Problems loading this infographic? - Please click here

Source: Man Group database; as of 30 June 2022. *Russell 2500 benchmark excludes Real Estate, Mortgage REITs, and Biotechnology. The above example is intended as an illustration of typical investment considerations and strategy implementation. It should not be construed as indicative of potential performance of a fund or strategy or of any investment made by a fund or strategy.

VC deals data can give us deep insights into the industry verticals in which they are investing.

In a similar way, we can look at venture-capital (VC) deals to detect emerging trends, as investors in this space may have forward-looking views on growing segments of the economy. VC deals data can give us deep insights into the industry verticals in which they are investing.

Figures 6 and 7 paint a picture of the VC trends across these industry verticals over time. Mobile Apps, Ecommerce, and Software as a Service were the some of the largest areas of investment by deal volume from 2000 to 2021; we can also see emerging areas in which VCs were investing, with Blockchain, Cryptocurrency, and Fintech being the fastest growing verticals from 2020 to 2021.

Figure 6. Venture Capital Deal Volume by Year (Deal Count)

Problems loading this infographic? - Please click here

Source: Preqin VC Data, Subset of all Industry Verticals; as of 31 December 2021. For companies tagged to multiple industry verticals, split deal across verticals evenly.

Figure 7. Venture Capital Deal Volume by Year (Deal Count)

Problems loading this infographic? - Please click here

Source: Preqin VC Data, Subset of all Industry Verticals; as of 31 December 2021. For companies tagged to multiple industry verticals, split deal across verticals evenly.

Patents can indicate research and development in areas, or themes, that may not otherwise be recognised in traditional filings or reports.

Another way to identify themes is to turn to alternative data such as patents, in order to gauge the areas in which firms are innovating. Patents can indicate research and development in areas, or themes, that may not otherwise be recognised in traditional filings or reports. One unique aspect of patents is that they are labelled within the Cooperative Patent Classification (CPC) system, covering around 250,000 granular categories. We can leverage the CPC system to examine growth in patent categories. For instance, Figure 8 shows the aggregate results of such an exercise when applied to the renewable energy-related patents. We see that there was growth in the early 2010s.

Figure 8. Renewable Energy Generation Innovation in Patents

Problems loading this infographic? - Please click here

Source: GlobalData Patent Data; as of 30 June 2021. Three-year lookback patent count at end of June each year. Subset to companies in Numeric Global Universe.

Finding Companies with Exposure to a Theme

Having identified emerging themes, it is important to discern which companies are exposed to a theme. One question is whether we can do this systematically. As an example, let’s say we are interested in finding out which companies are in the Renewable Energy theme. Many questions about renewables arise when first thinking about the problem: for example, it is important to know the types of generation, the industries involved, the technologies used, and the main players. This involves some expertise, but how can we obtain this knowledge?

NLP can extract the key phrases relevant to a theme of interest and find the companies with the highest exposure.

One approach is to leverage natural language processing (NLP). Scanning through company documents, we can extract the key phrases relevant to a theme of interest and find the companies with the highest exposure to those key phrases. Figure 9 portrays a word cloud of the words that are most related to Renewable Energy. Some of the most recurring keywords that arise include renewable energy sources such as wind and solar but also can include the related technologies such as panels and turbine. Many of the terms will be familiar, but it can also highlight crucial areas such as electrification that may be overlooked in a traditional focus on production means like solar and wind.

Figure 9. NLP and Renewable Energy

Source: Man Numeric; as of August 2022. For illustrative purposes only.

Once we have the key phrases relating to the theme of interest, we can find the companies that have the highest exposure. Our results suggest that the companies with the highest exposure to the Renewable Energy key phrases can span traditional sector classifications, and may even be one or two steps removed in the value chain. There are obvious candidates in utilities, but we also find companies with renewable energy exposure span industries such as copper mining, semiconductor equipment, building products, and industrial machinery. Each is integral to renewable energy, but may not feature in top-down sector screens. These findings continue to validate the idea that themes can transcend sector boundaries, and that techniques such as NLP can be useful in finding the companies that belong to the theme.

Making Sense of the Plethora of Themes

How can we understand the unique concepts and make sense of the large number of baskets covering a theme? One way to reduce the dimensionality of the problem is to form clusters of baskets.

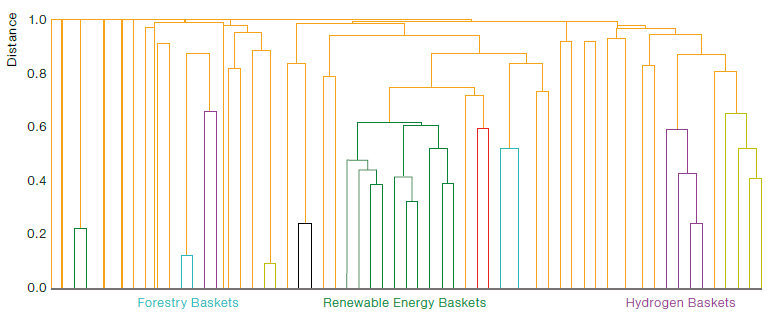

Another aspect to consider in thematic investing is how to make sense of the many potentially overlapping baskets relating to a theme. We have seen that the sell-side and data providers have been using their knowledge and expertise to create thematic baskets. Taking Climate as an example, we have identified 61 potentially overlapping baskets covering various climate-related areas. How can we understand the unique concepts and make sense of the large number of baskets covering a theme? One way to reduce the dimensionality of the problem is to form clusters of baskets. In Figure 10, we show the 61 baskets in a hierarchical clustering dendrogram, where the y-axis represents the distance between the thematic baskets. We highlight a few of the clusters seen in the dendrogram. We can see common topics covered within these clusters of more closely related baskets, including areas such as Forestry, Renewable Energy, and Hydrogen.

Figure 10. Hierarchical Clustering Dendrogram for Climate Theme

Source: Bloomberg sell-side baskets data and Sustainalytics; as of 30 June 2022.

How to Gauge Whether It is Too Late to Allocate to a Theme: Dynamic Theme Rotation

Having discussed approaches to identify themes and their constituents as well as make sense of thematic basket data, we believe one of the greatest challenges for investors is to decide whether it is an opportune moment to buy into that theme. Themes can offer exponential growth, but the corollary of that potential can be higher volatility and sharper selloffs, as illustrated in the performance of an example thematic ETF (Figure 11).

Figure 11. Performance Profile of an Example Thematic ETF

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 30 June 2022. Rebased to $1 at 31 October 2014.

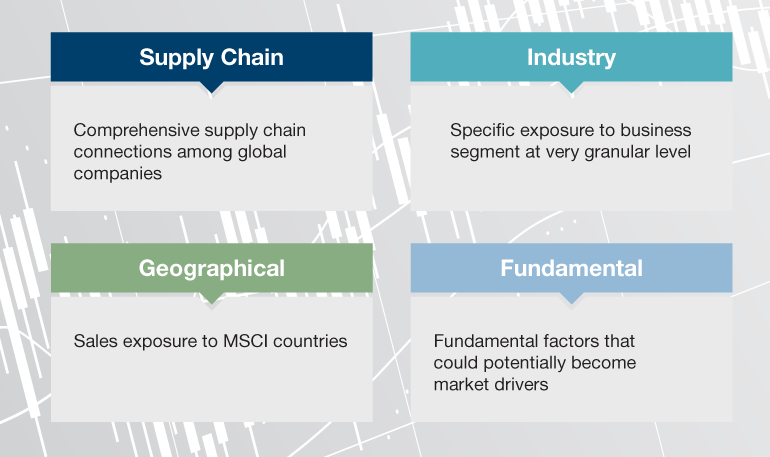

A period of strong performance may provide validation of a thematic thesis, but may also lead investors to fear they have missed the rally or are entering at overly stretched valuations. We understand these concerns, and therefore favour diversified and dynamic exposure to a range of themes rather than trying to pick and time individual themes. In seeking to construct such a model, we believe a process based on fundamental analysis and persistent trends can be effective. When considering the universe of possible themes from which to select, we focus on four sources from which themes can emerge, as depicted in Figure 12. Emerging themes driven by these four areas can give investors some confidence in the outlook, especially when a model is diversified across multiple themes but rotated towards the strongest on a fundamental and trend basis.

Figure 12. Areas From Which to Select Themes

Source: Man Numeric; as of October 2022. For illustrative purposes only.

Fad or Opportunity?

We can leverage the advancements in data and analytic techniques to capture emerging thematic trends and dynamically rotate between themes.

The recent rise of thematic investing creates both challenges and opportunities for investors, not least that individual themes may be faddish and performance may be volatile and go out of favour.

However, we believe that thematic investing presents many rich opportunities, and has a place in the investment landscape as it allows one to capture unconventional groupings of companies. As quantitative investors, we can leverage the advancements in data and analytic techniques to capture emerging thematic trends and dynamically rotate between themes.

1. Choy, Jackie, et al. “Morningstar Global Thematic Funds Landscape 2022.” Morningstar Manager Research, March 2022.

2. Choy, Jackie, et al. “Morningstar Global Thematic Funds Landscape 2022.” Morningstar Manager Research, March 2022.

3. Bérubé, Vincent, Sacha Ghai, and Jonathan Tétrault. “From Indexes to Insights: The Rise of Thematic Investing,” McKinsey on Investing, Number 1, Winter 2014/2015 https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/from-indexes-to-insights-the-rise-of-thematic-investing

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.