Over the last 10 years, we believe investors have become increasingly frustrated with the cost and performance of hedges, despite outsize gains across their broader portfolios. Investment banks, recognizing client fatigue with hedging losses, have turned to pitching products that are tailored to clients’ biases against losing premium, rather than to their portfolio risks. The drive to lower the cost of hedges has resulted in the creation of complex option structures, seemingly random basis trades and back-test fitted strategies. We believe when assessing these, portfolio managers need to be just as rigorous in their analysis of hedges as they are on their investments to ensure they are not giving up significant protection in an attempt to cheapen hedge costs.

When it comes to tail hedging, with option prices closer to historic lows, we believe it is time to be net buying optionality, not selling it.

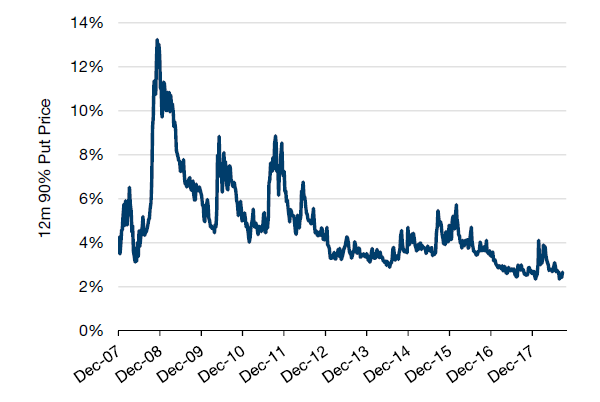

As Figure 1 shows, put prices are close to post-2008 crisis lows, even with markets near highs and central banks withdrawing liquidity. With options prices low, we believe there is an opportunity to hedge to better manage risk. We believe investors should be willing to accept some performance drag at the portfolio level and use hedges to target risk, not returns. Rather than focus on cheapness, managers should focus on the robustness of their hedging process in our view.

Figure 1. Cost of protection near post-crisis low

Source: Bloomberg, as of 31 August 2018.

Evolution of hedging since 2008

In 2008, despite extreme levels of volatility and option prices, investors with large losses continued to buy puts, volatility and convexity at extraordinary levels with abysmal return prospects. Figure 1 shows that the price of a 90% put hit 14% in late 2008, requiring a 24% decline in the market to break even. This compares with requiring a 12% decline at today’s prices.

“One of the basic phenomena of choice under both risk

and uncertainty is that losses loom larger than gains.” 2

Cumulative prospect theory (CPT), an innovation in economic theory for which Daniel Kahneman won a Nobel prize, undercut the concept that people always behave as rationally as economic models were expecting. Extrapolated to financial markets, aspects of the theory suggested that investors excessively fear potential losses and tend to mentally overweight extreme, but unlikely, events. For an options trader, the term skew is a measure of richness of out of the money puts versus at the money puts. Skew is generally high and fits the market expectation that investors overpay for puts.

Richard Thaler expanded upon Kahneman’s work by positing that prior outcomes influence the way subsequent potential gains and losses are evaluated. He termed this the ‘Wealth Effect.’ A portfolio with embedded gains after a long rally gives downside comfort and less urgency to hedge, whereas market losses lead to risk aversion.

Indeed, market lows are often accompanied by highs in the VIX and in put/call ratios, while rallies lead to substantial declines in hedging and volatility.

After a sustained rally in equities, risk appetite has remained relatively strong while the perceived need for hedges has waned in line with the wealth effect concept in our view. Further, in discussing protection, many market participants often cite prior losses as having diminished their appetite to continue hedging. By decoupling hedges from portfolios, we believe they are inadvertently framing hedges as losses (to which they are averse) and targeting returns rather than risk. All the while, they are fed a narrative that conflates hedging with irrationality. For further discussion of risk targeting, please refer to: ‘Volatility Is Back: Better to Target Returns or Target Risk?’3

Hedging 2018: What questions should investors be asking about their hedges?

We believe fear of continued losses on hedges has led to banks using financial alchemy to create and market ‘cheaper’ forms of protection. Buying outright puts on the SPX can potentially be a drag on a portfolio. However, we believe investors should view protection through the lens of risk instead of returns and ask the questions below:

- Is that structured option cheap for a reason?

An exotic options trader from earlier in my career, when asked why a certain put structure was so inexpensive, answered simply “it’s cheap for a reason.” There was no clever financial engineering. It was just less likely to pay off for the client. To create cheaper and cheaper option structures requires increasing complexity or adding some form of basis risk. If an option is cheapened by adding some contingency, it follows that the likelihood of payoff is diminished. When a pitch starts with “if you think…,” raise your guard. A put on the SPX may seem rich, but is a put on the best-performing member of a basket of DAX, SPX and the Korean won ‘cheaper’ or just lower premium? Is the risk from the added complexity correlated to your portfolio? Is it enough to assume that because it performed in 2008 that it will do the same in the next crisis? Why stop adding complexity? Why not add a slug of Zloty or Latvian real estate? - What do words like ‘dynamic’ and ‘systematic’ mean? (Fear the Backtest)

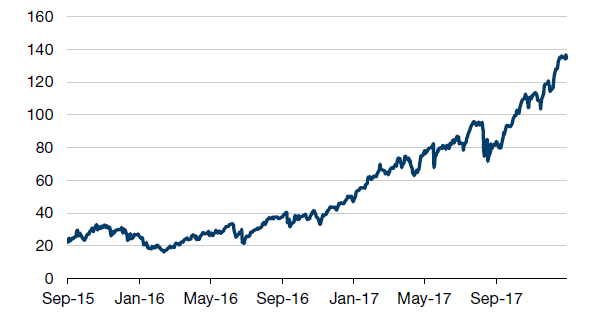

When it comes to back-tested options strategies, ‘systematic’ has increasingly come to be a euphemism for selling volatility. As an example, refer to the Vol ETF charts below. Note how Figure 2 omits the August 2015 decline of 56% − as a cleverly depicted backtest chart might.Figure 2. ‘Optimised’ – Short Volatility ETF History (XIV)

Source: Bloomberg, as of 29 December 2017.

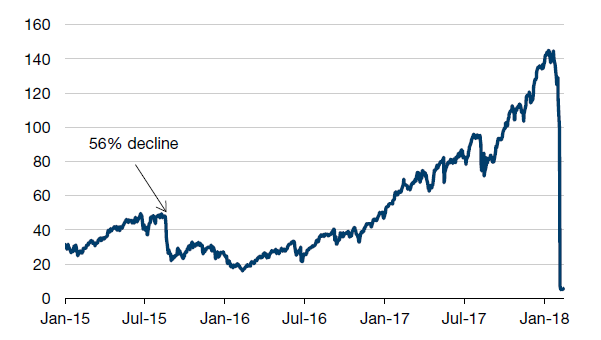

Figure 3. Reality – Short Volatility ETF (XIV)

Source: Bloomberg, as of 14 February 2018.

When looking at a protection strategy, we believe clients should ask:

a. Has the strategy managed positive returns over the last five years because it net sold options?

b. What is the max loss of the strategy?

c. Does the backtest sufficiently stress test the strategy?

d. Are the positive risk attributes in 2008 a function of that crisis alone and will the next crisis look like the last one?

e. Can you survive the initial gap lower and the adverse outcomes that might come with it

(and do you know what those might be)?

f. Do underlying assumptions include taking profits earlier than your risk profile dictates? - How rare is rare: exactly how fat are the tails?

The market clearly is unable to predict the magnitude and frequency of declines. Therefore, when constructing hedges, we believe investors should not attempt to do so either. According to the normal distribution, market swings of greater than 7% in a single day should come once every 300,000 years. Yet, it has happened 64 times in the last 100 years.4 The February spike in the VIX was a bit more unusual: if the distribution from which it was drawn is assumed to be normal, the implied frequency of the move that occurred on February 5 is closer to once in 300 quintillion years.5 By now, investors are well-acquainted with the concept of fat tails and the danger of using the normal distribution to manage portfolio risk. Selling optionality in a bid to cheapen protection being bought could entail an implied bet on the frequency and fatness of the tails. - Does the strategy rely on market liquidity being available and thus depend on an ‘illusion’ of control?

Dynamic trading strategies that reduce portfolio risk are often marketed as a form of protection. Risk reduction is usually accomplished by selling equities into market declines at predetermined loss thresholds (-10%, -20%, etc). This approach purportedly offers similar protection as provided by options without the premium outlay. Names like Constant Proportion Portfolio Insurance bring back memories of the 1987 crash. The core supposition is that investors, in a time of crisis, will have the ability to execute and get filled at prices they want when, in fact, they may not. Gaps lower in the market or low liquidity periods may be severely detrimental to results. Will the market cooperate and allow methodical risk reduction or inflict damage via a flash crash? When markets snap back, longs may be rebuilt. How are excessive trading and opportunity costs evaluated? Will those costs exceed the cost of options in a fat tail event? - It looks great at maturity in the payoff section of pitch book, but what is the mark to market?

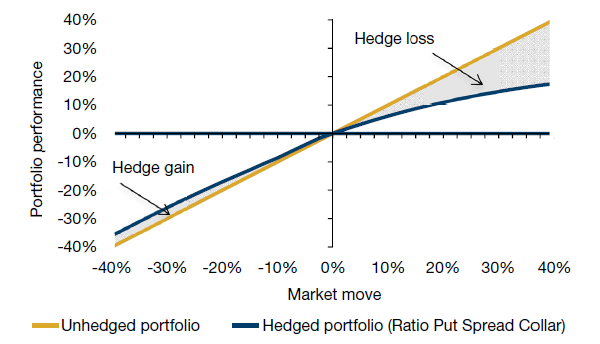

A popular hedge currently being pitched is a 3-year trade that costs zero up front, makes 25% if the market rallies and offers protection from a decline of up to 15%. Below 15%, the portfolio becomes long again but, the story goes, one should be happy about this because that’s a good level to get long again. This idea feeds both the impulse to get a bargain hedge at zero cost and the greed impulse of getting long down 15%. In fact, to fund it all, the structure requires selling more puts at the 85% strike than are being bought. As a result, the hedge is net short puts and short volatility at all market levels. How does it perform in a shock? In a 30% decline over three months, the mark to market would be a profit of less than 4% assuming no unwind cost in what would likely be a very illiquid market. In the name of saving premium, the portfolio has achieved minimal protection in a large decline, is short volatility and net is going to wind up even longer the market. Rather than leaving the portfolio well protected and able to take advantage of the market dislocation, the investor has left himself or herself with a fairly complicated set of decisions about how to manage risk going forward. To realize the promised gains at maturity, the portfolio would have to endure 2.5+ years of short equity volatility with no further declines in stocks. This, just to achieve virtually the same yield it could make owning Treasuries over that period.Figure 4. Hedge impact mark to market

Source: Bloomberg, as of 4 September 2018. Assumptions: Market move occurs in next 30 days, Volatility up 5 points with market down more than 10%.

- How sensitive is the strategy to the market path and timing?

In designing hedges, we believe that not only do investors need to control for complexity, convexity and basis risk, they also need to consider the expiration date of hedges and the path the market may follow over the hedge period. Lost in the swirl of breakeven analyses, payoff charts and backtests, is the simple notion that time and type of market declines also matter. It is quite likely that every investor has had the feeling that his or her hedges often expire right before the start of a market decline or that the market closes right above the strike price of puts on the date they expire. The sentiment is similar to feeling that one is always in the slowest queue at the super market or at airport security. While we may not have so much acumen in choosing the right queue, the good news for hedging is that we believe proper design of hedging strategies allows for some control. How a market falls matters. Is it a long slow decline or a fast correction? A volatility-based hedge may only pay off in sharper selloffs, while short-dated puts may not deliver in markets that drag down slowly over months. Hedges that sell upside calls may leave portfolios overly reducing risk in rallies, while complex protection prove hard to monetize. In designing hedging programs, we believe investors should consider their hedge time horizons, tolerance for interim market declines and how protection might look in fast or slow rallies and declines. This includes considering when to take profits, which may well be the topic of a future note.(For those interested, in the US alone, it is estimated the people spend 37 billion hours a year in waiting in line.6 This has led to the birth of Queueing Theory analysing why people suffer in a 10-minute queue at airport security, but happily wait for hours to see Star Wars – or how complaining actually makes people feel better about waiting.)

An Alternative View on Hedging: Portfolio Drag is not Such a Terrible Thing

All this is not to argue against all types of contingency: complexity and basis risk can potentially offer great exposures when used to improve the focus of the hedge to protect more effectively against points of vulnerability. For example, the real risk in a multi asset portfolio might not be ‘equities down,’ but ‘equities down with bonds going down too.’ Here, an equity put contingent on rates going higher may be a strong risk offset at a fraction of the cost of a vanilla index put. Similarly, puts on the EuroStoxx contingent on a weaker euro worked around Brexit. If a limited downside protection scenario works in the context of a relatively low risk portfolio, clients may consider taking advantage of the skew to cheapen hedges via a put spread. We believe complexity that contemplates risk in the portfolio makes sense, but complications added to options solely to reduce price often do not and may have unintended consequences.

With markets at or near highs and volatility closer to lows, we believe investors should naturally be averse to short volatility, cost-mitigating traps when designing hedges. The markets may be moving from an era of implied central bank puts towards one with less liquidity and more potential downside. This new environment may have tails that are fatter than risk models assume. As every crisis is different, a back-test fitted hedge strategy may not anticipate from where the next one originates and thus leave a portfolio vulnerable. If concerned about a market crash, solvency or other extreme downside scenarios, we believe client hedges should match those risks and avoid hedges that leave them short volatility or long the market at levels where their risks call for the opposite profile.

Hedges are often meant to put a portfolio manager in a position of strength to take advantage of significant dislocations across asset classes. Instead of becoming forced sellers, managers are then able to decide among maintaining protection, monetizing hedging gains or buying other more severely distressed assets. We believe this requires being long volatility and able to provide liquidity at market pain points rather than being short volatility and desperately seeking it. At these levels of volatility, we believe that the small amount of drag to the portfolio to accomplish this is well worth it to maintain optionality in a time of crisis.

1. Mandelbrot, Benoit: The Misbehavior of Markets; 2008.

2. “Advances in Prospect Theory: Cumulative Representation of Uncertainty,” Journal of Risk and Uncertainty, Vol. 5, No. 4 (1992), pp. 297-323.

3. Man FRM, February 2018.

4. Mandelbrot, Benoit: The Misbehavior of Markets; 2008.

5. JPM Derivatives Research.

6. Stone, Alex: "Why Waiting in Line is Torture." New York Times; 2012.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.