Introduction

Spreads in merger arbitrage strategies, which seek to exploit the differential between stock prices of acquirer and acquired in M&A situations, have reached historical wides in recent weeks as the coronavirus outbreak caused investors to reconsider the corporate finance landscape. Much of the selling was driven by technical rather than fundamental pressure, though, creating potential investment opportunities.

From Record Tights to Unprecedented Wides

Merger arbitrage strategies seek to exploit the uncertainty surrounding M&A transactions. In an acquisition scenario, portfolio managers will express views on the likelihood of the deal successfully closing. In simple terms, this is expressed by either shorting the stock of the acquiring company and going long the stock of the target (in the event that the manager believes the deal will close), or the reverse positioning if one is sceptical about the chances of the deal closing. The objective of the strategy is to capture the arbitrage spread – the difference between the acquisition price and the price at which the target’s stock trades before the consummation of the merger. To have an edge, event-driven portfolio managers need to have excellent relationships with management teams as well as a deep knowledge of the competitive and regulatory landscape. Managers often apply leverage to their portfolios to increase their returns; this has particularly been the case in recent years when crowding in the space and a benign market backdrop drove spreads to record tights.

Those tight spreads persisted right up until late-February of this year, when the average annualised return on US and European deals was under 3%.1 With the coronavirus panic and the radical re-shaping of the M&A environment, this return gapped out to more than 20% by mid-March2, with seemingly little differentiation between deals that are due to close in the near term and where the rationale behind the purchase remains coherent, and those deals that correctly appear more difficult to complete in the light of the altered economic backdrop.

To illustrate the scale of the technical pressure in the space, it’s worth looking back at an article we wrote last year – in what seems like an entirely different era – when we spoke about those things that one should look for in deals they invest in: a solid and defensible transaction rationale that is not dependent on short-term factors; a strong balance sheet at the acquiring company with a good cash position and a range of funding options; and impressive management teams with clear plans for integration of the two firms.

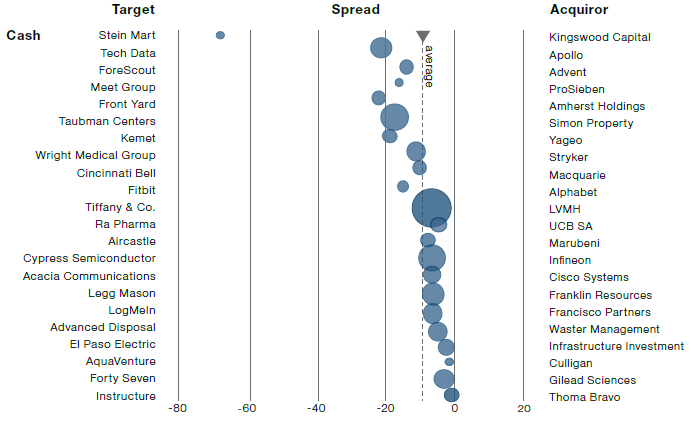

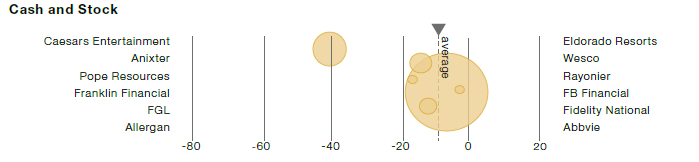

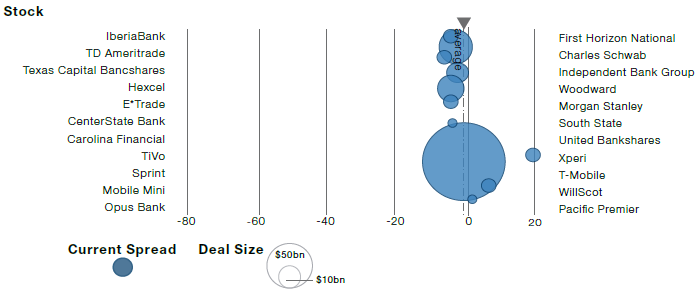

When we analyse recent price performance in the merger arbitrage space, it is immediately apparent that companies that fit many, if not all, of these characteristics have suffered every bit as badly as those less viable tie-ups. What’s more, even deals that are due to close in the coming weeks, which had been trading with a spread measured in basis points, have gapped out substantially, an illustration of the forced nature of recent selling. Figure 1 shows spreads for a variety of large US deals as of the middle of March.

Understanding the Shape of the New Landscape

It’s important to stress that much of the current potential opportunity is likely to be short-lived. Like all strategies, merger arbitrage funds experienced significant outflows in the wake of the coronavirus-related panic, as investors sought to de-risk their portfolios and fled to the safety of cash. This selling pressure was exacerbated by the fact that many of the best-known players in the space apply significant leverage to their strategies in order to amplify returns. As such, each dollar of investor money that was withdrawn from these strategies precipitated a much larger unwinding of positions in the underlying stocks.

We believe that once the situation begins to normalise, there is likely to be a raft of new corporate activity as companies weakened by the downturn seek safety in combination with others, while more robust firms pick up bargains while prices are depressed. We would expect to see particular activity in sectors hard-hit by the crisis – travel, energy and luxury goods – and there are likely to be a series of megadeals (those valued at more than USD10 billion). The most attractive opportunities could be found amongst smaller, mid-market deals, and in those sectors where strong companies look to take opportunistic advantage of depressed prices – health care, utilities and logistics, for instance.

Figure 1. US Deal Spreads

Source: Financial Times, S&P Global Market Intelligence. As of 20 March 2020.

Note: Spread to deal value (%), US deals pending greater than USD500 million.

Conclusion

Before the coronavirus crisis hit, we were entering that stage of the cycle – at the end of a bull run – where corporate activity tends to pick up as firms seek to replace fading organic growth with acquisitions. Things have certainly changed dramatically in recent weeks as the full extent of the coronavirus crisis has become clear, but we believe that corporate activity will continue and should even pick up pace as normality returns. Many of the key drivers of M&A activity will remain in place, with low rates and generous funding terms supported by vast private equity capital needing to be deployed. The currently excessively wide spreads in merger arbitrage are driven by technical pressure as often highly leveraged funds have been forced to liquidate large positions in stocks attached to deals (or, indeed, to cover their shorts).

As such, we believe that there could be an extraordinary, but temporary, opportunity to gain exposure to this type of investment strategy at levels never before witnessed, but that manager track record and expertise is of greater importance than ever, given these uncertain times and shifting M&A landscape.

1. Source: Bloomberg; data as of 30 March 2020.

2. Source: Bloomberg; data as of 30 March 2020.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.