Introduction

In line with other risk assets, the high yield (‘HY’) market has experienced indiscriminate selling across credits in all sectors, with energy the worst performer, following the collapse in oil prices and due to the Covid-19 outbreak. Consequently, there have been ratings downgrades spread across sectors and categories. We believe it is highly likely that we will see a global recession and a large hit to corporate earnings. Our view is that we could be looking at a short but sharp shock, rather than a deep and prolonged global recession.

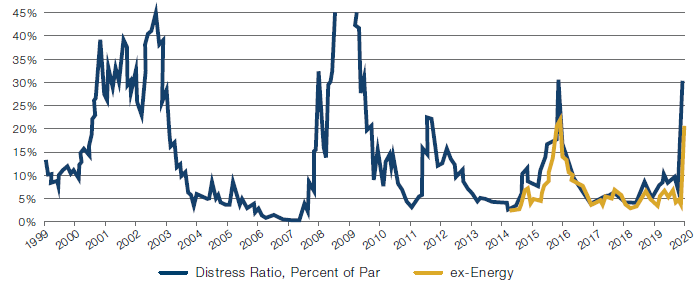

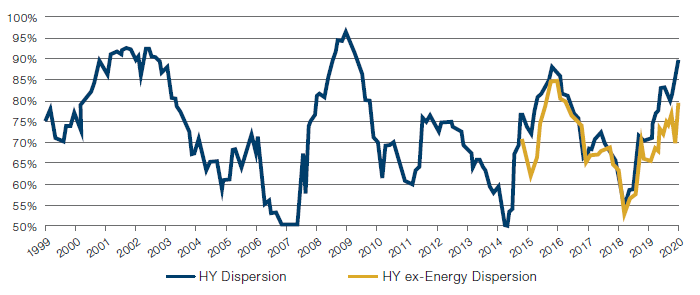

In the current environment, many (if not all) HY issuers are having to focus their attention on preserving cash and adopting measures to help ensure their survival. Key indicators are pointing to a turn in the credit cycle, as evidenced by the spike in the number of bonds trading at distressed levels with spreads over 1,000 basis points, and the wider levels of dispersion not seen since 2008.

Figure 1. Distress Ratio

Source: BofA Global Research; as of 20 March 2020.

Figure 2. HY Dispersion

Source: BofA Global Research; as of 20 March 2020.

The Rare Opportunity

Current spreads are pricing in default rates higher than at any point in history, even when assuming zero recoveries. Euro HY currently implies a 5-year cumulative default rate of 35%, whilst US dollar HY implies a default rate greater than 40%, which increases to c. 60% when assuming recoveries of 40%. To put these rates into perspective, the worst global 5-year cumulative default rate on record is around 32%.

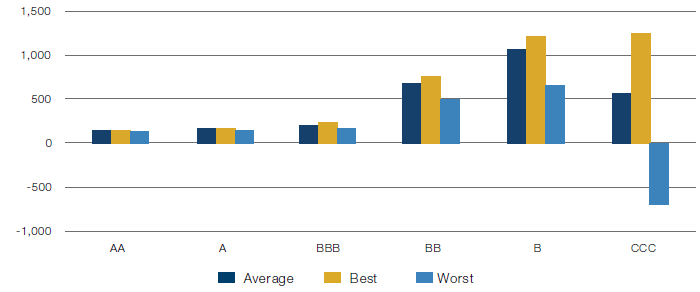

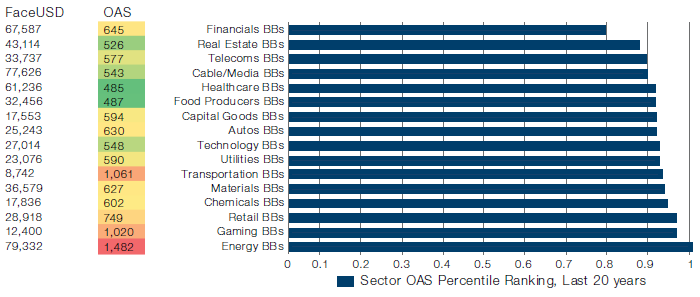

Recent analysis shows that at present, based on the default spread premium (‘DSP1’), spreads comfortably compensate investors for most, if not all, default rate outcomes, particularly in the mid to upper bands of the market. BBs and single-Bs in both the EUR and USD markets offer wider DSPs, even compared with investment grade (‘IG’) credit.

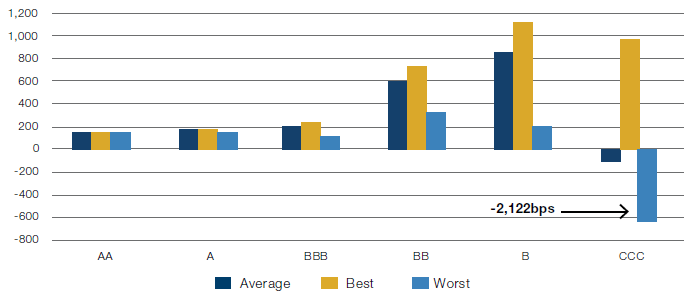

Figure 3. DSPs by Rating Based on Different Default Scenarios and a 40% Recovery, EUR

Source: Deutsche Bank; as of 23 March 2020.

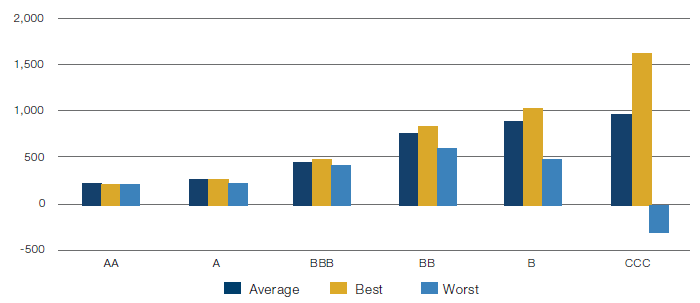

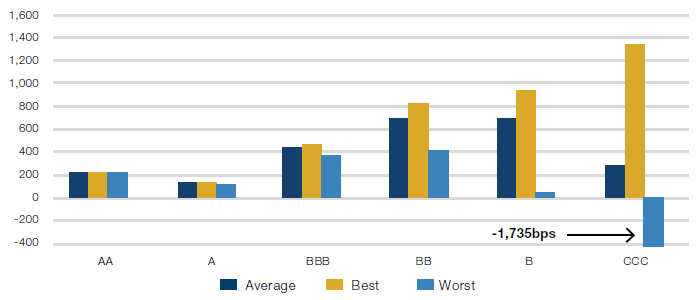

Figure 4. DSPs by Rating Based on Different Default Scenarios and a 40% Recovery, USD

Source: Deutsche Bank; as of 23 March 2020.

Figures 5-6 are based on zero recoveries. Under the worst default scenario, single-Bs DSPs drop to the point where IG DSPs are wider in USD credit but are still positive. Based on an average default scenario, BBs and single-Bs still provide the widest DSPs.

Figure 5. DSPs by Rating Based on Different Default Scenarios and a 0% Recovery, EUR

Source: Deutsche Bank; as of 23 March 2020.

Figure 6. DSPs by Rating Based on Different Default Scenarios and a 0% Recovery, USD

Source: Deutsche Bank; as of 23 March 2020.

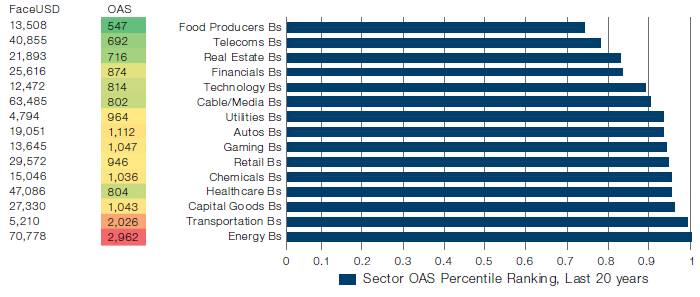

We believe realised defaults could peak in the 10% range, focused mainly in consumerfacing sectors and US energy.1 With the option-adjusted spread (‘OAS’) +1,000, the market may now be offering real long-term value and could be compensating investors for a much worse default rate outcome than we think might be possible.

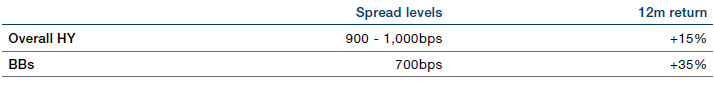

Against this backdrop, the ‘entry point’ offered by current spread levels and valuations could offer attractive long-term potential, in our view. Historic median data shows that in the right circumstances, equity-like returns are possible when investing at levels the market is currently trading at.

We believe markets are likely to remain volatile in the near term. However, downside risks, in our view, should be limited from here. Even if we do encounter a deeper and more protracted recession than we expect, we think HY is already pricing in a substantial margin of safety and could be a cycle opportunity.

Figure 7. Historic Data Shows the Following Returns From Current Spreads

Source: BofA Global Research; as of 20 March 2020.

Figure 8. BBs Current OAS as a Percentile Rank Over 20 Years

Source: BofA Global Research; as of 20 March 2020.

Figure 9. Single-Bs Current OAS as a Percentile Rank Over 20 Years

Source: BofA Global Research; as of 20 March 2020.

Conclusion

We are now materially bullish on a longer-term horizon following the aggressive repricing of market spreads and believe that the market is now offering a rare value opportunity in HY.

1. Based upon internal models and research. Data available upon request.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.