Introduction

Opportunity is everywhere.

This, in our view, is especially true for an actively managed high yield (‘HY’) bond portfolio, which may offer investors a number of benefits throughout the business cycle, including: diversification, an attractive and reliable source of income and low duration.

The Business Cycle

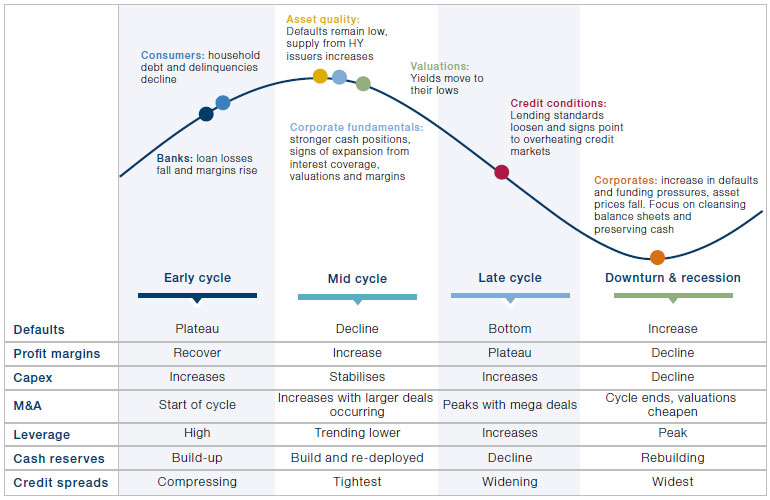

In the early phase of the cycle, high yield tends to perform well and has historically outperformed other risk assets as default rates fall, credit spreads tighten and volatility trends lower.

A business cycle generally follows four stages: early; mid; late; and downturn and recession. We believe that HY opportunities can be found throughout the cycle for those who are willing to do the detailed bottom-up work.

In the early phase of the cycle, HY tends to perform well and has historically outperformed other risk assets as default rates fall, credit spreads tighten and volatility trends lower. HY issuers typically work to improve their balance sheets in this phase of the cycle and benefit from the overall lift in economic activity.

Similarly, during the expansionary mid cycle phase, economic and credit conditions continue to improve, and lenders are more willing to offer capital while borrowers have increased confidence to take on the additional liabilities. Typically, central banks would tighten policy as the cycle moves into the latter stages and we believe HY bonds would continue to perform well in this backdrop given their lower duration.

In a downturn, economic activity slows, and lending conditions tighten, thus making it more challenging for businesses to service their debt. HY credit would typically find this market environment challenging given the flight to safe-haven assets such as government bonds. However, we believe opportunities can still be found in this environment and it is key to seek out issuers with robust business models, that have positive cash flows and are well-positioned to navigate a market slowdown. The Covid-induced market sell-off in 2020 is a prime recent example of this, where many issuers were oversold and downgraded despite having attractive fundamentals, in our view, and as a result have gone on to perform strongly. Furthermore, a downturn can offer HY investors the opportunity to invest in crossover credits; fallen angels which are investment grade issuers that have been downgraded to HY; and also to benefit from fundamentally good businesses where an over-leveraged capital structure is trading at distressed prices.

Figure 1. HY Opportunities Across the Business Cycle

Source: Man GLG. For illustrative purposes only.

The Importance of Active Management

Rather than packing a fund with the highest yielding bonds and hoping for the best, we believe clients are best served by fund managers who are experts in stock picking to deliver the best risk-adjusted returns.

A large number of credit managers believe that predicting the macroeconomic picture is the most important factor in order to generate alpha from investing in HY. This would entail making a top-down decision, followed by an approach of ‘filling the sector, rating or duration buckets’ with high-yielding credits. We believe this is a binary bet and defaults can (and do) occur in the HY space, which subsequently has a negative impact on performance.

In a yield-starved world, investors are increasingly comfortable with taking on additional credit risk in order to earn potentially higher returns. As a result, HY is an area of the market that is gaining further traction with investors, with many increasing their allocation to the asset class. We believe it is important for investors to look for strategies with flexibility to invest across sectors and geographies, and across the full performance spectrum of high yield, with a bottom-up focus to maximise risk-adjusted returns. Rather than packing a fund with the highest-yielding bonds and hoping for the best, we believe clients are best served by fund managers who are experts in stockpicking to deliver the best risk-adjusted returns.

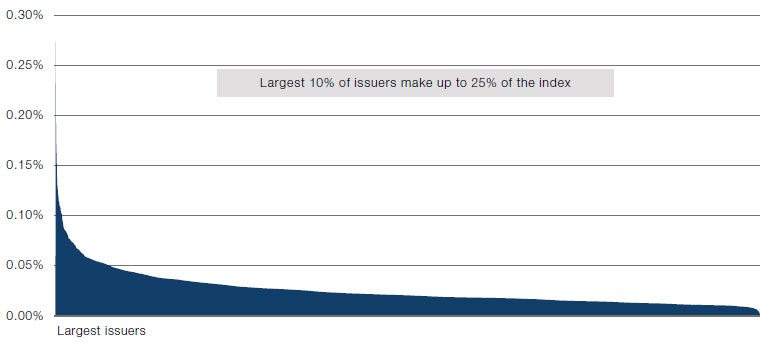

It is worth highlighting that periods of market dislocation can create top-down pricing inefficiencies in all asset classes, and this is typically driven by investor sentiment, as opposed to the underlying risk factors in the asset class. These periods are particularly important as managers with a fundamental, bottom-up approach are well-positioned to take advantage of such inefficiencies due to the idiosyncratic risk nature of HY. The market is made up of a number of privately held or small- to midcap companies, making it a fertile ground for bottom-up credit pickers. Top down and passive managers tend to focus their attentions on larger issuers which dominate the index (Figure 2), while paying little attention to smaller names which are often under researched and misunderstood.

Figure 2. Larger Issuers Dominate the Index

Source: Bloomberg; as of 31 August 2021.

Data shows weights of all issuers in the ICE BofA Global High Yield Index.

A Focus on Bottom-Up Analysis

While it is important to be aware of the macroeconomic environment, we believe a bottom-up approach should be the cornerstone of the investment approach for two main reasons.

The majority of returns from high yield bonds is income. As such, selecting the right bonds is imperative to delivering attractive returns.

First, not all parts of the credit market (or sectors, or regions) will rise (or fall) in unison (Figure 1). Being an asymmetric asset class, we believe these differing risk profiles at different points in the cycle can be best targeted with a bottom-up, highly selective and repeatable process. For example, the unconventional monetary policy implemented by major central banks in recent years has led to an environment of artificially repressed yields with investors generically starved of income from their bond investments.

A bottom-up approach is, in our view, more important at this stage in the cycle as it provides access to more idiosyncratic alpha sources, while top-down tends to become crowded.

Second, the majority of returns from HY bonds is income. As such, selecting the right bonds is imperative to delivering attractive returns. Bottom-up credit selection – with due consideration being placed on the structure of the issuer, the supply chains, financing, revenue streams, customer bases, manufacturing processes, research and development, governance and management styles – helps conduct a rigorous analysis of an issuer’s solvency and ability to meet its debt obligations.

Where We See Opportunities

Cyclical reflation themes have been challenged over the past few months, as a number of factors including peak growth, the delta variant and the beginning of Fed exit have all conspired to reduce the market’s enthusiasm. We believe the curb has been overdone and the market has gone from worrying too little to worrying too much about global cyclical risks in our view. We see potential opportunities and attractive entry points back into cyclical assets and their re-emerging outperformance in the second half of the year. An example would be the energy sector which was indiscriminately impacted by the Covid-induced selloff, combined with the collapse of OPEC+. The sector is now experiencing supportive tailwinds along with other Covid-impacted sectors.

Conclusion

The HY market has historically offered investors compelling opportunities through the business cycle, particularly during recovery and expansionary phases. Given that the market is highly diverse, with many companies being private, it also requires strong analytical resources. Contrary to other participants, we believe that a topdown lens should be a secondary driver when investing in HY bonds, while bottom-up fundamental analysis should be the primary driver of performance.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.