Introduction

From higher commodity prices to increased investment spending to improved trade balances, inflationary conditions are likely to act as a tailwind to EM equities.

Inflation. Regardless of whether you think it’s transitory or persistent, what is undebatable is that the combination of expansive monetary and fiscal policy has changed the risks of an inflationary outcome versus the past 15 years.

This increased risk of an inflationary outcome is positive for emerging-market equities, in our view. From higher commodity prices to increased investment spending to improved trade balances, inflationary conditions are likely to act as a tailwind to EM equities.

Why Emerging-Market Equities Now?

There are four main reasons we believe an inflationary outcome is positive for emerging-market (‘EM’) equities.

First, EM equities are a beneficiary of leading inflation. Despite the complete transformation of EM investable universes over the last decade, this inflationary relationship is immediately apparent when looking at the long-run performance of the MSCI EM Index and commodities. Since the inception of the asset class, EM equity has tracked commodities (Figure 1). And as we’ve written previously, industrial commodities have the best real returns through periods of rising inflation.

Source: Bloomberg; as of 28 July 2021.

Problems loading this infographic? - Please click here

Second, if policymakers can successfully engineer a persistent shift in inflation expectations, this should have a profound positive effect on investment spending, which has been on a downward trajectory since the 1980s driven by ever lower expectations of nominal GDP and an orthodoxy of limited state expenditures since Ronald Reagan (Figure 2).

Source: Bloomberg; as of 28 July 2021.

Problems loading this infographic? - Please click here

An expansion in investment spending in developed markets is manna for emerging markets.

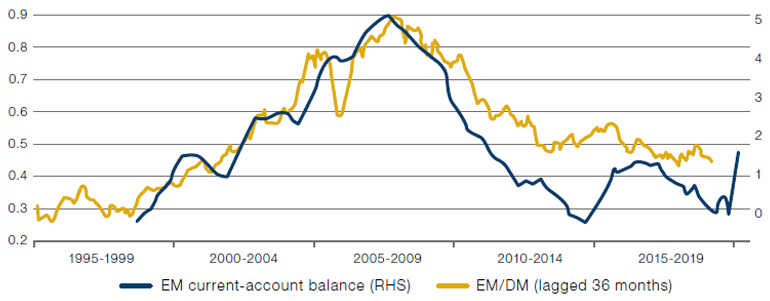

An expansion in investment spending in developed markets (‘DM’) is manna for EM. EM economies are largely export-oriented and open. If DM economies are investing, they are typically buying capital equipment and intermediate goods, trade is growing and DM external deficits are expanding. The flipside of that is the EM surpluses expand, benefiting EM equities relative to DM (Figure 3). On a standalone basis, the growth in trade is a support for EM earnings (Figure 4).

Figure 3. EM External Surpluses Are a Support for EM Equities…

Source: Bloomberg; as of 7 July 2021.

Source: Minack Advisors; as of 15 July 2021.

Problems loading this infographic? - Please click here

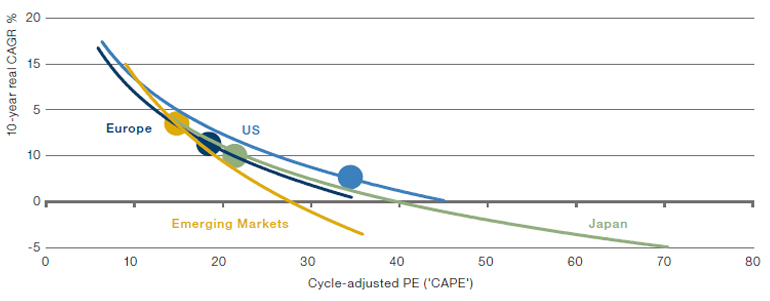

The conditions described above have been notably absent since the Global Financial Crisis. While we cannot be sure if the global inflation regime is truly changing, we can confidently say that the benefits of balancing allocations to help insure against the risk makes sense. As well as the tailwinds that growth in trade and investment may bring, EM equities are relatively cheap compared to other regions (Figure 5).

Figure 5. Valuation and Subsequent Returns for Regional Equities

Source: Minack Advisors; as of July 2021.

Note: MSCI indices, USD terms. EPS and price index deflated by US CPI to calculate CAPE. Total return is in USD deflated by US CPI. Data from 1980. Japan returns are in yen terms. EM data from 1998. MSCI EPS series linked to IBES trailing EPS. Dots show current CAPE.

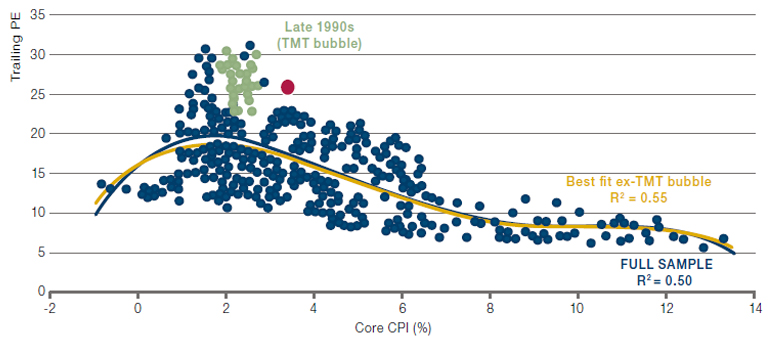

EM equities being relatively cheap may prove to be a material advantage if higher inflation does materialise, as inflation is inversely correlated to price/ earnings ratios.

In fact, EM equities being relatively cheap may prove to be a material advantage if higher inflation does materialise, as inflation is inversely correlated to price/earnings (‘PE’) ratios (Figure 6). PE multiples are currently most elevated in the US. With this rise in inflation, would you rather be holding US equities, which are at risk of multiple contractions; or EM equities, which are relatively cheap compared to US and other developed-market equities? We know where we’d rather be…

Figure 6. US Equity Trailing PE and Core Inflation

Source: Minack Advisors; as of 17 July 2021.

Note: Latest observation marked in red. Operational earnings from 1988. Monthly data from 1955.

We acknowledge that there has been a spike in US dispersion during the pandemic, but we believe this is a transient spike, and that dispersion will favour emerging markets once again as it has historically.

Finally, and this is not an argument for now per se, EM equities offers a persistently higher level of dispersion versus other regions (Figures 7-8). We acknowledge that there has been a spike in US dispersion during the pandemic, but we believe this is a transient spike, and that dispersion will favour emerging markets once again as it has historically. Durable alpha ultimately relies on the breadth of independent bets, and the higher dispersion in EM stock returns underpins this rich alpha opportunity. If that is combined with a robust beta opportunity, we believe it’s a highly compelling prospect.

Source: Bloomberg, Man Numeric; as of 1 June 2021.

Problems loading this infographic? - Please click here

Source: Bloomberg, Man Numeric; as of 30 June 2021.

Problems loading this infographic? - Please click here

Other Considerations for Investing in EM Equities

As investors weigh up the likelihood of persistent inflation, one thing at least is clear: history indicates that inflationary outcomes benefit emerging-market equities.

While we do believe that the increased risk of an inflationary outcome is positive for emerging-market equities, there are some considerations to bear in mind.

First, the MSCI Emerging Markets Index is becoming increasingly concentrated: not only has China grown as a percentage of the overall market (from 20% in 2015 to 50% now), but more than 30% of the index consists of a handful of names. This has ramifications for the investment processes and portfolio construction. As such, managing portfolio risk relative to the benchmark as it pertains to position sizing as well as industry, sector and country allocation becomes a lot more critical, in our view.

Second, geopolitical issues are always simmering in the background in EM. One needs to look no further than the most recent actions taken by the Chinese government to improve social welfare and its impact on financial markets. News of the Chinese government’s call to restructure tutoring firms as non-profits had far reaching implications, affecting equity prices that extended beyond the USD120 billion private tutoring industry. Turkey is another recent example where a deterioration of economic fundamentals and restriction on foreign capital flows resulted in profound impacts on equity returns. We believe having an increased eye towards risk management is required when investing in emerging markets.

Conclusion

As investors weigh up the likelihood of persistent inflation, one thing at least is clear: history indicates that inflationary outcomes benefit emerging-market equities. From higher commodity prices to increased investment spending to improved trade balances, inflationary conditions may act as a tailwind to EM equities.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.