So, how hawkish will the Federal Reserve go? Even the more traditionally dovish Fed members have had little choice but to pivot away from rate cut rhetoric as inflation data shows few signs of returning to the 2% target any time soon.

Even with the economy growing at a less than expected 1.6% annualised rate in the first quarter, policy makers’ focus should be firmly on prices.

The pivot from the Fed closely follows a trend of higher-than-expected core inflation rates. This development is concurrent with the easing of financial conditions since November 1 when the Fed signalled it was done hiking, as suggested by the Goldman Sachs Financial Conditions Index (Figure 1). Looser financial conditions have boosted economic activity which is stalling any disinflationary trends.

Problems loading this infographic? - Please click here

It's worth noting that the disinflation observed in the latter half of 2023 can, in our view, be largely attributed to the delayed effects of falling energy costs.

Fed’s Conundrum

The Fed now finds itself in a conundrum. It cannot easily revert to a strategy of cutting rates due to the dwindling impetus that had energised the recent rally in risk assets and rates since the November 1 pivot away from raising rates. The factors that fuelled this rally, such as the extension of Money Market fund durations, cannot be replicated given the increasingly two-sided nature of rate risk, and the Fed reverse repo has been exhausted.

In order to navigate these challenges and ensure a smoother USD curve volatility, the Federal Reserve and the Treasury might resort to three potential strategies:

- Slowing or halting quantitative tightening, which is expected to commence in June.

- Secondly, although less probable at this stage, a strategy might involve adjusting bank regulations to treat US treasury holdings more favourably.

- The most plausible strategy involves the Treasury announcing a decrease in long-term treasury issuance during the upcoming quarterly refunding announcement on May 1st.

The economic data released over the past month doesn't provide any reassurance about the disinflation process. Even absent stable energy prices, as we had noted earlier, we had anticipated inflation acceleration. Indeed, energy prices are now nearing mid-2023 peaks. Furthermore, the transportation sector, previously a driver of disinflation, is now contributing to rising inflation. The CPI index further corroborates this trend, showing a monthly inflation rate slightly over 0.25% (or 3% annualised).

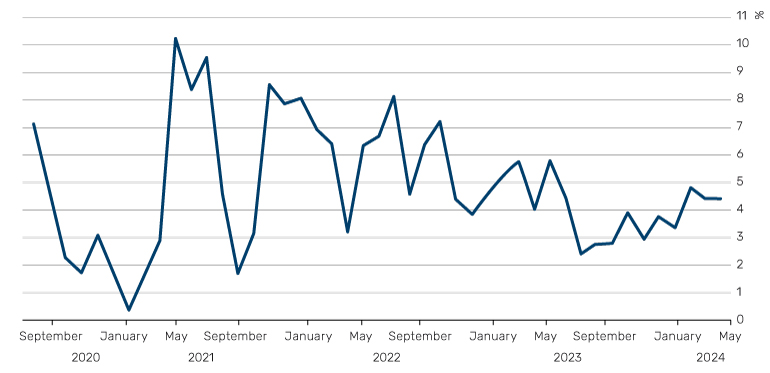

This trend of rising inflation undermines a previous key argument by FOMC members in favour of cutting rates. Core CPI, which had briefly fallen below 3% annualised in mid-2023, is now above 4%, within the range of inflation numbers that we observed in the second half of 2022 when the Fed was hiking at 75bps per meeting (Figure 2).

Figure 2: Core inflation does not signal rate cuts

Source: Macrobond

Adding another layer of complexity to this scenario, home price inflation has accelerated, while rental inflation hasn't decelerated as much as expected. These trends pose a serious challenge to the Fed's objective of reaching its 2% inflation target, especially with the widening divergence between home prices and rental costs.

Looking ahead, while we believe it is likely that the US Treasury will announce a reduction in the duration of US treasuries to be issued in the next two quarters, this move is unlikely to trigger the same flow to extend duration by money market funds that we saw in late 2023. Such a development could potentially exacerbate the inflation outlook, heightening the risk that the Fed will have to tighten monetary policy further. Moreover, any attempts to support risk asset markets for electoral purposes by reducing issuance duration could prove problematic, as such a move would need to be fully reversed post-election, potentially during a period of tightening fiscal stance.

All sources Bloomberg unless otherwise stated.

With contributions from Guillermo Ossés, Head of Emerging-Market Debt (‘EMD’) Strategies at Man Group, Maria Cal, Product Specialist on the EMD team, Man Group.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.