After more than two-and-a-half years of interest-rate hikes aimed at taming pandemic-driven inflation, the Federal Reserve (‘The Fed’) is set to reduce rates at next week’s meeting. Chairman Jerome Powell and his colleagues now face the task of balancing efforts to reduce inflation with safeguarding the US job market.

Optimists might view lower rates as a stimulant for an economy that has mostly avoided recession. Pessimists will observe weakening data, declining earnings, and expensive assets.

The question, now, is how big the cut will be. Last week’s weak jobs and ISM data (the purchasing manager’s index) won’t guarantee a 50-basis point cut. In part, this is because we expect Powell to exercise caution so close to the election, lest the decision looks politically motivated. Mainly, though, it is because a 50-basis point cut is rare outside of market crises. Here, we look at effects in key markets and how investors can protect their portfolios.

Private Credit: Balancing relief and risk in the US

The year so far has not been plain sailing for the private lending market. “Higher for longer” interest have increased liquidity stress among portfolio companies and all stakeholders have been asked to step up their support. Recent market data shows that amendments to loan terms have involved adjustments in cash and payment-in-kind interest, sponsor infusions, maturity extensions, and covenant holidays to support borrowers through the high-interest environment.

Fierce competition for high-quality assets has driven credit-spread and fee compression, modest deterioration in deal structures, and weaker documentation standards. The reopening of the broadly syndicated loan (BSL) market and ample dry powder further contributed to the loosening of lending standards.

We think that the impact of rate cuts on US private-sector credit will likely be a mixed bag. While a lower base rate could offer some relief to companies who borrowed by easing interest burdens and improving cash flow, the competitive environment and pressure on spreads and fees means lenders will face tighter margins and must carefully manage risks to maintain profitability.

On the surface, historically low credit spreads might give investors a false sense of security as lenders rush to allocate available funds. Managers may be forced to consider proactive spread reductions to retain strong credits in an ultracompetitive market, despite tightening spreads and fee compression squeezing overall returns. This approach may contrast with the reality of increasing default rates.

Investors who focus on middle market companies have had an easier time. They may expect to benefit from the relative stability and higher spread premiums in this segment compared to the more volatile broadly syndicated loan market. As of the second quarter, middle market direct lending term loans commanded a spread premium of about 100 basis points over middle market syndicated term loans, wider than the historical average.

Problems loading this infographic? - Please click here

As the Fed embarks on its rate-cut path, managers will increase their focus on revenue and earnings growth during economic slowdowns; as well as critical metrics like interest coverage and fixed charge coverage to assess potential business models.

Staying close to the portfolio companies and being aware of the latest developments is critical to mitigating downside risk and preserving recovery values early on.

Discretionary Equities: All eyes on Asian central banks

The anticipated cut will have a significant effect on emerging markets, particularly Asian economies. Many of these countries, particularly in Southeast Asia, have been in a position to cut interest rates for a while, but have been constrained by concerns over potential domestic currency weakness. This expected action by the Fed provides greater flexibility for central banks to initiate their own easing cycles without the fear of negatively impacting their currencies.

Even China has maintained a restrictive monetary policy to preserve the renminbi's value despite economic challenges. With the Fed leading the way, we expect these banks to follow suit, as evidenced by the Philippines starting its cutting cycle in mid-August. We also anticipate a more dovish stance in China now that there is greater clarity on the direction of Fed policy rates.

Historically, the performance of Asia ex-Japan following a Fed rate cut hinges on the US economy's ability to avoid a recession. However, even if US economic growth continues to weaken, select markets in the region may still benefit from lower interest rates as local demand conditions improve. In this scenario, we expect China and certain Southeast Asian economies to outperform, driven by a rotation out of global cyclicals into domestic cyclicals.

Systematic Investing: Navigating cuts with a risk-balanced portfolio

In recent history, many investors have viewed equities and bonds as a diversifying combination given their often-negative correlation, giving rise to the widely known ‘60/40 benchmark’ (which allocates 60% to equities and 40% to bonds on a notional basis). However, this allocation heavily skews risk towards equities, which can be problematic during cutting regimes.

Over the past two decades, rate cuts have tended to predicate structural issues in the economy (think the dot-com bubble, the Global Financial Crisis), which may not be conducive for strong equity performance. Even without structural issues, risk assets can underperform during rate cuts as, by definition, they follow a period of financial tightening. On the flip side, cutting cycles generally benefit bond holders as falling yields mean rising prices.

It’s reasonable to question if past insights apply today, given the unique market dynamics. While we can't predict the future, we believe in the predictability of risk. By using a more flexible approach that combines equal risk targeting with active risk management, investors can potentially improve returns while maintaining a similar risk profile to a traditional portfolio.

Perhaps considering a risk-balanced approach is more relevant than ever given the imminence of a rate cutting cycle, particularly as it typically demands higher bond exposure than 60/40, given the historically low volatility nature of the asset class.

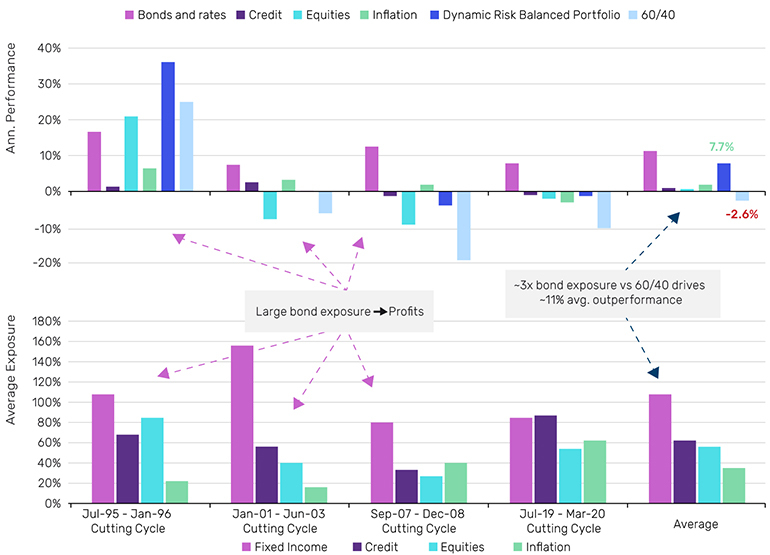

To test the efficacy of this proposition, in Figure 2 we compare the performance of a dynamic risk-balanced portfolio to that of a static 60/40 over the last four rate cutting cycles. These are defined as peak-to-trough periods of the Fed Funds Rate.

Figure 2. Dynamic risk-balanced portfolio exposure during cutting cycles

Past performance is not indicative of future returns. Data to end H1 2024

Source: Bloomberg, Man AHL internal data base.

Figure 2 illustrates the benefit of a risk-balanced approach in such an environment, outperforming 60/40 in all four of the most recent cutting cycles. To compare performance across different rate-cutting cycles, we annualise the returns from each period. Our analysis shows that, per year of rate cuts, the dynamic risk balanced portfolio returns +7.7%, while the static 60/40 portfolio loses -2.6%, an outperformance of 10.5%. Although there are many factors contributing to the outperformance, such as asset diversification and active risk management, a common theme emerges across each cycle – an outsized exposure to the asset class which profited in every instance: bonds.

With bond volatility at multi-decade highs, a plausible rhetoric would suggest that a risk-parity investor would enter this cutting cycle with a comparably smaller fixed income exposure, stifling the portfolio’s ability to capture outsized profits as before. We believe that this observation can be countered by the introduction of active risk management techniques as an integral foundation of the investment process.

By regularly monitoring market volatility, inter-asset correlations and price momentum, exposures can remain dynamic and reactive, providing the portfolio with the necessary speed and confidence to quickly scale up exposures and capture the rally.

All data Bloomberg unless otherwise stated.

With contributions from Adam Singleton, CIO, External Alpha, Solutions, Andrew Kurtz, Vice President, Private Markets, Man Varagon, Nick Wilcox, Managing Director, Discretionary Equities, Tarek Abou Zeid, Senior Client Portfolio Manager at Man AHL and Max Buchanan, Client Portfolio Management Analyst, Man AHL.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.