A year is a long time in markets. Winding back the clock to October 2022 we had one of the most prophesised recessions in modern investing history. The American Association of Individual Investors (AAII) has been tracking sentiment since the 1980s. In October 2022 bearish sentiment hit levels last seen since the GFC. That recession failed to materialise and since then markets have largely weathered a deteriorating macro-outlook. Looking ahead though, how will macro-sensitive sectors, particularly European capital goods, machinery and industrials, which are the region’s biggest employer, fare?

Figure 1. AAII Bearish Investor Sentiment surged last year

Problems loading this infographic? - Please click here

Source: Bloomberg and AAII.

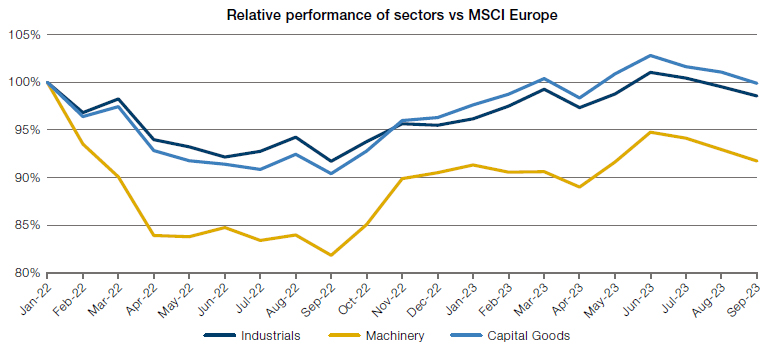

Last year, they had already traded down versus the broader market, anticipating a slowdown. What followed in November was a sharp risk rally from a position of extreme sentiment aided and abetted by expectations of a powerful re-opening of the Chinese economy. Some investors may have dismissed this as a temporary trend, but the market disagreed, driving broad industrial indices above their 2022 highs as it embraced the soft landing (or no landing) narrative.

Figure 2. Markets still expecting a soft landing

Source: Bloomberg.

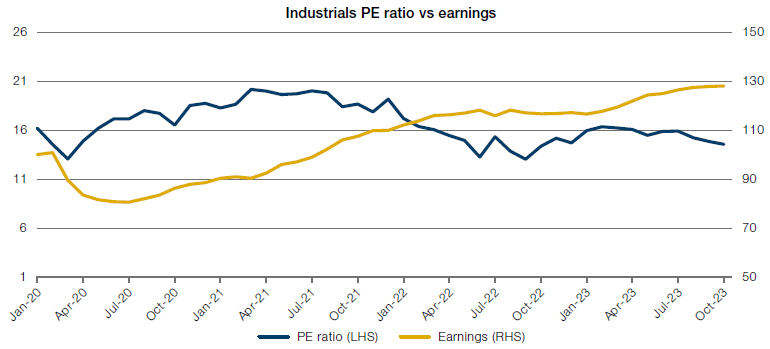

The upward move has been warranted based on realised outcomes. Earnings expectations have reaccelerated through 2023 versus a flat 2022. Profits have held up better than people expected despite higher interest rates and a progressively diminished impact of the Chinese re-opening against initial high hopes.

Figure 3. Profits have held up better than expected

Source: Bloomberg.

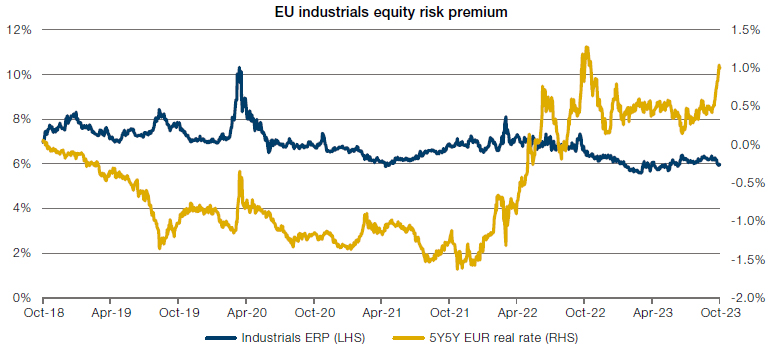

Some investors would argue that a falling PE ratio suggests the market has already started to embed lower profits going forward. Decomposing the valuation, industrials remain expensive based on equity risk premium (the difference between expected earnings yield and intermediate-duration real rates i.e. how much am I getting paid to own equity over a risk-free asset in real terms).

Figure 4. Industrials remain expensive based on equity risk premium

Source: Bloomberg.

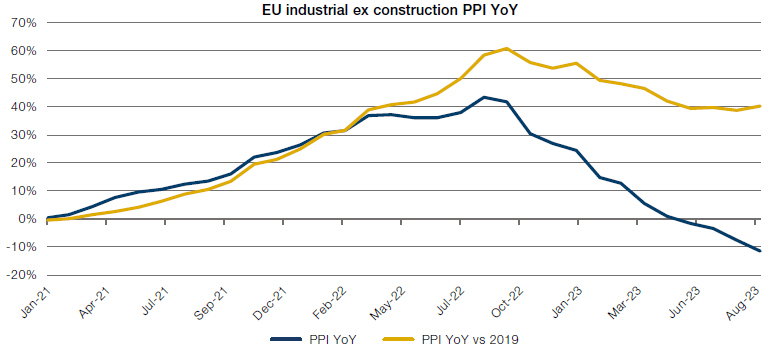

Discussions with corporates in Q4 last year were indicative that 2023 was going to be a strong year for pricing catch-up. Many corporates had already started to drive extraordinary price increases in summer 2022 to handle energy, labour and raw material inflation and this pricing has flown through with gusto in the first half of 2023.

However, this is not the entire story. As pricing went up input costs (excluding labour) have generally declined or at least moderated. Positive revenue growth emanated from pricing on flatter volumes and margin expansion from positive price-cost.

Figure 5. Producer Price Inflation is slowing

Source: Bloomberg.

A year on, the story looks very different. The AAII recession gauge has retreated but several shoes may be about to drop for Europe’s industrial sector. Macroeconomic uncertainty remains high and geopolitical turmoil has increased.

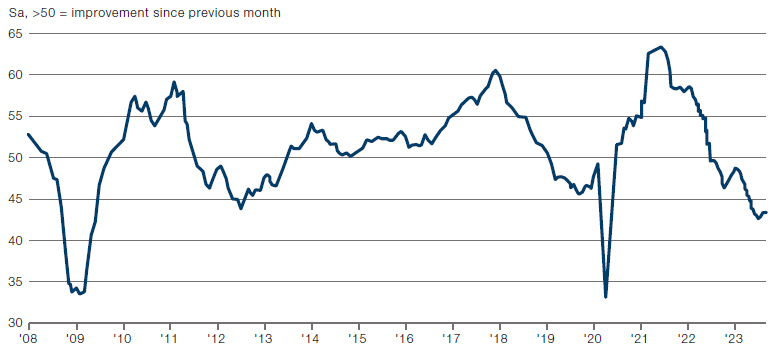

Europe’s Purchasing Managers’ Index (PMI) has made grim reading for a while but up to now backlogs have been supporting volumes and employment.

However, with new orders remaining elusive and backlogs cleared, companies have started to make workers redundant, instituted hiring freezes or are ramping up short-term contracts. The PMI new orders component declined at one of the steepest rates in the survey’s 26-year history in September and exports also remained weak.1

Figure 6. European Manufacturing slumping from a post-Covid bounce

Source: HCOB, S&P Global PMI.

Manufacturing may only account for about a fifth of EU value-add output2, but it’s the bloc’s biggest employer,3 therefore strongly tied to the economy.

It’s not all doom and gloom and there are some resilient spots for investors, including suppliers to the oil and gas industry as fossil fuel companies refit their plants to meet their emission reduction targets4. Demand for copper and other metals is shored up by new-energy sectors5 and catching up after years of underinvestment. The automotive industry has also shaken off its component shortage chokehold and demand has rebounded with companies and car hire firms turning over fleet stock.

In this environment of uncertainty and high interest rates, company fundamentals really matter and defensive stocks with good balance sheets should continue to do well. Also, the macro-sensitivity of the sector also means that if more stimulus is forthcoming, the outlook for these better-quality companies tends to ramp up rapidly.

With contributions from Jamie Lewis, Senior Analyst, GLG Euro Midcap.

1. https://www.pmi.spglobal.com/Public/Home/PressRelease/a008adc6781e44e48e77db10d6657249

2. https://ec.europa.eu/eurostat/statistics-explained/index.php?title=National_accounts_and_GDP#Gross_value_added_in_the_EU_by_economic_activity

3. https://www.cedefop.europa.eu/en/tools/skills-intelligence/sector-employment-occupations?year=2021&country=EU#1

4. https://www.bloomberg.com/news/articles/2023-10-02/oil-industry-to-act-on-methane-and-flaring-cop28-chief-says

5. https://www.bloomberg.com/news/articles/2023-10-09/copper-extends-rebound-from-11-month-low-as-china-returns

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.