In 2023 it has been liquidity dynamics, rather than fundamentals, that have arguably driven financial assets. Any narrative around what is driving prices has been formed by market participants rationalising price moves after the fact. When yields have been soft, consensus has been for a soft landing. When less supportive, markets’ focus has shifted to disappointments in inflation, activity and labour market readings. Underlying these factors, however, is the overwhelming amount of liquidity – both in terms of flows and stock – that has been the actual driver of price moves. What happens when this liquidity support starts to reduce? At that point, it’s likely that markets will be able to price risks more accurately once more.

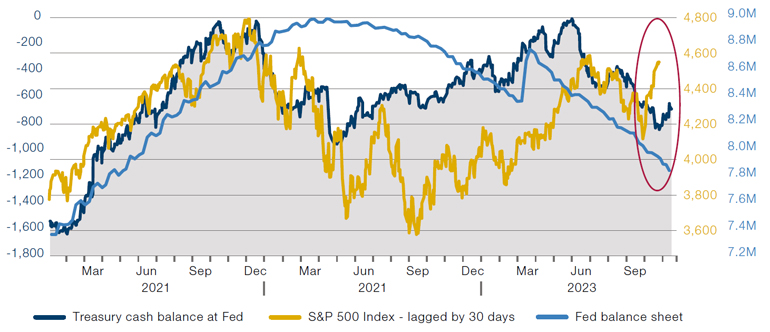

Figure 1 shows that when the Treasury cash balance deposited at the Federal Reserve (Fed) decreases (inverted in the chart), this supports risk assets, using the S&P 500 Index here as a proxy. This drop happens especially when the government reaches the debt ceiling and cannot inject the organic increase in duration typically observed during normal times. When the debt ceiling limits are rolled over, Treasury issuance accelerates and the duration injection increases.

Rinse and repeat…

Digging into recent data, over 2021, the combination of a Treasury liquidity boost (approximately $1.6 trillion between early January and late December) and growth in the Fed’s balance sheet (roughly another $1.6 trillion) buoyed risk assets. However, when the debt ceiling was rolled over in early 2022 and the Treasury replenished its cash account at the Fed, quantitative easing made way for tightening, leading to selloffs. This cycle repeated between October 2022 and June 2023, coinciding with fluctuations in the Treasury cash account and the subsequent selloff after the debt ceiling rollover.

Figure 1: Relationship between the US Treasury general account (inverted), the Fed’s balance sheet and S&P 500 performance

Source: Bloomberg, as of November 24 2023.

Until the correlation breaks down

As indicated by the red oval in Figure 1, this correlation seems to have recently broken down. Market consensus is that the data released in recent weeks suggests a soft landing is nearly certain, justifying the near-record highs in equities and tight spreads, as well as Treasury yields falling by some 50 basis points in the middle and longer ends of the curve.1 Around 90 bps of rate cuts are now priced in over the next year, with the first one likely by May 2024. The rationale? The Fed will need to cut rates as inflation converges to the 2% target to prevent a significant increase in real rates and thus monetary tightening.

Another argument is that the US economy will experience a recession driven by a reduction in fiscal stimulus, with the private sector unable to step in to take up the slack. However, were this the case, we would expect to see yields and equities both down, rather than yields down and equities up.

Can the rally last? High-frequency trading may hold the answer

A simpler, although unproven, hypothesis to explain the rally in equities and bonds since 22 October is that the activity of high-frequency trading strategies (CTAs, algorithms etc.), which now account for a significant portion of daily volume, overwhelms the actions of longer-term investors focused on fundamentals.

The sharp increase in Treasury yields around 23 October was a consequence of the liquidity withdrawal resulting from the debt ceiling rollover in early June and the Treasury’s announcement in August of increased note and bond issuance that began in September. As we approached the October peak, several FOMC members said that the steepening yield curve was tightening financial conditions, which could reduce the need for further hikes. Following this, on 1 November, the US Treasury announced a reduction (albeit small) in the future issuance of Treasuries relative to market expectations. This triggered significant acceleration in the decline in yields which, combined with the idea that an expectation of increased labour participation could temporarily boost economic growth potential beyond long-term levels. If this holds, the Fed may take the risk of not hiking further.

Between 1 November and 21 November, inflation, labour and activity releases indeed supported this idea of disinflation. However, initial claims data, Michigan sentiment, and inflation expectations released during Thanksgiving week are the first data points that challenge this view. Based on analysis of CTA returns, most short rate positions have been unwound, equity exposure has been added, and credit exposure remains high, arguably setting the stage for another upward move in yields. And if yields do start rising again, a near-term reversal of the recent rally in risk assets seems likely.

With contributions from Guillermo Ossés, Head of Emerging Market Debt Strategies, Man GLG.

1. Source: Bloomberg.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.