Inflation and Equity Margins

Traditionally, equities have been thought to provide some respite from inflation. Because their cashflows are not fixed, equity holders should receive a stream of earnings positively geared to inflation. As inflation rises, so do earnings.

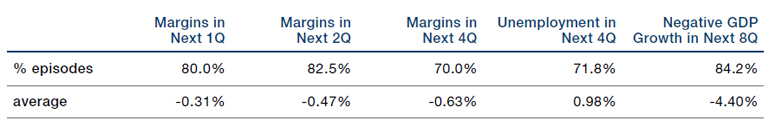

However, while headline earnings may rise, margins do not survive inflationary periods intact. Our analysis of five periods since 1960 – when annual CPI was above 4% and rising – indicates that US companies are unable to fully pass on costs to consumers. On average, margins contract by 0.63% over four quarters, a significant decline (Figure 1). Only during the very start of the Reagan’s Boom (which lasted from 1987-90) did margins avoid contraction, and this period still ended with negative GDP growth.

At the same time, unemployment tends to rise following inflationary spikes. In our view, this indicates that companies tend to use one of the only levers available to them to defend margins. With input costs rising, headcount reduction is one of the few ways corporates can defend margins during an inflationary squeeze, although this in turn contributes to the likelihood of negative GDP growth.

Figure 1. US Corporate Margins, Unemployment and Negative GDP Growth During Inflationary Periods (1960 – Present)

Source: Man Group, Bloomberg; as of 12 April 2022.

The Antidote to Oil Supply Fears

Russian oil output losses were expected to average 1.5 million barrels per day in April, doubling to almost 3 million barrels a day in May, according to the International Energy Agency. In addition, the Organization of the Petroleum Exporting Countries said it would not pump more crude to replace expected supply losses from Russia.

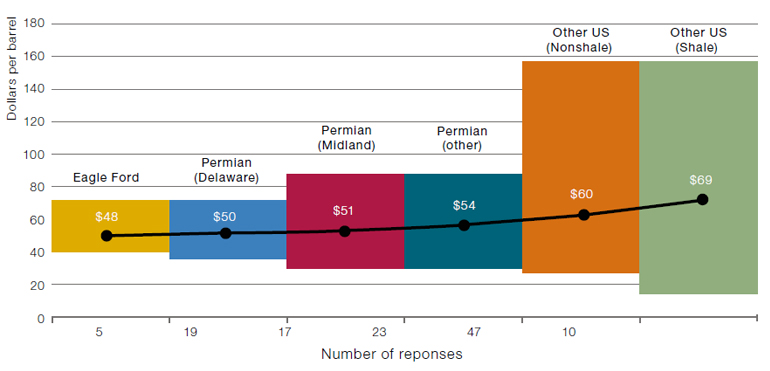

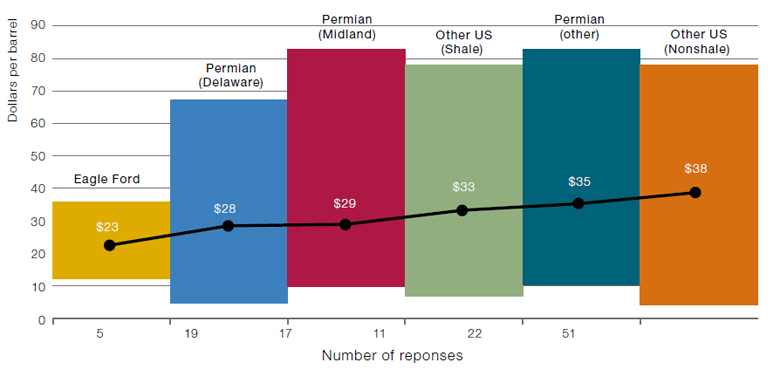

However, there is one ray of hope in the oil supply market: the US. According to a Federal Reserve Bank of Dallas survey1, the current price of USD100/barrel exceeds the break-even prices of both new and existing wells across onshore US (Figures 2-3).

Unsurprisingly then, that the respondents to the survey said they intended to ramp up oil production. Indeed, half of the large firms surveyed said they intended to increase production by at least 5%. This trend is even more pronounced for small firms, with three-quarters of those surveyed intending to increase production by at least 5%.

Taken together, the results of the survey show one thing. With the oil price at its current level, US producers are going to drill, and supply – at least from the US – should start to ramp up.

Figure 2. Break-even Prices of New Wells Across Onshore US

Source: Federal Reserve Bank of Dallas; survey conducted 9-17 March 2022.

Note: Bars show range of responses; line shows the average.

Figure 3. Break-even Prices of Existing Wells Across Onshore US

Source: Federal Reserve Bank of Dallas; survey conducted 9-17 March 2022.

Note: Bars show range of responses; line shows the average.

Rising Yields: The Return of Earnings Power and the End of Some Beautiful Relationships

Some things just go together. Love and marriage. A horse and carriage. And until recently, European banks and 10-year bund yields. When bund yields went up, so did the European banks index, largely predicated on the fact that higher yields improved net interest income (Figure 4).

However, bund yields are now rising while European banks have fallen. This is partly due to investors discounting the end of the cycle, when they expect a deterioration in credit quality.

We see a similar relationship breakdown when it comes to 10-year Treasury yields and consumer staples. Staples are traditionally negatively correlated to yields: as higher multiple companies, they tend to have a larger part of their valuation in the terminal value component of a discounted cash-flow model. Rising yields increases the discount rate, which can reduce terminal value quite significantly – thus making staples relatively sensitive to rising yields. However, over the last five months, this relationship hasn’t held at all.

In our view, the end of these relationships is actually something of a positive. Instead of being dictated by rates and macro factors, the slowdown in economic growth is creating a situation where individual stocks are being judged on their own earnings results, rather than on an overall view on a factor or sector.

Figure 4. European Banks and 10-Year Bund Yields Have Now Decoupled

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 14 April 2022.

With contributions from: Ed Cole (Man GLG, Managing Director – Discretionary Investments)

1. Survey of about 80 exploration and production firms conducted between 9-17 March.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.