When Might the Fed Start Signalling Lift-Off?

At last week’s Monetary Policy Committee meeting, the Federal Reserve dot plot indicated that MPC members were considering interest rate rises in 2023 rather than 2024. Labour markets have been softer than expectations for a few months, so why exactly might the FOMC be thinking about lift-off?

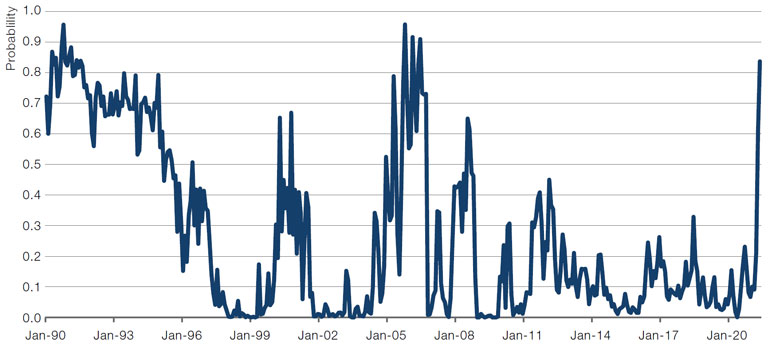

The first factor to consider is the level of core PCE, the Fed’s preferred inflation metric. The St. Louis Fed is predicting an 80% chance that core PCE could exceed 2.5% in the next 12 months, the highest since 2006 (Figure 1). The Fed targets a flexible 2% average for core PCE, so by this measure, one of the factors the Fed wants to see is quite likely to happen.

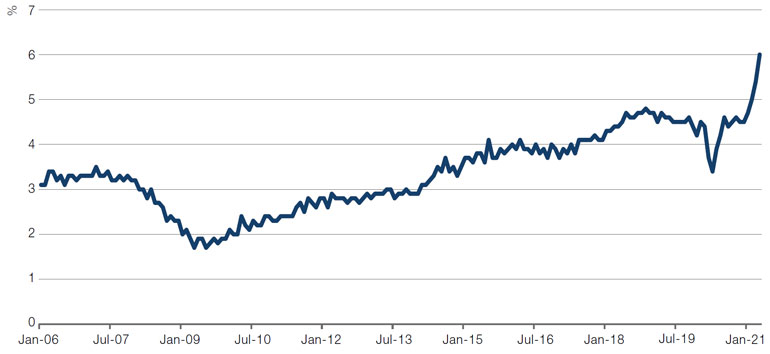

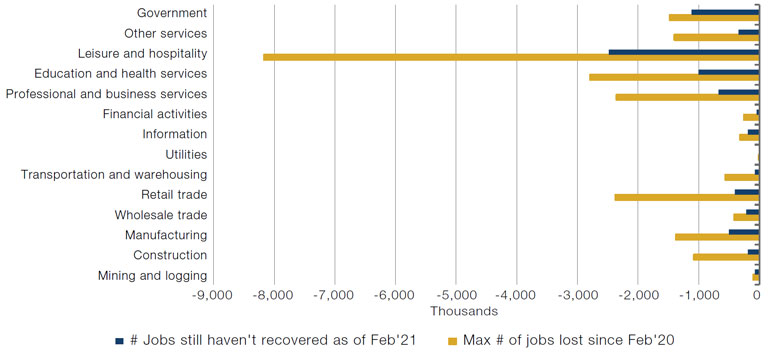

The second factor is the state of the labour market. While we have recently seen somewhat underwhelming non-farm payroll numbers, demand for labour is unimpaired (Figure 2). Demand is now higher than before the pandemic, which is remarkable given that it took around five years for labour demand to recover after the Global Financial Crisis. Figure 3 shows the maximum number of jobs lost since February 2020 versus the number of jobs yet to be recovered. About 6 million jobs are yet to be recovered as the reopening of the economy gathers pace, in sectors such as leisure and hospitality, retail and education. With approximately 16 million Americans regarded as unemployed, underemployed or discouraged from seeking working (U6 unemployment), there is significant scope for these vacancies to be filled rapidly, especially as unemployment insurance starts to roll off.

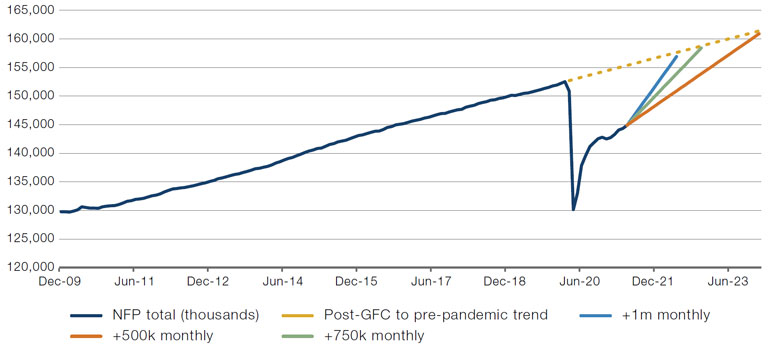

Figure 4 shows the different trajectories of new jobs that need to be created on a monthly basis to return to pre-pandemic employment trends. It is not unconceivable that 750,000 new jobs per month could be created on average. Such a scenario means that by around the second or third quarter of 2022, employment may well have fully recovered.

In summary, then, a durable recovery could well push labour markets to levels consistent with lift-off, and it’s not beyond the realms of possibility that it could come in 2022, rather than 2023, as the dots suggest. Perhaps the Fed’s deliberate attempt to be behind the curve means actual policy responses would come later. But that wouldn’t stop markets moving.

Figure 1. Price Pressures Measure

Source: Economic Research Division, Federal Reserve Bank of St Louis; as of 31 May 2021.

Figure 2. US Monthly Job Openings

Source: Bloomberg; as of May 2021.

Figure 3. Jobs Lost by Industry

Source: Bureau of Labor Statistics; as of February 2021.

Figure 4. Monthly Job Growth – Hypothetical Trajectories

Source: Bloomberg, Man GLG; as of May 2021.

The ‘S’ Crisis: Priced Out Post-Pandemic

Sharply rising asset prices have been a disquieting feature of the pandemic: everything from timber to Bitcoin has been lifted by the tide of central bank stimulus, while equity indices have shrugged off fears of inflation and many remain at or near all-time highs. For ESG investors, though, the global spike in residential property prices ought to be a key area of focus. Figure 5 ranks countries on five housing market metrics: price-to-rent ratio, price-to-income ratio, real price growth, nominal price growth and annual credit growth.

It is no surprise that countries with high population density (the Netherlands, the UK, Belgium) have high bubble scores – supply and demand dynamics would suggest no less. More concerning is the extent to which lower interest rates are contributing to bubble conditions in other major economies: France, Belgium, Australia, Canada and Italy have all seen credit growth of above 9% year-on-year.

In our view, policymakers must take note, and try to balance competing concerns. The need to stimulate economies as we move out of the pandemic means that low interest rates will persist in the short term. But by creating the conditions for a global property boom, policymakers have priced many low- and middle-income citizens out of the housing market altogether. Homes that are safe, affordable and convenient for work are an essential feature of a functioning economy. We would therefore re-iterate our previous calls for governments across the world to embrace the benefits of community housebuilding.

Figure 5. Housing Bubble Conditions

Source: Bloomberg; as of 15 June 2021.

We use standardised ratios. Values over 100 indicate that the present price-rent ratio, or price-income ratio, is above its long-run average.

Annual house price and credit growth are based on Q1 2021 or latest quarterly date available.

Blomberg Economics ranking obtained by taking an average of the z-scores of each of the five measures.

With contribution from: Ed Cole (Man GLG, Managing Director – Discretionary) and Steven Desmyter (Man Group, Global Co-Head of Sales & Marketing and Co-Head of Responsible Investing).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.