Introduction

The coronacrisis has been a unique economic event. We have seen pandemics before. We have seen equity market selloffs before. And we have seen recessions before. But the policy reaction to coronavirus of much of the developed world – lockdowns, and consequential interest rate cuts, quantitative easing and massive fiscal spending – has been unprecedented.

This has major consequences for the operating models of European banks, in our view. Banks, through their role as lenders, are both protagonists and by-standers when it comes to the coronavirus policy response.

The Debt Explosion

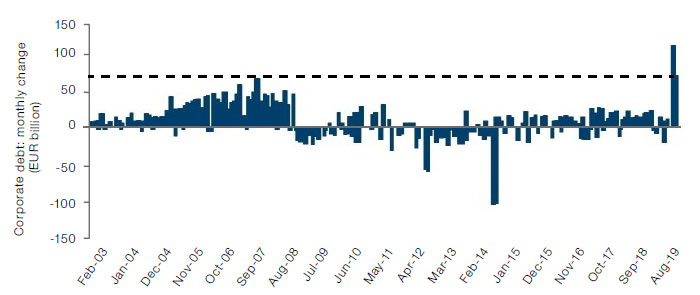

The decrease in economic activity caused by coronavirus lockdowns has resulted in an explosion of banks issuance of loans to corporates: European companies have borrowed more during April and May 2020 than in the rest of the previous decade combined (Figure 1)!

Figure 1. European Corporate Borrowing

Source: ECB; as of May 2020.

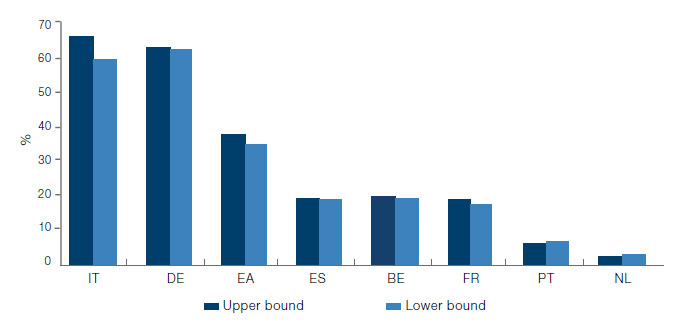

Rather than creditworthiness, we believe that borrowing at such levels is an indication of corporate desperation. Unlike in the US, most European companies borrow directly from their banks rather than tapping corporate credit markets, meaning this explosion of borrowing is held directly on the balance sheet of major banks rather than securitised in investors’ portfolios. While this could generate increased revenues, we believe that the increased lending activity is unlikely to trickle down to the bottom line. Indeed, the European Central Bank is projecting that around a third of this lending will eventually find its way on to government balance sheets as bad debt rather than remaining with banks, via a series of loan guarantee schemes (Figure 2).

Figure 2. ECB Estimates of the Share of Loan Losses Covered by Government Guarantee Schemes.

Source: ECB; as of May 2020.

Note: Estimates of loan losses generated under a range of macro scenarios, assuming full take-up.

Heads I Win, Tails You Lose

This is balance-sheet growth, but not the kind of growth that shareholders want. In an ideal world, a bank would expand its balance sheet with creditworthy loans. But bulk lending in expectation that the loans will be non-performing is not just less than ideal: it is a transformation of the economic role of a bank, from a profit-making enterprise to a subordinate instrument of fiscal policy.

This is underlined by a proposed amendment to the European Union’s Capital Requirements Regulation, which reads:

“In order to enhance the resilience of the financial sector and to strengthen its capacity to lend to the real economy in the actual crisis situation, credit institutions will suspend any kind of distribution until October 2021. Until this date, credit institutions will also suspend share buybacks and excessive bonus payments.”

This would potentially result in the elimination of Additional Tier-1 (‘AT1’) and contingent convertible (‘CoCo’) coupons and equity dividends until October 2021, as part of a raft of forbearance measures whose overall aim is to enable banks to lend more.

The logic is simple: if banks retain cash on their balance sheets by forgoing dividends, they are able to maintain higher Common Equity Tier-1 and net stable funding ratios, allowing them to lend more and still be compliant with capital adequacy regulation. In many senses, this is only an extension of existing policy. On 27 March, for example, the ECB ordered EU banks to freeze dividends until October 2020. But, by increasing the time banks may not pay dividends, and enshrining in EU law rather than as the directive of the regulator, the ultimate purpose of banks will have changed. Instead of acting in the best interests of the shareholders (as determined by management), privately owned banks will simply become the delivery mechanism for policymakers rather than autonomous agents.

There remain a number of directions in which the European coronavirus bailout could go, each with differing implications for banks.

Current proposals focus on the European Recovery Fund (‘ERF’): a combination of EUR500 billion of loans and EUR250 billion of grants, directed to European countries on the basis of population, GDP per capita and unemployment figures between 2015 and 2019. Liability for the grants is held jointly at the EU level, with liability for loans held by individual countries – an attempt to resolve the fears of northern European countries that this is Trojan Horse leading to fiscal transfers within the EU. The fund will be repaid from 2028 onwards, using a combination of:

- An extension of the Emissions Trading System to the maritime and aviation sectors;

- Carbon border adjustment mechanism;

- Own resources based on operations of large enterprises;

- A digital tax.

The upside of this proposal is that it would relieve the need for banks to extend capital to companies whose futures remain uncertain. However, flooding the market with cheap or free capital does somewhat undercut the market for profitable lending, neutering banks of one half of their business model (the other being their trading and exchange functions). Furthermore, whilst banks would receive fees for acting as agents, this would come with strings attached. It seems politically unpalatable that banks would be able to pay dividends or bonuses with these fees for acting as a nonrisk taking broker. Which politician would be keen to run for re-election if their bailout policy allowed banks to charge fees for lending the taxpayer’s money? In our view, it is more likely that fees would be severely capped, or that governments would wish for a much greater say in how banks use their profits.

Another possible option is that as part of the package or as a standalone plan, policymakers agree a series of loan haircuts on existing and future non-performing loans, combined with the creation of a bad bank, in part to mitigate the risks of using banks as delivery agents for the ERF (i.e. loading down banks’ balance sheet with bad loans). This would force shareholders to bear some losses, whilst cleansing the worst of the NPLs from balance sheets. Whilst this might ensure the long-term stability of the sector (and indeed was mooted as a solution to the structural weakness of European banks long before coronavirus), any haircut will be painful for shareholders in the short term.

A third option would be to use the ECB to provide helicopter money. This would present entirely different challenges, up to and including hyperinflation. It should be noted that in an inflationary environment, it is usually better to be a debtor than a creditor, as the value of the money paid back is worth less in real terms than the value of the original loan.

Conclusion

The legacy of coronavirus is likely to be deeply unpalatable for European banks. With banks constrained from rewarding shareholders via dividends, discouraging bailout proposals on the horizon and with their very purpose re-directed from maximising shareholder value to being delivery agents for the coronavirus bailout, it forces us to consider one question: when again will it seem attractive to own a European bank?

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.