Introduction

In September 2023, the International Capital Markets Association (ICMA) published the first guidance on blue bonds, defined by the World Bank as debt instruments issued by governments, development banks or others to raise capital to finance marine and ocean-based projects that have positive environmental, economic and climate benefits. This marked an important milestone for blue bonds, but the debt instrument remains nascent. In this article, we examine why blue bonds are necessary, the progress the debt instrument has made to date and what is required if blue bonds are to emulate the success of green bonds.

The ‘Blue Planet’

The blue economy is valued at approximately $3 trillion, which would be the equivalent of the world’s seventh largest economy in GDP terms.

Covering more than three-quarters of the surface of the planet and representing approximately 97% of the water in terms of volume, the oceans are the main reason behind the Earth’s appellation of ‘Blue Planet’.

Beyond the large scale of space they occupy, oceans are also vital for billions of people, not only in terms of habitat (40% of the world’s population live in coastal regions), but also in terms of livelihood (more than 3 billion people rely on the ocean for their livelihoods, the vast majority of whom live in developing countries1). The blue economy is valued at approximately $3 trillion, which would be the equivalent of the world’s seventh largest economy in GDP terms.2

,In addition, the oceans serve as the ‘the lungs of the earth’: not only do they produce half of the oxygen in the atmosphere, but the phytoplankton in oceans release four times more oxygen than the Amazon rainforest. The oceans also act as a carbon sink by absorbing approximately 30% of CO2 emissions, as well as having absorbed around 90% of excess heat caused by human activities.

Lagging investment flows into the blue economy

SDG 14, the United Nations’ Sustainable Development Goal covering life below water, is the most under-funded of the 17 SDGs.

In discussions about the path to net zero, emphasis is often placed on reducing greenhouse gas (GHG) emissions and developing new carbon capture technologies, but our oceans also form a key part of the solution. Indeed, there is a case for raising awareness of the importance of oceans to people’s livelihoods, as well as their role as a buffer against climate change. This lack of awareness is mirrored by lagging investment flows into the blue economy. SDG 14, the United Nations’ Sustainable Development Goal covering life below water, is the most under-funded of the 17 SDGs. The financing gap for contributions to the blue economy overall is estimated to be around $750 billion from the European Commission by 2030, and up to $5 trillion for the Asia-Pacific region. It is estimated that investing $1 across four key ocean-related actions (mangrove protection and restoration, decarbonising the shipping sector, scaling up offshore wind energy production, sustainable fishing and aquaculture) could yield at least 5% in global benefits.3 So how can investors help to bridge this gap and channel the necessary funds towards the blue economy?

Blue bonds seem an ideal tool to finance the necessary investments to achieve this goal. The World Bank defines blue bonds as a debt instrument issued by governments, development banks or others to raise capital to finance marine and ocean-based projects that have positive environmental, economic and climate benefits.

As per the latest ICMA guidelines, blue bonds can finance, but are not limited to, the following areas:

From 2018 to 2022, there were only 26 blue bonds, with a cumulative value of approximately $5 billion, which represents less than 0.5% of the sustainable debt market.

As per the latest ICMA guidelines, blue bonds can finance, but are not limited to, the following areas:

- Water supply

- Water sanitation

- Ocean-friendly and water-friendly products

- Ocean-friendly chemicals and plastic related sectors

- Sustainable shipping and port logistics sectors

- Fisheries, aquaculture and seafood value chain

- Marine ecosystem restoration

- Sustainable tourism services

- Offshore renewable energy production

Since the debut of blue bonds as an investable instrument in 2018 (the first blue bond was issued by the Republic of Seychelles, 11 years after the first green bond), the take-up has been very slow. From 2018 to 2022, there were only 26 blue bonds, with a cumulative value of approximately $5 billion, which represents less than 0.5% of the sustainable debt market.4

A still nascent debt instrument

Blue bond issuance to date has predominantly been limited to sovereigns and development banks, with a heavy emerging markets tilt, given the strong reliance of these markets on revenues related to the blue economy. Sovereign blue bonds issuance, although very promising and with a distinct environmental impact, still faces many challenges, such as high country credit risk for emerging markets issuers and weak secondary market liquidity.

Issuance in the corporate space is still nascent, with Danish energy company Ørsted the first corporate to issue a blue bond for its offshore renewable energy project. Yet, at $100 million, the bond is too small to allow flows from large institutional investors.

There is potential for blue bonds to leap some of the hurdles that green bonds initially faced.

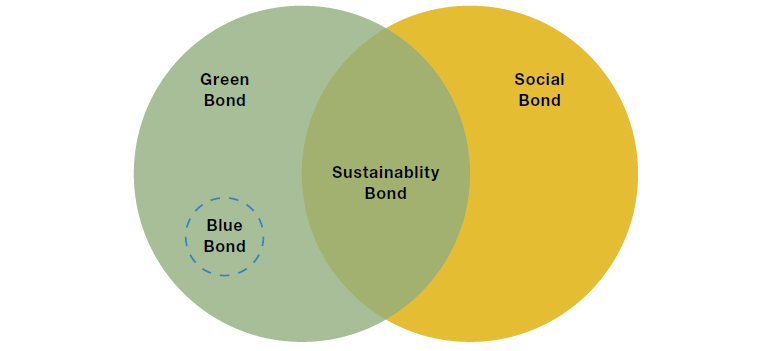

With ICMA guidance now in place, creating a place for blue bonds that is distinct but firmly within the wider green bond market (as illustrated in Figure 1), there is potential for blue bonds to leap some of the hurdles that green bonds initially faced. Arguably blue bonds can benefit from the proven and established demand for sustainable investments we see in markets today. This was one of the big challenges that green bonds faced. It took close to 12 years for green bonds to reach $1 trillion in cumulative issuance, with the Paris Agreement in 2015 a key moment for the asset class.5 It remains to be seen whether the Treaty of the High Seas (High Seas Treaty), adopted by the United Nations in June 2023, or the new ICMA guidelines for blue finance, will mark a similar watershed moment for blue bonds and whether they will allow for other bond issuers to enter the space

Figure 1. Types of Use-of-Proceeds Bonds

Source: Based on ICMA Principles.

Establishing metrics to measure impact is key

Impact reporting will also play a vital role in establishing and maintaining the credibility of the asset class.

Impact reporting will also play a vital role in establishing and maintaining the credibility of the asset class. While the green bond market predominantly concentrates on GHG emission reductions, there is not, at present, a universal metric for measuring impact in the blue bond universe. Quantifying carbon sequestration or the impact of biodiversity protection on ocean life pose a plethora of challenges. However, efforts must be made to find solutions given this will be key in establishing investor confidence in the asset class and ultimately encouraging increased issuance and wider adoption.

Conclusion

In summary, we believe the success of the blue bonds will be dependent on the following non-exhaustive factors:

- A strong framework: blue bonds are currently bundled under the ‘green bonds’ umbrella. Clear frameworks, methodologies and ringfencing on the use of proceeds must be developed. Organisations such as the ICMA, the Taskforce on Nature-related Financial Disclosures (TNFD) and the European Commission, via their taxonomy, would be natural candidates to create and/or strengthen these frameworks and to standardise their use. We have seen the first signs of this with the ICMA guidance issued in September 2023.

- A stronger pipeline of projects to invest in to address the blue economy’s financing gap.

- A wider range of debt instruments beyond those issued by sovereigns and development banks.

- Impact reporting: the blue economy not only plays a role in the livelihood of billions of people around the world, but also has a vital part to play in the climate change debate from a carbon-capture perspective, nature-based solutions as well as the decarbonisation of key sectors such as shipping. It is important to create a set of metrics to measure all these impacts, which will help guard against potential bluewashing and help to establish investor confidence in the asset class.

The world’s oceans are vital to the livelihoods of billions of people, as well as an important buffer against climate change. While blue bonds are currently in their nascence – and have a number of hurdles to overcome before they are adopted more widely – we believe they have the potential to play a key role in preserving our oceans, marine life and ultimately our planet.

1. Sources: OECD - Ocean Economy and developing countries.

2. Source: Oceans - United Nations Sustainable Development.

3. Source: Konar, M., & Ding, H. 2020. A Sustainable Ocean Economy for 2050 Approximating Its Benefits and Costs. Secretariat of the High Level Panel for a Sustainable Ocean Economy, World Resources Institute. Washington, DC.

4. Source: Bloomberg Data.

5. Source: $1Trillion Mark Reached in Global Cumulative Green Issuance: Climate Bonds Data Intelligence Reports: Latest Figures | Climate Bonds Initiative.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.