GLG RI Sustainable European Income

GLG RI Sustainable European Income (the ‘Strategy’) is a long-only, European equity income strategy with sustainability at its core from both a financial and ESG perspective.

- Managed by Firmino Morgado (+25 years’ experience) and Filipe Bergana (+15 years’ experience)

- A proven 5 year track record of managing a European equity income strategy

- Active management is paramount, the team aim to construct a high conviction portfolio of 25 to 35 positions with income sustainability at its core. The Strategy blends two dividend categories:

- Dividend Yielders – stocks that have a high, sustainable dividend (>4%) but moderate growth potential

- Dividend Growers – stocks that have a moderate dividend yield but have high growth potential (>5%p.a.)

- Focused on sustainable responsible investment having developed systematic process via a proprietary ESG tool which identifies specific targets through a science-based approach

- Deep synergies with Man GLG’s European Equities stock picking team – numerous sector specialists provide an analytical edge

Approach

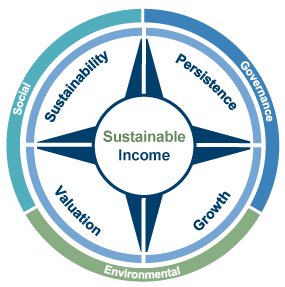

The team’s core aim is to deliver a growing sustainable income through a high conviction and concentrated portfolio that combines stocks from companies the team deem to be either Dividend Yielders or Dividend Growers. Companies are only considered if they display the following four key characteristics.

- Sustainability: cash generating business model with an ability to consistently pay dividends

- Persistence: clear dividend policy and strong commitment to honour payments embedded in the company’s culture

- Growth: potential to grow a dividend over time without jeopardizing capital solidity and financial prudence

- Valuation: attractive valuation and equilibrium between prospective dividend yield and dividend growth potential

Sustainability at the core of the investment process

The team now takes a fully dedicated approach to sustainable investing. The ESG framework has been designed to run parallel to the four-stage investment process. The investment process maintains a Science-based approach to E, S and G with analysis backed by proprietary ESG tools. The team are able to monitor relative metrics versus the overall sector and against the company’s own history.

The team prioritizes stakeholders, as it believes the long term sustainability of a company is crucially linked on creating value for employees, clients and shareholders. It firmly believes that a company’s culture of growing dividends leads to better capital allocation decisions. Their approach is to identify companies with business models that demonstrate consistent and sustainable growth potential, with management teams that are good capital allocators and reward shareholders with a growing and sustainable cash dividend. The ideal investment is one that the team will hold indefinitely, and the end goal is to have a portfolio of high conviction ideas, independent of index weights.

You are now exiting our website

Please be aware that you are now exiting the Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Group related information or content of such sites and makes no warranties as to their content. Man Group assumes no liability for non Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Group.