Man Asia (ex Japan) Equity Strategy

- The investment team is led by Andrew Swan who is a highly experienced and established Asian Equity portfolio manager

- The investment strategy has been developed and refined over a period of 9+ years

- The strategy is centered around bottom-up analysis with a focus on relative earnings revisions

- High conviction all-cap portfolio with preference for mid-caps

- Style agnostic approach with flexibility to shift in/out of styles

Approach

The strategy uses a combination of top down and bottom up concentrated risk-taking with the stated objective of alpha or excess return through the economic cycle. The majority of risk relative to the benchmark and the majority of returns is expected to be achieved through idiosyncratic, stock specific risk taking.

Underpinning the investment philosophy is the notion that the main drivers of alpha in Asia (ex-Japan) equity markets are high cross-sectional single stock dispersion and relative earnings revisions. As such, the team’s core focus is to capture turning points in companies that have high EPS revision potential over a forecast period of up to 12-18 months.

The team conduct detailed fundamental analysis and financial modelling on companies across the region to identify candidates with the highest EPS revision potential. The aim of this process is to identify sources of potential surprise (positive or negative) in the company’s key profit drivers such as revenue, costs, margins, cash flows and ultimately earnings per share. These sources of surprise can be derived by many factors including management strategy and operational decision making, competitive dynamics, macro and micro economic factors.

In addition to bottom up risk taking, the team will overlay various deliberate and diversified top down macro views in order to achieve the stated objective of “through the cycle” alpha.

| Approach | Long-only |

| Asset Class | Equity |

| Geographic Focus | Asia (ex-Japan) |

| Benchmark | MSCI All-Country Asia (ex-Japan) |

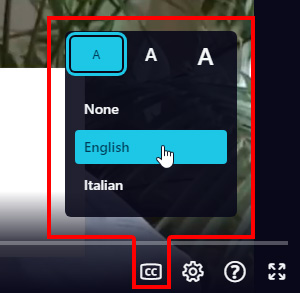

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.