With the flood of money pouring into everything AI, one might question how many data centers the world actually needs? At some point, will the music stop? No one rings a bell at the market top, but it’s worth looking for the warning signs.

The durability of the AI capital expenditure cycle is the single most important question for equity investors (particularly in the US) over the next few years. Current estimates suggest the construction of data centers may be propping up the US economy against a weakening job market, and at a minimum is significantly contributing to economic growth.

However, the AI boom has created a circular economy where the biggest winners are essentially funding their own customers – and when this game of musical chairs ends, it could take down almost a quarter of the S&P 500.

The biggest winner so far is Nvidia. Following the ChatGPT moment, Nvidia’s advanced chips have been flying off the shelf with the firm’s quarterly revenue run-rate ballooning from US$5 billion to US$50 billion in about two years – and at eye-watering margins.

Figure 1. Nvidia is the big winner of the AI boom

Source: Bloomberg, as of 26 September 2025.

Problems loading this infographic? - Please click here

With a market cap exceeding US$4 trillion, Nvidia investors are expecting growth to continue unabated for the next several years. And thus far, everything appears to be going according to plan. The hyperscalers continue to increase their investment commitments, and no challenger in advanced chips has taken material market share (yet?).

Stagnant cash flow

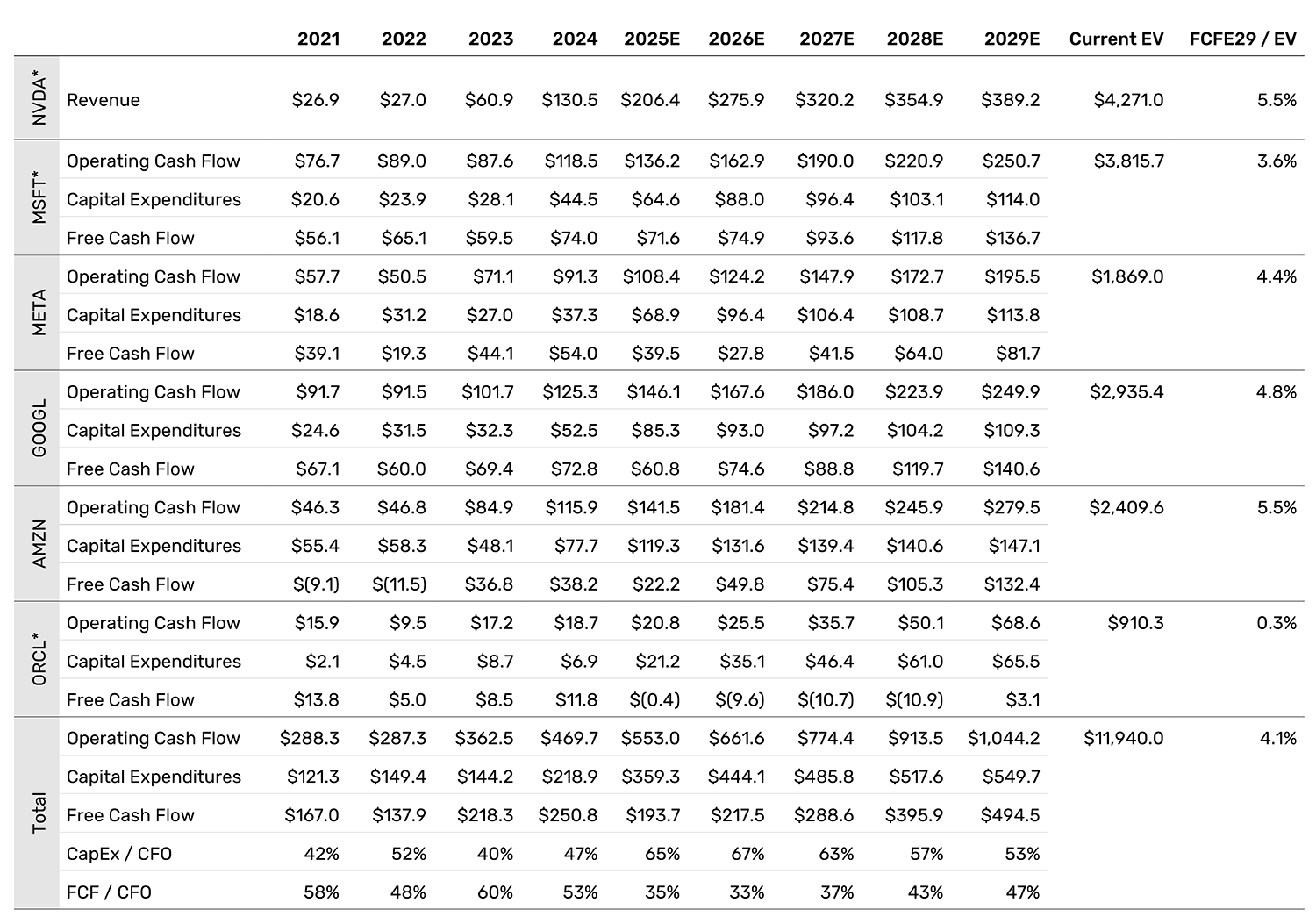

But at what point will shareholders of the hyperscalers expect a return on their investment? At Microsoft, Meta, Alphabet, and Amazon, capital expenditures have been growing significantly faster than cash flows, and in all four cases, free cash flow has been stagnant from 2021 and is expected to remain so this year and next.

The newest entrant to the space, Oracle, which has entirely reinvented itself over the last few years, has gone from cash cow to having its first free cash flow deficit since fiscal year 1990(!). That, and the massive ramp-up expected in capital expenditures over the next few years may explain its recent US$18 billion bond offering.

Figure 2. The great cash flow squeeze after big tech's AI investment binge

Source: Company data, Bloomberg, as of 26 September 2025.

Of course, who really cares about boring financial statement data? The opportunity in front of us is massive! But the increasing circularity of the AI economy could be a canary in the coal mine. It is well documented that many of the Magnificent 7 are Nvidia’s biggest customers – Microsoft, Meta, Amazon, and Alphabet recently made up more than 40% of its revenues.

A few weeks ago, Oracle announced their remaining performance obligations had increased by 359% to US$455 billion driven by multiple billion-dollar contracts. But it turned out that US$300 billon was from OpenAI which currently does not have access to that amount of capital.

In fact, OpenAI recently raised its cash burn estimate between now and 2029 from US$35 billion to US$115 billion (we can assume that some of that is the Oracle contract). And OpenAI CEO Sam Altman has said he wants to spend trillions investing in this space, which seems ambitious given its current burn rate and the fact that the company recently reached US$12 billion in annual recurring revenue. Who might come to the rescue?

The tangled web

As luck would have it, Nvidia has just announced up to US$100 billion in equity financing for OpenAI (spread out over several years) to build AI data centers that, wait for it, hold Nvidia’s AI chips.

To be fair, Nvidia is generating so much cash that it can actually afford this investment. But the optics leave a little to be desired. And it may be the case that Nvidia leases the chips to OpenAI which could expose Nvidia to more risk from a depreciation standpoint.

And Nvidia has already invested in CoreWeave and Lambda; these companies lease out AI-capacity that, uses Nvidia chips. The scale of those investments was an order of magnitude smaller than the OpenAI investment though. CoreWeave recently expanded its relationship with OpenAI, which is good for them because Microsoft is currently responsible for 71% of their revenues. This is becoming quite a tangled web and it’s hard to keep up with all the linkages, but maybe there is nothing to see here.

OpenAI’s Sam Altman recently said: “As AI gets smarter, access to AI will be a fundamental driver of the economy and maybe eventually something we consider a fundamental human right”. If AI does indeed become a fundamental human right, maybe no amount of capital is too much to spend securing this technology for our future.

Of course, an alternative hypothesis could be that an ecosystem of AI-cheerleaders has developed to justify parting investors from their hard-earned capital. Interestingly, apparently these two are not mutually exclusive as Altman has also said “someone is going to lose a phenomenal amount of money.”

The five stocks in Figure 2 currently represent 24.4% of the S&P 500. If When the music stops, the impact will be broader than just AI-dedicated investors. The multi-trillion dollar question is whether we’ll have to worry about this for 2026 or if we have a bit more time?

All data sourced from Bloomberg unless otherwise stated.

Author: Dan Taylor, Chief Investment Officer at Man Numeric.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.