As Chancellor Rachel Reeves prepares to deliver her second Budget, the mood in the UK remains decidedly grim. Anxiety around potential tax rises, possible pension reforms requiring UK equity allocations, and unwelcome regulatory changes have created a pervasive bearish narrative.

However, for us, it's precisely this consensus gloom that may be creating one of the more interesting contrarian setups in developed markets.

The FTSE’s almost 18% gain this year is particularly remarkable against a backdrop of frankly miserable earnings expectations. This disconnect between price performance and fundamental revisions has shifted the valuation picture. For the first time in recent memory, the UK market is no longer cheap relative to its own long-run average.

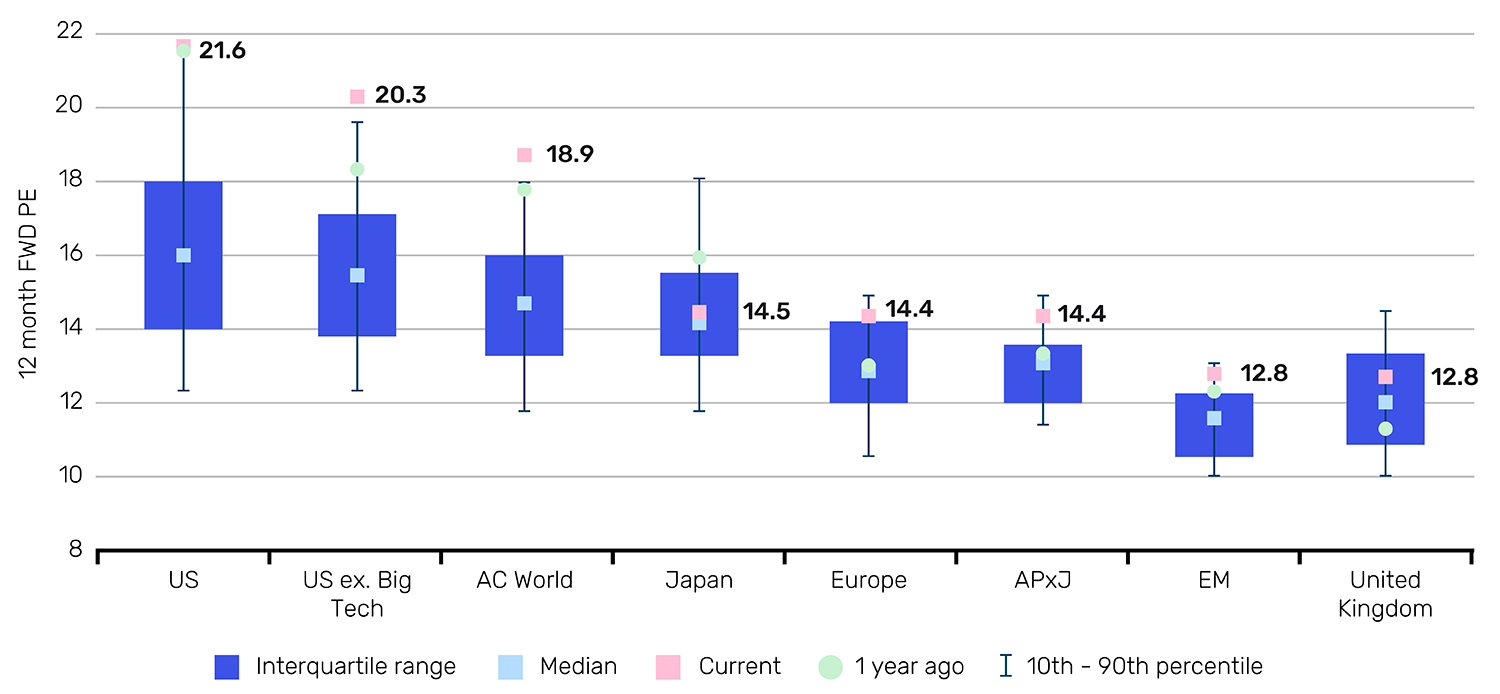

Figure 1. 20-year global equity market valuations – UK equities have sharply re-rated

Source: Goldman Sachs, as of 30 June 2025.

It still appears inexpensive compared to US or European markets, but the domestic valuation discount that UK value managers have routinely pointed to has now closed. A year ago, or even at the start of 2025, the UK traded materially below its historical averages. That is no longer the case, which makes the market's composition – and what has driven returns – all the more relevant to understanding where value might now sit.

A two-speed market

Nearly two-thirds of those returns have been driven by just twelve stocks: five large-cap banks plus an eclectic "Momentum 7," including Rolls-Royce, BAE Systems, and AstraZeneca. It's an exceptionally narrow rally and therein lies the opportunity.

Figure 2. The two-speed market

Source: Bloomberg, as of 30 August 2025.

Problems loading this infographic? - Please click here

While banks have re-rated and defensives have soared, the market's cyclical underbelly has been left behind. Companies in construction materials, recruitment, and industrial packaging now trade at valuations rarely seen in their histories. Some sit below tangible book value or the replacement cost of their assets. One aggregates business, for example, has delivered steady earnings growth over 10-15 years but now trades at record-low multiples. Current valuations suggest the market expects prolonged weakness rather than a typical cyclical downturn.

The Budget has become the focal point for this pessimism. However, there is an argument that when negative narratives become this entrenched, they may already be reflected in prices. The question is whether the Budget could serve as a clearing event – not because it will necessarily be benign, but because expectations are now so low.

It’s not all doom and gloom

The fixation on fiscal fear may be obscuring genuinely positive structural shifts. The Labour Party's planning reforms are already showing promise in housebuilding and related sectors; these kinds of supply-side improvements could prove far more significant than marginal tax adjustments. These are medium-term tailwinds being drowned out by near-term noise.

The recent journey of UK banks offers an instructive template. NatWest began 2020 trading at half of book value, deemed "almost unownable" by many investors. The subsequent path involved navigating Silicon Valley Bank, Credit Suisse's collapse, and private credit concerns. Yet through steady earnings delivery and disciplined capital returns, it's now up over 100% over five years. The point isn't that cyclicals will exactly mirror banks’ performance, it's that when unloved sectors with depressed valuations find positive operating momentum, the re-rating can be swift and substantial.

There are tentative signs of such momentum building. Sterling's strength against the dollar, falling freight costs, and moderating energy prices are creating disinflationary forces that could spur lower interest rates, which are particularly helpful for domestic cyclicals. European government spending is picking up, led by Germany. Manufacturing PMIs are inflecting positively. A broader global capex cycle may be emerging.

You snooze, you lose

Perhaps most tellingly, there are some who recognise the opportunity even if public markets don't. The past two months alone have seen multiple private equity bidding wars for UK assets. Meanwhile, listed companies have been aggressively buying back stock with several major names reducing share counts meaningfully. When private equity and management teams act decisively, maybe public market investors should take note.

None of this guarantees that cyclical sectors will recover soon, or that the Budget will prove less challenging than feared. But the combination of extreme bearish sentiment, depressed valuations in economically sensitive sectors, and tentative signs of economic stabilisation suggests the setup warrants attention.

All data sourced from Bloomberg unless otherwise stated.

Author: James Houlden, a UK Portfolio Manager at Man Group.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.