Man Dynamic Income

Strategic bond funds have been a cornerstone of fixed income allocations for wealth managers and independent financial advisors for decades. These funds have offered a “one-stop shop” for fixed income allocations – providing access to government bonds, investment grade and high yield corporates, as well as more esoteric assets such as emerging market debt and asset-backed securities.

We believe that a fundamental characteristic an investor should expect from their strategic bond allocation is an ability to “go anywhere”. However, in our view, many strategic bond funds overly rely on top-down, asset allocation investment processes which are driven by macroeconomic forecasts. A manager’s view on duration, currency or a country’s growth prospects can dominate the portfolio construction process. Whilst this has the potential to deliver attractive returns, we believe that this can also create unwanted volatility.

Avoid Forecasting the Future

For example, even the Bank of England sets itself a wide range when attempting to predict future growth, inflation and even the path of interest rates. Often realised UK GDP figures have been vastly different to predictions, even those made only twelve months ago. Sometimes forecasts can be accurate, such as the Bank’s expectations for 2023 end of year rates, however, they can also be far from the actual outcome.

Problems loading this infographic? - Please click here

Problems loading this infographic? - Please click here

Source: Bank of England as at 31 December 2024

A Top-Down Heavy Universe

Many managers adopt a top-down heavy approach based on forecasts of macroeconomic outcomes. These strategies, with highly experienced managers with solid track records, form part of many bond allocations for both retail and institutional investors and manage a considerable amount of assets.

However, the last few years have presented a difficult environment for bonds – inflation driven rate hikes, global conflict and most recently trade wars. As a result, volatility has increased and historical economic relationships which underpin macro models haven’t worked as well as they did in the past.

Source: Evestment, Peer Websites.

A true bottom-up disruptor

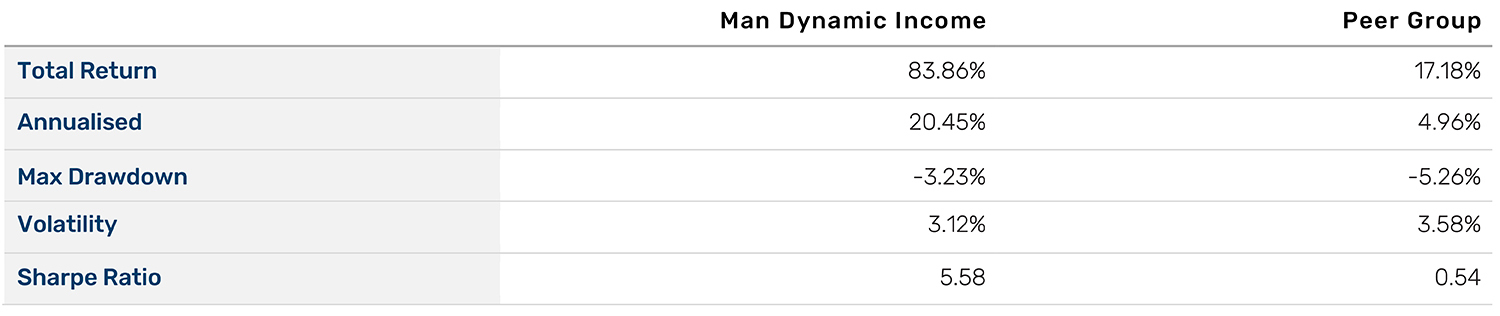

Therefore, we believe that our process of allocating based on an issuer’s fundamentals and searching the market for undervalued credits rather than trying to forecast the future is much better suited to a turbulent macro backdrop – we believe our returns relative to peers since inception validate this.

Problems loading this infographic? - Please click here

Data as 31 August 2025 and is based on the performance of Man Dynamic Income I H GBP. Past performance is not indicative of future results. Returns may increase or decrease as a result of currency fluctuations. Performance data is shown net of fees with income reinvested and does not take into account sales and redemption charges where such costs are applicable. Returns are calculated net of management fees. Other share classes may charge higher fees. Launch date: 03 July 2022. Please consult the Prospectus or KIID for more information. The Fund has an SRRI of 5.

Since Jonathan Golan launched Man Dynamic Income in June 2022, its bottom-up approach has delivered returns which have seen it ranked #1 in the Investment Association £ Strategic Bond sector. Its bottom-up focussed approach makes it a style diversifier in the sector.

What makes our approach different?

- A Truly Dynamic & Flexible Approach

A fundamental characteristic of Dynamic Income is its truly unconstrained investment approach. Our strategy maintains no systematic bias towards any sector or region, allowing investment decisions based purely on security or issuer value.

A key competitive advantage lies in our nimbler size (£1.9bn as at June 2025) and focused portfolio of around 100 positions, compared to peers holding over 1,000 positions. We specifically target smaller and medium-sized bond issuers, which tend to be under-researched and thus more likely to present mispricing opportunities. In contrast, larger funds typically allocate to broad market segments first, diluting their ability to add value through security selection.

Duration is maintained within 2-5 years under normal market conditions and currency exposure is hedged back to base currency. - High Conviction Approach to Credit Investing

Rather than focus on every possible issuer across the credit landscape, we focus on the companies that are trading at a significant discount (wide spread) compared to the majority of the market – we quickly filter out fairly priced bonds and seek to only buy securities which we believe will generate significant alpha for the fund, rather than trying to simply preserve capital and harvest yield.

Rather than invest based on macroeconomic predictions and forecasts, we believe a bottom-up approach to investing, underpinned by rigorous fundamental analysis, is much more repeatable and has to potential to deliver alpha in both bull and bear markets. - Prudent risk management

Risk management is of paramount importance.

The fund manages its downside mitigation in several ways. First off, within the investment process, there is evaluation and scrutiny of a company’s fundamentals and ensuring that, in our view, there is a “margin of safety” with every addition to the portfolio. Secondly, the flexible nature of the fund means that it is able to operate both offensively and defensively, depending on the market conditions and opportunity set. This means that when valuations are tight, the fund is able to reduce its spread duration and net exposure, focusing on select opportunities rather than buying parts of the market.Problems loading this infographic? - Please click here

Source: Man Group database as at 31 August 2025. Performance is shown for Man Dynamic Income I H GBP, is net of fees and does not take into account sales and redemption charges where such costs are applicable. Man Dynamic Income is part of the IA Strategic Bond Sector Peer Group. The Fund is classified as an SRRI 5. The investment objectives, risk limits and/or regulatory investment limits applied to any of the constituents in the peer group, may be materially different to those applied to Man Dynamic Income and therefore the performance data is not intended to provide a direct comparison of performance.

Risk management cannot fully eliminate the risk of investment loss.

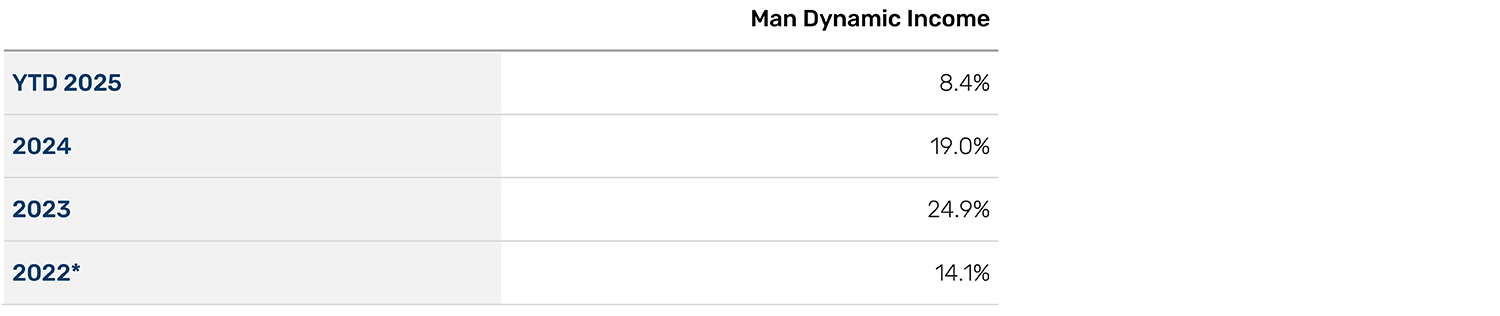

Calendar year performance

Data as at 31 August 2025 and is based on the performance of Man Dynamic Income I H GBP. Performance data is shown net of fees with income reinvested and does not take into account sales and redemption charges where such costs are applicable. Returns are calculated net of 0.60% management fees. Other share classes may charge higher fees. Launch date: 03 July 2022. Please consult the Prospectus or KIID for more information. *Part Year.

Past performance is not indicative of future results. Returns may increase or decrease as a result of currency fluctuations.

Investment Policy

The Fund aims to provide investors with income and capital growth over a medium to long-term period by investing predominantly in bonds issued by companies and governments worldwide.

The Investment Manager evaluates the expected risk and return of each individual issuer in the Portfolio. Metrics such as yield, or yield spread to government bonds with a similar maturity date will be analysed to assess expected returns. The investment philosophy is to buy securities in which the expected returns overstate the risks, benefitting from income and capital appreciation either by holding the security to redemption or through selling the security at a higher price when the implied risk of default as determined by the market is equal to the Investment Manager's assessment of the risk.

The Fund will invest at least 80% of its Net Asset Value in fixed and floating rate government, corporate or securitised bonds denominated in USD (or in other currencies and hedged back to USD) issued by governments, government agencies, supra-national and corporate issuers worldwide listed or traded on markets globally. The Fund will invest across the full range of capital structures from senior secured to subordinated bonds (senior securities holders will always be first to receive a payout from a company's holdings in the event of default whereas subordinate status means they only are paid out after senior bonds). The Fund may also invest in a number of other assets including currencies, money market instruments, mortgage-backed securities, asset backed securities (including collateralised loan obligations and collateralised mortgage obligations), equities and other fixed income investments, eligible collective investment schemes and other liquid assets. The Fund may also invest in bonds that are convertible from debt to equity upon the occurrence of a trigger event (CoCos). The Fund's investments will not be limited by geographical sector. The Fund may invest in emerging markets and such investment is not expected to exceed 40% of its Net Asset Value. There is no limit to the extent the Fund may gain exposure to non-investment grade securities.

The Fund is actively managed; no benchmark is used as a universe for selection or for performance comparison purposes.

Important Considerations

One should carefully consider the risks associated with investing, whether the Fund suits your investment requirements and whether you have sufficient resources to bear any losses which may result from an investment:

Investment Objective Risk - There is no guarantee that the Fund will achieve its investment objective.

Market Risk - The Fund is subject to normal market fluctuations and the risks associated with investing in international securities markets and therefore the value of your investment and the income from it may rise as well as fall and you may not get back the amount originally invested.

Counterparty Risk - The Fund will be exposed to credit risk on counterparties with which it trades in relation to on-exchange traded instruments such as futures and options and where applicable, ‘over-the- counter’("OTC", "non-exchange") transactions. OTC instruments may also be less liquid and are not afforded the same protections that may apply to participants trading instruments on an organised exchange.

Currency Risk - The value of investments designated in another currency may rise and fall due to exchange rate fluctuations. Adverse movements in currency exchange rates may result in a decrease in return and a loss of capital. It may not be possible or practicable to successfully hedge against the currency risk exposure in all circumstances.

Liquidity Risk - The Fund may make investments or hold trading positions in markets that are volatile and which may become illiquid. Timely and cost-efficient sale of trading positions can be impaired by decreased trading volume and/or increased price volatility.

Financial Derivatives - The Fund will invest financial derivative instruments ("FDI") (instruments whose prices are dependent on one or more underlying asset) to achieve its investment objective. The use of FDI involves additional risks such as high sensitivity to price movements of the asset on which it is based. The extensive use of FDI may significantly multiply the gains or losses.

Leverage - The Fund's use of FDI may result in increased leverage which may lead to significant losses.

Emerging Markets - The Fund may invest a significant proportion of its assets in securities with exposure to emerging markets which involve additional risks relating to matters such as the illiquidity of securities and the potentially volatile nature of markets not typically associated with investing in other more established economies or markets.

Non-Investment Grade Securities - The Fund may invest a significant proportion of its assets in non-investment grade securities (such as “high yield” securities) are considered higher risk investments that may cause income and principal losses for the Fund. They are instruments which credit agencies have given a rating which indicates a higher risk of default. The market values for high yield bonds and other instruments tend to be volatile and they are less liquid than investment grade securities.

Total Return - Whilst the Fund aims to provide capital growth, a positive return is not guaranteed over any time period and capital is in fact at risk.

A complete description of risks is set out in the Fund's prospectus, which along with the KIID/KID and other fund documentation can be found at Man Dynamic Income

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.