We have revised our outlook on distressed strategies to negative, a notable change following our positive outlook in the past four quarters.

We have revised our outlook on distressed strategies to negative, a notable change following our positive outlook in the past four quarters.

April 2021

1. Introduction

Our outlook for hedge funds remains positive across the majority of sub-strategies. We maintain our positive view on event-driven, especially merger arbitrage, which is well-placed to benefit from high levels of deal activity, wider spreads, and a competitive M&A environment. We believe there is a fruitful opportunity set for discretionary macro managers given our expectation of continued volatility across asset classes and cross-country trading opportunities driven by divergence in the speed of economic recovery across regions. We have revised our outlook on credit strategies to neutral for credit long-short and negative for distressed strategies, a notable change following our positive outlook in the past four quarters. Finally, we are enthusiastic about emerging themes in quantitative strategies, such as opportunities in Chinese markets, systematic credit and ESG.

Our outlook for the financial environment is similar in theme to the previous quarter: we have an optimistic view on equity markets as progress to beat the pandemic and bold stimulus measures will likely lead to a fast economic recovery. The main risk is that the economy could overheat with consequences especially for bond and currencies markets, which may potentially lead to continued volatility.

The acceleration of the economic activity driven by front-loaded fiscal support of historic proportions has silenced the discussions around the shape of the recovery of the US economy. If it looks like a V, it is a V. However, the speed of recovery is diverging across sectors.

2. Financial Environment Outlook

Easy financial conditions and accelerating economic growth provide solid support for risk assets. We therefore expect that markets will continue to find a bid. Interest rates are likely to rise further as extraordinary fiscal stimulus is deployed. The main risks to this outlook are: an unexpected, large increase in inflation; and the fragility of the financial system where especially a withdrawal of liquidity from Treasuries could trigger market volatility and deleveraging. In addition, while rates are still low, the speed of the increase in recent months could lead to some market trouble in the near term.

Economic growth prospects have been upgraded with the rollout of the vaccines. The outlook for economic activity has especially improved in the US thanks to the efficient vaccination campaign and the USD1.9 trillion American Rescue Plan – effectively the fifth US stimulus package to address the economic damage from the pandemic. Growth is likely to diverge between countries. The near-term outlook for the Eurozone, in particular, has hardly improved. The appalling management of the vaccination efforts has contributed to a third infection wave that has negatively impacted Europe’s relative growth prospects. But for the world overall, improvement in the US will help the global economic output to likely exceed pre-pandemic levels by mid-year – at least six months earlier than previously expected.1

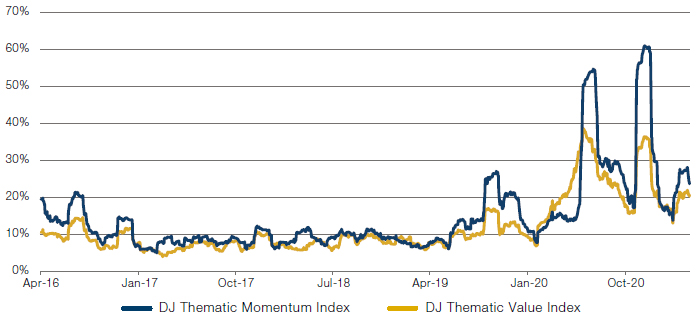

The acceleration of the economic activity driven by front-loaded fiscal support of historic proportions has silenced the discussions around the shape of the recovery of the US economy. If it looks like a V, it is a V. However, the speed of recovery is diverging across sectors. An initial large boom from stimulus benefiting stay-at-home stocks could be followed by reopening growth that will boost the service sector. The divergences between sectors and stocks will present opportunities for equity long-short funds, but could also be a driver for factor volatility. Extreme factor volatility as we have experienced last year could present a challenge (Figure 1).

Figure 1. DJ Thematic Momentum and DJ Thematic Value 30-Day Volatility

Source: Bloomberg, April 2021.

While corporate earnings have already beaten expectations in the last three quarters, the accelerating economic revival improves companies’ profitability and eases concerns around equity market valuations. Analysts’ earnings forecasts for the S&P 500 Index have increased by 5% since the beginning of the year.2 It is typical for analysts to underestimate operational leverage on the upside as well as the downside, and we suspect this cycle to be no different in that respect.

We believe that a further curve steepening is likely as the fiscal spending requires higher long-term bond issuance, while monetary policy and reduced bill issuance by the Treasury as it reduces its cash holdings will keep the short end low.

Remarkably, additional stimulus in the US may be on its way in the form of infrastructure and green energy initiatives. If these policy proposals pass the legislative process, total Covid-related stimulus could amount to 35% of US GDP.3 Considering these numbers, it is understandable that the consensus is bullish on growth, and so are we. But we believe that there is a risk of overheating, as the demand that these economic programs will trigger could add to the price pressure on labour and materials.

Interest rates markets have reacted to this risk and are pricing in higher risk premia. Ten-year US Treasury bonds had their worst quarter since 1981 in the first quarter, with a total return of -5.7%. The interest curve steepened as the short end remained anchored by the Federal Reserve, while the long end priced in higher term premia, higher inflation expectations and possibly higher compensation for inflation risk. We believe that a further curve steepening is likely as the fiscal spending requires higher long-term bond issuance, while monetary policy and reduced bill issuance by the Treasury as it reduces its cash holdings will keep the short end low. This could pressure prices of corporate bonds. We are reflecting this in a moderation of our heretofore bullish view on credit strategies.

The Fed’s communication about the near-term outlook for short-term rates doesn’t lack clarity: it will comfortably let inflation shoot over its long-term 2% target. Eventually, the Fed will take steps towards policy normalisation though and the question remains: what will the market’s reaction be? In 2013, during the taper tantrum, the 10-year US interest rate rose approximately 135 basis points from May to September, triggered by the Fed’s announcement to taper purchases of bonds. A difference between then and today is that the flexible inflation targeting will keep rates expectations anchored, while in 2013, the forward market began to price in tightening. A material factor behind the rates volatility in 2013 was the need for mortgage-backed securities (‘MBS’) holders to hedge the negative convexity of their securities, thereby accelerating the sell-off in Treasuries. Today, active hedgers have a smaller share of the MBS market and the Fed, which does not hedge its MBS portfolio, owns more bonds than it did in 2013.4 We believe that these two factors will help to contain volatility once the Fed announces policy changes. Equities, which sold off 5-10% for developed markets and 15-20% for emerging markets during the Taper Tantrum, may also react less violently thanks to the fiscal support for the economy today. The expected strong economic growth will provide central banks a normalisation window – if they decide to use it.

Higher volatility in interest rates, currencies and other asset classes could provide trading opportunities for discretionary macro funds, which is in part the rationale for our constructive outlook for this strategy.

If higher inflation expectations persistently exceed the 2% target and the Fed decides not to counter it in a credible manner – possibly because of fears of the market’s reaction to tightening – there could be renewed pressure on the US dollar. The dollar has recently benefited from the relatively stronger growth outlook in the US, defying the widely expected downtrend. However, an improvement of the relative growth outlook in other regions later in the year and a possible increase in the US current account deficit could reignite the bearish forces on the dollar, leading to higher volatility in currency markets.5

Higher volatility in interest rates, currencies and other asset classes could provide trading opportunities for discretionary macro funds, which is in part the rationale for our constructive outlook for this strategy. However, liquidity withdrawal from US Treasuries is a concern, as it may result in volatility spikes and deleveraging. The regulatory framework that was put in place post the Global Financial Crisis (‘GFC’) has inherent weaknesses that increase the liquidity stress on Treasury markets exactly at the point when liquidity is most needed.6 We experienced in February how thin market liquidity is, when the poor Treasury auction led to an outsized intra-day sell-off in bonds. This can put pressure on managers to quickly de-risk portfolios, especially in highly levered relative value strategies. Liquidity evaporation can lead to broader market stress, which central banks can eventually counteract and stabilise, as we saw in March 2020. However, by then, the damage on many portfolios may have already been done. It is therefore important that investors continue to monitor asset liquidity, leverage and concentration, as well as balance strategies that are exposed to this risk, with those that have a positive expected return during times of market stress.

In summary, we believe that the backdrop for markets is constructive as progress to beat the pandemic and bold stimulus measures will likely lead to a fast economic recovery. The main risk is that the economy could overheat with consequences, especially for bond and currencies markets. We believe that this environment is attractive for macro, event-driven and equity long-short funds. We reflect the risk of an ongoing sell-off in bonds with a moderation in our outlook in certain credit strategies.

3. Strategy Outlook

We maintain our view that the environment for hedge funds is positive across a broad set of strategies. Namely, we believe merger arbitrage benefits from high levels of deal activity, wider spreads and a competitive M&A environment. Discretionary macro managers may see persistent opportunities arising from cross-country trading opportunities as a result of differing speeds in economic recovery across regions, as well as from asset class volatility. Our view on equity long-short remains positive as well, especially for managers that exhibit factor awareness as we believe they will be well-placed to capitalise on opportunities that arise from the different recovery speed across sectors. We are also constructive on a number of emerging themes, particularly in the quantitative space, such as China opportunities, ESG (in the longer term) and systematic credit.

For traditional US statistical arbitrage strategies, our enthusiasm for stock dispersion has been dulled by further equity market neutral de-gearing that we witnessed in the first quarter, which makes us more cautious in the space given the crowding. We have revised our outlook on credit strategies to neutral on credit long-short following further compression in credit spreads over the past quarter, and we are now bearish on distressed, as the landscape may prove challenging for capital deployment given the substantial decline in defaults and levels of outstanding distressed debt.

3.1. Credit Strategies

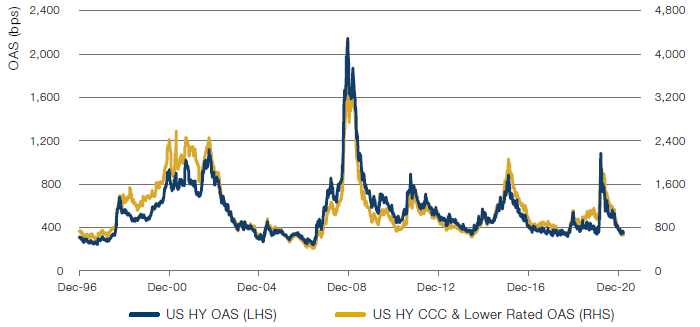

We have maintained a positive view on corporate credit strategies since the Covid-driven sell-off in the first quarter of 2020, which led to US high yield spreads widening to more than 1,000 and lower-rated CCCs trading close to 2,000 basis points (Figure 2). After a strong rebound in the credit markets through the end of last year, we revised this to a near-term opportunity. We are now revising this further to a neutral outlook on credit long-short and a negative outlook on distressed.

Figure 2. US HY and CCC and Lower-Rated Spreads

Source: Bloomberg, March 2021.

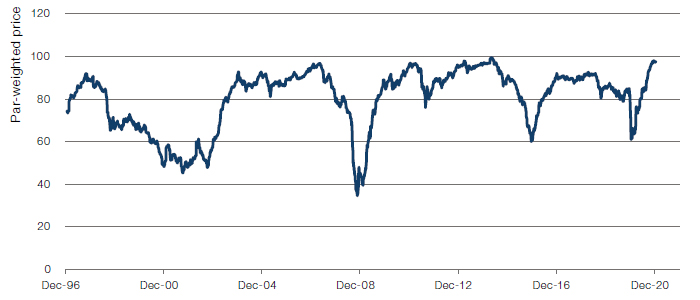

There has been further significant compression in credit spreads since the beginning of the year, particularly in CCCs, which are now trading close to par (Figure 3), up from a low of about 60 cents in March 2020. We believe the opportunity set for credit long-short managers is now more idiosyncratic with less room for meaningful price appreciation and spread tightening on a market-wide basis. Managers continue to focus on intra-capital structure dislocations, particularly debt versus equity and liability management-related trades in sectors that have been directly impacted by Covid-19. We find the risk/reward for taking a lot of outright credit risk unfavourable. The opportunity set in financial preferreds versus last quarter is also less attractive in the near term given the headwinds for the sector in an expected rising rate environment.

Figure 3. US HY CCC and Lower-Rated Price

Source: Bloomberg, March 2021.

Distressed managers are monetising the pipeline of opportunities created by the significant uptick in default activity in 2020, which saw USD141.4 billion of defaults7, including distressed exchanges and a par-weighted US high yield (‘HY’) default rate of 6.2%.8

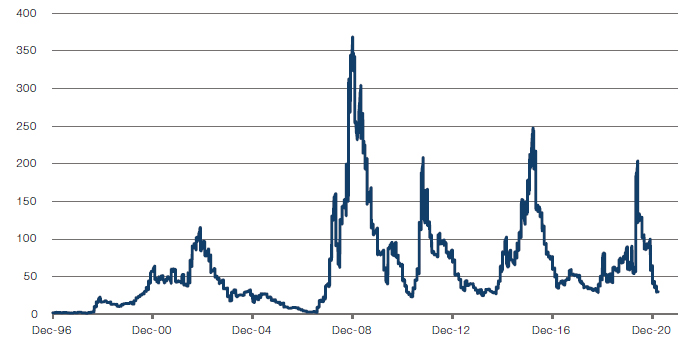

However, there has been a substantial decline in defaults over the past few months, with only USD2.1 billion of activity year to date.9 In addition, there has been a significant decline in the levels of outstanding distressed debt (Figure 4) and more benign default expectations looking ahead, given wide open primary markets and expectations of a strong economic recovery. JP Morgan now estimates 2.0% default rate for US HY in 2021, down from 3.5%.10

Figure 4. US HY Bonds Trading Over 1,000 Basis Points

Source: Bloomberg, March 2021.

We acknowledge that in the near term, there might still be opportunities for distressed managers to be liquidity providers to certain companies in what might be fundamentally challenged sectors (e.g. energy, retail, travel, leisure, gaming, etc.). However, capital deployment for these managers will become more challenging given the easy financial conditions. Hence, we have shifted our outlook for the strategy.

We acknowledge that in the near term, there might still be opportunities for distressed managers to be liquidity providers to certain companies in what might be fundamentally challenged sectors (e.g. energy, retail, travel, leisure, gaming, etc.). However, capital deployment for these managers will become more challenging given the easy financial conditions.

We continue to like the opportunity set for convertible arbitrage managers in the near term. Broad markets are still trading somewhat cheap to estimates of fair value, driven primarily by higher implied volatility inputs, while credit spreads have largely normalised.

We believe the recent drivers of elevated equity market volatility remain in place and should continue to lead to gamma trading opportunities for managers. These include any news around Covid-19 infections and vaccinations, higher and volatile rates markets, policy announcements by the new US administration, and ongoing potential for sector/factor rotation related market and single-stock moves.

The size of the convertible bond market has continued to expand given an extremely busy primary calendar over the past year. Heavy new issuance has put some near-term pressure on valuations, but overall should present managers with better opportunities.

Lastly, driven by the rally in equities, deltas are generally higher across convertible arbitrage portfolios and managers are also seeking opportunities in more defensive ‘synthetic put’ type of trades in deep-in-the-money convertibles.

Risks to our outlook remain a significant volatility compression or a systemic event, e.g., a sudden and substantial backup in Treasury yields. Should single stock volatility decline, there is little room for credit spreads to tighten further. Convertible prices could therefore cheapen. Also, it is highly unlikely that we will see a repeat of the exceptionally strong post-pandemic returns from the space anytime soon.

We also remain favourable on the outlook for structured credit managers in the near term. Lower-rated, credit-sensitive tranches across most securitised products sectors have lagged the recovery of the broader markets and loss-adjusted yields remain higher versus pre-Covid levels under more conservative assumptions. The sector continues to represent good relative value (yield) versus other fixed income sectors and the fundamental backdrop for US housing and consumer remains positive.

However, our forward-looking return expectations for the strategy are more modest now, as there is less room for further significant spread compression and a meaningful backup in rates could be an eventual headwind for this strategy as well.

3.2. Equity Long-Short Strategies

We remain positive on the strategy, as opportunities should continue to persist while the market discovers the new post-Covid equilibrium. While events at the end of January highlighted short-squeeze vulnerability for some, we believe that in the wake of this, equity managers are more cognisant of this risk than ever before and have taken a heightened view of their position sizing not only in the context of their own portfolio, but also relative to the outstanding short float in the market.

Given that markets are still short-termist in defining the market paradigm, we expect actions from policy makers to dominate the agenda and the factor landscape to be volatile, particularly around data releases. We believe that, as we pass through 2021, horizons will gradually shift to a longer-term view, therefore holding a balance of exposures that we can re-weight quickly is crucial.

Expectations around inflation and rising rates are becoming more prevalent and commentators continue to draw comparisons between the current environment and that of the dot-com bubble in 1999. While we believe there are similarities, we also respect the key differences between then and now, particularly around the discount rate for stocks with high price-to-earnings (‘PE’) ratios. However, if we continue to see signs of recovery and inflation surprises on the upside (as we expect), Value optimism should grow as expectations for rate rises are priced into longer-term rates, as we’ve seen historically, and a Growth/Momentum decoupling is possible. In this environment, managers who display factor awareness should be able to seize on the opportunities such rotations can generate.

3.3. Relative Value Strategies

In relative value, we are positive on event arbitrage, especially merger arbitrage, and we also have a positive view on broader event-driven strategies that have the flexibility to rotate into additional opportunities, e.g. SPACs, special situations across the capital structure, or soft catalysts.

Our outlook for merger arbitrage is positive for the following reasons:

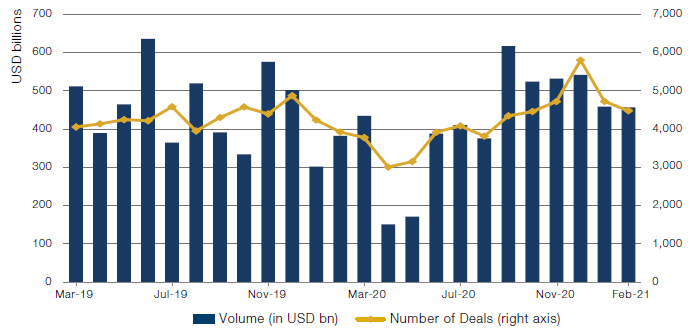

- Merger and other deal activity remain high (Figure 5) across all regions, as companies have switched from defensive to growth mode amidst broad-based business optimism;

- Merger spreads have widened and indicate compelling average annualised return targets, even for large, liquid and fairly safe deals. There is a lot of dispersion, which, together with volatile markets, offers skilled managers numerous trading opportunities. While this opportunity set may close somewhat when the current crop of large deals completes in coming months, regularly announced mega-cap deals bode well for a sustained period of M&A, which also reduces the risk of overcrowding;

- The competitive M&A environment offers good potential for hostile counterbids to drive up share prices of acquisition targets, and deals agreed several months ago are often favourably renegotiated in response to shareholder or board pressure to reflect improved valuations of peer companies in a transaction;

- Despite current uncertainty regarding the impact of various anti-trust authorities, particularly the Federal Trade Commission and Department of Justice in the US, the current consensus is for scrutinised deals to close, even if timelines may be extended.

Figure 5. Global M&A Deal Count and Volume

Source: Bloomberg; February 2021

We also remain positive on broader event-driven strategies that have multiple return drivers and investing flexibility beyond only merger arbitrage, e.g. the ability to rotate into softer catalyst opportunities like holding/operating company relative value trading, or corporate actions like restructurings and stub trades. However, this is moderated by the fact that relative value convergence strategies are generally more difficult to execute in a higher volatility environment, are harder to time, and they absorb a lot of gross exposure. Managers also have to be selective and thoughtful about short positions that may be exposed to short squeezes.

The dramatic increase in SPAC IPOs in recent months has also been successfully incorporated by many event and other relative value managers as a source of new transactions and arbitrage opportunities. However, the sharp pull-back since mid-February highlighted that the asset class had become frothy amidst retail hype and other factors favouring growth companies (typically the targets of SPAC mergers). Nonetheless, although mark-to-market risks remain, pre-deal announcement positions with low or even negative premium-to-trust value have little long-term downside risk and exhibit interesting optionality. And, while we continue to monitor the key questions around the opportunity set, e.g. how long the growing pool of capital can find sensible acquisition targets and what the implications might be of increased regulation, we believe that the asset class has become significantly more institutionalised, and with many SPACs trading near or below trust value, there are likely attractive opportunities to be found at present.

We believe there is significant opportunity in China-focused quant managers who can harvest alpha from the inefficiency, breadth and microstructure dynamics of the domestic equity markets. We also recognise opportunities in Chinese futures markets and the potential for these to grow when regulatory barriers are reduced.

We also remain positive on fixed income relative value, which we believe will be able to source trades in an environment of higher volatility. However, tail risks have in our view increased because of the discussed fragility of the market structure.

In quantitative micro strategies, we believe there is significant opportunity in China-focused quant managers who can harvest alpha from the inefficiency, breadth and microstructure dynamics of the domestic equity markets. We also recognise opportunities in Chinese futures markets and the potential for these to grow when regulatory barriers are reduced. We will look to expand the approved list to gain exposure to these strategies in the coming quarters. Systematic credit and ESG funds also remain a focus.

In more traditional quantitative strategies, we maintain our view that larger managers have advantages over their smaller peers. Last quarter, we were positive on ongoing stock price dispersion, and we continue to view this as constructive for reversionary strategies like equity statistical arbitrage. However, we must also recognise that we continue to see modest setbacks from de-gearing activity in equities. We believe this may be due to crowdedness and lack of liquidity, giving us reason for pause in US equities. More constructively, some managers are arguing that heightened retail activity is net beneficial, but this is a complex argument, with the counter being that much of the retail flow is netted by market makers through ‘pay for order flow’ before it reaches the main exchanges. At the margin, we believe investors should reduce risk in US equities in favour of other opportunities, but we will monitor this carefully and remain nimble and in a position to change this view if we believe the retail trend is helping.

3.4. Global Macro Strategies

We are positive on discretionary macro strategies. We expect an uneven economic recovery across regions and between countries as the timing and scale of policymakers’ response to fighting the coronavirus pandemic and its economic impact is likely to differ. Heterogeneity in policy response sets up cross-country trading opportunities, particularly if regions that experience faster return to ‘normal’ start to show signs of overheating and break the trend of setting historically low central bank rates. This is likely to keep volatility elevated and create catalysts and inflection points, particularly around macroeconomic data releases, which provide alpha opportunities for managers with proven trading ability and structuring edge. We see opportunities especially in FX markets and commodities that can be used to play inflationary themes and economic divergence between countries.

In quantitative macro, we continue to believe a stabilising Covid end game will provide opportunities for trend followers and systematic macro managers. Both strategies remain quite neutrally positioned at the time of writing, which is beneficial if there are dramatic changes in markets. However, this does not completely mitigate the potential risk of being whipsawed by changing sentiment.

Changes to QFII rules in the fourth quarter of 2020 appeared to open opportunities in the attractive area of trend following in Chinese commodity futures, but at the time of writing, the list of futures contracts that will be approved for QFII remains uncertain.

1. OECD Economic Outlook, Interim Report, March 2021.

2. Barclays, Global Outlook, March 2021.

3. Man Dynamic Allocation Team, Quarterly Note #15, Q2 2021.

4. Views from the Floor, Man Group, March 23, 2021.

5. BIS Quarterly Review, March 2021.

6. Discussed in Man FRM Investment Strategy Q3 2020.

7. JP Morgan, December 2020.

8. JP Morgan, December 2020.

9. JP Morgan, February 2021.

10. JP Morgan, February 2021.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.