In this week’s edition, we discuss the potential for a more constructive stance toward Brazilian assets; and when will fundamentals matter again in EM?

In this week’s edition, we discuss the potential for a more constructive stance toward Brazilian assets; and when will fundamentals matter again in EM?

May 28 2019

Brazilian Pension Reform: A Carnival for Contrarians?

Earlier in February 2019, we wrote that the Brazilian market appeared to be pricing in too much optimism over Jair Bolsonaro – and crucially, over his pension reform plan.

The pension reform – which aims to save more than USD260 billion over the next 10 years – remains a priority for Jair Bolsonaro’s government. The reform bill passed a crucial test on 24 April when a congressional committee voted that the proposed legislation was constitutional and could proceed through to Congress. The reforms, which will likely be viewed by a congressional commission, still needs to be approved by a 60% majority in both the Chamber of Deputies and the Senate to be passed into law.

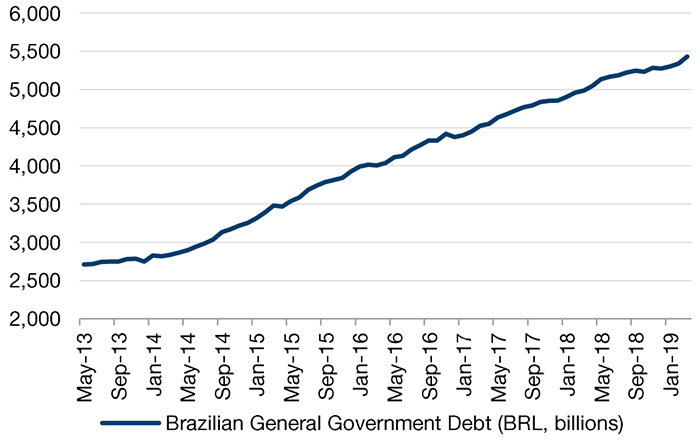

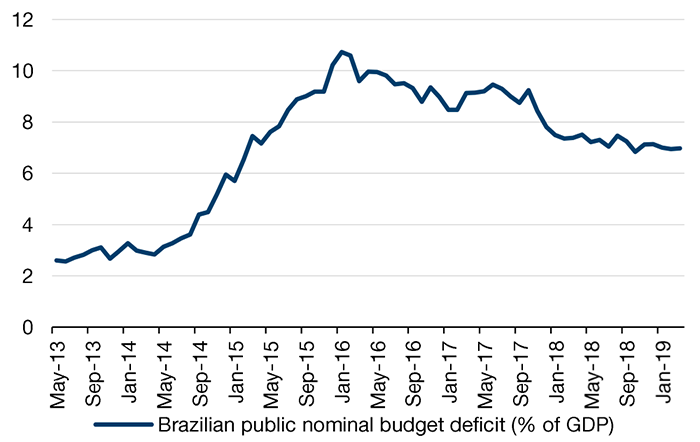

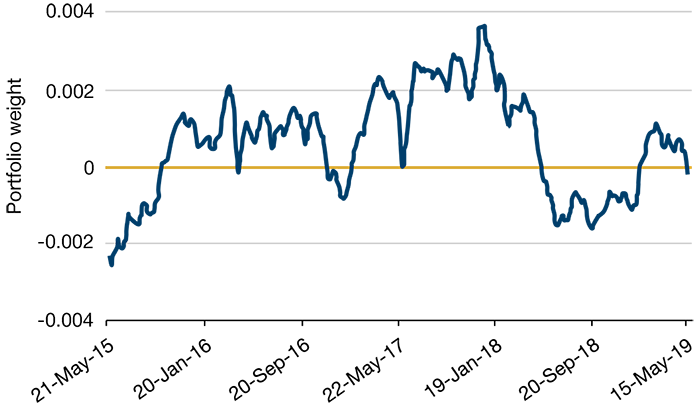

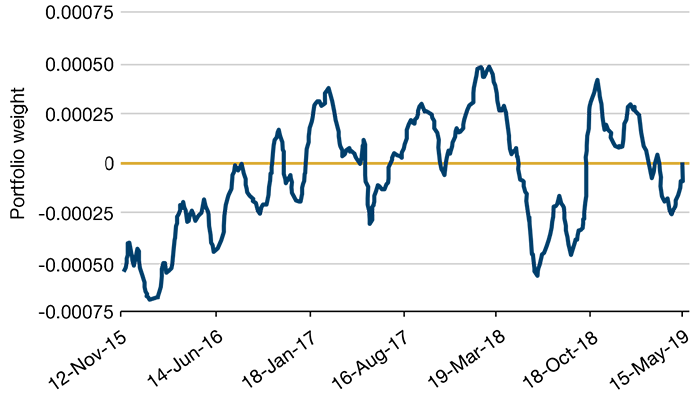

Heading into this pension reform, debt is rising (Figure 1) and the budget deficit appears to be stuck (Figure 2). However, the recent correction in Brazilian asset prices has seen overweights purged, and holdings in FX and equities are now underweight (Figures 3-4), leaving the positioning clean, and risk/reward more positively skewed in the event of better news. It is often the case that emerging markets’ reform efforts respond to weakness in markets, which in our view would argue for a patient approach. However, the cocktail of weaker markets, underweight positioning and a reform deadline looming is setting up the potential – later in the summer – for a more constructive stance toward Brazilian assets.

Figure 1: Brazil Debt Is Rising

As of March 2019.

Figure 2: Brazil’s Budget Deficit Appears to Be Stuck

As of March 2019.

Figure 3: FX Holdings Are Underweight…

Source: State Street Global Markets; As of 20 May, 2019. Note: Below 0 implies an underweight; above 0, an overweight.

Figure 4: …As Are Equities

Source: State Street Global Markets; As of 20 May, 2019. Note: Below 0 implies an underweight; above 0, an overweight.

When Will Fundamentals Matter Again in Emerging Markets?

Typically, investors aim to identify companies with positive earnings growth (based on analyst forecast estimates), as improving earnings growth is rewarded by the market.

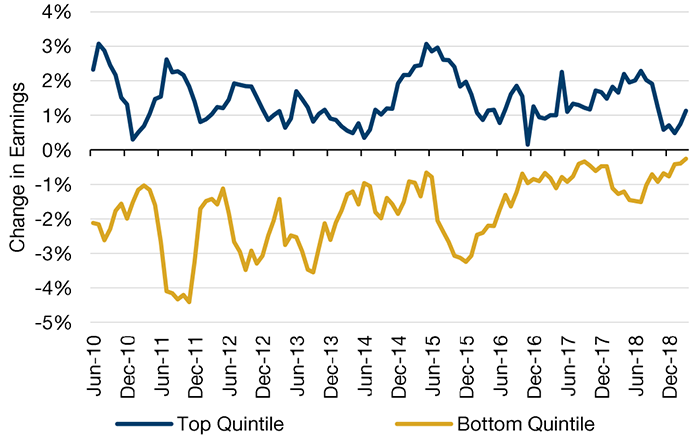

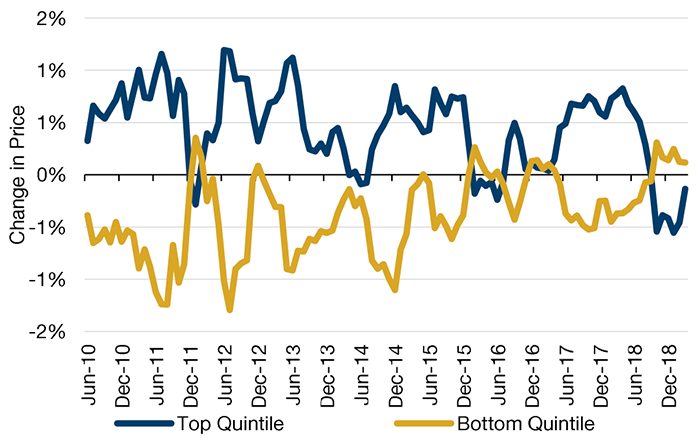

However, despite improving earnings forecasts (Figure 5), emerging-market stocks have experienced both country- and sector-adjusted price declines (Figure 6). Counterintuitively, stocks with declining earnings growth have outperformed since the fourth quarter of 2018.

So, fundamentals – specifically forecast earnings growth – have not been rewarded in emerging market equity recently. When will these fundamentals start to matter again?

Figure 5: EM Equity Earnings Forecasts Have Been Improving…

Source: Man Numeric, MSCI; Between January 2010 and March 2019.

6-Month rolling average of country- and sector-adjusted forecast earnings growth.

Figure 6: …But This Has Not Been Reflected in EM Equity Prices

Source: Man Numeric, MSCI; Between January 2010 and March 2019.

6-Month rolling average of country- and sector-adjusted forecast earnings growth.

With contribution from: Ed Cole (Man GLG, Managing Director), Ori Ben-Akiva (Man Numeric, Head of International Strategies) and Ziang Fang (Man Numeric, Senior Portfolio Analyst).

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.