In this week’s edition: why we believe Bolsonaro’s pension reform is not the real deal; and Brexit deal or no-deal -- Who cares?

In this week’s edition: why we believe Bolsonaro’s pension reform is not the real deal; and Brexit deal or no-deal -- Who cares?

February 26 2019

Bolsonaro’s Pension Reform: The Real Deal?

On 20 February, the Bolsonaro administration submitted its pension reform proposal to Congress, which, in our view, is the first – and most critical – element required to help set Brazil back on a sustainable debt trajectory.

Officially estimated to offer savings of BRL1.16 trillion ($312 billion) over 10 years,1 the reforms introduced a minimum retirement age of 65 for men and 62 for women (versus the current pension plan of a minimum contribution time of 35 years for men and 30 years for women, which typically translates to an average retirement age of 54 and 52 years, respectively).

While polls show more support for pension reforms than in the past, we view execution risk related to the passage of the reforms as high: First, legislative pushback may result in dilution of the estimated savings impact – potentially between BRL400 billion and BRL60 billion of savings.1 Second, the proposed reform requires amending the constitution, which needs the support of over 60% of both houses of Congress in two rounds of voting. Such a high level of consensus is likely to face challenges in a highly fragmented congress, particularly in the Lower House, which requires 308 deputies out of 513 in two votes before going to the Senate.

Political capital is typically highest during the first year of office. As such, the next few months will be critical as a positive outcome from the Lower House needs to be achieved by June 2019 (before breaking for mid-year recess in July), so that the proposal can then be sent to Senate by the second half of the year.

Even if a diluted pension reform gets passed, we believe that additional measures, including freezing the minimum wage in real terms, is necessary in order to return to a sustainable debt trajectory: Gross general government debt climbed to 77% of GDP in 2018, according to our calculations, and is rising at an unsustainable pace. As such, we estimate the primary balance needs to improve by more than 3% of GDP (from -1.8% to +1.5%) to achieve a sustainable debt trajectory.

Brazilian government 5-year credit default swaps were at 163 basis points and the carry on the Brazilian real (annualizing 6-month forwards) was 2.8% as of 22 February.2 While the passage of pension reform could give the administration the ammunition and/or time to pass additional measures, our view is that the market appears to be pricing in too much optimism relative to the execution risk and fiscal improvements that are yet to be achieved.

Problems loading this infographic? - Please click here

Source: The Economist, OECD, IMF; As of 20 February, 2019 *Or latest available

Deal, No Deal, Who Cares? GBP/EUR Totally Range-Bound

UK Prime Minister Theresa May has delayed the Members of Parliament’s (‘MPs’) “meaningful vote” to 12 March, just 17 days before the UK is due to leave the EU. The vote was originally planned for 27 February.

This has dismayed some businesses, European leaders and Europhile MPs. The market, however – as determined by the GBPEUR exchange rate – appears to be pricing in some sort of deal being reached. Indeed, as Figure 2 shows, the GBPEUR has been trading in a pretty tight range over the past year, and is currently at the top end of that range.

Problems loading this infographic? - Please click here

Source: As of 25 February, 2019

The Impact of the Trade War…

The US has delayed an increase in tariffs on USD200 billion of Chinese goods, initially set for 1 March.

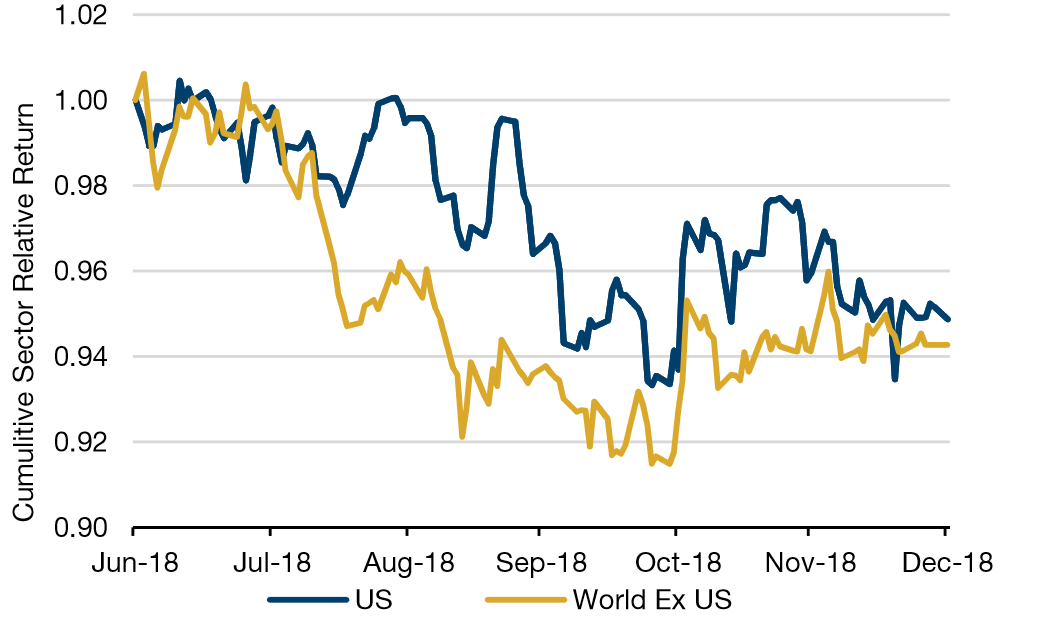

Unsurprisingly, stocks with the most revenue exposure to China3 underperformed their sector peers in the second half of 2018, and mostly significantly in September and October. Surprisingly, though, while the main trade tensions were between the US and China, non-US companies were equally hard hit (Figure 3).

Figure 3: Average Sector-Relative Return of Most China Exposed3 Stocks

Source: Man Numeric, Factset; As of 31 December, 2018

…As China Stimulates Its Economy

January credit data for China was the largest on record, with approximately USD700 billion of new credit issued. This is the latest in a series of clear signs that the government is stimulating the economy again, following the launch of a central bank-backed bond swap in January, plus reductions in bank reserve requirements. Relative to GDP, this is the second-largest January in the last 10 years, and is supportive of our expectations that data will be visibly improving by the second quarter of this year.

Problems loading this infographic? - Please click here

Source: Bloomberg, Man GLG, as of January 31, 2019

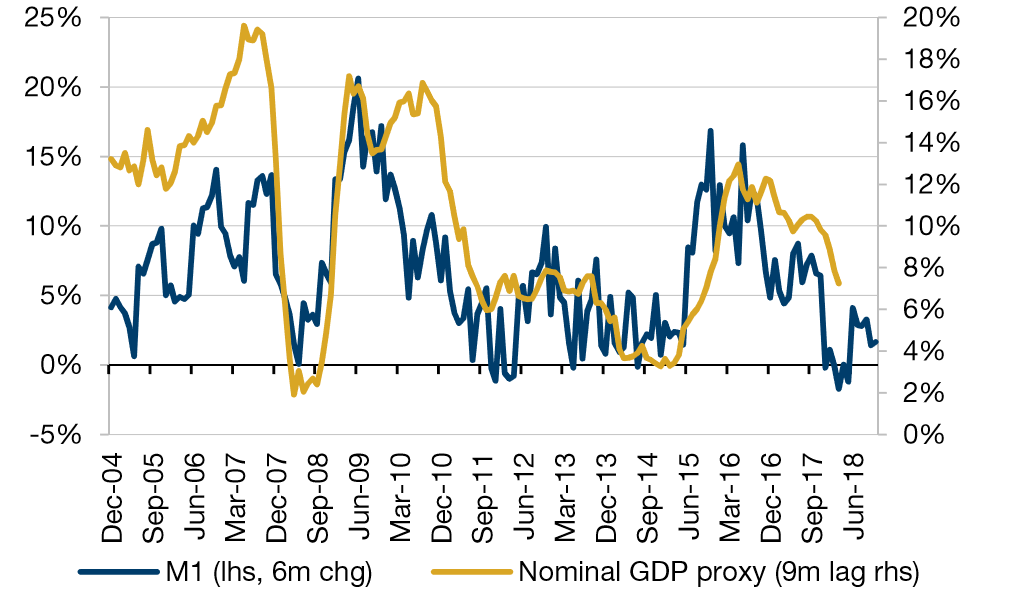

Alongside the release of the credit data was China’s monetary aggregates, which poured some cold water on this constructive view: M1 growth in January was just +0.4% year on year. There is much commentary pointing out the lunar New Year impact on M1, namely that year-end bonuses have depressed corporate demand deposits, and that this will normalise in February. We are optimistic that this could be the case.

However, in the meantime, we are cognisant of the long-term relationship between M1 and nominal GDP growth, which looks as though some more patience may be required before fully backing the turnaround in the cycle.

Figure 5: The Chinese Credit Impulse

Source: Bloomberg, as of January 31, 2019

With contribution from: Lisa Chua (Man GLG, Portfolio Manager), Matthew Sargaison (Man AHL, co-CEO), Ed Cole (Man GLG, Managing Director), Rob Furdak (Man Numeric, co-CIO) and Ed Fang (Man Numeric, Deputy Director of Research).

1. https://www.ft.com/content/ba196f86-3525-11e9-bb0c-42459962a812

2. Source: Bloomberg

3. At least 30% of revenues coming from China as of June 30, 2018

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.